Until last week I did not believe in the transmigration of souls from celluloid to reality. That changed when Congress passed the so-called “big beautiful bill.” Raymond Shaw, the brainwashed assassin of “The Manchurian Candidate,” is alive and well and living in the White House. There may be other explanations. But outside of the theater of the loony it’s difficult to understand why a president of the United States would gift China the greatest act of strategic self-destruction next to China’s own suicide in the 15th century.

taxes

Palm Coast Adopts 75% Stormwater Rate Increase Over 5 Years, Then Cap on Future Hikes

The Palm Coast City Council this morning voted 3-2 to adopt a stormwater fee increase of residents’ monthly bill from $22.27 currently to $39.10 by 2028, a 76 percent increase. Increases after 2028 will be limited to the rate of inflation.

Palm Coast Residents’ Doubled Stormwater Fee Could Reach $542 a Year by 2027

Palm Coast resident’s $22.27 monthly stormwater fee would increase to $45.16 over the next four years if the city follows its consultant’s recommendation. Some residents would pay more in stormwater fees than in city taxes. Even lesser options would result in sharp increases, and no increases are not an option.

How Flagler County’s Drunken-Sailor, All-Republican Commissioners Tried to Con You Into a Higher Tax

The Flagler County Commission’s attempt unilaterally to impose an increase in the sales tax is the latest example of a lazy, bumbling commission addicted to spending, deceptive in its methods and indifferent to the long-term public interest.

Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.

This Year Floridians Get 3 Tax ‘Holidays’–for Hurricane Preparedness, Culture and Recreation, and School

The disaster-preparedness tax holiday will run from May 28 through June 6, the recreation-tax holiday runs for a week starting July 1, and the back-to-school holiday runs for 10 days in August.

A Tax Break for Residents of Flood-Prone Areas? Florida House Floats Sea Rise Proposals

Floridians would be asked to approve a tax break for people who elevate their homes to avoid the threat of flooding, while up to $100 million a year would be set aside to help local governments combat rising sea levels, under proposals announced Friday by House Speaker Chris Sprowls.

County and City Taxes Will Stay Flat for Most Homesteaded Properties Except for Spike in Bunnell

Residents of Flagler County and each of its cities will again see little to no change in their property tax bills next year as governments are adopting tax rates that either stay flat or roll back a little, with the exception of Bunnell.

The Bailout Is Working — For the Rich

The economy is in free fall but Wall Street is thriving, and stocks of big private equity firms are soaring dramatically higher. That tells you who investors think is the real beneficiary of the federal government’s massive rescue efforts.

A Trump Tax Break To Help The Poor Went To a Rich GOP Donor’s Superyacht Marina in West Palm Beach

Wealthy donors Wayne Huizenga Jr. and Jeff Vinik lobbied then-Gov. Rick Scott for the lucrative tax break for the Rybovich superyacht marina in West Palm Beach — and won it. Poorer communities lost out.

The Rich Should Be Taxed Differently Than You and Me

A 10 percent surtax on incomes over $2 million should be levied on wages and salaries and investment income gained from wealth, including capital gains and dividends.

Palm Coast Proposal Would Raise Property Taxes 9%; Sheriff’s Request for 6 New Deputies Not in the Budget

Though Palm Coast government is proposing to keep its property tax rate flat, a valuation increase of 9 percent will equate to a tax increase, though homesteaded property owners won’t feel it.

Congress Is About to Ban the Government From Offering Free Online Tax Filing. Thank TurboTax.

A bill supported by Democrats and Republicans would make permanent a program that bars the IRS from ever developing its own online tax filing service.

Everything From Impact Fees to Franchise Fees Could Be Called ‘Taxes’ Under Proposal Worrying Cities and Counties

On the local government level, the proposal would identify as a tax any new or increased special assessment or non-ad valorem assessment, impact fee or mobility fee, and franchise fee.

