In inflation adjusted dollars, current spending on public education is $1,100-per-student less than it was in 2007, and would still be $1,000 less if the Legislature goes along with a state board of education proposal.

taxes

Florida’s Tax Revenue Expected to Grow by Modest $462 Million By June 2017

At least some of the extra money is likely to be eaten up by increasing enrollment in the state’s public schools, changes to health-care spending and the like.

Raise the Gas Tax Already

The federal gas tax has been stuck at 18.4 cents a gallon since 1993, lowest among advanced countries. Yet Congress just adopted a three-month stopgap measure, kicking the gas can down the road for the 35th time since 2009.

County and Bunnell Join Schools and Palm Coast’s Higher Taxes, Flagler Beach Holds Line

The tax increases are generating almost no opposition, in large part because they are tied to benefits taxpayers can see: raises for teachers and cops, additions of firefighters (three this year at the county, three more next year), restoring reserves decimated during the recession, and so on.

Palm Coast Proposes 6 Percent Tax Hike; Home Owners Will See Much Lower Increase

If the council sticks with the proposed 2016 rate, which is the same as this year’s, a homesteaded homeowner with a $150,000 house, in the median range in Palm Coast, would see a tax increase of between $5 and $10 dollars for the year.

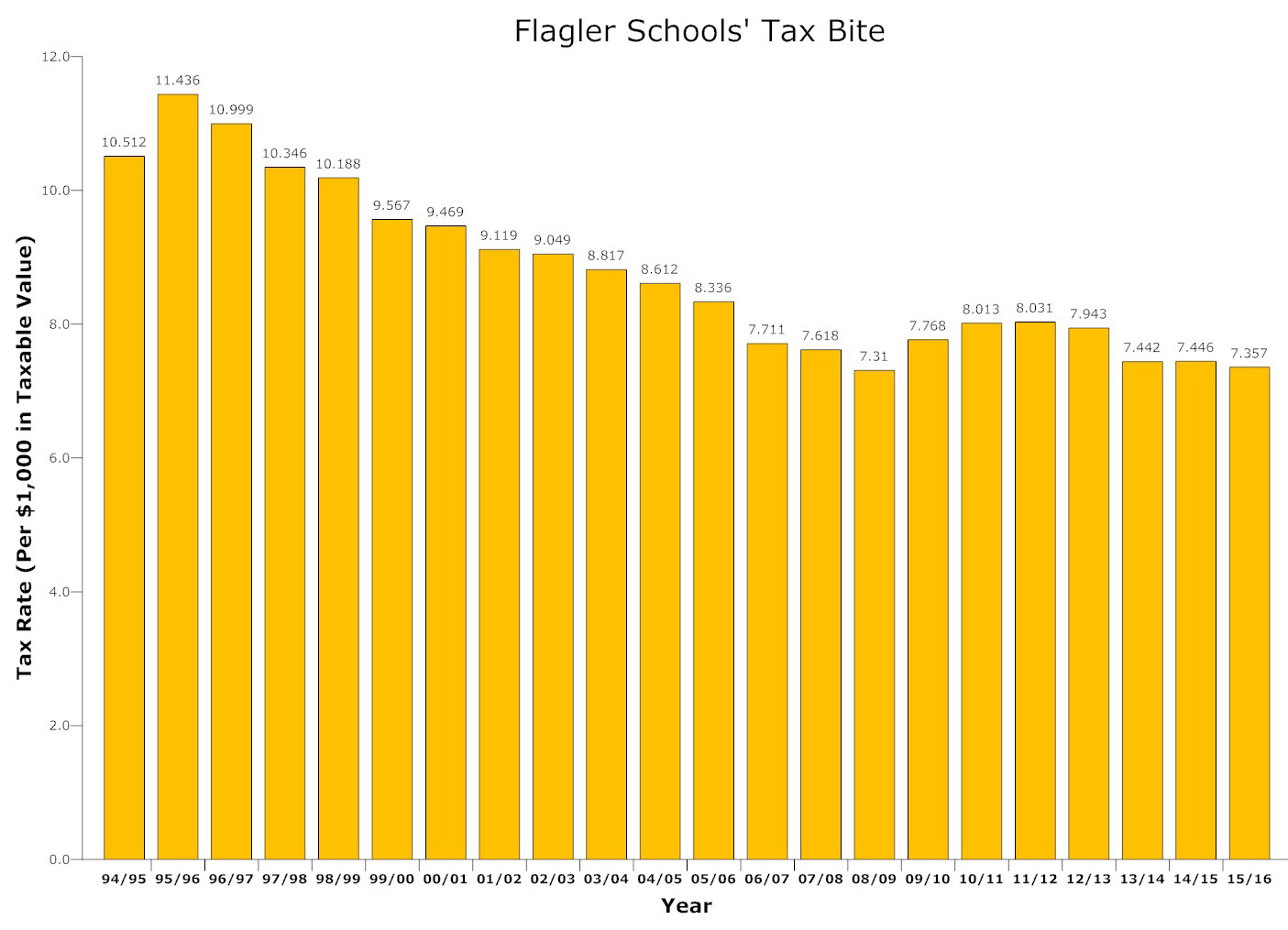

Flagler School Taxes Going Up About 4%, Heralding Season of Steeper Government Levies

The typical Palm Coast house valued at $150,000 will pay roughly $50 more in school taxes for the year even as the tax rate goes down slightly.

$780 Million More for Education in Florida, But a $500 Million Property Tax Increase

