A majority of Flagler county commissioners ignored their administrator’s and finance director’s numbers and proposals today and told their staff to find ways to cut $2 million from the county’s own budget while ensuring that the sheriff and other constitutional officers, such as the clerk of court and supervisor of elections, get all the budget increases they’re asking for.

Taxes

Back from Boys’ Camp, Palm Coast Council Adopts Tentative Tax Rate, But Policing Budget Is Contested

The Palm Coast City Council on Tuesday broke its impasse over a tentative tax rate, approving what for now is the same rate that’s been in effect since 2019, with council members’ pledge to look for ways to reduce it. But that may be difficult with a slew of competing demands in services, including additional sheriff’s deputies, street paving, and other administrative requests.

No Sales Tax on School-Related Supplies for 10 Days, Beginning Saturday

With most students expected to be in classrooms next month, after many learned online for at least part of the 2020-2021 school year, retailers anticipate a surge in shopping during Florida’s upcoming back-to-school sales tax “holiday.”

In Unprecedented Gridlock, Palm Coast Council Can’t Even Agree to Tentative Tax Rate, Skirting Legal Violation

The Palm Coast City Council was required today merely to set a tentative tax rate for next year, a routine step. It could lower the rate at will over the next few weeks. An ideological brawl prevented a vote, deferring the decision to August and effectively preventing the administration from refining the budget until then.

Yes, States Got More Money from Washington than they Needed for Covid Relief

It appears that the pandemic-related economic downturn in states was quite muted, confounding everyone’s expectation. For example, sales tax revenues actually grew by 0.5% in fiscal year 2020 and are on track to increase 2% in fiscal year 2021.

How Flagler County’s Drunken-Sailor, All-Republican Commissioners Tried to Con You Into a Higher Tax

The Flagler County Commission’s attempt unilaterally to impose an increase in the sales tax is the latest example of a lazy, bumbling commission addicted to spending, deceptive in its methods and indifferent to the long-term public interest.

Quietly, and Without Voter Say, Flagler County Readies to Raise Sales Tax on Everyone. Palm Coast Says No.

The Palm Coast City Council today rejected a request by county government to support raising the local sales tax from 7 to 7.5 percent. The rejection deals a blow to county government, which is looking to increase the tax to pay for law enforcement and fire operations, but it also replays tensions from 10 years ago when the county’s approach on the sales tax was equally clumsy and unilateral.

Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.

This Year Floridians Get 3 Tax ‘Holidays’–for Hurricane Preparedness, Culture and Recreation, and School

The disaster-preparedness tax holiday will run from May 28 through June 6, the recreation-tax holiday runs for a week starting July 1, and the back-to-school holiday runs for 10 days in August.

Florida House Backs Allowing Tourism Tax Money to be Spent on Flooding and Sea Rise Projects

The Florida House on Wednesday passed a bill that would allow counties to spend so-called “bed” tax money on efforts to combat flooding, despite concerns from the tourism industry that the change would reduce marketing dollars.

Florida House Set to Approve Online Sales Tax on Out-of-State Retailers That Would Raise $1 Billion

The money would initially be used to replenish the state’s Unemployment Compensation Trust Fund, which became depleted during the Covid pandemic. After the fund is replenished, the revenue would be used to make a major cut in a tax on commercial rent.

Finally, the Biggest Healthcare Expansion in a Decade. Now Make It Permanent.

This victory is only one step in efforts to expand health care access. The next step is to make them permanent — or, better yet, move toward a public option or universal, Medicare for All system that doesn’t tie health care access to employment or income at all, argues Olivia Alperstein.

A Tax Break for Residents of Flood-Prone Areas? Florida House Floats Sea Rise Proposals

Floridians would be asked to approve a tax break for people who elevate their homes to avoid the threat of flooding, while up to $100 million a year would be set aside to help local governments combat rising sea levels, under proposals announced Friday by House Speaker Chris Sprowls.

