Senate Finance and Tax Chairwoman Dorothy Hukill of Port Orange’s proposal could cut $250 million a year from state revenue. Business leaders want the tax, currently at 6%, eliminated altogether as Gov. Rick Scott travels the state on a tax-cutting tour.

Taxes

Lawmakers File Bill to Prohibit Red-Light Cameras in Florida as Palm Coast Snaps On

GOP Sen. Jeff Brandes blames red-light cameras “as backdoor tax increases,” but the Palm Coast City Council Tuesday reasserted its commitment to its 43 cameras even as they siphon out more than $3 million a year from the local economy–in taxes to state government, and in revenue to ATS, the Arizona-based company that runs the system.

Back-to-School Tax Holiday Now Includes Computers, Tablets and Electronic Gadgetry

Florida’s back-to-school tax holiday Aug. 2 through Aug. 4 for the first time includes high-tech computer and other electronics as long as each individual item is priced under $750. Retailers are preparing for the demand, in some cases lowering prices to match the benchmark.

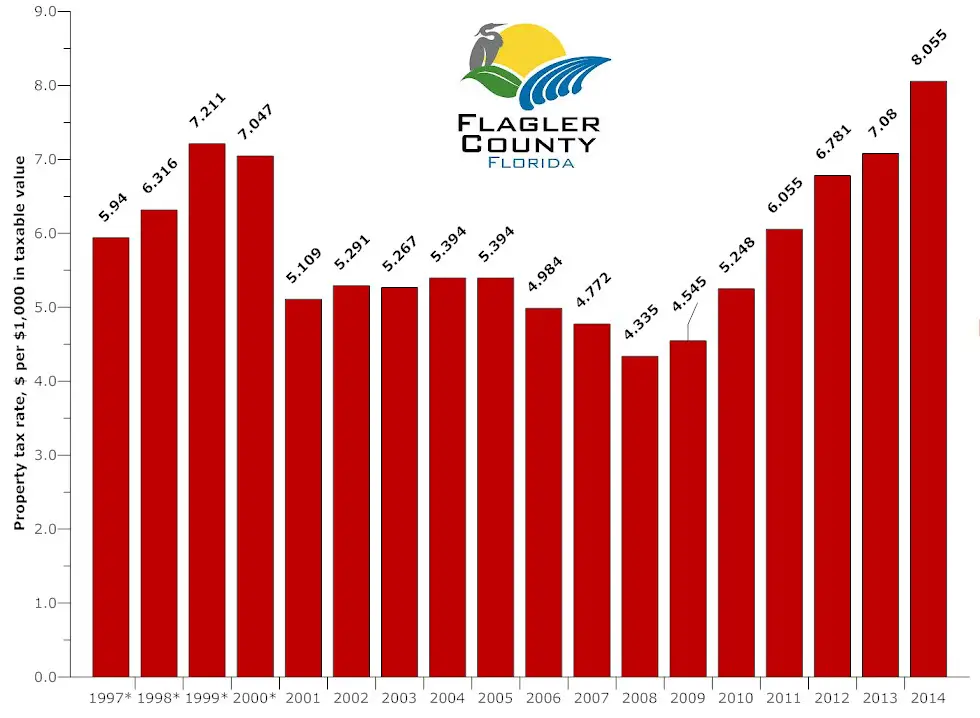

Facing Mandatory Spending, County May Raise Taxes by Nearly $100 for Median Home

In previous years, tax rate increases didn’t mean much because they were either entirely or more than offset by decreases in property values. The end result was lower tax bills for most, even as tax rates went up. That’s over. And tax rates are set to go up in every city, too.

A “Nasty” Government Building Highlights County’s Priorities as Budget Spells Higher Taxes

An unclear Government Services Building and what it costs to maintain it properly was emblematic of the Flagler County Commission’s budget discussion this morning, as the government faces at least a $3.3 million gap, or more, if it hires an extra custodian, no new revenue, and the likelihood of higher taxes.

