While supporters insisted that the legislation signed Wednesday will help provide a better business climate, they were quick to say that a variety of factors were at work in the economy, and it would be difficult to accurately figure out how many jobs the measures might create.

Taxes

In a Blow to the County, Palm Coast Explores Switch from Sales Tax to New Utility Taxes

The Palm Coast City Council is exploring dropping a half-cent sales tax surcharge it’s been levying with the county for 10 years, and adopting instead new utility taxes without need for voter approval or splitting revenue with the county.

Florida’s Misguided Lunge for Internet Sales Taxes

Nancy Nally, a Flagler County-based web publisher, argues that Florida’s proposed law to compel internet merchants to pay sales taxes won’t level the playing field or increase revenue, but hurt local businesses like her own.

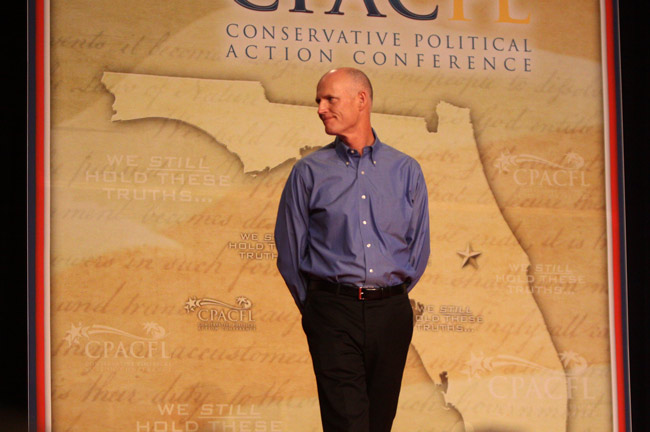

Florida Corporations Get a Bigger Tax Break, Shoppers Get Another Sales Tax Holiday

Gov. Rick Scott called the corporate tax break “a huge victory” for Floridians that would help businesses create more jobs, though there is little evidence that such tax breaks spur job creation, and some evidence that the tax breaks are closer to corporate welfare.

Good News for Flagler Property Owners: Most Home Values Will Barely Fall; Some Will Rise

Flagler County Property Appraiser’s preliminary estimate sees a property value drop in “the low single-digits” at most, with taxable values rising in Grand Haven and Flagler Beach, among other spots, as the five-year collapse in values appears to draw to an end.

Don’t Ban Internet Cafés. Regulate Them.

Internet cafés may be a pest, and their proponents make laughable arguments when they claim they’re not about gambling. But it’s not government’s business to ban them while swinging from the lottery’s levers. Regulation is the key.

When Profit-Raking Disney and the Daytona Speedway Beg Florida for Corporate Welfare

Disney is asking the state for an array of tax breaks that could cost Floridians as much as $100 million over 20 years. International Speedway Corp., owner of Daytona International Speedway, is in on the deal.

Scott Orders Review of Special Taxing Districts Like Grand Haven, Dunes and Every CRA

The review affects such “community redevelopment agencies” such as Palm Coast’s Town Center. Special taxing districts generate $15 billion in revenue annually. Oversight can be more lax than for more general government revenues.

Florida Legislator Wants $1 Cigarette Tax Increase In Exchange for Lower Driver Fees

South Florida’s Jim Waldman, a Democrat from Coconut Creek, wants to roll back unpopular driver’s license and registration fees, paying for it with a $1 increase in Florida’s cigarette tax, now at $1.34.

We Don’t Need Another Payroll Tax Cut

We can all afford less tax coddling and more fiscal responsibility. But don’t expect to hear that from allegedly conservative Republican and our blandly, irresponsibly centrist president, who’s bribing his way to a second term.

As Florida Eyes Resort Casinos As Cash Cows, Economists Warn Against Too High a Bet

Faced with a series of unanswered questions, economists say they cannot not pinpoint how much money the state would rake in if Florida lawmakers approve a plan for three resort casinos.

