A spate of criminal-justice reform bills in the Florida Senate has Flagler’s sheriff and a county commissioner worried about what that could mean for the local jail population and budgets.

Taxes

Flagler Sheriff and County Officials Worry That Prison Reforms Could Shift Inmates,

Flagler Airport Chief Roy Sieger Calls Fuel Tax Cut Proposed By Renner Committee “Ridiculous,” and Loses

Airport Director Sieger spoke before Paul Renner’s Ways and Means Committee, but Renner, the Palm Coast Republican, voted with the committee to approve the tax cut.

No Love for Working Families This Valentine’s Day

A secretary gets an extra $1.50 a week from the GOP tax bill. The Koch brothers get an extra $27 million (minus a $500,000 thank-you note that went to Paul Ryan’s re-election committee).

Reducing Traffic Fines Part of Renner’s Tax Cut Push, But Local Revenue Would Fall

Renner, a Palm Coast Republican, chairs the committee introducing a bill that would cut some traffic fines by 18 percent and provide a $332 million tax cut, but local government revenue would fall by $38 million.

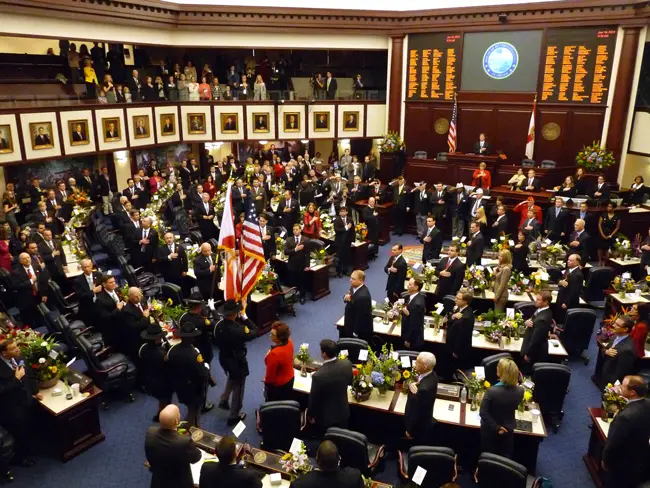

From Opioids to Taxes to Vacation Rentals: 11 Issues To Watch In Legislative Session Starting Tuesday

The House and Senate will negotiate a state budget and consider hundreds of bills including on health care, taxes, the environment, short-term rentals and hurricanes, among others. Here’s a preview.

Vacation Rentals Would Be Protected Class in Residential Neighborhoods In Bill Flagler Calls “Extreme”

One proposed bill would eliminate local regulation of vacation rentals and make it difficult for home-owner associations and towns like Flagler Beach to prevent short-term rentals anywhere.

Not To Worry, Estate Planners: Help For Struggling Millionaires Is On The Way

The estate tax was just slashed to exempt millionaire families up to $22 million, a doubling of the previous exemption, which had covered 99.8 percent of taxpayers.

Painters Hill and Hammock Dunes Property Owners Will Pay Extra Tax for Erosion Control

The four taxing districts, made necessary by hurricanes, will levy surtaxes on property owners only in those areas to defray the cost of protective sand berms and a sea wall the county will build.

3 Reasons The Trump Tax Plan Is a Disgrace

Robert Reich’s three-step guide on the rubbish of the Trump-Republican tax plan for when you confront your Republican Uncle Bob during the holidays.

County And Bunnell Score Big Grants For Plantation Bay and Stormwater, Flagler Beach and Palm Coast Do Not

Flagler County won a $500,000 grant for improvements to its Plantation Bay utility, Bunnell won $460,000 for stormwater and sewer improvements from the St. Johns River Water Management District.

Senate Leader Eyes Constitutional Amendment Requiring Two-Thirds Majority For Any Tax Increase

The Florida Constitution Revision Commission, which meets every 20 years, has the power to place constitutional amendments on the November 2018 ballot.

The Trump Tax Scam

The deeper costs of the $1.5 trillion tax plan are so large and so obvious that the failure of Republican leaders to disclose them is, for all practical purposes, a lie.