Florida Loses Out on Amazon Deal, and Up to 3,000 Jobs, Over Sales Tax Fumes

In a statement issued Thursday, Gov. Rick Scott’s administration implied that if Amazon were to locate in Florida and begin collecting taxes, that would amount to a tax increase on Florida residents who use the popular shopping portal.

Speculative Bust: How Widening Old Kings Road Left Palm Coast on Hook for $6.7 Million

Palm Coast borrowed millions from its own utility fund to complete the Old Kings Road widening on the assumption that the economy would pick up and enable the city to re-finance with bonds. That never happened. Now the city is looking to recoup its money from property owners along the road, who’d agreed to a special taxing district but with optimistic assumptions of their own that never panned out.

Ending 3rd Budget Drag-Out in 8 Days, School Board Settles on $1.8 Million in Cuts

After 13 hours of at times harrowing debate, the Flagler County School Board by Tuesday evening settled on $1.8 million in cuts, sparing most programs but not Everest alternative school. The cuts will be restored should voters approve a tax referendum on June 7.

Its Value $26 Million in the Hole, Bunnell Rethinks Downtown Redevelopment Zone

Bunnell established its 800-acre downtown redevelopment zone in 2007, assuming that most tax revenue generated there could then be reinvested in the area to reinvigorate it. Instead, property values fell $26 million in the zone, forcing the city to rethink the CRA’s viability.

Closing Schools a Possibility With or Without Referendum as District Closes Budget Gap

The Flagler County School Board found the $1.8 million in cuts it needed to balance its books Thursday, but was also told that closing Indian Trails Middle, Wadsworth Elementary or Old Kings Elementary may become necessary by 2014-15 if enrollment declines persist.

Flagler County’s Budget Outlook Adds Up To $8 Million Gap and Likely Tax Increase

It’s difficult to see how Flagler commissioners will emerge from the budget process in September without either a substantial tax increase of one type or another or vast cuts in county services, though they began taking on sacred cows, such as consolidating fire departments.

Flagler School District Hones Its Sales Pitch for New Tax Ahead of June 7 Referendum

The Flagler school district is campaigning for the June 7 referendum on a new property tax for schools with a “You Decide” approach that emphasizes restoring time to the school day and reinforcing school security in spite of cuts in state funding.

Online Sales Tax On Its Way, But Phone, Cable and Web Service Taxes Would Be Cut

The measure would offset the increased revenue brought in by the measure by lowering other taxes, including the communications services tax charged on phone service, cable, and satellite TV and internet connections.

Sports Welfare’s Engines: Lawmakers Prep $60-Million Tax Break to Daytona Speedway

A measure that could land more than $60 million in sales tax rebates for the Daytona International speedway was unanimously supported by the Senate Commerce and Tourism Committee on Monday, allegedly to keep the speedway “relevant.”

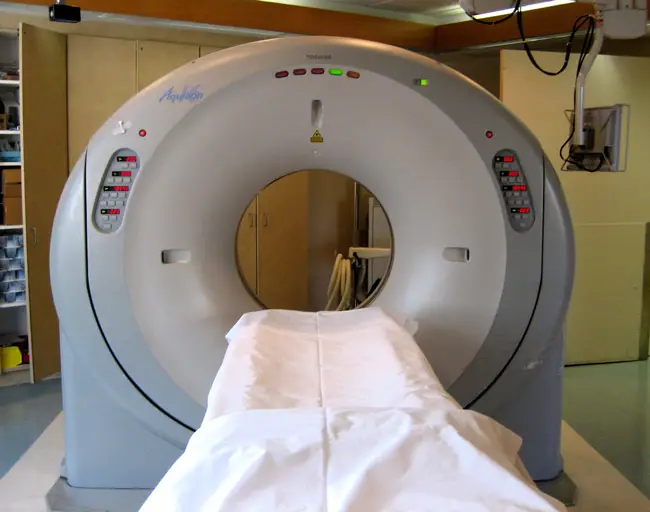

1.7 Million Floridians Could Get Lower Premiums Under Obamacare, But Don’t Know It

The premium assistance, which begins Jan. 1, will come in the form of tax credits for low- and middle-income workers and their families. The money will flow directly to the patients’ health plans, which simplifies matters and means patients don’t have to come up with cash and wait for reimbursement.