Flagler’s Beach ‘Renourishment’ Is Exorbitant Futility

Whether it’s the Corps of Engineers’ plan for 2.6 miles of Flagler Beach sands or Flagler County’s ongoing dune-rebuilding over 12 miles, there’s no money to sustain either, yet officials are mortgaging the county’s future on a blank check.

Tax Notices Mailed to Property Owners Point to Mostly Modest Increases

Property owners started receiving their tax notices in the mail last week. the numbers are not as dire as feared or as they seem, particularly when a tax bill is looked at whole rather than in its various parts.

Florida’s Back-To-School Sales Tax Holiday Is This Weekend: Here’s A Guide (No Electronics)

Florida’s sales tax holiday on school supplies, clothing, shoes and other select accessories is this weekend–starting at a minute after midnight Friday, Aug. 3, through midnight Sunday, Aug. 5.

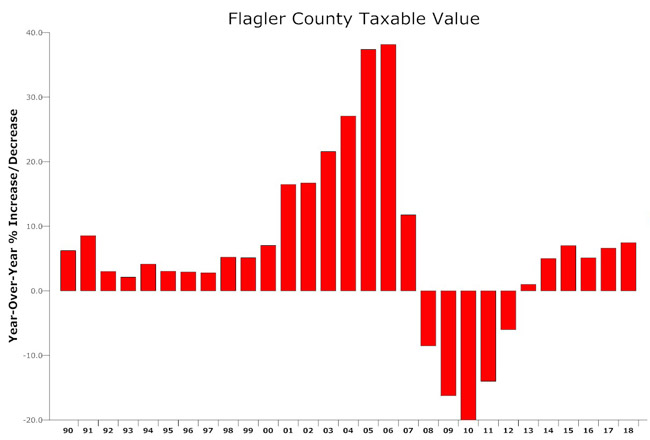

Flagler Property Values Rise 7.5%, Best Since Recession, But Government Revenue Faces Shock

Higher values ease pressure on government revenue but a potential increase in the homestead exemption would reduce revenue by millions, absent tax hikes.

Sales Tax ‘Holiday’ For Disaster-Preparedness Supplies Set For June 1-7 Across Florida

Expanded from three days last year, the tax holiday has drawn added attention after Florida experienced hurricanes in 2016 and 2017 after a decade’s calm.

Tax-Evaders Beware: Flagler Will Take Over Local Collection From Short-Term Renters, Projecting Jump in Revenue

The Flagler County Tax Collector, not the state Department of Revenue, will be collecting the 5 percent tax on short term rentals starting in July–a tax hundreds of property owners are evading currently.

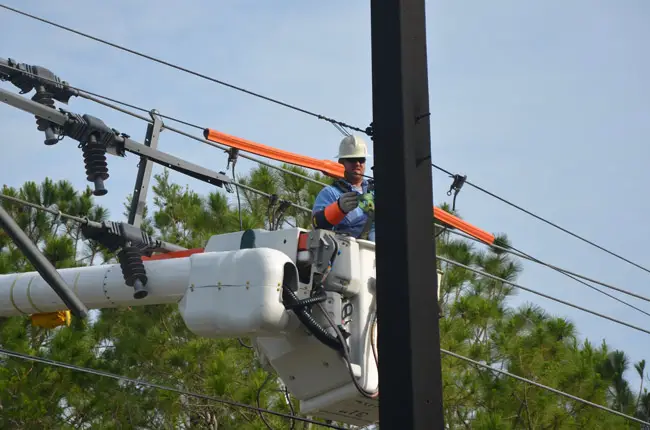

FPL Will Not Charge Customers For Irma Repairs After All, Citing Tax Savings

FPL says savings from the federal tax overhaul will allow it to avoid billing customers for the $1.3 billion cost of restoring electricity after Hurricane Irma.

Not To Worry, Estate Planners: Help For Struggling Millionaires Is On The Way

The estate tax was just slashed to exempt millionaire families up to $22 million, a doubling of the previous exemption, which had covered 99.8 percent of taxpayers.