The special session’s much-touted tax cut of $427 million is wiped out by a nearly $500 million tax increase to pay for education funding increases.

Gov. Scott Signs $429 Million Tax-Cut Package, Saving Average Floridians a Few Dollars a Year

The tax savings are projected at less than $2 a month for people paying $100 a month for phone or TV services. The package reduces costs on cell-phone bills, cable TV bills, gun club memberships, college textbooks and luxury boat repairs.

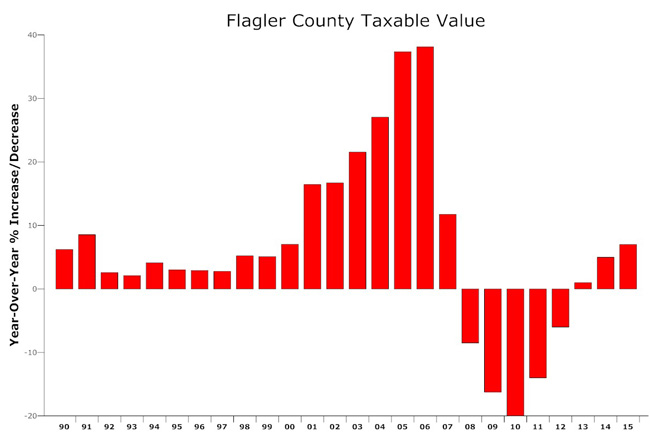

Taxable Values Rise Again–6% in Palm Coast, 7% in Flagler–But So Do Demands on Budgets

With more value comes more revenue for local governments, and more expectations from various agencies and the public–including a $2.4 million budget increase request from the sheriff’s office alone.

Despite Budget Crunch, Cable and Cell Phone Tax Cuts Still Expected in Special Session

Floridians could still get a reduction in their cable-TV and cell-phone bills as part of a new House tax-cut package, though it’ll fall short of the nearly $700 million package projected earlier this year.

Scott’s Magical ‘Tax Cut Calculator’ Obscures Nation’s 2nd Most Unfair Tax System

As Gov. Scott touts minor tax cuts for consumers, you could ask why that $43 a year saved on the cable bill compares so unfavorably with the $3-4 billion in corporate tax evasion he and his legislative allies let Florida’s biggest, most profitable businesses get away with each and every year, writes Daniel Tilson.

Florida House Pushes $690 Million Tax-Cut Package, Exceeding Gov. Scott’s Request

The proposed cuts include sales-tax holidays and eliminating taxes on gun-club memberships, college textbooks, materials purchased at book fairs and vehicles purchased overseas and brought to Florida by military members.