Big Savings and Unexpected Revenue Allow Palm Coast to Hire 2 More Cops and Restore Raises Despite Covid

Palm Coast’s ultra-conservative fiscal management is allowing the city to hire two additional sheriff’s deputies, restore employee raises, and restore the city manager’s own raise, which he had declined last year on the approach of Covid’s era of uncertainty.

County and City Taxes Will Stay Flat for Most Homesteaded Properties Except for Spike in Bunnell

Residents of Flagler County and each of its cities will again see little to no change in their property tax bills next year as governments are adopting tax rates that either stay flat or roll back a little, with the exception of Bunnell.

Trimming Budget and Rancor, Flagler Beach Commissioners Agree to No Tax Increase Next Year

In recognition of residents’ difficulties with Covid-19, Flagler Beach city commissioners agreed to a net-zero tax increase next year, which will translate to a modest tax decrease for many property owners, or some increase for those who aren’t homesteaded and whose assessed values have shot up.

In Flagler Beach, A Pitched Battle Over Taxes Is Dividing Commissioners as Administration Draws Fire

The Flagler Beach City Commission appeared ready to prevent a tax increase of any kind this year until a surprising call for another budget meeting had two commissioners questioning the administration’s motives, and those of fellow-commissioners.

Back To School Sales Tax ‘Holiday’ This Weekend Includes Computer Costs of Up to $1,000

Many children are expected to start the school year taking classes online because of concerns about the spread of the virus, likely spurring some families to look for computer equipment.

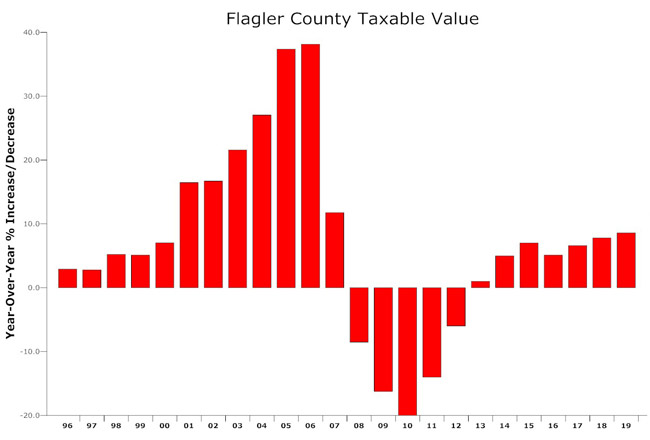

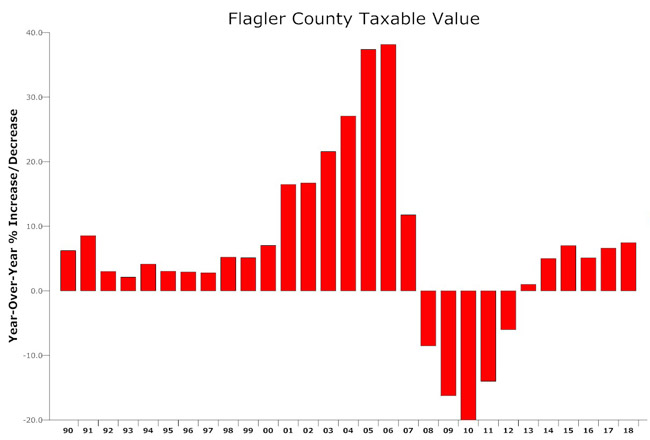

Flagler’s Taxable Values Rise at Slowest Pace in 4 Years, But Still Enough to Help Budgets

Local governments are looking to keep tax rates flat. Flagler Beach’s valuations increased 5.3 percent, Palm Coast’s by 5.8 percent, Bunnell’s by nearly 10 percent and the school board’s by 4.7 percent.

