Supporters of the overhaul say it’ll fill up empty homes. Critics say it’ll also slash local government revenue and further shift the tax burden to current residents, exacerbating inequities.

taxes

They Bring Good Schemes to Life:

How GE Pays Little Or No Corporate Taxes

GE’s tax department is a company in itself: some 1,000 people working to minimize GE’s corporate tax liabilities, with huge success. In 2010, GE paid no taxes on $14.2 billion in profits. GE claimed a tax benefit of $3.2 billion.

State of the State Tonight: Scott and Legislature’s GOP Keep Their War Civil–So Far

Don’t expect Gov. Rick Scott to deviate much from his frequent message as he delivers his first State of the State speech Tuesday night before a joint session of the Legislature: Budget cuts, tax cuts, potshots at Washington rather than his own dissenting GOP.

Flagler Schools Prepare to ‘Awake the State’ As Night of Long Budget Knives Falls on Florida

As school employees prepared to demonstrate against massive state budget cuts on Tuesday, the Flagler School Board got closer to proposing cuts of its own that would eliminate classes and up to four dozen teachers.

Enough Nickel and Diming: How to Cut $1.5 Trillion From the Budget Without Really Trying

Voodoo economics is back, this time with Obama sprinkling the wrong salts. His plan to reduce the deficit is irresponsible. Here’s one way to do it now, with everyone contributing. The alternative is French status in 10 years.

School Board Reminds County and Cities of Its Own 1/2 Penny Sales Tax Renewal Ahead

The county is angling for a new half-penny sales tax for economic development. That tax could hurt the school district’s renewal of its own half-penny tax, in effect since 2002.

Marineland’s Future: Dividends in Waiting After Acquisition by Georgia Aquarium

David Kimmel, President of the Georgia Aquarium, the new owner of Marineland’s dolphin attraction, and others assess the future of the marriage between town and attraction.

Severe, $3.5 Million in School Cuts on the Way: 40 Teachers, Shorter Days, Shorter Calendar

The Flagler County School Board agreed to the cuts today, the result of federal stimulus aid running out and Gov. Rick Scott’s proposed cuts to the education budget. Many of the cuts must be negotiated with the unions.

Skipping Specifics, Scott Calls for $5 billion in Spending Cuts, $4 Billion in Tax Cuts

Gov. Rick Scott today unveiled to a tea party crowd a budget that would cut an unprecedented $5 billion and provide for $4 billion in tax cuts, $1.4 billion of which in property taxes. Scott’s details are few.

Done Deal: City Picks Architecture Firm, Advertises Construction For New City Hall

City council members, including Mayor Netts, insist that until they have a signed contract, nothing is a go. Netts is still waiting for hard data from City Manager Jim Landon justifying the new building.

Flanked by Tea Party, Rick Scott Will Unveil State Budget in Central Florida Monday

As tea party activists gather from Central Florida to Eustis, Gov. Rick Scott’s budget unveiling Monday will have the feel of political rally as he attempts to close a nearly $4 billion hole while still proposing tax cuts.

Detox for Tax Fact Cheats

It’s a resilient urban legend: the top 5 percent of earners pay over 50 percent of taxes, and over half our citizens pay no taxes. It’s also false. Time to set the record straight.

Incentive This: Corporate Tax-Breaking Our Way to Job Creation

Barack Obama’s second State of the Union Address fell flat, argues St. Augustine novelist Jack Cowardin, who makes an original proposal for job creation and a break in the corporate tax rate.

Dog-and-Pony Powerpoints: Landon’s Stage-Managed Shows for a New Palm Coast City Hall

City Manager Jim Landon says the $10 million city hall project is different than the plan 82 percent of voters rejected in 2005. He’s right: residents won’t be allowed to vote this time, even though economic conditions are far worse.

Election Primer: Amendment 4, “Hometown Democracy” and Sprawling Misinformation

Amendment 4, Florida’s so-called “Hometown Democracy” amendment, is an attempt to give voters a voice in major local development initiatives. It’s also rife in misinformation.

FPC’s Top Student Makes the Case

For the .25-Mill School Tax Referendum

Kyle Russell, the top-ranked senior at Flagler Palm Coast High School, argues that students need every competitive advantage they can get if they’re to have a chance against others in the state and the nation.

In Palm Coast, Another Dud Turnout At School Tax Town Hall

School officials had thought (and feared) that the tea party throngs would turn up at Monday’s town hall on the proposed $0.25 mill school tax referendum. They didn’t. What those tea leaves say is not clear.

County Raises Bed Tax to 4%, a Victory for Milissa Holland’s Tourism Marketing Thrust

The higher tax, Milissa Holland argued, will broaden Flagler County’s marketing power, drawing more visitors and creating more jobs for local, small businesses.