Obama Proposals Would End Tax-Subsidized Loans For Sports Stadiums

The proposal comes as many team owners, including Florida, are pressing cities and states for new facilities, with some threatening to move elsewhere if they don’t get them.

Attention Homeowners: Now’s The Deadline For Homestead Exemption Applications

Today is the deadline to file for a Homestead Exemption in Flagler County. If you miss the deadline, the Flagler County Property Appraiser’s office may be able to work with you within a reasonable window of time.

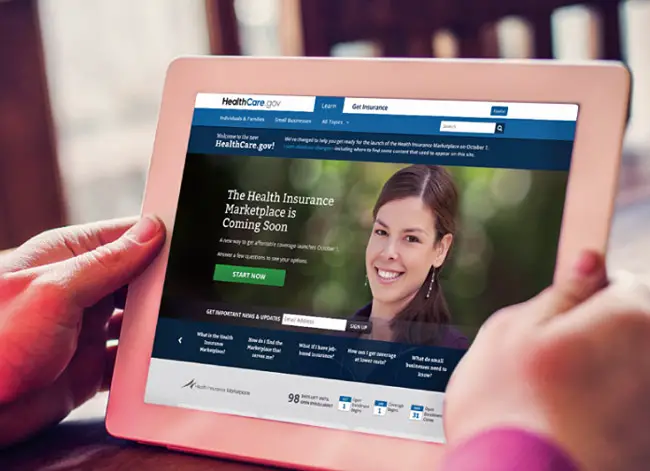

Obamacare Enrollment Will Re-Open From March 15 to April 30 For Penalized Tax Filers

The Obama administration will allow a special health law enrollment period from March 15 to April 30 for consumers who realize while filling out their taxes that they owe a fee for not signing up for coverage last year.

A Strip-Club Sin Tax That Also Takes Names? This Conservative Says No And No.

Florida lawmakers are considering a measure that would charge a $10 surtax on sex-club patrons and require the business to keep a database of customers. Nancy Smith says no.

No Surprise: Florida’s Economic Development Agency Wants Tax Subsidies for Daytona Speedway, Jaguars and 2 Other Sports Venues

Daytona International Speedway is seeking $3 million a year for 30 years to subsidize its operations, the NFL’s Jacksonville Jaguars have asked for $1 million a year for three decades.

Seeking $500 Million Cut, Scott Asks for Lower Taxes on Cell Phone, Satellite and Cable Bills

The governor’s office said it would save about $43 a year for a family that spends $100 a month on cell-phone and cable services, though spending on such services varies widely by household.

Slashing Taxes, Fighting Vouchers, Expanding Medicaid (or Not): What’s Ahead in 2015

With Gov. Rick Scott set to be sworn in for his second term and legislative committee meetings beginning this week, the topics that will dominate discussion in the Capitol in the coming year are shaping up. Here’s a rundown.

Daytona Speedway Seeking $3 Million A Year in Tax Gifts, Jaguars Close Behind

The Jacksonville Jaguars are following closely behind the Daytona Speedway in requests of up to $90 million in sales tax dollars over 30 years, tax revenue that would be subtracted from public needs.

Lockheed’s F-35 Stealth Fighter: A $1.5 Trillion Waste of Tax Dollars

With a projected eye-popping price tag of up to $344.8 million each, the F-35 is almost 8 years behind schedule, billions over budget and not yet combat-ready. And it’s bleeding the Treasury.

Tag Fees Drop Monday and Gov. Scott

Pledges More Tax Cuts on Campaign Trail

Over the next two weeks Gov. Rick Scott will campaign across the state on a pledge to cut $1 billion in taxes over the next two years.

Palm Coast, Flagler and School Tax Bills To Increase About 5% as County and District Set Tentative Rates

For a $175,000 house with a homestead tax exemption of $50,000, the typical tax bill will be $2,574, a saving of $2 from the current rate, when Palm Coast, Flagler, School Board and water management district taxes are combined, before accounting for higher property values of about 5 percent. Totals will be higher in Flagler Beach and Bunnell.