Obama’s Roosevelt Envy–And Ours

Obama’s version of Roosevelt Lite won’t cut it if he can’t back up his rhetoric with a more serious program of defending the middle class against corporate predators and rich-class irresponsibility.

Don’t Restrict Our Ability to Levy Taxes, Wishful Cities Tell Florida Lawmakers

The Florida League of Cities is urging Florida senators to avoid the temptation to restrict the ability of local officials to levy taxes, and asking for more flexibility on how they spend insurance premium tax revenue and adjust pension benefits.

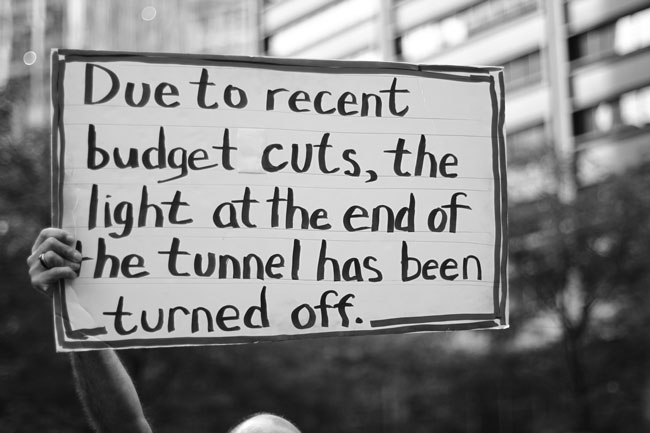

0.2% Stupor: Protecting 350,000 Millionaires At the Expense of 160 Million Workers

There’s a very simple way to ensure that this country goes the way of old, bankrupt empires, and it doesn’t take flying planes into building or suckering the world’s mightiest military into pointless wars halfway around the globe. All it takes is voting Republican.

The Rich Are Different From You and Me

Donald Kaul responds to questions raised by his recent “class-war-is-over-the-rich-guys-won” column, demystifying wealth, taxes and other dogmas.

Expedia v. Florida: Claims of Harassment And Privilege in Online Booking Tax Brawl

Rep. Rick Kriseman, the St. Petersburg Republican, distributed Expedia documents that showed the company knew as early as 2003 that it should pay Florida’s bed taxes. The company wants him to explain his role in court. The Legislature is claiming that lawmakers cannot be forced to testify about issues in the legislative process.

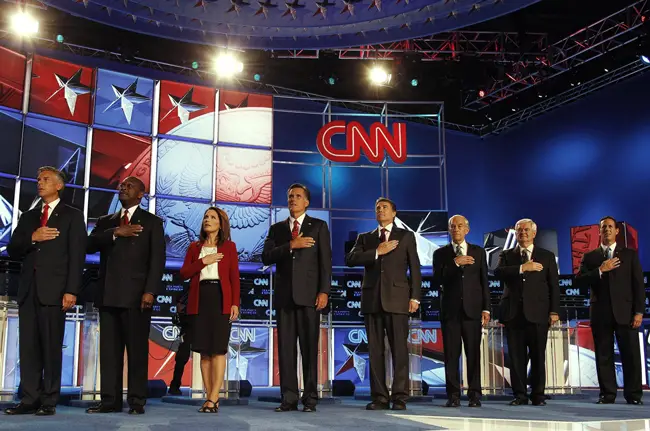

My Fairest Tax Proposal: A Tax on Nonsense

Watching Republican candidates debate taxes and creationism on TV reminds me of original Star Trek episodes featuring those low-tech aliens that nevertheless managed to speak English every time.

Gov. Scott Proposes Corporate Tax Cuts Even As Florida Faces a Deficit of Up to $2 Billion

Gov. Rick Scott wants to double the corporate income tax exemption to $50,000 and eliminate the tangible tax for half of the state’s 300,000 businesses that now pay it. It’s part of his plan to eliminate all corporate taxes ins even years.

Of Course It’s Class Warfare. And the Rich Are Winning in a Rout.