Florida Legislators Have $3.5 Billion More To Play With This Year Than Last

Forecasters added $153 million in tax revenues in the budget year that ends June 30, and $106.5 million for the year that begins July 1. Even taking into account likely policy decisions and budget increases, the state could have a surplus of $1.1 billion.

Risks, Cautions, But Mostly Needs as Flagler School Board Readies for Tax Referendum

The Flagler County School Board Tuesday evening will approve going to a tax referendum in June, asking voters to increase their property taxes modestly to preserve programs and add security in schools, but the proposal doesn’t have the unanimity two similar proposals had in the last three years.

Flagler School District Will Propose New Tax, Citing Costly Security Needs and Programs

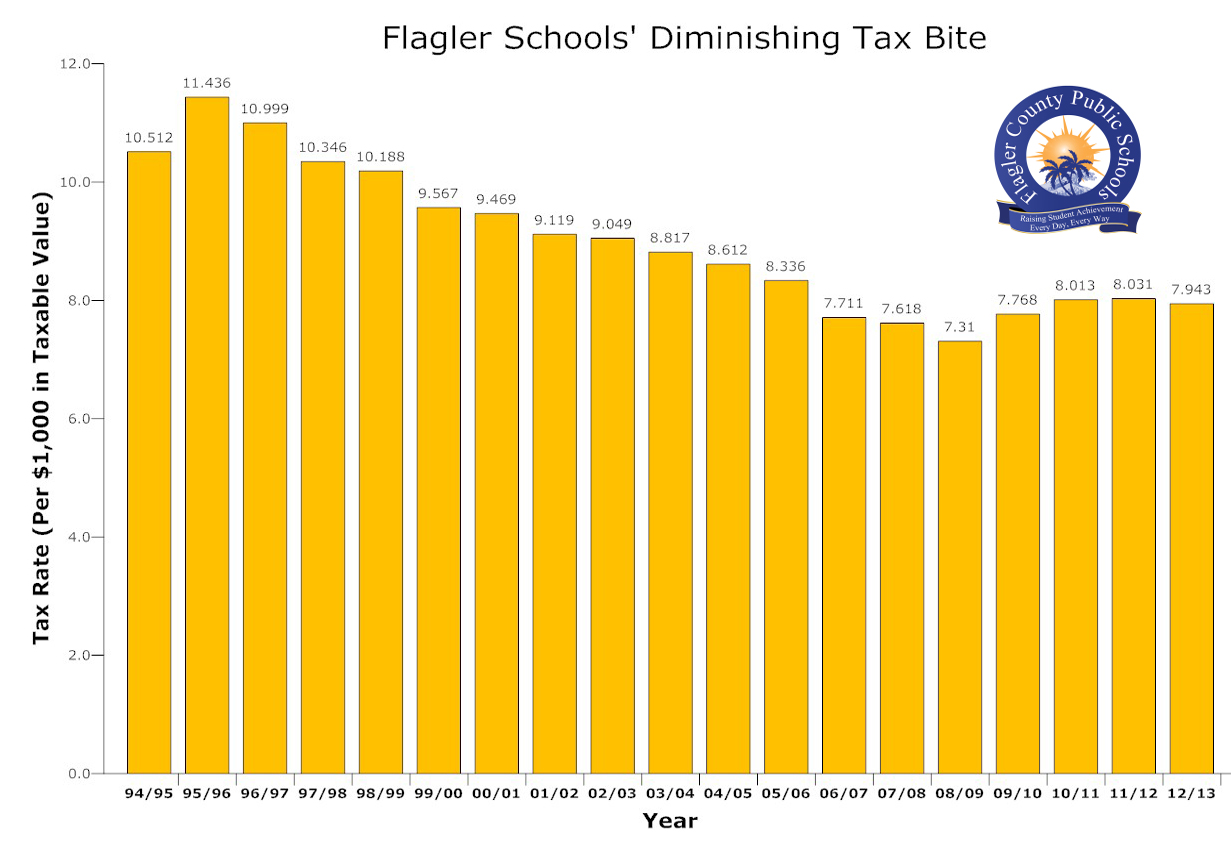

The school board voted 4-1 to ask voters to approve doubling an existing critical-needs levy, to 50 cents per $1,000 in assessed property value–a decision Board Chairman Andy Dance opposed for being too large, citing “school-funding fatigue” among voters.