Florida’s Government Revenue Takes a Nearly $1 Billion Hit in April

State revenue was off $878.1 million in April from an earlier estimate as tourism and hospitality-related industries, along with car sales, were grounded by the coronavirus, according to economists.

Millions of People Face Stimulus Check Delays for a Strange Reason: They Are Poor

The IRS has had trouble getting money to people quickly because millions of Americans pay for their tax preparation through a baroque system of middlemen.

A Trump Tax Break To Help The Poor Went To a Rich GOP Donor’s Superyacht Marina in West Palm Beach

Wealthy donors Wayne Huizenga Jr. and Jeff Vinik lobbied then-Gov. Rick Scott for the lucrative tax break for the Rybovich superyacht marina in West Palm Beach — and won it. Poorer communities lost out.

Facts Dissolve in Antifreeze In Largely Misinformed Protest of Palm Coast’s Taxes and Budget

Palm Coast’s 2020 tax rate and the size of its budget drew some protesters at a hearing Wednesday, but many residents addressing the council were misinformed or mis-characterized the numbers.

School Supplies Sales Tax Holiday Through Tuesday, Back To School Jam Saturday at FPC

The 2019 back-to-school sales tax suspension, or holiday, began at a minute after midnight today (Aug. 2) and runs through Tuesday, Aug. 6. The Flagler County district’s annual Back to School Jam is on Saturday at Flagler Palm Coast High School, from 10 a.m. to 1 p.m.

Palm Coast Proposal Would Raise Property Taxes 9%; Sheriff’s Request for 6 New Deputies Not in the Budget

Though Palm Coast government is proposing to keep its property tax rate flat, a valuation increase of 9 percent will equate to a tax increase, though homesteaded property owners won’t feel it.

Flagler Property Values Rise Nearly 9%, Higher in Cities, Providing Windfall For Local Budgets

Property values are a driver of local government budgets. Generally, as values increase, local property tax revenue rises, assuming governments don’t proportionately reduce their tax rates.

Calling It ‘Fiscally Responsible,’ Governor Signs $91 Billion Budget, Vetoing Just $131 Million

Gov. DeSantis praised lawmakers for exceeding his request for spending on environmental projects and for a boost in per-student funding in public schools, though as FlaglerLive previously reported, that funding increase is not necessarily what it seems.

To Spur Town Center’s ‘Innovation District,’ Palm Coast Eagerly Gives Developers

What They Want

Palm Coast’s Town Center is finally stirring with sustained development after a decade and a half’s slumber, with generous financial breaks and changes in regulations attracting developers.

Tax Holiday Begins Friday on Hurricane-Prep Supplies Ahead of Storm Season

Floridians will have seven days to build a hurricane-season stockpile — including batteries, flashlights and radios — free of sales taxes, beginning Friday.

Congress Is About to Ban the Government From Offering Free Online Tax Filing. Thank TurboTax.

A bill supported by Democrats and Republicans would make permanent a program that bars the IRS from ever developing its own online tax filing service.

Everything From Impact Fees to Franchise Fees Could Be Called ‘Taxes’ Under Proposal Worrying Cities and Counties

On the local government level, the proposal would identify as a tax any new or increased special assessment or non-ad valorem assessment, impact fee or mobility fee, and franchise fee.

Electric Service Tax Is Back As Part of Proposed Options to Rebuild Palm Coast’s Public Works

The Palm Coast City Council backed down from instituting electric taxes last fall in the face of staunch public opposition, but those options are back as part of a new round of discussions on rebuilding the public works facility and improving roads.

Amendments 1, 2 and 5: Taking Aim at Taxes Through Homestead Exemption, a Cap and Supermajorities

Three proposals on the November ballot that would make tax-related changes to the state Constitution have drawn conflicting views from the real-estate industry, local governments and other groups about the measures’ potential economic impacts.

Facing Staunch Opposition, Palm Coast Council Retreats From Electric Tax To Seek Alternatives

The Palm Coast Council this morning voted unanimously to indefinitely delay further discussions of new electric taxes to pay for city roads and a new public works facility.