Republicans are accusing President Obama of waging class warfare, which, Donald Kaul argues, is a little like the Japanese complaining about the time Pearl Harbor attacked them in 1941.

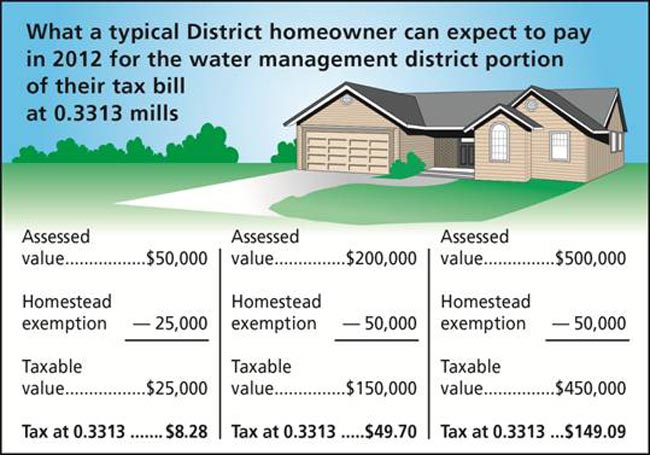

Much Slimmer Water Management District Approves Lower Tax Rate Imposed From Above

The St. Johns River Water Management District’s 26 percent tax reduction resulted in lay-offs of 95 people and the elimination of more jobs through buyouts and vacancies, affecting various parts of the district’s mission.

Check the Box Scoundrels: Corporations Lobby to Preserve a $10 Billion Loophole

The ‘check-the-box’ rule, meant to cut red tape for companies, has inadvertently allowed them to avoid billions of dollars in taxes each year, and the government keeps balking at closing the loophole.

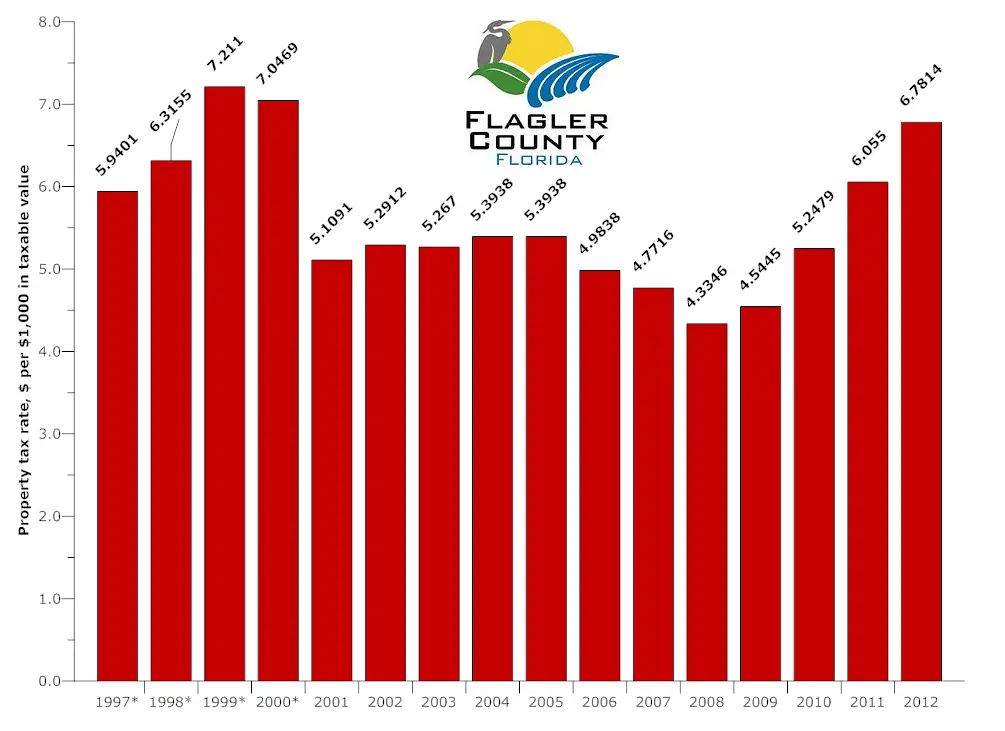

Flagler’s Taxes 15th Lowest Even as Taxable Values See 2nd Worst Drop in Florida

The county commission adopts the 2012 budget for good Thursday evening, essentially cutting taxes modestly even as the tax rate will rise to a 12-year high, despite home values continuing to fall at nation-leading rates.

