Every local government–the county and every city–is increasing property taxes in 2018, some, like Palm Coast and Flagler Beach, by relatively significant amounts. Yet property owners will not see much of a tax increase when their bill comes due.

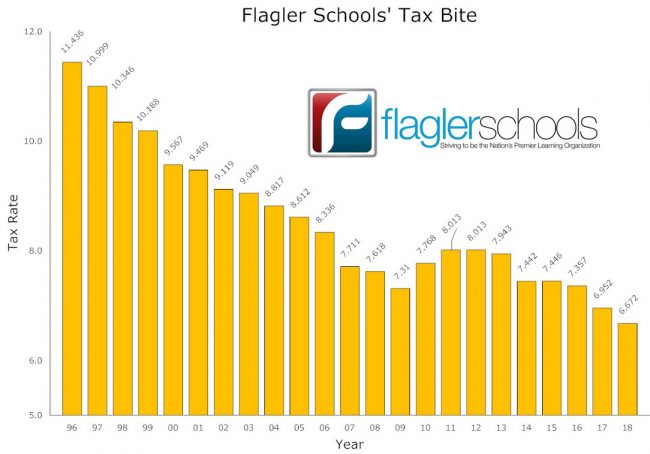

The reason: school property taxes have fallen to an all-time low.

School taxes account for about a third of the typical property owner’s tax bill. So when that portion of the bill falls, it disproportionately affects the rest of the bill, erasing or at least limiting whatever increases other local governments have approved.

Let’s assume you have a $175,000 house and you live in Palm Coast. You have to pay taxes to the school district, the county, the city, the East Flagler Mosquito Control District, St. Johns River Water Management District, and the Inland Water River Navigation District. This year, you paid a combined bill of $2,728, with school taxes accounting for $1,043 of that, county taxes taking $1,079, Palm Coast $536, and the remaining agencies taking the small amounts left.

For 2018, the school tax rate will drop enough to decrease the bill for that $175,000 house by close to $50. That’s enough to absorb increases approved by the county and Palm Coast. The 2018 bill, based strictly on tax rates and without taking improvements in property values into account, will come out to $2,715, a decrease of $13. (Once property values are figured in, the assessment will come out closer to a $100 increase overall.)

For 2018, the county tax rate will remain the same. That still amounts to a tax increase under Florida law, because property values have increased about 6 percent, and assessments are based on the taxable value of your home or business. But from a property tax rate perspective, there’s no increase. In Palm Coast, there’s a tax rate increase and a property value increase, which would raise your bill by about $43–still not enough to match the decline in school taxes.

Flagler Beach just approved a significant tax increase of its own, but as in Palm Coast, it won’t be so steep as to overcome the benefit of the school district’s tax decrease.

Property owners and businesses may be glad that their taxes aren’t going up significantly. But the sharp decrease in school property tax rates means that the local district is still having to make do with fewer dollars per student than it did before the housing crash–and significantly fewer dollars when inflation is taken into account.

All property tax rates are set by the local agency that manages those dollars–except for the school district. That rate is set by lawmakers. The local Flagler County School Board has no say. It merely goes through the motions every September of adopting the rate imposed by lawmakers, as it did this year. Every local government held two legally required public hearings to adopt those rates (some still have a hearing or two to go). But none of the hearings drew an audience.

Property taxes in local government pay for all basic services, from law enforcement to fire services to sanitation, code enforcement, publicity, governments’ legal costs and so on, while paying the salaries of all employed in those fields. But property tax rates do not reflect many additional government services that are paid for through fees and which, if included in tax bills, would result in much higher taxes. In Palm Coast, for example, the $11-a-month stormwater fee, to pay for drainage, is separate, as is the garbage fee, as are utility fees to pay for water and sewer services. Water and sewer service fees are going up significantly in Flagler Beach, as is the garbage fee.

Below is a complete chart of every government’s tax rates and what that means when applied to the typical homeowner with a $175,000 house.

![]()

Property Tax Rates and Effective Tax Bills for Residents in Flagler County, Palm Coast, Flagler Beach and Bunnell, on a $175,000 House with a $50,000 Homestead Exemption (2017-18).

| Local Government | ||||||

|---|---|---|---|---|---|---|

| Flagler County School Board | ||||||

| Flagler County | ||||||

| County Debt and Sensitive Land Levies | ||||||

| St. Johns River Water Management District | ||||||

| Florida Inland Navigation District | ||||||

| Mosquito Control | ||||||

| Total: What All County Residents Pay* | ||||||

| Palm Coast Residents | ||||||

| Flagler Beach Residents | ||||||

| Bunnell Residents | ||||||

| Beverly Beach Residents | ||||||

| Marineland Residents |

(*) For residents of west Flagler, the mosquito control tax does not apply. For city residents, the total rate from countywide taxes is added to the city rate for a final tax bill total.

(**) For a definition of the roll-back rate, go here.

(***) The tax bill is calculated on a median-priced house of $175,000, with the assumption that the house has a $50,000 homestead exemption. So its taxable value would be $125,000 in 2017, or $150,000 when calculating school taxes. The taxable value in this chart does not take into account the increased or decreased value of a property. Values have appreciated between 3 and 6 percent across the county, which would affect tax bills accordingly.

Sources: Flagler County Property Appraiser and local governments.

Mark says

Cut Landon’s pay and benefits and we can lower the tax rate.