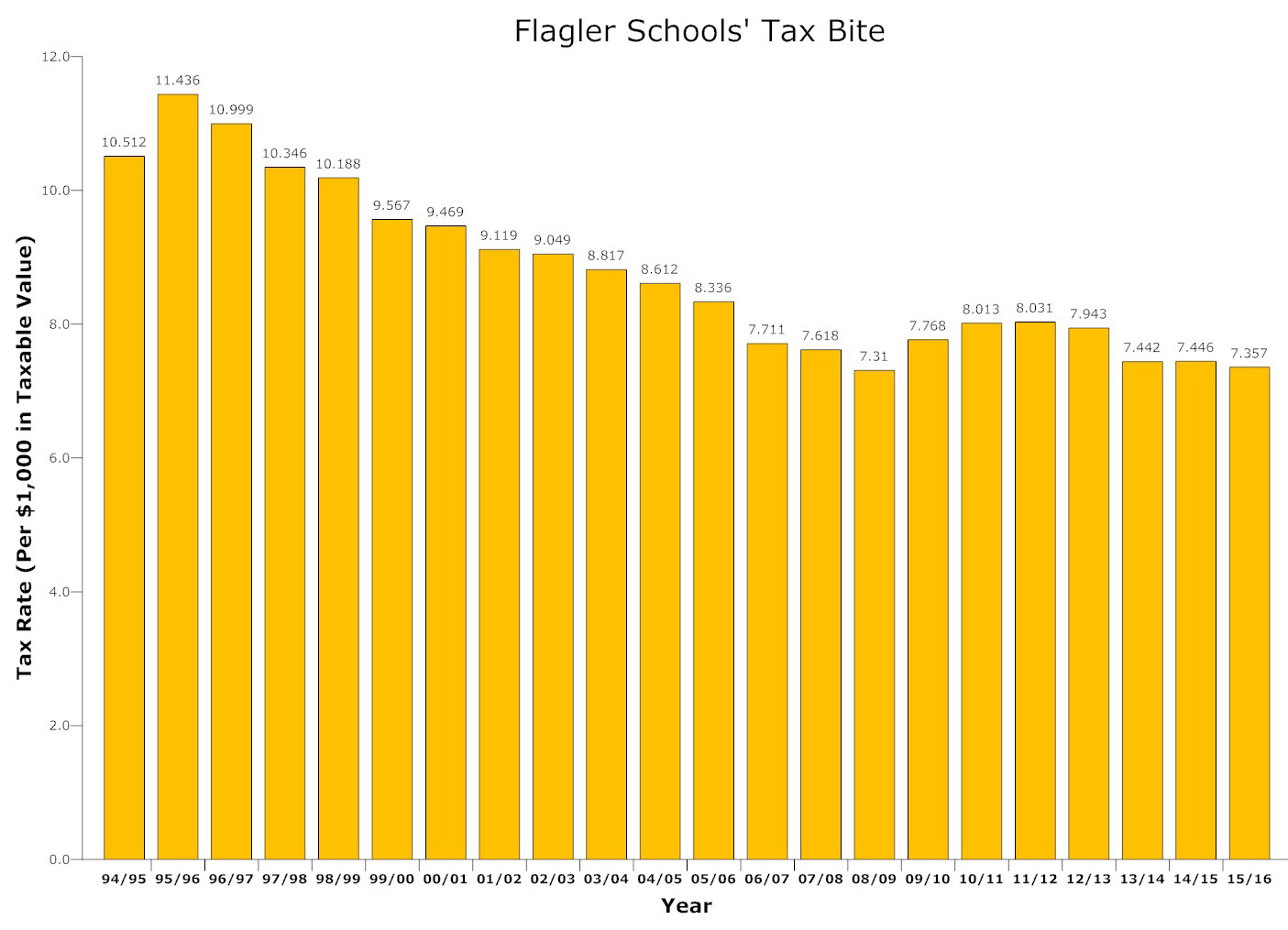

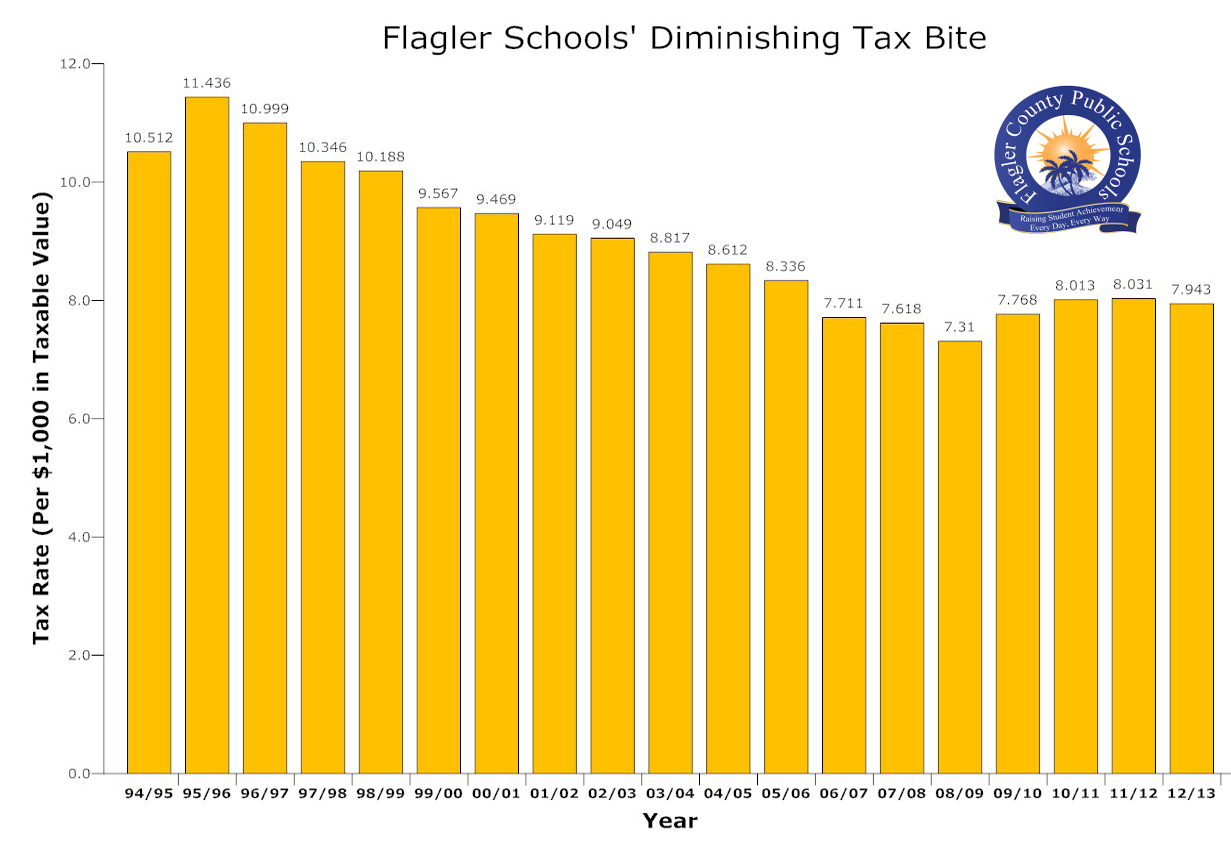

Even though county government, Palm Coast, Flagler Beach and Bunnell are all increasing taxes, homeowners’ bills will not see a steep increase thanks to a lower school tax.

local government taxes

Privatize the Flagler Beach Pier? Commission Says Yes to 6 Events Per Year, to Make Money

The Flagler Beach pier already generates well over $300,000 a year for the city, and rising, but commissioners want more: they’d close off the pier to private parties six times a year, for $155 an hour plus additional fees.

State Education Board’s “Historic” Funding Proposal Is Still $1,000 Per Student Below 2006 Level

In inflation adjusted dollars, current spending on public education is $1,100-per-student less than it was in 2007, and would still be $1,000 less if the Legislature goes along with a state board of education proposal.

County and Bunnell Join Schools and Palm Coast’s Higher Taxes, Flagler Beach Holds Line

The tax increases are generating almost no opposition, in large part because they are tied to benefits taxpayers can see: raises for teachers and cops, additions of firefighters (three this year at the county, three more next year), restoring reserves decimated during the recession, and so on.

Palm Coast Proposes 6 Percent Tax Hike; Home Owners Will See Much Lower Increase

If the council sticks with the proposed 2016 rate, which is the same as this year’s, a homesteaded homeowner with a $150,000 house, in the median range in Palm Coast, would see a tax increase of between $5 and $10 dollars for the year.