Flagler County Tentatively Adopts Highest Tax Rate in 12 Years at Subdued Hearing

Only one person, a tea party representative, addressed the Flagler County Commission as it adopted, in the first of two votes, a $65.3 million budget and a 12 percent increase in its tax rate, though most property owners will pay less in taxes.

Flagler Beach Touts Taut Budget With 14.6% Tax Rate Increase and 3% Employee Raise

Though Flagler Beach’s tax rate is again increasing, most property owners will see their tax bills decrease. For Acting City Manager Bruce Campbell, budget season closes a crucial part of his on-going job interview.

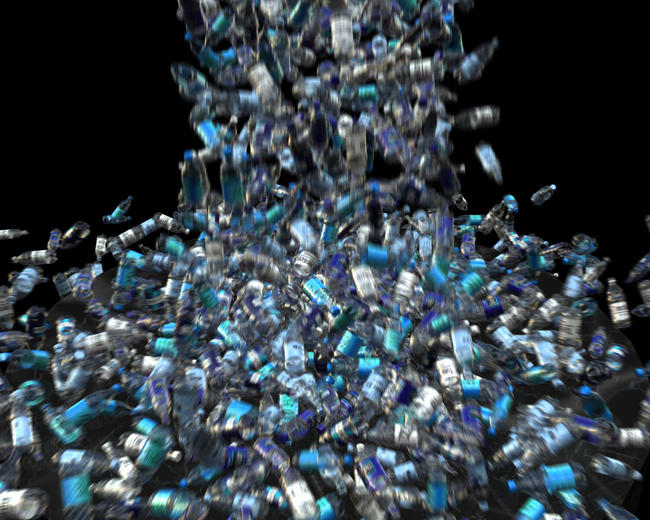

A 6% Tax on Bottled Water in Florida: Ormond Beach’s Sen. Lynn Revives Proposal

The bottled-water tax in Florida would pay for repairing environmental damage from trashed plastic. The water industry is opposing Ormond Beach Sen. Evelyn Lynn’s proposal.

Taxes, the Economy, the Stimulus: Separating Fiction from Fact

Answers to recurring questions of the day: what’s the state of the economy, are Americans really as overtaxed as they think they are, and what has the 2009 economic stimulus accomplished–or not?

The Down Side of Fuel Efficiency: Florida Governments Will Take a $5 Billion Hit

As the Obama administration seeks to double average fuel efficiency by 2025, State and local government revenue dependent on gas taxes will see big declines in revenue that pays for roads, bridges and other infrastructure.

When Income Was Taxed at 94%: How FDR Tackled Debt and Reckless Republicans

The last time the nation faced war debts Franklin Roosevelt didn’t hesitate to raise taxes and show up Republicans who stood in the way of fiscal responsibility, argues Sam Pizzigati.

Reminder: Florida’s Sales Tax Holiday Is This Weekend: Here’s A Guide

Florida’s Tax Free Days, or sales tax holiday, is scheduled this year for August 12 through August 14. The sales tax exemption applies to clothing and school supplies. A complete guide.