3 Reasons The Trump Tax Plan Is a Disgrace

Robert Reich’s three-step guide on the rubbish of the Trump-Republican tax plan for when you confront your Republican Uncle Bob during the holidays.

Senate Leader Eyes Constitutional Amendment Requiring Two-Thirds Majority For Any Tax Increase

The Florida Constitution Revision Commission, which meets every 20 years, has the power to place constitutional amendments on the November 2018 ballot.

Historically Low School Tax Will Diminish Effects of Tax Increases in Palm Coast and County

Even though county government, Palm Coast, Flagler Beach and Bunnell are all increasing taxes, homeowners’ bills will not see a steep increase thanks to a lower school tax.

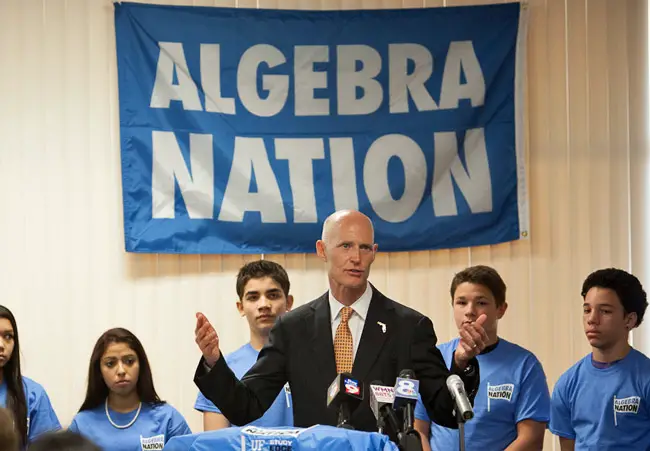

Gov. Scott Seeks Amendment To Require Supermajority When Lawmakers Raise Taxes

Gov. Scott didn’t define the meaning of “supermajority” but 15 states, liberal and conservative, already have the requirement of from 60 to 75 percent supermajorities when lawmakers raise taxes.

In Some States, Sales Tax Holidays Lose Luster as Hype Overshadows Cost

Tax holidays don’t increase buying but merely concentrate it around specific dates. They’re regressive. They’re more political than useful: in Florida, the Legislature turned down Gov. Scott’s request for 10 days.

There’s No Good Reason for Your Boss to Make 347 Times What You Do

It’s business executives through outsized CEO pay — not movie stars, professional athletes, or heiresses — who grabbed the dollars that once flowed to the American worker.

Lawmakers Approve Budget With Tax Cuts, Severe Cuts to Medicaid, Minor Increase For Education and Big Boost to Charters

The budget package includes a modest increase in per-student spending through the state’s main education formula, $521 million in Medicaid cuts for hospitals and far-reaching changes to education across the board.

Senate Approves Constitutional Proposal That Would Increase Homestead Exemption to $75,000

The homestead exemption proposal would go before voters as a constitutional amendment in 2018, would save homeowners money but cost local governments millions in revenue.

GOP Plan Scraps Individual Mandate Only to Create New, 30% Penalty For Laggards

The GOP approach is called a “continuous coverage” penalty. It increases premiums for people who buy insurance if they have gone 63 consecutive days without a policy during the past 12 months.

Renner Is Right: Kill Enterprise Florida and Visit Florida, Twin Kleptos of Public Troth

Enterprise Florida and Visit Florida are two tax-supported state agencies that act more like slush funds, wasting money behind secretive veils and returns on investment that have never lived up to the promise.

Trump On Your Side? Repealing Obamacare Is a Tax Break For Rich at Poors’ Expense

If Obama’s health law is reversed, taxes will go down for the rich and up for the poor, while millions lose coverage. It is redistribution for the wealthy.

The Best and Worst Presidents on Taxes

Ronald Reagan was among the worst–and the best–when it came to tax fairness, Teddy Roosevelt isn’t given enough credit, but a majority of American presidents did little by way of making the tax code fairer. It’s often been the opposite, argues Sarah Anderson.