In a Major Blow to Obamacare, Court Rules Health Insurance Subsidies Illegal in 36 States, Including Florida; 2nd Court Disagrees

The decision is a potentially fatal blow to the Affordable Care Act, but it conflicts with an opposite conclusion by a different appeals court on the same day. In Florida, 91 percent of those enrolled get an average monthly subsidy of $278 a month. Most could not afford the premiums without the subsidies, which would disappear if the decision sticks.

Palm Coast Taxes Will Remain Flat This Year As City Projects “Stale and Boring” Budget

The typical Palm Coast property owner will pay roughly $534 for the year, about the same as this year and possibly a few dollars less, as the Palm Coast City Council prepares to adopt a caretaker budget.

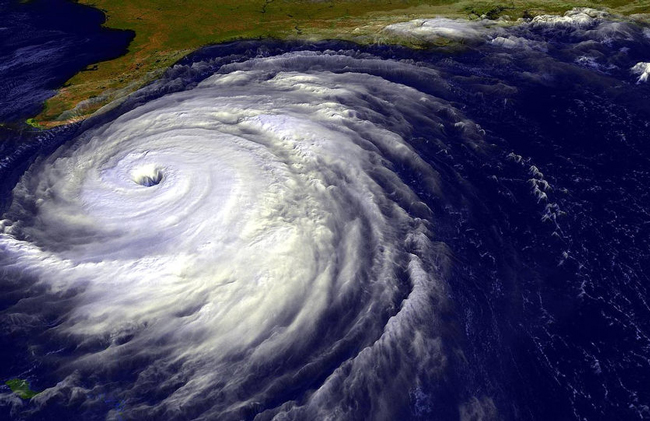

That 1.3% Hurricane Charge on Your Property and Auto Insurance Is Ending 18 Months Early

Collected to help pay claims from the 2004 and 2005 hurricane seasons, an extra charge on homeowners- and auto-insurance policies will be removed 18 months earlier than previously expected.

Flagler Sheriff Warns of Persistent IRS Phone Scam

Immigrants are frequently targeted. Potential victims are threatened with deportation, arrest, having their utilities shut off, or having their driver’s licenses revoked. Callers are frequently insulting or hostile – apparently to scare their potential victims.

County Taxes To Increase Some in a $68.6M Budget That Sheds Austerity for Investment

Flagler County’s 2014-15 budget, led by a $600,000 increase in the sheriff’s costs, is a reflection of a more relaxed, less financially pressured budget season, and a willingness among commissioners to replace years of austerity with increased investment in the government infrastructure.

Don’t Mind a Gap This Year: Flagler County’s Budget Prospects Brighten With Talk of Tax Cut

Countywide property values are expected to rise 5 percent this year and bring in an additional $2.3 million at today’s tax rates, reducing pressures on the budget and allowing the county commission to consider tax cuts and the expansion of services, including the addition of three firefighters.

From a New Branch Library to a West Side Fire Station, Flagler Commissioners Weigh Sales Tax-Funded Projects

Most of the $2-million-a-year sales tax revenue the county commission voted in almost two years ago is spoken for–a new jail, a new sheriff’s HQ–but a few million dollars remain spendable. The administration is proposing a long wish list that commissioners will now rank.

New, Panopticon-Like 272-Bed Flagler County Jail Set to Lock Up First Inmate by Fall 2015

The new county jail, estimated to cost less than $20 million, will be paired with renovated administrative spaces on land that may accommodate two additional “pods” totaling 500 more beds, should needs arise later this century.

Scott Signs Tax Cut Package Rolling Back Car Registration Fees and Offering 2 Tax Holidays

The hurricane sales-tax holiday runs from May 31 through June 8, the back-to-school holiday will run from Aug. 1 through Aug. 3, and vehicle registration fees have been scaled back to pre-2009 levels, among other measures Gov. Rick Scott signed into law.