School Taxes Would Rise To Pay For Per-Student Increase, But Formula Could Further Hurt Flagler

Flagler is the 6th-highest taxed district in the state, by legislative formula, yet gets back the 65th lowest dollars per student. A governor proposal to increase education funding could make that worse for the district.

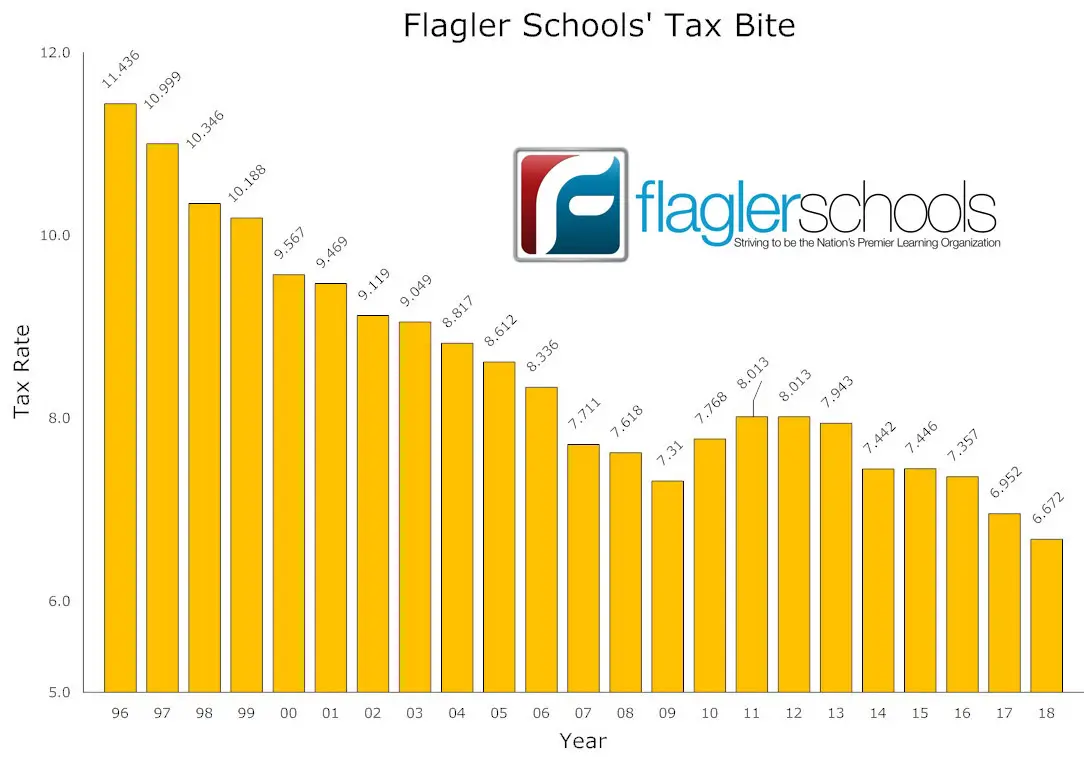

Historically Low School Tax Will Diminish Effects of Tax Increases in Palm Coast and County

Even though county government, Palm Coast, Flagler Beach and Bunnell are all increasing taxes, homeowners’ bills will not see a steep increase thanks to a lower school tax.

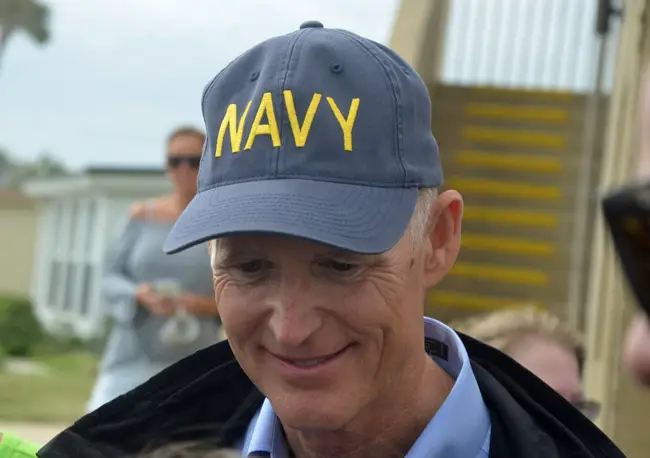

Gov. Scott Seeks Amendment To Require Supermajority When Lawmakers Raise Taxes

Gov. Scott didn’t define the meaning of “supermajority” but 15 states, liberal and conservative, already have the requirement of from 60 to 75 percent supermajorities when lawmakers raise taxes.