Flagler School Taxes Going Up About 4%, Heralding Season of Steeper Government Levies

The typical Palm Coast house valued at $150,000 will pay roughly $50 more in school taxes for the year even as the tax rate goes down slightly.

Palm Coast Council Again Warms to City Hall Scheme That Would Snub Voter Permission

City Manager Jim Landon is proposing a refurbished $6.8 million plan that would use general fund dollars to build a new city hall without raising taxes, even though $5.8 million of that–a repayment from the Town Center taxing district–could be used to lower property taxes or build other capital projects with broader public uses. Residents had roundly rejected a similar plan in 2010 and 2011, when the building would have cost $10 million.

Water Management District Tax Will Decline Slightly, to About $33 For Average Flagler House

All property owners in Flagler County, including all its cities, pay the St. Johns River Water Management District tax. The district’s $135.5 million proposed budget includes $13 million for 22 reclaimed water and water conservation projects, one of them in Flagler.

A “Nasty” Government Building Highlights County’s Priorities as Budget Spells Higher Taxes

An unclear Government Services Building and what it costs to maintain it properly was emblematic of the Flagler County Commission’s budget discussion this morning, as the government faces at least a $3.3 million gap, or more, if it hires an extra custodian, no new revenue, and the likelihood of higher taxes.

Flagler County’s Budget Outlook Adds Up To $8 Million Gap and Likely Tax Increase

It’s difficult to see how Flagler commissioners will emerge from the budget process in September without either a substantial tax increase of one type or another or vast cuts in county services, though they began taking on sacred cows, such as consolidating fire departments.

As County Ratifies School Levy Referendum, Elections Supervisor Lines Up Concerns

Weeks, who expects a very low turn-out, is not planning on having an early-voting site for the June 7 special election, which falls on a Friday. The election may cost upwards of $100,000. The commission voted 5-0 to place the initiative on the ballot.

Risks, Cautions, But Mostly Needs as Flagler School Board Readies for Tax Referendum

The Flagler County School Board Tuesday evening will approve going to a tax referendum in June, asking voters to increase their property taxes modestly to preserve programs and add security in schools, but the proposal doesn’t have the unanimity two similar proposals had in the last three years.

Flagler School District Will Propose New Tax, Citing Costly Security Needs and Programs

The school board voted 4-1 to ask voters to approve doubling an existing critical-needs levy, to 50 cents per $1,000 in assessed property value–a decision Board Chairman Andy Dance opposed for being too large, citing “school-funding fatigue” among voters.

Appeal Court Rejects Taxing Online Travel Bookings, a Blow to Flagler and Other Counties

The 1st District Court of Appeal, in a 2-1 ruling, said companies such as Expedia and Orbitz cannot be forced to pay local tourist-development taxes on part of the money they collect from customers. The majority found that the disputed amounts relate to reservation charges — not to the actual amounts paid to rent hotel rooms — and described the companies as “conduits.”

Palm Coast Approves 46% Stormwater Fee Increase, But Permanent Solution Still Elusive

The Palm Coast City Council is looking for ways to pay for a $7.5 million a year stormwater infrastructure. Residents’ stormwater fee will go up from $8 to $11.65 a month, while the council has until February to find a permanent solution that may push some fees even higher.

Palm Coast Water and Sewer Rates Set to Rise Up to 22% Over the Next Three Years

The Palm Coast City Council prides itself on keeping property taxes low, but its array of fees continue to increase steeply, as will utility rates if the council approves a debt refinancing plan that would let the city borrow another $15 million for utility improvements, even though growth in the city has slowed to a drip.

Flagler School Board Rejects Building-Tax Cut, a Blow to Builders and the Chamber

Chamber President Doug Baxter had hoped Palm Coast would “fall in line” with a building-tax moratorium of its own if the county and the school board adopted one. The county did. The school board refused to go along Tuesday evening, calling the proposal irresponsible.

Snubbing Voters, Lame-Duck County Enacts 20-Year Sales Tax While Slashing Cities’ Shares

Many questions remained unanswered about the use of the money and the size of the proposed jail it’s supposed to pay for as the Flagler County Commission voted 4-1 to enact a sales tax it feared the public would not have approved at the ballot box this November.

Palm Coast Mayor Netts Says Amendment 4 Takes Taxes From “Screwy” to “Screwier”

Other Flagler government leaders joined Jon Netts in criticism of of proposed Constitutional Amendment 4, which would limit the tax liability of commercial, rental and vacant properties while lowering the tax liability of first-time home-buyers, but at the expense of local government revenue, which has been battered since 2007.