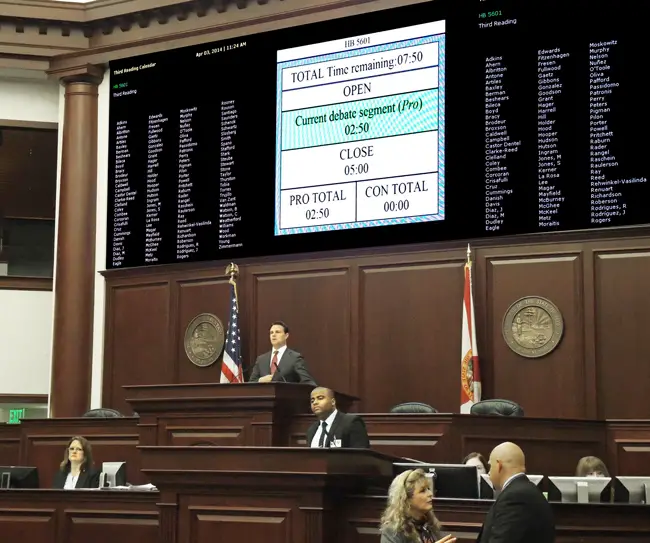

Late-Night Session Nears Agreement on $75 Billion Budget, Including Increase in Student Funding

After two days of what appeared to be faltering negotiations the deals were a sign that lawmakers could finish the budget and have it on lawmakers’ desks by Tuesday. The legislative session is scheduled to end Friday, and lawmakers are required to wait 72 hours before voting on the completed budget.

Your Amazon Holiday Is Over: Giant Starts Collecting Sales Tax in Florida in 2 Weeks

For Floridians who are supposed to pay the taxes but haven’t, the announcement of Amazon’s entry into the state’s brick-and-mortar retail landscape could mean about $80 million a year in sales taxes, according to one business lobbying group.

House Balks at $2 Million-a-Year Tax Subsidy to Daytona Speedway as Other Breaks Advance

Funding for Daytona International Speedway and a temporary tax break on gym memberships could be casualties when the House and Senate meet next week on their opposing packages to complete Gov. Rick Scott’s $500 million election-year tax cuts.

As March 31 Deadline Nears: Going Without Health Insurance Will Likely Cost You At Tax Time

If you thought you could get health coverage later this year, you may not get that chance until November, which means that you’ll most likely have to pay a penalty of 1 percent of your income at tax time, even if only a single member of your family is not insured. Penalties rise in subsequent years.

David Beckham Lobbies Tallahassee for Tax Breaks on a Soccer Stadium in Miami

Elected officials — including Gov. Rick Scott — and staffers flooded Twitter with “selfies” alongside Beckham, who wants to bring a professional soccer team to Miami and has set his goal on the Port of Miami as a potential stadium site.

Moral Monday Comes to Florida as NAACP Leads Capitol Protest, and Right-Wingers Respond

“Moral Monday” included an array of left-leaning groups calling for lawmakers to expand Medicaid, stop the state’s voter purge and roll back the “stand your ground” self-defense law, while a right-wing group later held its own event to oppose expanding Medicaid and support overhauling the state’s pension system, cut taxes and expand school vouchers.

Florida Lawmakers Reeling Up Billion-Dollar Tax Breaks For Film and TV Industries

Less than a week after a measure was introduced in the House to provide $1 billion in tax credit to film and television production efforts in Florida, the Senate Commerce and Tourism Committee released a proposal that offers $300 million in tax credits.

Another Tax Cut for Business: Putnam Proposes Reducing Electricity Sales Levy By Half

By phasing in the reduction from 7 percent to 3.5 percent, the impact to state revenue should be a reduction of about $85 million the first year, and an additional $70 million in each of the two following years. Residential customers would see no tax cut.

In Latest Re-Election Ploy, Scott Proposes 10-Day Sales Tax Holiday, Triple the Usual Length

Scott announced Friday he wants lawmakers to approve a 10-day sales tax holiday in August. The extended tax-free period is the latest of the budget proposals Scott has rolled out in advance of the 2014 legislative session.

