City Manager Jim Landon is proposing a refurbished $6.8 million plan that would use general fund dollars to build a new city hall without raising taxes, even though $5.8 million of that–a repayment from the Town Center taxing district–could be used to lower property taxes or build other capital projects with broader public uses. Residents had roundly rejected a similar plan in 2010 and 2011, when the building would have cost $10 million.

taxes

Back-to-School Tax Holiday Now Includes Computers, Tablets and Electronic Gadgetry

Florida’s back-to-school tax holiday Aug. 2 through Aug. 4 for the first time includes high-tech computer and other electronics as long as each individual item is priced under $750. Retailers are preparing for the demand, in some cases lowering prices to match the benchmark.

Pay an Issue as Flagler County Fire Chief Don Petito and Others Aim for Jobs Elsewhere

Flagler County Fire Chief Don Petito is one of a growing list of senior county staffers, especially in the fire department, who have left or are seeking to leave the department for neighboring departments where pay is significantly higher, a brain-drain issue County Administrator Craig Coffey has been warning county commissioners about this summer.

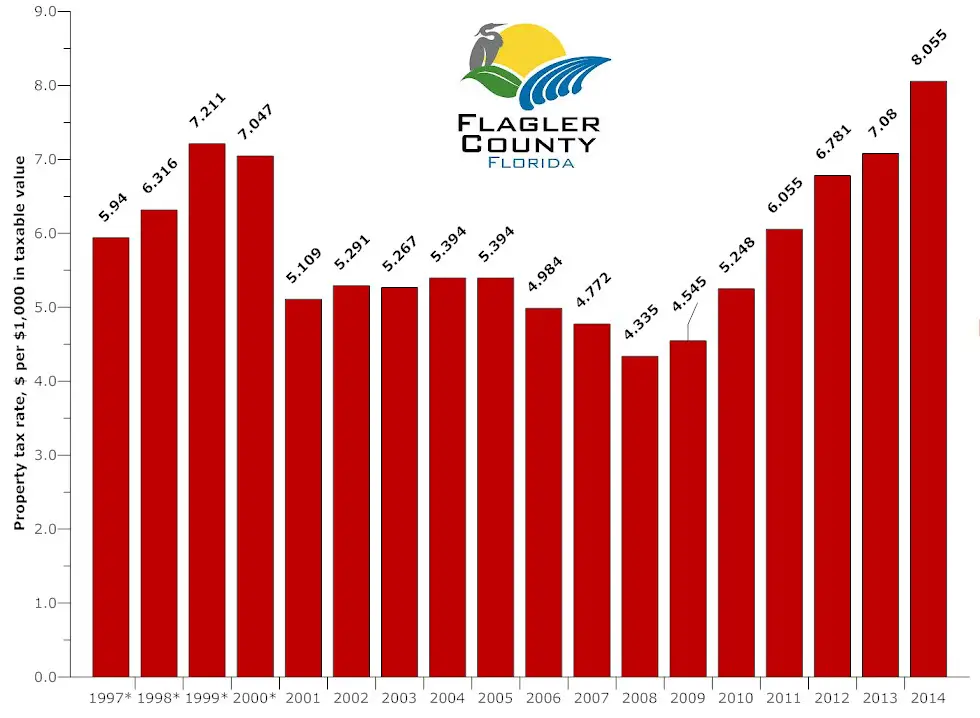

Facing Mandatory Spending, County May Raise Taxes by Nearly $100 for Median Home

In previous years, tax rate increases didn’t mean much because they were either entirely or more than offset by decreases in property values. The end result was lower tax bills for most, even as tax rates went up. That’s over. And tax rates are set to go up in every city, too.

Palm Coast Proposes to Increase Its General Fund Budget by $700,000 and Add 9 Positions

For the first time in seven years, property values have increased in Palm Coast, if only fractionally. Even so, residents will likely see a small property tax rate increase that for most would mean a slightly higher tax bill as the city continues to balance tight budgets with residents’ demands for services, and loosen the tight belt somewhat.

Water Management District Tax Will Decline Slightly, to About $33 For Average Flagler House

All property owners in Flagler County, including all its cities, pay the St. Johns River Water Management District tax. The district’s $135.5 million proposed budget includes $13 million for 22 reclaimed water and water conservation projects, one of them in Flagler.