Taxes Will Stay Flat For Most Property Owners in Flagler and Its Cities in 2017

Taxes have increased in Flagler County and in all five cities, but will be largely offset by a tax decrease in school taxes, while values have increased only marginally.

In 3-1 Vote, County Enacts Special Taxing Districts for Two Hammock Subdivisions to Drain Flooding

Flagler County government is rolling out a long-awaited plan to contain drainage problems in Marineland Acres and the Malacompra Basin, with a new annual tax on property owners to help pay for the improvements. Some residents welcome the plan, others see it as costly and as jeopardizing the beachfront atmosphere.

Give Tax and Spend a Chance

The astonishing momentum of Bernie Sanders’s presidential candidacy reveals that millions of taxpayers are willing to entertain the idea that some of us aren’t taxed enough, and that it’s hurting the rest of us, argues Isaiah J. Poole.

Court Upholds Prohibition on Married Couple Claiming 2 Separate Homestead Exemptions

Whether in state or out of state, the Florida appeals court found that the plain language of the law meant that only one homestead exemption was allowed, regardless of location.

3-Day School “Tax Holiday” Part of $129 Million Tax-Cut Package Nearing Approval

The package is far short of the $1 billion in tax cuts that Gov. Rick Scott requested. The trimmed-down package is the result, at least in part, of lawmakers responding to state economists reducing revenue forecasts for the next couple of years.

With $714 Million For School Construction, Lawmakers Close in on $80 Billion Deal

Lawmakers have to agree on the roughly $80 billion overall spending plan by Tuesday for the legislative session to end on Friday, as scheduled.

Gov. Scott Sought $1 Billion in Tax Cuts. Senate Cuts It Down to $129 Million.

The new tax-cut package will combine with about $290 million earmarked to hold down local property taxes that would otherwise go into the state’s school-funding formula.

Sheriff Issues Warning of IRS Scams as “Hundreds” of Palm Coast Residents Report Fraud

Tax season is intensifying scams from fraudsters posing as the IRS, who have been targeting Palm Coast residents and threatening them with arrest if they don’t immediately pay bogus tax bills.

Starting With $8.50 Increase Next Year, FPL Seeks Monthly Rate Increase of $14 By 2020

The proposal would help cover the nearly $16 billion that the power company has been investing since 2014 to improve its electricity service.

Florida House May Back Scott’s $1 Billion Tax Cut, With Minor Differences

The House intends to offer a $1 billion tax-cut package that includes Gov. Rick Scott’s call to reduce a tax on commercial leases and holding a back-to-school sales tax “holiday.”

Familiar Priorities In Scott State of the State: Tax Cuts and Spending on Business Incentives

The governor has essentially staked his legislative session on the success of two initiatives: A $1 billion tax cut and devoting $250 million to a new “Florida Enterprise Fund” to help lure employers to the Sunshine State.

Taxation’s Next Frontier: The Cloud

But as states look to tax cloud services, questions arise as to whether storage space in the cloud is a tangible “good,” subject to sales taxes, a “service,” subject to use taxes, or neither of those.

Scott Wants Tax Cuts Larger Than Projected Surplus. Lawmakers Are More Prudent.

Scott wants a larger tax-cut package in 2016 than the $673 million he sought this year, even though the state budget surplus is projected at $635.4 million, much of it one-time revenue that won;t recur in subsequent years.

Florida Lawmakers Consider Dumping Property Tax and More Than Doubling Sales Tax

If the state eliminated all property taxes, committee records indicate the state’s sales tax would have to go from 6 percent to 12.72 percent to cover existing state, local, school and special district expenses.

Yet Another Sales Tax “Holiday” Proposal, For Two Months, This Time for Military Veterans

The military veteran sales tax break would last from Nov. 1, 2016, through Dec. 31, 2016, just in time for the holidays, but competes with other breaks.

County Approves Indefinite Halt to Road Impact Fees, May End Them in East Flagler

A moratorium has cost cost the county $810,000 in transportation impact fees and $145,000 in parks and recreation fees as a result.