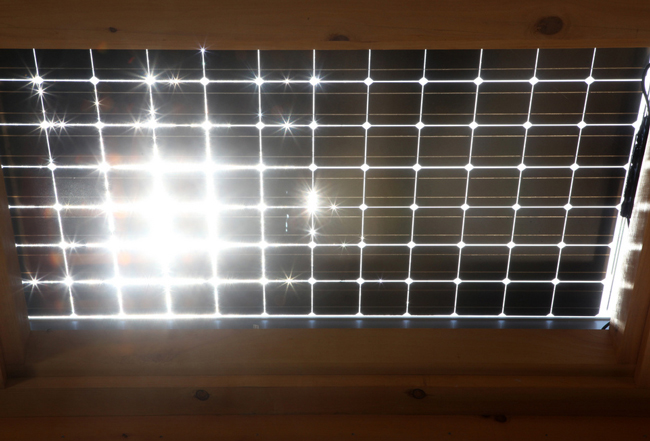

Solar Panel Users as Freeloaders: ALEC Network’s State Lobbyists Attack Homeowner and Business Subsidies

According to the American Legislative Exchange Council, a conservative network better known as ALEC, our solar panels make us “free riders.” What? Yes, according to ALEC, an organization that specializes in getting the right-wing agenda written into state laws, people like me who invest in energy-efficiency and shrinking our carbon footprints ought to be penalized, writes Isaiah J. Poole.

Police and Firefighters’ Unions Troubled by Plan to Give Local Governments Freer Hand in Pensions

A Senate committee pushed forward Wednesday with a bill that would overhaul how local governments fund pensions for police officers and firefighters, hoping that a different political climate in 2014 will allow the legislation to succeed after it died in the House during the spring legislative session.

Extra State Revenue Could Top $1 Billion As Legislature Approaches Spring Session

State economic forecasters added $324.3 million to expected tax revenues during the current budget year, which ends June 30, and the fiscal year that begins the next day. Because lawmakers have already passed a budget covering this year, all of the new money should be available for the spending plan that starts in July.

Another Obamacare Surprise: Married Couples Not Eligible For Subsidies Given Single Filers

For middle class married couples who don’t have children, the subsidy cutoff is $62,000. If one spouse makes $30,000 and the other $40,000, they are ineligible for a subsidy when combined. But if they were just living together, each would be eligible for a subsidy.

State Rakes In Cash From Seminole Casinos and Rethinks Gambling Landscape

Under the current deal with the Seminoles, which ends in 2015, the tribe makes the payments to the state in exchange for having the exclusive right to offer banked table games, such as blackjack, along with a monopoly on all slot locations outside of Broward and Miami-Dade counties. The Seminoles agreed to pay a minimum of $150 million in each of the first two years, $233 million in the third and fourth years and $234 million in 2015.

Sen. Dorothy Hukill Proposes Cutting Sales Tax on Commercial Rental Property to 5%

Senate Finance and Tax Chairwoman Dorothy Hukill of Port Orange’s proposal could cut $250 million a year from state revenue. Business leaders want the tax, currently at 6%, eliminated altogether as Gov. Rick Scott travels the state on a tax-cutting tour.

Projection Shows $846 Million Surplus Ahead of Florida’s 2014 Budget

The estimated $845.7 million surplus could be used during the 2014-15 fiscal year to increase spending or cut taxes — or it could be rolled into the budget for the following year. The projection comes with all sorts of caveats, as the 2014-15 year will not start until July 1.

Lawmakers Will have $435 Million More to Work With in 2014 as Recovery Continues

The added revenue swells to $2 billion the net increase from this year’s budget in the general revenue, but lawmakers aren’t scheduled to take up the budget again until next spring’s legislative session, and other revenue forecasts are expected in the interim, meaning it will likely take awhile before the full budget picture is known.

From 50 Miles a Year to 5,600 Yards: Palm Coast’s Repaving Program Scales Back, Briefly

Only four streets in the R Section will be repaved this year, beginning later this month, sharply contrasting with the 50-mile-a-year program that stretched over 10 years, but City Manager Jim Landon cautioned the city council that a more aggressive resurfacing program of perhaps 15 miles will have to be funded come next year, as streets again show deterioration.