Florida’s Back-To-School Sales Tax Holiday Is This Weekend: Here’s A Guide

Florida’s 2017 sales tax holiday on school supplies, clothing, shoes and personal computers and other select accessories is this weekend–starting at a minute after midnight Friday, Aug. 4, through midnight Sunday, Aug. 7.

Flagler Depleted as 2017 Hurricane Season Begins; Tax Holiday This Weekend on Emergency Supplies

For Flagler County, a season a 70 percent likelihood of 11 to 17 named storms is beginning even as costly and exhausting recovery efforts from Hurricane Matthew have a long way to go.

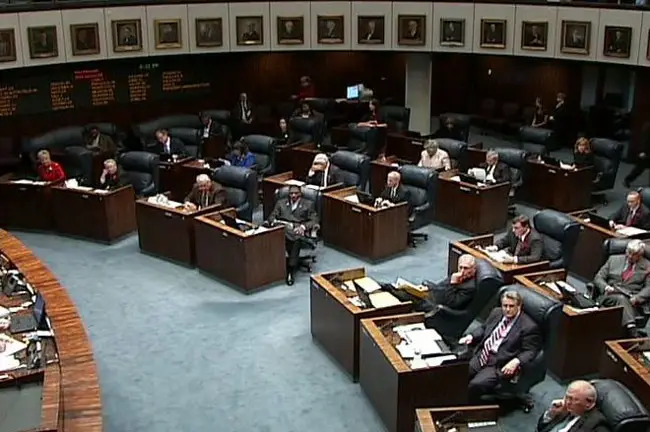

Lawmakers Approve Budget With Tax Cuts, Severe Cuts to Medicaid, Minor Increase For Education and Big Boost to Charters

The budget package includes a modest increase in per-student spending through the state’s main education formula, $521 million in Medicaid cuts for hospitals and far-reaching changes to education across the board.

Senate Approves Constitutional Proposal That Would Increase Homestead Exemption to $75,000

The homestead exemption proposal would go before voters as a constitutional amendment in 2018, would save homeowners money but cost local governments millions in revenue.

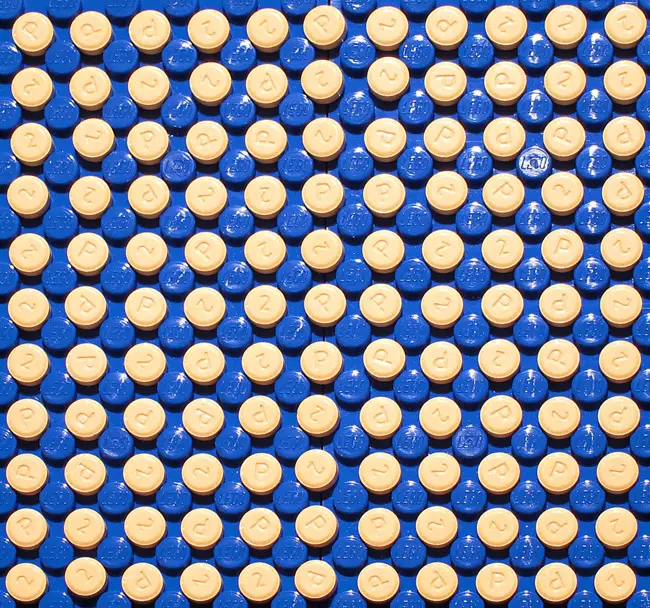

Governments Mull Way To Fight Prescription-Drug Crisis That Worked With Tobacco: Taxes

California, Alaska and the US Congress are considering taxing prescription drugs to raise money for treatment and discourage their use, but the amounts of the taxes would be relatively small.

Scott’s $83.5 Billion Budget Seeks 3% Boost in Per-Student Funding and $618 Million in Tax Cuts

House Speaker Richard Corcoran has been a harsh critic of the governor’s plan to spend $85 million for business incentives and another $76 million to market the state’s tourism industry.