Superintendent Janet Valentine: Why You Should Vote For the .25 Mill School Tax Levy

School Superintendent Janet Valentine makes the case for the 25-cent-per-$1,000 property tax levy on November’s ballot, the continuation of a tax homeowners have been paying all along.

School Board Members Talking to Empty Benches at Town Halls on Tax Levy

School officials think most people have already made up their minds about Flagler’s .25 mills school tax levy. They just can’t tell which way they’ll vote.

Leery of Landowners and Litigation, Palm Coast Council Kills Latest Stormwater Proposal

Property owners of large and vacant lands objected to paying a stormwater drainage fee in exchange for no discernible benefit. The two-year old attempt to rewrite the ordinance continues.

“Economic Development” Tax Dies: Enterprise Flagler Wants It Removed from the Ballot

Enterprise Flagler will ask the county commission to ensure that the voting on the troubled tax not be counted. Plan B: a sales tax proposal.

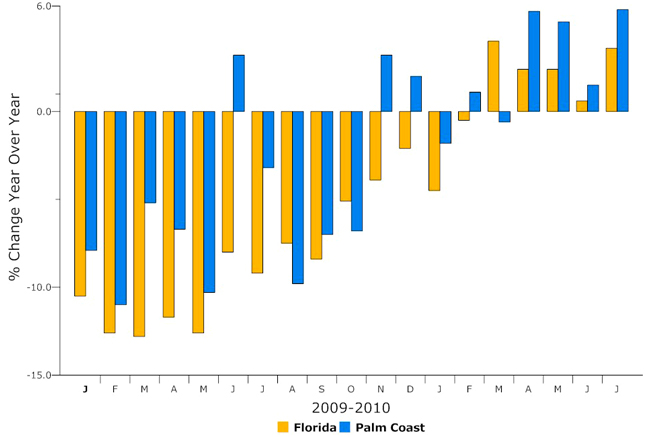

Palm Coast Consistently Beating Florida As Taxable Sales Indicators Continue to Improve

Tourism and retail sales, and fewer people traveling elsewhere to buy goods, are keeping Palm Coast’s taxable sales among the most-improved in the state, compared with 2009.

Palm Coast Redraws Its Stormwater Tax, Benefiting Some Big Landowners

Vacant properties of 25 acres or more will pay less than considerably less than the $8 a month stormwater tax assessed on the typical residential property in Palm Coast.

Inaccurately and Incoherently, Fischer Opposes School Tax Measure; Sword Favors It

The two school board candidates differ sharply in their awareness and understanding of a proposed school tax referendum on the November 2 ballot, with Fischer calling himself “confused” about it.

The Other Tax Referendum: School District Battles Misperceptions to Preserve Levy

What looks like a new school tax on the Nov. 2 ballot is, in fact, the continuation of a tax property owners have been paying all along. The school district still has a battle on its hand to convince voters.

Its Initiative in Flames, Enterprise Flagler Hands Tax-and-Build Plan’s Fate to Tea Party

The Flagler County Tea Party Group will hold a straw ballot on Enterprise Flagler’s tax-and-build “economic development” initiative on Sept. 21. Enterprise Flagler may then ask the county commission to pull the measure from the ballot.

Hometown Democracy and Class-Size Amendments Spark Up Civic Association Forum

The Flagler Palm Coast Civic Association’s forum featured contrasting views on ballot proposals that would affect class sizes, development laws, and two local taxes.

In 1st of 2 Rounds, County Adopts 14% Tax Rate Increase Against Scattered Criticism

The rate, $5.5905 per $1,000 in assessed value is up from $4.8894 per $1,000; for a $138 million budget that includes 287 county employees, down 64 positions in three years.

Tourist Tax Increase Clears Key Hurdle With 4-1 County Commission Vote

The Flagler County Commission must now hold a public hearing on the increase of the tax from 3 to 4 percent, but the 4-1 vote suggests the measure is headed for approval.

School Board Approves $166 Million Budget; Tea Party’s Response Is Mostly Decaffeinated

The school board’s final budget adoption hearing was better attended than most ion previous years; questions and comments didn’t necessarily have much to do with the budget.

Memo To Enterprise Flagler: Why Your Tax Plan Is Fumbling (and What To Do About It)

From its message to its messenger, Enterprise Flagler’s tax-and-build plan is facing obstacles and unanswered questions of its own making. It may be too late to reverse opposition, but not too late to do the right thing.

It’s Raining Taxes, Cont’d: Behind Scenes, County Manager Floats Sales Tax Increase

One proposal would increase the half-cent sales tax by a super-majority vote of the county commission, bypassing voters.