Flagler Tea Party Spreads False and Misleading Claims as It Declares Against School Tax

The Tea Party’s opposition to the referendum is based on flawed, misleading or outright false information, which the school district has been at pains to counter or correct. The fate of the June 7 referendum may hinge on the district’s success—or failure—in that counter-offensive.

Property Appraiser Gardner: Correcting the Record on School Taxes and the Referendum

In an endorsement of the half-mill school tax levy, Flagler County Property Appraiser James Gardner responds to claims that the school district has “continually increased our taxes. Based upon factual information, this is simply not true.” He shows why.

A “Nasty” Government Building Highlights County’s Priorities as Budget Spells Higher Taxes

An unclear Government Services Building and what it costs to maintain it properly was emblematic of the Flagler County Commission’s budget discussion this morning, as the government faces at least a $3.3 million gap, or more, if it hires an extra custodian, no new revenue, and the likelihood of higher taxes.

Tax Subsidy May Trigger Free for All as Florida Cities Grab for Spring Training Teams

New rules for spring training funding offer up to $666,660 a year in sales tax revenue for stadium upgrades or construction if a community seeks to retain or entice a single team to move. The funding can jump to $1.33 million if a community can cobble together a two-team package.

Flagler School District’s Paraprofessionals, Key to Special Education, Protest Impending Job Cuts

Uncertainty about the future drove paraprofessional teachers fearful of losing their jobs to make emotional pleas Tuesday evening for alternative budget cuts by a financially challenged Flagler County School Board. But the “paras,” as they are known in the district, got no satisfaction: the School Board is not reversing its decision to plan for a […]

The IRS’ Nonprofit Dysfunctions: A Problem Deeper Than Conservative Targeting

The IRS division responsible for flagging Tea Party groups has long been an agency afterthought, beset by mismanagement, financial constraints and an unwillingness to spell out just what it expects from social welfare nonprofits, former officials and experts say.

Florida Loses Out on Amazon Deal, and Up to 3,000 Jobs, Over Sales Tax Fumes

In a statement issued Thursday, Gov. Rick Scott’s administration implied that if Amazon were to locate in Florida and begin collecting taxes, that would amount to a tax increase on Florida residents who use the popular shopping portal.

Speculative Bust: How Widening Old Kings Road Left Palm Coast on Hook for $6.7 Million

Palm Coast borrowed millions from its own utility fund to complete the Old Kings Road widening on the assumption that the economy would pick up and enable the city to re-finance with bonds. That never happened. Now the city is looking to recoup its money from property owners along the road, who’d agreed to a special taxing district but with optimistic assumptions of their own that never panned out.

Flagler’s School Tax Referendum: An Opposing View

Adding to a growing debate over the June 7 Flagler County School Board tax referendum, Brad West argues against the levy, saying the district taxes constituents enough as it is, while the “cup-of-coffee-per-month” argument is a more expensive proposition than the board claims.

Ending 3rd Budget Drag-Out in 8 Days, School Board Settles on $1.8 Million in Cuts

After 13 hours of at times harrowing debate, the Flagler County School Board by Tuesday evening settled on $1.8 million in cuts, sparing most programs but not Everest alternative school. The cuts will be restored should voters approve a tax referendum on June 7.

Andy Dance: Why I Will Vote “Yes” On the School Tax Referendum

“I will vote for the half mill, and I ask those that are on the fence or are leaning “no” to reconsider,” writes Andy Dance, the Flagler County School Board chairman, who has himself reconsidered his earlier opposition to the full .50-mill tax referendum. He explains why.

School Board Chairman’s Q&A on Flagler District’s 0.5-Mil Tax Referendum on June 7

Flagler County School Board Chairman Andy Dance has been taking and answering questions on the referendum, on June 7, proposing to raise property taxes modestly to ensure the continuation of certain academic programs. The full Q&A is published here.

Closing Schools a Possibility With or Without Referendum as District Closes Budget Gap

The Flagler County School Board found the $1.8 million in cuts it needed to balance its books Thursday, but was also told that closing Indian Trails Middle, Wadsworth Elementary or Old Kings Elementary may become necessary by 2014-15 if enrollment declines persist.