As Gov. Scott Announces His Budget, His Math Doesn’t Match Lawmakers’

Scott’s $2.8 billion surplus estimate makes some unlikely assumptions about how lawmakers will act when they return to the Capitol for the legislative session that begins March 7.

Trump On Your Side? Repealing Obamacare Is a Tax Break For Rich at Poors’ Expense

If Obama’s health law is reversed, taxes will go down for the rich and up for the poor, while millions lose coverage. It is redistribution for the wealthy.

Public Schools Dealt Blows in Pair of Court Decisions Favoring Vouchers and Charters

One court decision upholds corporate tax vouchers for private schools, another diminishes the role of local school boards in deciding what charter schools may operate.

If You Still Have Damaged Property, You Could Knock Hundreds of Dollars Off 2017 Tax Bill

Property owners anywhere in Flagler and its cities who still have lost or damaged assets as of Jan. 1, such as lost screened-in areas, are eligible for re-assessments that could bring down their property tax bills.

Assume Obamacare Is Repealed. What Then?

Republicans have also pledged to repeal the taxes that Democrats used to pay for their health law. Without that funding, Republicans will have far less money to spend on whatever they opt for as a replacement.

Opting Out of Obamacare: When Penalties Are Preferable to Unaffordable Premiums

Amid the uncertain future of Obamacare in a Trump administration, some resisters are feeling vindicated and other consumers simply don’t see the need to sign up.

The Best and Worst Presidents on Taxes

Ronald Reagan was among the worst–and the best–when it came to tax fairness, Teddy Roosevelt isn’t given enough credit, but a majority of American presidents did little by way of making the tax code fairer. It’s often been the opposite, argues Sarah Anderson.

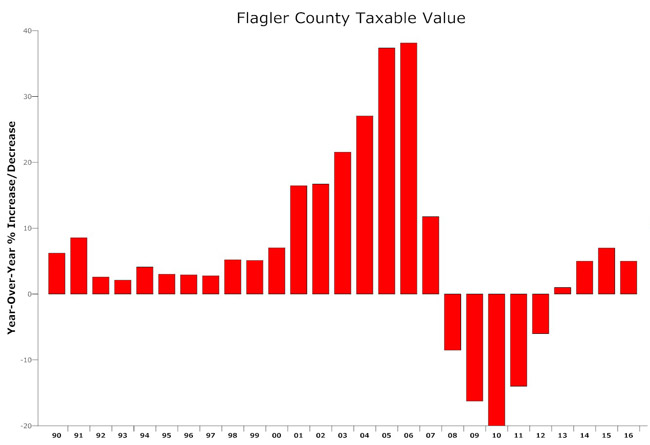

Taxes Will Stay Flat For Most Property Owners in Flagler and Its Cities in 2017

Taxes have increased in Flagler County and in all five cities, but will be largely offset by a tax decrease in school taxes, while values have increased only marginally.

Despite $1.65 Billion Profit in 2015, FPL Seeks 23% Rate Increase Over Next Three Years

The proposal would increase the monthly base rate for a typical residential customer using 1,000 kilowatt hours of electricity from $57 to about $70 by 2020. The Public Service Commission would have to approve.

The American Dream, Canada-Bound

Our country has historically prided itself on being a socially mobile society, where your ability is more important than the race or class you’re born into. Not anymore. If you forgot to be born into a wealthy family, you’re better off today living in Canada or Northern Europe.

A Homestead Exemption in Two States? Supreme Court Asked To Rule on Legality

Pointing to a “far-reaching impact” of the case, attorneys for a Broward County woman are asking the Florida Supreme Court to take up a case that involves a married couple having homestead tax exemptions in two states.

Taxable Values Improve Less Than in 2015, But Still More Strongly Than in Pre-Recession Years

Palm Coast’s and Bunnell’s values improved least among local governments, at 3.9 and 2.2 percent, while county, school and Flagler Beach values all exceeded 5 percent.