Appeal Court Rejects Taxing Online Travel Bookings, a Blow to Flagler and Other Counties

The 1st District Court of Appeal, in a 2-1 ruling, said companies such as Expedia and Orbitz cannot be forced to pay local tourist-development taxes on part of the money they collect from customers. The majority found that the disputed amounts relate to reservation charges — not to the actual amounts paid to rent hotel rooms — and described the companies as “conduits.”

Online Booking Companies’ Tax Evasion Fleeces Flagler Tourism and Florida Dues

Online booking companies like Expedia and Hotels.com are short-changing Flagler and Florida of millions of dollars in sales and bed taxes, and unfairly competing with local hotels, argues Milissa Holland, yet the Legislature is looking to give those companies more tax breaks. It’s not the way to go.

Palm Coast Water and Sewer Rates Set to Rise Up to 22% Over the Next Three Years

The Palm Coast City Council prides itself on keeping property taxes low, but its array of fees continue to increase steeply, as will utility rates if the council approves a debt refinancing plan that would let the city borrow another $15 million for utility improvements, even though growth in the city has slowed to a drip.

Amendment 3: A Fight Between Capping Taxes and Funding Government Responsibly

Amendment 3 before Florida voters on the November ballot would tighten the state’s rarely-used revenue cap, potentially giving it more teeth – something supporters say will restrain reckless spending but opponents say would gut vital services.

After Ridiculing County’s Sales Tax Revenue Compromise, Palm Coast Now Wants to Deal

In a turn-around stunning for its audacity, the Palm Coast City Council Tuesday agreed to ask the county commission to revive a compromise the commission had proposed on sharing sales tax revenue–a proposal Palm Coast rejected derisively over the summer.

Flagler Beach Kills Discussion on Amendment 4 as Property Tax Measure Divides Politicians

The quick death of the discussion item is a reflection of the polarizing effects of Amendment 4, which has ardent anti-tax advocates–including politicians elected on limited government platforms–rallying around it while some local government representatives strain to explain how it would short-change revenue.

Snubbing Voters, Lame-Duck County Enacts 20-Year Sales Tax While Slashing Cities’ Shares

Many questions remained unanswered about the use of the money and the size of the proposed jail it’s supposed to pay for as the Flagler County Commission voted 4-1 to enact a sales tax it feared the public would not have approved at the ballot box this November.

As Expected, Flagler County Suspends $1,707-a-Home Building Tax for 2 Years

The county’s moratorium is relatively small, but Flagler’s chamber of commerce and its home builders association hope to get the school board to approve a moratorium next, then move to Palm Coast, where impact fees add up to $15,270.

Palm Coast Mayor Netts Says Amendment 4 Takes Taxes From “Screwy” to “Screwier”

Other Flagler government leaders joined Jon Netts in criticism of of proposed Constitutional Amendment 4, which would limit the tax liability of commercial, rental and vacant properties while lowering the tax liability of first-time home-buyers, but at the expense of local government revenue, which has been battered since 2007.

Property Tax Amendments on November 6 Ballot Would Cut Local Revenue Further

Florida voters in November will face a flurry of proposed amendments to reduce property tax levies for groups ranging from first-time homebuyers to disabled veterans, while preventing increases on those whose homes lose value.

Despite County’s Spike, Most Flagler and City Homeowners’ Tax Bills Will Fall in 2013

It’s been a familiar and recurring complaint, but also an inaccurate one: that property taxes keep going up. They don’t. For most people, property taxes fell this year. And for most people, property taxes will either stay flat or fall again in 2013. Here are the city-by-city details.