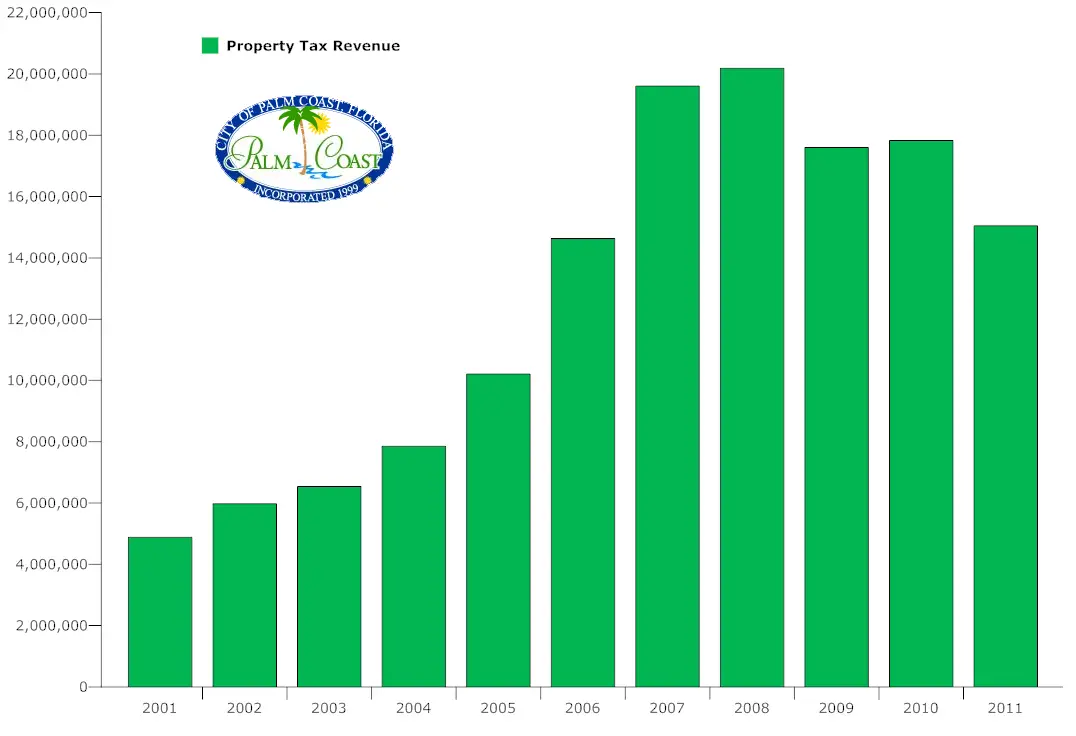

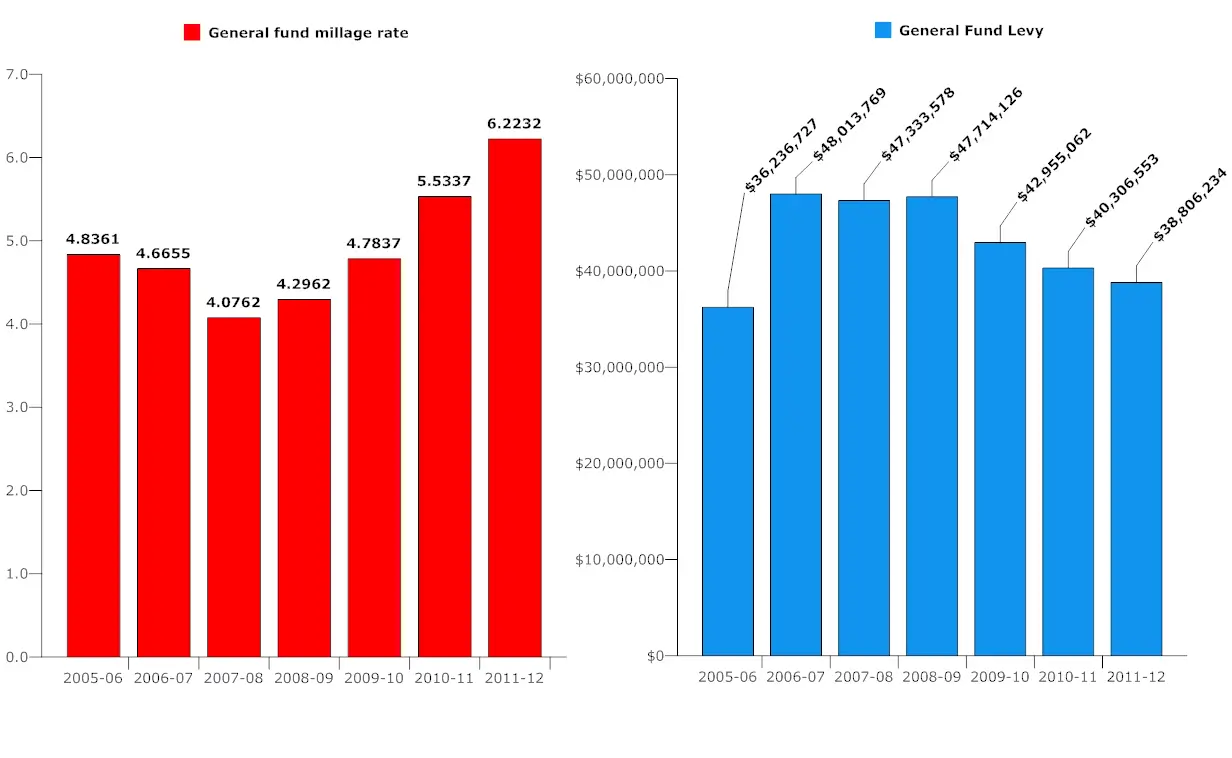

Palm Coast to Raise Tax Rate 14% and Eliminate Stormwater Cost Exemption for Many

Most city services and jobs are protected in a proposed budget that will raise taxes enough to bring in almost as much revenue next year as it did this year, with shifts in sales tax dollars to subsidize the general revenue fund.

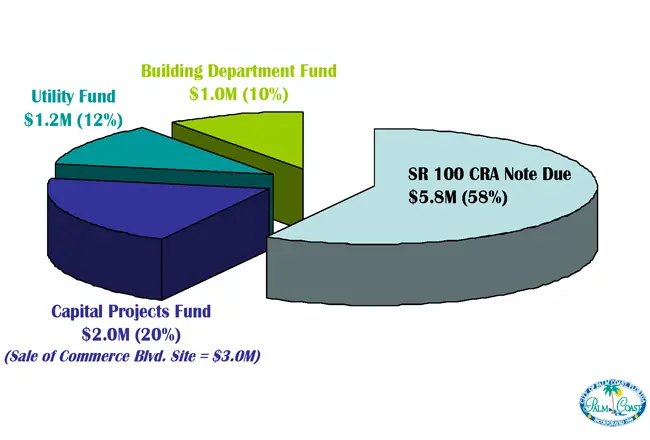

Palm Coast Council Shocked, Shocked To Hear It Ever Had $10 Million for City Hall

The Palm Coast city administration now says that it never had $10 million to build a city hall. The copious record on the matter says otherwise, raising questions about the city’s numbers and verbal shell games.

Palm Coast Sets Intial Tax Rate 14% Higher With Goal of Whittling It Down By September

Palm Coast City Council members are trying desperately to hold the line on property tax increases, but will likely not succeed entirely. The final tax rate will still not translate into a tax increase for most.

Flagler County Tax Rates Will Go Up 12%, But Tax Bills Are More Likely to Go Down

Flagler County’s tax rate is going up for the fourth year in a row to make up for collapsing valuations, but the rise will still not translate into a tax increase for most. The contrary may be true.

Bunnell Commission Says Nyet To Reducing $1 Million Police Force, Whatever the Savings

Bunnell City Commissioner Elbert Tucker proposed reducing the police department’s ranks to cut back its $1 million burden on a $4 million general fund budget. The rest of the commission smacked him down.

Flagler Property Tax Bills Set to Drop Markedly As School Board Keeps 2012 Levy Flat

Contrasting with public perceptions that taxes are going up, a typical house may see a $150 drop from school taxes alone next year, giving Palm Coast and the county more room to maneuver for higher tax rates.