Palm Coast’s Shocking Electric Tax Scheme

Out of nowhere the Palm Coast City Council is about to ram through a large tax increase on residents and businesses with hardly any discussion, no hearings, no public education. No wonder we have tea parties.

Palm Coast Again Considering 2 New Electric Taxes That Drew Bitter Opposition 6 Years Ago

The Palm Coast City Council is considering a public service electric tax and an electric franchise fee to diversify revenue, build a new, $20 million public works facility and repave city streets.

Palm Coast Residents’ Stormwater Cost Will Double Over Next 6 Years and Utility Bills Increase By $30 a Month

Palm Coast homeowners are in for big rate increases between the new water and sewer rates the council just approved and the steep new stormwater rates it is set to approve next week.

Palm Coast Would Raise Water and Sewer Rates 20.6% Over the Next 4 Years

The average monthly residential bill for water and sewer is $65.76. It would rise to $79.33 by 2022, when the average annual bill will be $163 higher than it is now.

Flagler Beach Sets Tentative Property Tax Rate 21% Higher. Don’t Panic: It Won’t Stick.

Flagler Beach commissioners were forced to agree to a proposed tax rate that will be mailed to property owners even though they had not held their first budget workshop yet.

County Eyes Slightly Higher Property Tax Rate; It Would Be Offset Some By Lower School Rate

The average homeowner would see a $50 increase in county taxes next year, but also a small decrease in school taxes, which would keep overall tax bills increasing at a little more than the rate of inflation.

County Commissioners Again Can’t Agree On How Much To Raise Next Year’s Taxes

For the third straight budget workshop, Flagler County Commissioners have been unable to agree on what property tax rate to set for next year and what to cut to get there.

Balking at Proposed Tax Increase, County Commissioners Offer Alternatives Outside of Public Meeting

Flagler County commissioners want to cut a proposed budget increase but didn’t do so at a workshop, and plan to offer their suggestions outside of budget workshops.

U.S. Supreme Court Ruling On Web Retailers Could Boost Florida’s Sales Tax Revenue

A 5-4 ruling upheld a law that allowed the state to apply its sales tax to major online retailers, even if they had no physical presence in the state.

U.S. Supreme Court Ruling On Web Retailers

A 5-4 ruling upheld a law that allowed the state to apply its sales tax to major online retailers, even if they had no physical presence in the state.

Ambulance Fees Going Up 48% as Flagler Fire Rescue Makes Pitch For Big Budget Increase

Flagler County’s fire department is asking for a substantial budget increase to raise pay and buy $1.5 million worth of equipment, and the county approved huge increases in emergency transportation fees.

Flagler Property Values Rise 7.5%, Best Since Recession, But Government Revenue Faces Shock

Higher values ease pressure on government revenue but a potential increase in the homestead exemption would reduce revenue by millions, absent tax hikes.

Sales Tax ‘Holiday’ For Disaster-Preparedness Supplies Set For June 1-7 Across Florida

Expanded from three days last year, the tax holiday has drawn added attention after Florida experienced hurricanes in 2016 and 2017 after a decade’s calm.

Tax-Evaders Beware: Flagler Will Take Over Local Collection From Short-Term Renters, Projecting Jump in Revenue

The Flagler County Tax Collector, not the state Department of Revenue, will be collecting the 5 percent tax on short term rentals starting in July–a tax hundreds of property owners are evading currently.

From Guns To Opioids To Education, A Legislative Session That Got A Few Things Done

The session became dominated in February by the aftermath of the mass shooting at Marjory Stoneman Douglas High School in Broward County.

Ding Dong! The Obamacare Tax Penalty Is(n’t) Dead–Not Until 2019

That means you still will owe an Obamacare tax penalty if you didn’t have health insurance or an exemption from the mandate in 2017. The same holds true for this year.