Palm Coast Stormwater Fees Going Up 46%, Taxes Stay Level, Most Infrastructure Neglected

With the Palm Coast City Council’s refusal to raise property taxes , the city’s infrastructure will continue to deteriorate, Mayor Jon Netts and the city administration warned. But a majority of council members, led by Frank Meeker–who’s running for a county commission seat–refused to budge.

Paul Ryan’s Budget: The CBO Analysis

The non-partisan Congressional Budget Office produced a 17-page analysis of the budget Congressman Paul Ryan submitted in 2012. The full analysis is presented.

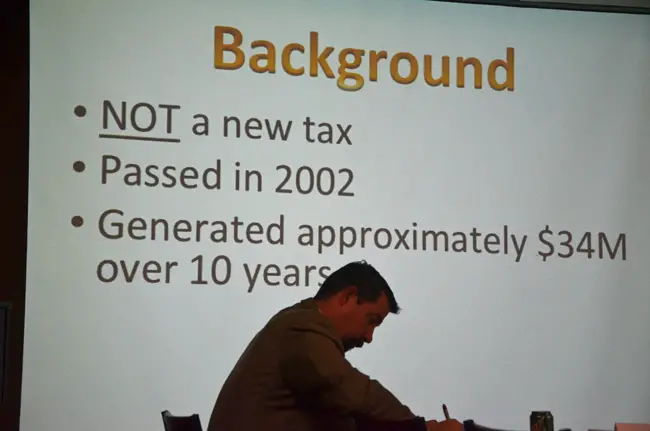

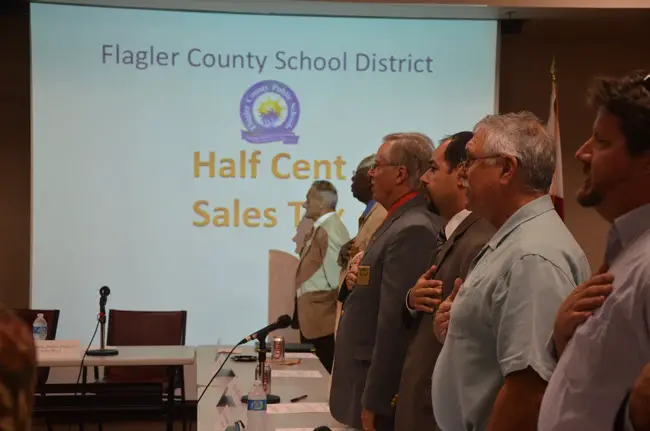

Andy Dance: Why You Should Support Flagler Schools’ Renewal of the Half-Penny Sales Tax

Andy Dance, the school board member, explains why your vote approving the renewal of the half-penny sales tax in the Aug. 14 referendum is critical for Flagler County schools. All registered voters may cast a ballot regardless of party affiliation.

Fearing Rejection at the Ballot Box, County Opts to Renew Sales Tax Unilaterally

The Flagler County Commission decided not to put out a half-cent sales tax renewal to voters this year, choosing instead to renew the tax by a vote of the commission by November. The decision ensures that the tax will stay on the books, generating $4 million for the county and the cities.

When Bankruptcy and a Second Mortgage Combine Into an Opportunity for Florida Homeowners

“Bankruptcy” and “exciting news” don’t usually go together well in the same conversation. But a recent ruling by a federal court is giving Florida homeowners a window of opportunity to strip off a second mortgage, argues consumer attorney Lewis Roberts.

Flagler School District’s Feared Budget Cut Was Vastly Overstated, But Tax Cut Is Real

A report in the papers this morning that the Flagler school district was facing an additional $3.8 million cut (or 4 percent of its budget) was premature. The state is cutting the local school tax and its revenue, but making up all the difference except $400,000, which the district has already plugged.

Another Court Ruling Favors Online Travel Companies Over County Tax Collectors, Including Flagler’s

A Tallahassee judge has sided with online travel companies like Expedia and Orbitz in a dispute over local tax obligations — a blow to counties, including Flagler, that have argued the companies weren’t paying enough.

12% Property Tax Increase and Reserves Will Close $4.6 Million County Budget Gap

The Flagler County Commission agreed in principle to raise the property tax 12 percent and use a combination of reserves and other one-time dollars to close what, going into the budget season, had been a gaping deficit provoked by new expenses, accounting issues and falling property values.