Flagler County’s Budget Outlook Adds Up To $8 Million Gap and Likely Tax Increase

It’s difficult to see how Flagler commissioners will emerge from the budget process in September without either a substantial tax increase of one type or another or vast cuts in county services, though they began taking on sacred cows, such as consolidating fire departments.

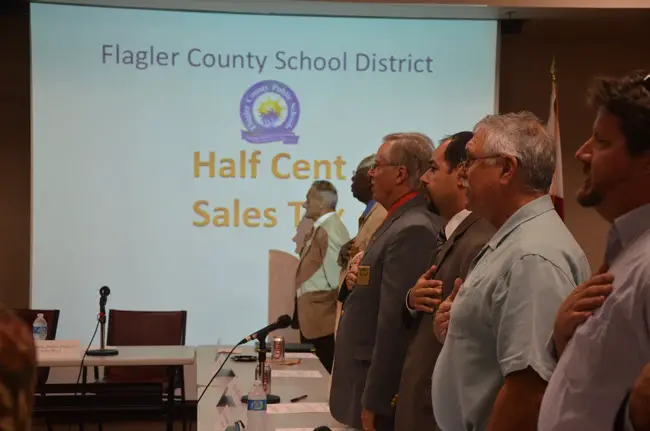

Flagler School District Hones Its Sales Pitch for New Tax Ahead of June 7 Referendum

The Flagler school district is campaigning for the June 7 referendum on a new property tax for schools with a “You Decide” approach that emphasizes restoring time to the school day and reinforcing school security in spite of cuts in state funding.

Online Sales Tax On Its Way, But Phone, Cable and Web Service Taxes Would Be Cut

The measure would offset the increased revenue brought in by the measure by lowering other taxes, including the communications services tax charged on phone service, cable, and satellite TV and internet connections.

Risks, Cautions, But Mostly Needs as Flagler School Board Readies for Tax Referendum

The Flagler County School Board Tuesday evening will approve going to a tax referendum in June, asking voters to increase their property taxes modestly to preserve programs and add security in schools, but the proposal doesn’t have the unanimity two similar proposals had in the last three years.

Appeal Court Rejects Taxing Online Travel Bookings, a Blow to Flagler and Other Counties

The 1st District Court of Appeal, in a 2-1 ruling, said companies such as Expedia and Orbitz cannot be forced to pay local tourist-development taxes on part of the money they collect from customers. The majority found that the disputed amounts relate to reservation charges — not to the actual amounts paid to rent hotel rooms — and described the companies as “conduits.”

It’s Not Just Hotels: Flagler Seeking to Collect Bed Tax From Booming Short-Term Rentals

The Flagler’s Tourist Development Council is spearheading an effort to make sure landlords who rent homes or condominiums on a short-term basis, defined as less than six months, pay the 4 percent tourist development tax.

Online Booking Companies’ Tax Evasion Fleeces Flagler Tourism and Florida Dues

Online booking companies like Expedia and Hotels.com are short-changing Flagler and Florida of millions of dollars in sales and bed taxes, and unfairly competing with local hotels, argues Milissa Holland, yet the Legislature is looking to give those companies more tax breaks. It’s not the way to go.

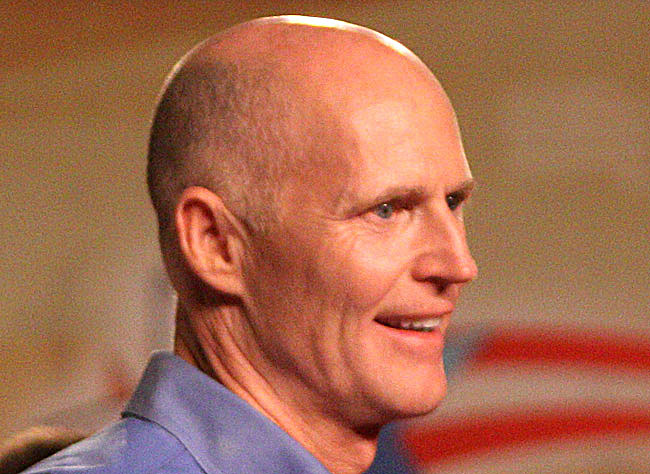

Week In Review: The Return of Candidate Rick Scott and Other Surprises

Rick Scott, the little-known, populist, former tea party politician emerged this week as a sweet-talking alternative to the Rick Scott who got elected in 2010 promising to be stingy and mean, to “Get to Work” at slashing the size of government.