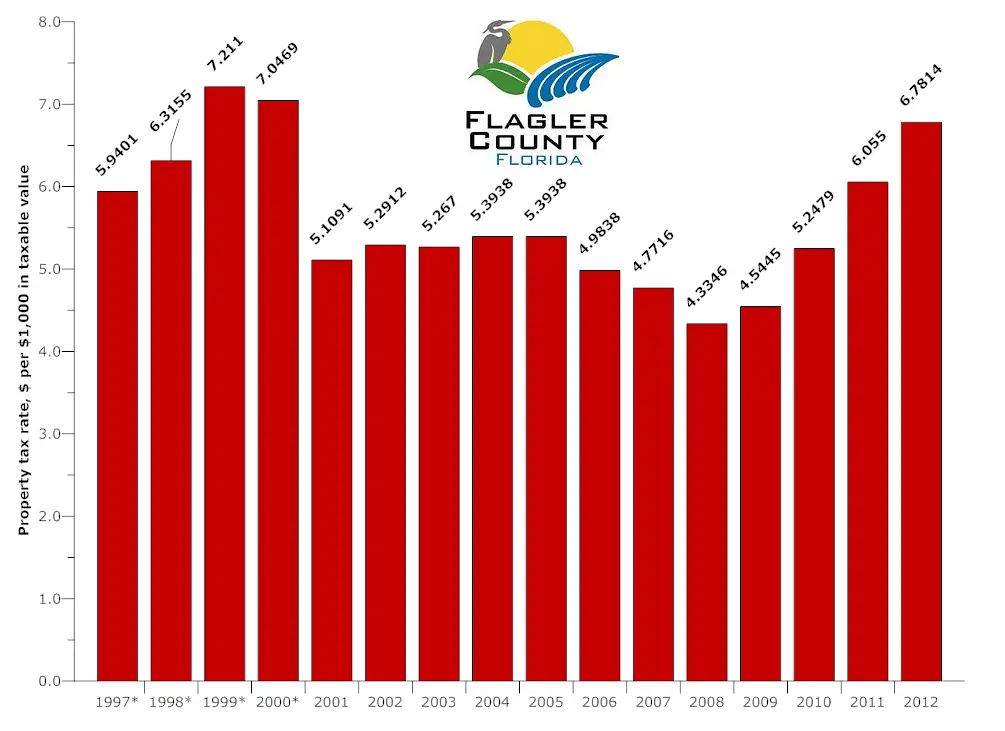

Despite County’s Spike, Most Flagler and City Homeowners’ Tax Bills Will Fall in 2013

It’s been a familiar and recurring complaint, but also an inaccurate one: that property taxes keep going up. They don’t. For most people, property taxes fell this year. And for most people, property taxes will either stay flat or fall again in 2013. Here are the city-by-city details.

Palm Coast Stormwater Fees Going Up 46%, Taxes Stay Level, Most Infrastructure Neglected

With the Palm Coast City Council’s refusal to raise property taxes , the city’s infrastructure will continue to deteriorate, Mayor Jon Netts and the city administration warned. But a majority of council members, led by Frank Meeker–who’s running for a county commission seat–refused to budge.

Flagler School Board Hails Sales Tax Victory and Revenue But Readies to Lose $2 Million

As Sue Dickinson and Colleen Conklin took their seats after winning a fourth term, the school board learned that its sales tax revenue was up to $4.2 million, thanks to more sales activity in the county. But the district is also losing at least $2 million from the expiration of an unrelated tax by year’s end.