Facing $5.65 Million Deficit, Flagler County Wrestles With What to Cut and What to Tax

The deficit was reduced to $3.65 million once commissioners agreed to use reserves and include a $1 million cut in the sheriff’s budget, but their debates got more heated on what services to eliminate or reduce, and what taxes to raise–or what new taxes could be imposed.

County and School Boards Ridicule Emergency Meeting Forced by Elections Supervisor Weeks

County Commission Chairman Barbara Revels called the emergency meeting “ridiculous,” School Board member Colleen Conklin called it “nonsense,” but neither commission nor school board felt it had a choice but to comply with Supervisor of Elections Kimberle Weeks’s demand that meeting be held.

In a Stunning Reversal, Palm Coast Council Bows to Acid Opposition and Kills Utility Tax

The campaign to force the council to reverse course was brutally effective against a council that appeared willing to ignore its own history and a year and a half of its administration’s work on the matter.

County Budget, Upended By Deficit of $3 to $4 Million, Sets Off Crisis Mode–and Pitfalls

The much larger-than-expected deficit, which forced the abrupt cancellation of a budget workshop, raises questions of accountability just months before four of the county commissioners face elections either to hold on to their seats or seek a higher office.

To Little Opposition, Palm Coast Approves New Levy for Stormwater Fixes, Delays Another

To little opposition, the council voted unanimously to add a 6 percent tax on electric utility bills, adding, on average, $6.27 a month to monthly residential utility bills. The council defeated a proposal to add a second tax that would have raised an equal amount.

Going Nose to Nose, Palm Coast and The County Remain Split on Half-Cent Sales Tax

Palm Coast wants to keep the split of the half-cent sales tax revenue what it is today. Flagler County wants to change the formula, which would decrease Palm Coast’s share by $500,000. The disagreement is jeopardizing a unified approach on a sales tax referendum both sides say is critical to their revenue needs.

Palm Coast Looking to Add a Pair of Taxes On Electric Bills to Replace Stormwater Fee

For residents, the so-called “utility franchise fee” and “public service tax” on electric bills would almost replace the $8-a-month stormwater fee that appears on water bills. The city would likely raise property taxes, too, to generate $7.5 million a year to repair its crumbling infrastructure.

Flagler School District, in a Surprise, Votes to Place ½-Cent Sales Tax Redo on Aug. 14 Ballot

The Flagler County School Board didn’t want its initiative lost in the clutter of the November ballot, or see it compete against the county’s and cities’ similar initiative, but primary turnout will be heavily Republican–an unhappy prospect for any tax initiative.

In a Defeat for Flagler and 16 Counties, Judge Rules For Travel Companies on Tourism Taxes

Leon County Circuit Judge James Shelfer ruled in favor of the industry last week, going against Flagler and 16 other counties that argue they have lost out on millions of dollars in tourist-development taxes.