County Approves Big Spending on Tourism Office Staff and Rigs and Hints at Raising Tax

County government absorbed the tourism office last fall and is spending big on it, raising staff pay, expanding staff, buying $300,000 worth of equipment and talking about raising the 4 percent sales tax supplement on short-term rentals to 5 percent.

Give Tax and Spend a Chance

The astonishing momentum of Bernie Sanders’s presidential candidacy reveals that millions of taxpayers are willing to entertain the idea that some of us aren’t taxed enough, and that it’s hurting the rest of us, argues Isaiah J. Poole.

With $714 Million For School Construction, Lawmakers Close in on $80 Billion Deal

Lawmakers have to agree on the roughly $80 billion overall spending plan by Tuesday for the legislative session to end on Friday, as scheduled.

Gov. Scott Sought $1 Billion in Tax Cuts. Senate Cuts It Down to $129 Million.

The new tax-cut package will combine with about $290 million earmarked to hold down local property taxes that would otherwise go into the state’s school-funding formula.

Sheriff Issues Warning of IRS Scams as “Hundreds” of Palm Coast Residents Report Fraud

Tax season is intensifying scams from fraudsters posing as the IRS, who have been targeting Palm Coast residents and threatening them with arrest if they don’t immediately pay bogus tax bills.

Palm Coast’s $9 Million Scam at Taxpayers’ Expense

Since 2008, Palm Coast government has wasted over $9 million in taxpayer money to subsidize its privately run, money-losing golf and tennis operations, which serve a small group of people. It’s been a colossal scam perpetrated on taxpayers.

Florida House May Back Scott’s $1 Billion Tax Cut, With Minor Differences

The House intends to offer a $1 billion tax-cut package that includes Gov. Rick Scott’s call to reduce a tax on commercial leases and holding a back-to-school sales tax “holiday.”

Taxation’s Next Frontier: The Cloud

But as states look to tax cloud services, questions arise as to whether storage space in the cloud is a tangible “good,” subject to sales taxes, a “service,” subject to use taxes, or neither of those.

Scott Wants Tax Cuts Larger Than Projected Surplus. Lawmakers Are More Prudent.

Scott wants a larger tax-cut package in 2016 than the $673 million he sought this year, even though the state budget surplus is projected at $635.4 million, much of it one-time revenue that won;t recur in subsequent years.

Florida Lawmakers Consider Dumping Property Tax and More Than Doubling Sales Tax

If the state eliminated all property taxes, committee records indicate the state’s sales tax would have to go from 6 percent to 12.72 percent to cover existing state, local, school and special district expenses.

Yet Another Sales Tax “Holiday” Proposal, For Two Months, This Time for Military Veterans

The military veteran sales tax break would last from Nov. 1, 2016, through Dec. 31, 2016, just in time for the holidays, but competes with other breaks.

County Approves Indefinite Halt to Road Impact Fees, May End Them in East Flagler

A moratorium has cost cost the county $810,000 in transportation impact fees and $145,000 in parks and recreation fees as a result.

County Government Will Take Over Flagler Tourism Office From Chamber in Latest Expansion

The tourism office’s four employees have been under contract through the Flagler chamber of commerce. By next fall, they’ll be county employees, but their budget will still be underwritten by the 4 percent surtax on short-term rentals.

Florida’s Tax Revenue Expected to Grow by Modest $462 Million By June 2017

At least some of the extra money is likely to be eaten up by increasing enrollment in the state’s public schools, changes to health-care spending and the like.

Raise the Gas Tax Already

The federal gas tax has been stuck at 18.4 cents a gallon since 1993, lowest among advanced countries. Yet Congress just adopted a three-month stopgap measure, kicking the gas can down the road for the 35th time since 2009.

2nd Only to Texas With Military Retirees, Florida Facing Stiff Competition For Them

Military retirees are some of the best-educated, best-trained and youngest retirees around. Florida has nearly 200,000 of them. States are using their tax codes to lure them.

County and Bunnell Join Schools and Palm Coast’s Higher Taxes, Flagler Beach Holds Line

The tax increases are generating almost no opposition, in large part because they are tied to benefits taxpayers can see: raises for teachers and cops, additions of firefighters (three this year at the county, three more next year), restoring reserves decimated during the recession, and so on.