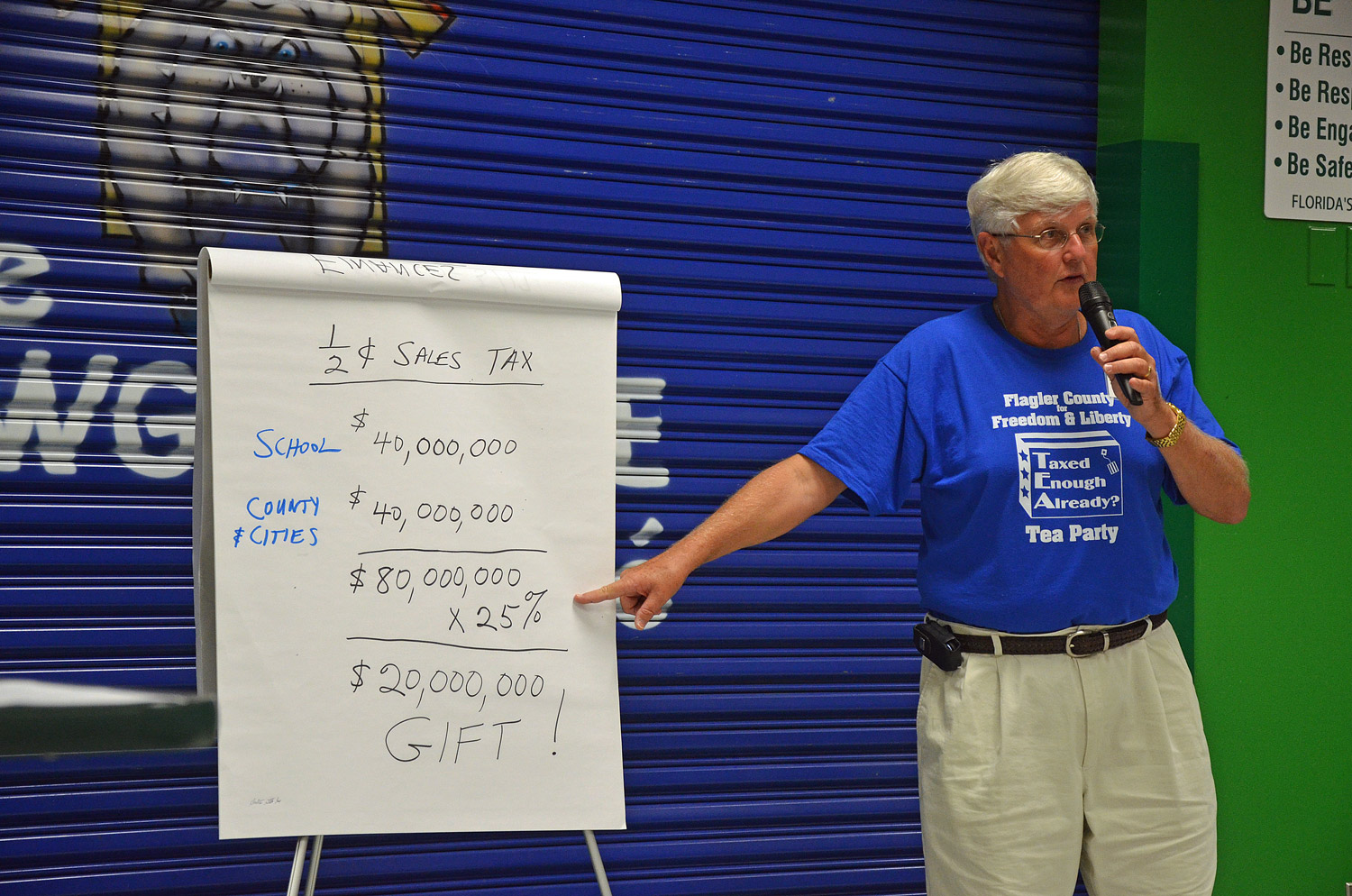

Tea Party’s Tom Lawrence, Back to His Roots, Endorses ½-Cent Sales Tax Before 135 Partiers

Tom Lawrence, the ardent anti-tax tea party chairman, was the champion of the sales tax Palm Coast lobbied for 10 years ago. He urged the Flagler tea party membership to support the tax again at the polls this year, boosting county government’s arguments for the tax, which Palm Coast so far has not embraced enthusiastically.

After Joint Meeting, Palm Coast and the County Remain Far Apart Over Sales Tax Renewal

Palm Coast and the county disagree over how to split $4 million in annual revenue from the a half-cent sales surtax. The county wants more than it’s been getting. A joint meeting Tuesday produced good will but no breakthrough.

Gap of Dollars and Concerns Splits Flagler County and Palm Coast Over Sales Tax Renewal

The two local governments are far apart over how to split revenue from a sales tax surcharge voters would have to approve this November, causing Palm Coast to think of dumping the sales tax–and the county to panic–as the two head for a joint meeting next week.

Flagler County Tentatively Adopts Highest Tax Rate in 12 Years at Subdued Hearing

Only one person, a tea party representative, addressed the Flagler County Commission as it adopted, in the first of two votes, a $65.3 million budget and a 12 percent increase in its tax rate, though most property owners will pay less in taxes.