Debt Ceiling Fallacies: How to Pay Down The Deficit Without Really Trying

The debt limit debate could have some catastrophic consequences for the economy, writes Kyle Russell, but politicians aren’t telling the whole story, and the fix isn’t nearly as bad as it may sound.

Water Management District Tax Rate Cut 26%, Reducing Revenue and Gutting Services

The tax bill on a $200,000 house will be $50, down from $62, but the district is laying off employees and reducing conservation, management and partnership projects in line with a new law approved by Gov. Rick Scott.

Tax Fears and $2 Million Gap Have Palm Coast Talking Firehouse Layoffs or End to EMS

The Palm Coast City Council clearly favored more cuts in services than tax increases during its first serious budget discussion of the year Monday, with the city’s fire department appearing to be the likeliest target.

Bunnell’s Challenges: Lawsuits, Layoffs, Deficits, and That $900,000 Police Department

Bunnell entered this year’s budget season facing a $900,000 deficit (about the cost of its police department) and the potential loss of a $1.3 million state contract, among other steep challenges.

$460,000 And Counting: With Federal Aid Unlikely, Flagler Will Bear Fires’ Entire Costs

The still-rising costs don’t help the county’s budget, which is acing a $5.5 million revenue loss from dropping property values. Gov. Scott could have minimized the impact, but he refused to ask for a federal emergency declaration, though previous, lesser fires had gotten such a declaration.

“You Smirked, Mr. Chairman”: Tea Party Puts County Commission On Notice

A tea party throng of close to 100 people jammed a county commission budget workshop Monday, cheering a promise that any tax increase would result in commissioners being voted out. The math on display was less reliable.

Adding to Mounting Legal Challenges for Scott, Public Employees Sue Over 3% Pension Hit

The class-action lawsuit is filed on behalf of 556,296 public employees, including state workers, teachers and police officers. It echoes frustrations that led the Flagler County School Board to talk lawsuit last week.

Counterpunch: Priceline and Travelocity Sue Over Tourist-Development Bed Taxes

The case is of interest to Flagler, whose Tourist Development Council has been aggressively pursuing avenues, including a lawsuit of its own, to compel online companies to pay their fair share of sales and bed taxes.

Flagler Beach Eyes Reserves and

More Taxes to Make Up Latest Revenue Loss

Flagler Beach has raised taxes for three successive years to make up for falling revenue from collapsing property values. It has a relatively large $3 million reserve, which it will likely use in combination with another tax hike to balance next year’s budget.

Facing $6 Million Hit, County Begins Long Budget Season as Tax Hike Appears Inevitable

County commissioners are unlikely to elicit sympathy from taxpayers—or from employees facing a 3 percent pay cut from new retirement-contribution requirements, and a third year without raises.

Summit-Scaling: Enterprise Flagler, Rising Again, Wants $6.5 Million Over 3 Years

What you can expect at Friday’s economic-development summit: Demands for more tax dollars, speculative promises of thousands of jobs from executives, skepticism and disconnects. In short, a retread of old scenarios.

Reserves and Stratagems All Spent, Palm Coast Faces Up to Higher Taxes and More Cuts

Palm Coast lost $3 million in revenue last year by refusing to raise taxes. It’s about to lose close to $2 million more. The administration and the council are preparing taxpayers for a tax increase–or crippling cuts.

County Property Values Fall Another 14%; Palm Coast: -12%; Tax Rates Heading Up

The declines, for the fourth year in a row, will define to what extent local governments must either raise taxes or cut services as they prepare next year’s budgets. Governments have little room to cut anymore, short of vitals services.

Property Tax Overhaul Passes House: Breaks For New Home Buyers, Business, Snowbirds

First-time home buyers would get a 50 percent property tax break on the value of their home. Voters would decide whether to cap property tax assessment increases for commercial properties at 5 percent.

Property Tax Reform: 50% Exemptions, Breaks for Investors, Losses for Local Governments

Supporters of the overhaul say it’ll fill up empty homes. Critics say it’ll also slash local government revenue and further shift the tax burden to current residents, exacerbating inequities.