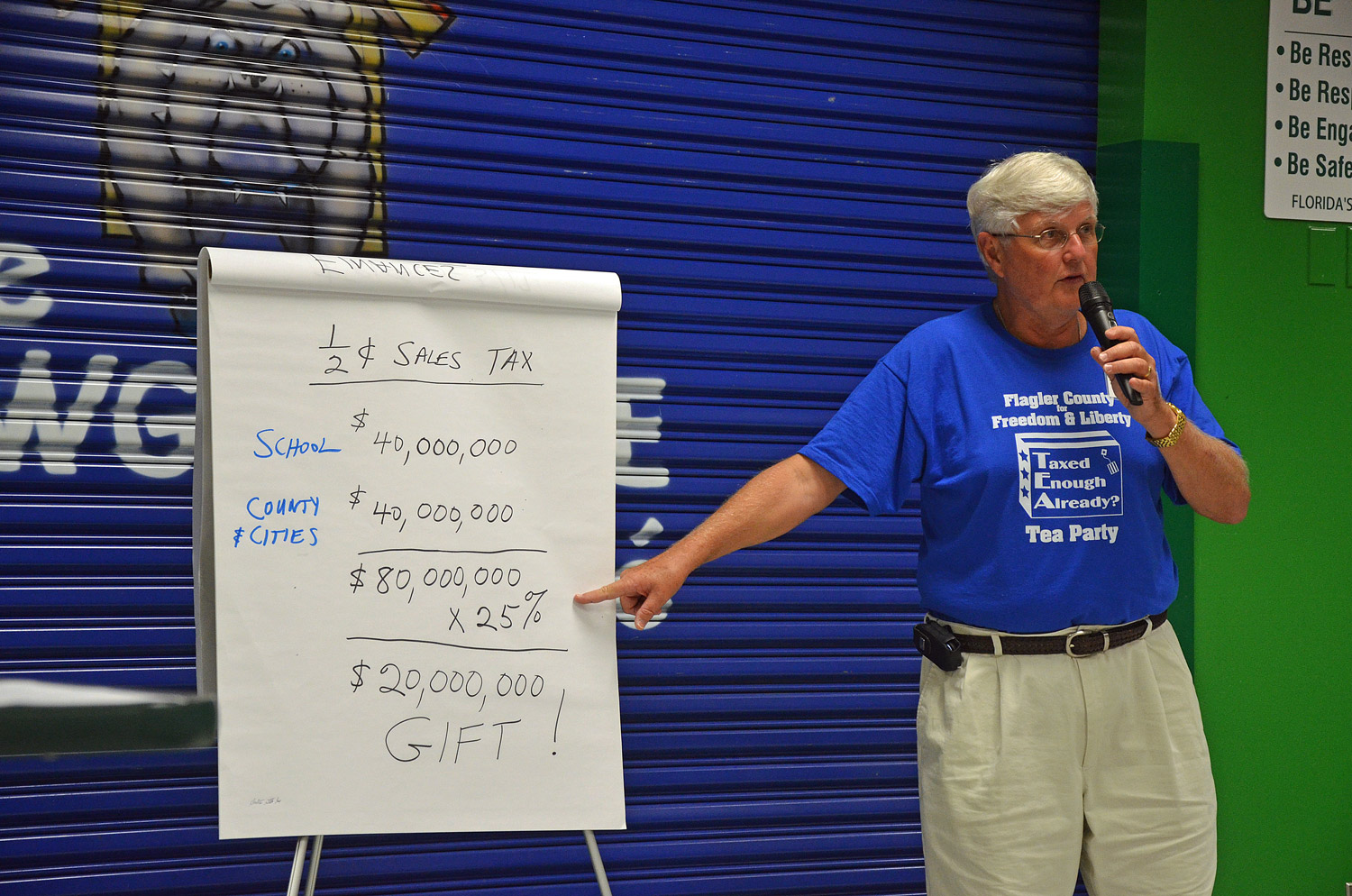

Tea Party’s Tom Lawrence, Back to His Roots, Endorses ½-Cent Sales Tax Before 135 Partiers

Tom Lawrence, the ardent anti-tax tea party chairman, was the champion of the sales tax Palm Coast lobbied for 10 years ago. He urged the Flagler tea party membership to support the tax again at the polls this year, boosting county government’s arguments for the tax, which Palm Coast so far has not embraced enthusiastically.

After Joint Meeting, Palm Coast and the County Remain Far Apart Over Sales Tax Renewal

Palm Coast and the county disagree over how to split $4 million in annual revenue from the a half-cent sales surtax. The county wants more than it’s been getting. A joint meeting Tuesday produced good will but no breakthrough.

Flagler County Government Faces Potential $3.3 Million Gap as Stresses and Needs Endure

The Flagler County Commission got its first budget overview of the year Monday, ahead of six months of discussions, debates and battles over budget priorities in the midst of an election year with its own unpredictable variables.

Gap of Dollars and Concerns Splits Flagler County and Palm Coast Over Sales Tax Renewal

The two local governments are far apart over how to split revenue from a sales tax surcharge voters would have to approve this November, causing Palm Coast to think of dumping the sales tax–and the county to panic–as the two head for a joint meeting next week.