County Caves to Court Clerk Gail Wadsworth’s Demand for Bigger Staff and Budget

The $120,000 increase, which the county will have to draw from reserves or from budget cuts, is identical to the amount it would take to keep Carver Gym funded at the current level.

Outlining Achievements, Enterprise Flagler Tells Palm Coast City Council: We Matter

The economic development agency’s list included achievements that weren’t quite its own while Director Greg Rawls remained cagey regarding the new tax the agency is proposing.

Innovative Garden Hose Start-Up Swells Flagler Hopes for Economic Revival at the Airport

MH Operations proposes to manufacture an expanding and retracting hose few will resist, and do so from a county airport, where it would create 125 jobs.

Cakes Across America Dumps Airport Building County Built For It; Taxpayer Bill: $300,000+

In another example of economic development subsidized at taxpayers’ expense, the cake company leaves taxpayers holding the bag for a promise of jobs never fulfilled.

Palm Coast City Manager Jim Landon’s Compensation Package: $218,296 a Year

Jim Landon’s base salary of $168,878 is higher than the total compensation package of the school superintendent, who manages five times as many employees and is responsible for 13,000 students.

450 Vehicles for 350 Palm Coast City Employees? Council Bridles at “Urban Legend”

Palm Coast’s city government owns a total of 285 vehicles, including dozens of off-road mowers, utility vehicles and firetrucks, though it also has a well-endowed vehicle fund.

Council Slams Enterprise Flagler’s Camouflage, Casting Doubt on “Development” Tax

The economic development agency that devours taxpayer dollars year after year hasn’t produced a report in years showing what it’s accomplished. Elected officials are tiring of the mystery.

It’s Raining Taxes: Despite Rising Revenue, County Considers Increase in Bed Tax to 4%

The increase to 4 percent would fuel the backlash against other local tax proposals and increases.

Laying Off Employees, Palm Coast Is Set to Pay at Least $83,000 for One School Deputy

The school deputy Palm Coast is paying for is a way to get four other extra deputies on Palm Coast’s streets for large portions of the year–at the schools’ expense.

In a Shift, Andy Dance Joins Unanimous Vote for School Tax Referendum in November

Andy Dance’s switch improves the school district’s case for a tax proposal while hurting that of an “economic development” levy.

What You Always Wanted to Know About Mills & Millage Rates

Even John Quincy Adams complained almost 200 years ago that few people could figure out the meaning of “mills,” and he wasn’t even talking about millage rates. Here’s an explanation and some history of the most commonly incomprehensible word at tax time.

County Tax Rate Going Up 15.4% Even as Revenue and Government Services Stall

The proposed 2011 property tax rate would be the highest in at least 10 years, yet collapsing property values mean government revenue will not rise at all compared with this year.

Andy Dance’s Two Masters: Voting for a Tax at the Chamber, Against One at the School Board

Dance says a perceived conflict between his positions on two tax proposals is unfortunate, but he’s still exploring the school option.

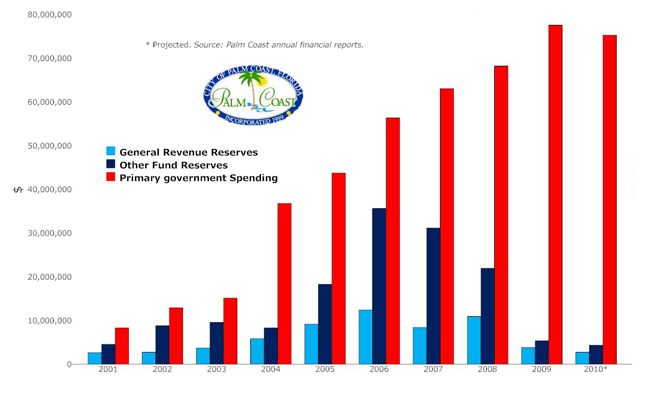

In Shifty Budget, Palm Coast Projects Peter Pots Paying Paul Pots and 12-15 Lay-Offs

Next year’s city budget is heavy on shifts, cuts and one pot of money subsidizing another while keeping the tax rate where it’s been.

Tax-Free Days: Aug. 13-15, But Applicable Items Are Limited

Everything you need to know about the back-to-school tax-free days this year. But don’t expect to get the tax break at Disney.

Florida Tax-Free Days: The Fine Print

The tax-free holiday in all its details: what’s tax-free, what’s not, according to Florida’s tax revenue department.

Palm Coast Goals: No Tax Hike, 8-10% Cuts, 10-15 Jobs Gone; City Hall Plans Unscathed

The Palm Coast City Council wants to keep property taxes the same, compensating for revenue with fees, fines, loans and reserves, and still build a new city hall.