Eyeing Re-Election, Scott Ends Austerity: $4 Billion Extra Spending in $74.2 Billion Budget

Gov. Rick Scott’s $74.2 billion budget proposal unveiled Thursday is the largest in the state’s history and includes a $4 billion spending increase that targets constituencies Scott hopes to win back as he seeks re-election in 2014, among them teachers, environmentalists and what state workers will remain on the payroll.

Palm Coast Water and Sewer Rates Set to Rise Up to 22% Over the Next Three Years

The Palm Coast City Council prides itself on keeping property taxes low, but its array of fees continue to increase steeply, as will utility rates if the council approves a debt refinancing plan that would let the city borrow another $15 million for utility improvements, even though growth in the city has slowed to a drip.

Amendment 3: A Fight Between Capping Taxes and Funding Government Responsibly

Amendment 3 before Florida voters on the November ballot would tighten the state’s rarely-used revenue cap, potentially giving it more teeth – something supporters say will restrain reckless spending but opponents say would gut vital services.

After Ridiculing County’s Sales Tax Revenue Compromise, Palm Coast Now Wants to Deal

In a turn-around stunning for its audacity, the Palm Coast City Council Tuesday agreed to ask the county commission to revive a compromise the commission had proposed on sharing sales tax revenue–a proposal Palm Coast rejected derisively over the summer.

Flagler School Board Rejects Building-Tax Cut, a Blow to Builders and the Chamber

Chamber President Doug Baxter had hoped Palm Coast would “fall in line” with a building-tax moratorium of its own if the county and the school board adopted one. The county did. The school board refused to go along Tuesday evening, calling the proposal irresponsible.

Palm Coast Mayor Netts Says Amendment 4 Takes Taxes From “Screwy” to “Screwier”

Other Flagler government leaders joined Jon Netts in criticism of of proposed Constitutional Amendment 4, which would limit the tax liability of commercial, rental and vacant properties while lowering the tax liability of first-time home-buyers, but at the expense of local government revenue, which has been battered since 2007.

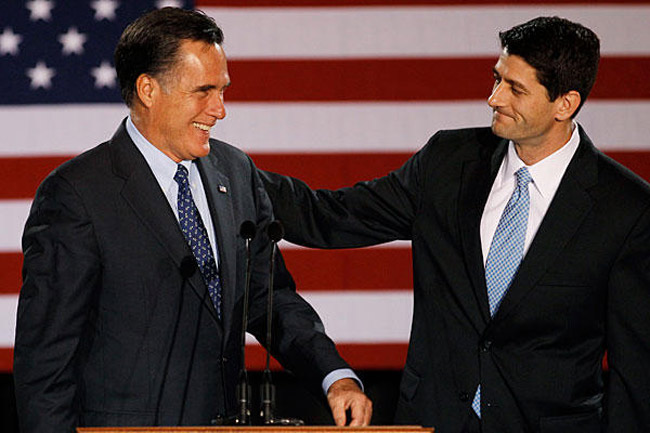

Mitt Romney’s Claim on Redistribution Gets a Pants on Fire

Mitt Romney got a Pants on Fire slap from Politifact for his claim on Sept. 19 that “redistribution” has “never been a characteristic of America.” It very much has: it’s been built into the nation’s progressive tax code since the beginning of the 20th century.

Mitt Romney’s 47 Percent Problem

In 2008 John McCain’s big challenge was to control Sarah Palin’s mouth. In 2012, Mitt Romney’s biggest challenge is to control Mitt Romney’s mouth. His characterization of 47 percent of Americans as victims and dependents, besides being demonstrably false, unravels the cynicism at the core of Romney’s campaign.

Despite County’s Spike, Most Flagler and City Homeowners’ Tax Bills Will Fall in 2013

It’s been a familiar and recurring complaint, but also an inaccurate one: that property taxes keep going up. They don’t. For most people, property taxes fell this year. And for most people, property taxes will either stay flat or fall again in 2013. Here are the city-by-city details.

What is the Roll-Back Rate in Property Taxes?

The roll-back or rolled-back rate is defined as it applies to property values and tax rates at budget time for local governments and property owners.

Flagler School Board Hails Sales Tax Victory and Revenue But Readies to Lose $2 Million

As Sue Dickinson and Colleen Conklin took their seats after winning a fourth term, the school board learned that its sales tax revenue was up to $4.2 million, thanks to more sales activity in the county. But the district is also losing at least $2 million from the expiration of an unrelated tax by year’s end.

Paul Ryan’s Budget: The CBO Analysis

The non-partisan Congressional Budget Office produced a 17-page analysis of the budget Congressman Paul Ryan submitted in 2012. The full analysis is presented.

Election Homework: The Goods on Paul Ryan

Everything you always wanted to know about Paul Ryan but were afraid was true: profiles, backgrounders, an FAQ on his plans for Medicare, and some of the best reporting on Mitt Romney’s vice presidential pick.

Two White Men Who Like to Cut Things: On Romney’s Nomination of Paul Ryan

Mitt Romney’s pick of Paul Ryan, the seven-term Wisconsin congressman, born during the first Nixon administration, is a puzzling choice, more calculated than inspiring, more cautious than bold, and in some respects, just as strategically faulty as John McCain’s pick of Sarah Palin.

Andy Dance: Why You Should Support Flagler Schools’ Renewal of the Half-Penny Sales Tax

Andy Dance, the school board member, explains why your vote approving the renewal of the half-penny sales tax in the Aug. 14 referendum is critical for Flagler County schools. All registered voters may cast a ballot regardless of party affiliation.

12% Property Tax Increase and Reserves Will Close $4.6 Million County Budget Gap

The Flagler County Commission agreed in principle to raise the property tax 12 percent and use a combination of reserves and other one-time dollars to close what, going into the budget season, had been a gaping deficit provoked by new expenses, accounting issues and falling property values.

Facing $5.65 Million Deficit, Flagler County Wrestles With What to Cut and What to Tax

The deficit was reduced to $3.65 million once commissioners agreed to use reserves and include a $1 million cut in the sheriff’s budget, but their debates got more heated on what services to eliminate or reduce, and what taxes to raise–or what new taxes could be imposed.

Attorney General OK’s Flagler Beach’s Plan to Spend Sales Tax Money on Erosion Projects

In an Attorney General’s opinion, Pam Bondi wrote that Flagler Beach’s plan to spend sales tax revenue on beach erosion projects is authorized by law, but that the ballot language authorizing that sales tax may have to specify erosion projects, not just general infrastructure.

County Budget, Upended By Deficit of $3 to $4 Million, Sets Off Crisis Mode–and Pitfalls

The much larger-than-expected deficit, which forced the abrupt cancellation of a budget workshop, raises questions of accountability just months before four of the county commissioners face elections either to hold on to their seats or seek a higher office.

Another Blow for the County: Palm Coast Rejects Flagler’s Sales Tax “Compromise”

Citing the county’s “Taj Mahal” of an administration building and the city’s future growth needs (and revenue), the Palm Coast council on Tuesday stuck to its refusal to change the way sales tax revenue is split, a blow for county government.

To Little Opposition, Palm Coast Approves New Levy for Stormwater Fixes, Delays Another

To little opposition, the council voted unanimously to add a 6 percent tax on electric utility bills, adding, on average, $6.27 a month to monthly residential utility bills. The council defeated a proposal to add a second tax that would have raised an equal amount.

Going Nose to Nose, Palm Coast and The County Remain Split on Half-Cent Sales Tax

Palm Coast wants to keep the split of the half-cent sales tax revenue what it is today. Flagler County wants to change the formula, which would decrease Palm Coast’s share by $500,000. The disagreement is jeopardizing a unified approach on a sales tax referendum both sides say is critical to their revenue needs.

Flagler School District, in a Surprise, Votes to Place ½-Cent Sales Tax Redo on Aug. 14 Ballot

The Flagler County School Board didn’t want its initiative lost in the clutter of the November ballot, or see it compete against the county’s and cities’ similar initiative, but primary turnout will be heavily Republican–an unhappy prospect for any tax initiative.