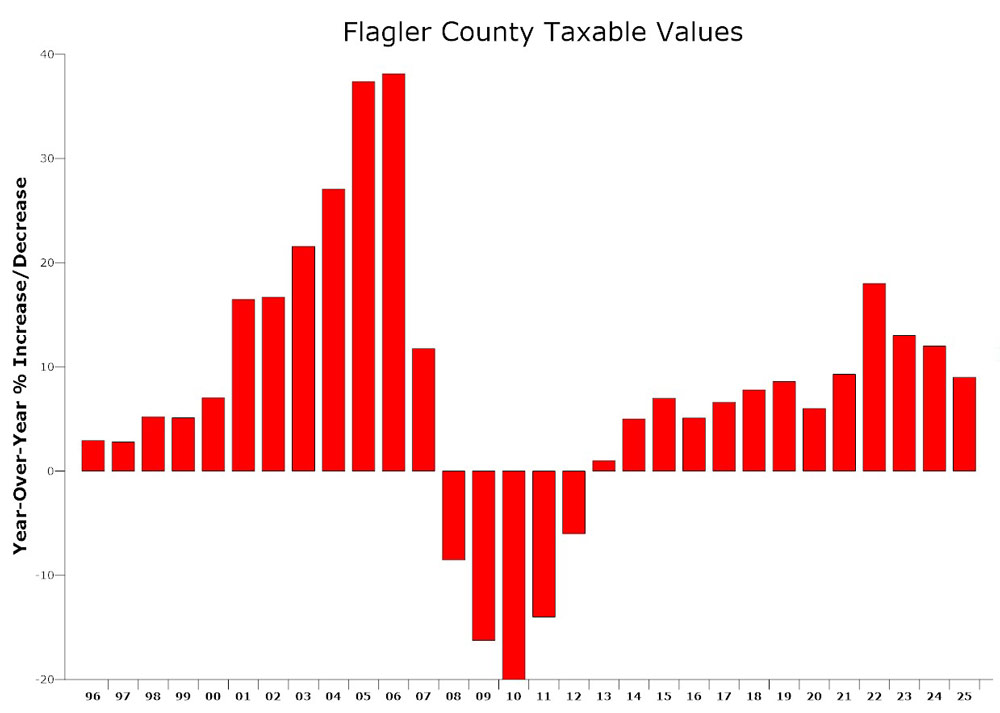

Annual taxable property value increases local governments depend on to fuel growth in their budgets have continued their descent from a post-crash high of 18 percent in 2022, to just 9 percent as of June 1 in Flagler County, according to figures released by the Flagler County Property Appraiser.

In Palm Coast, values increased 9.29 percent in 2025, with more than half of that powered by new construction. In Flagler Beach, it was 7.56 percent, and in Bunnell it was just 5.5 percent. Property value increases belie the anecdotal claim, at times peddled at local government meetings, that growth, or certain forms of development, have been hurting local property values.

Values are still increasing at a healthy rate even as the local housing market has cooled markedly: the median house price in Flagler County has leveled off below $400,000 and has remained in a narrow band of $360,000 to $390,000 since 2022.

In Palm Coast, more than half the increase is powered by new construction. The increase is nowhere near the boom years from 2001 to 2006, when year-over-year property value increases shot up to 20, then 30, then nearly 40 percent, setting up the inevitable housing crash and Great Recession. But it remains a more sustainable and even impressive increase. Despite that, it is not enough to erase a projected $3 million budget deficit for Flagler County government.

The assessed value is the overall value of a property as calculated by the appraiser. It is different, and significantly lower than, the just market value. The taxable value is that portion of the assessment subject to property taxes once exemptions are accounted for.

More than half the residential properties in Palm Coast are homesteaded. Even if their property value increases 5 or 10 percent, the amount of the increase that may be taxed is capped at 3 percent due to the “Save Our Homes” constitutional amendment that caps those increases. Increases for non-homesteaded properties are capped at 10 percent.

For example, Palm Coast’s overall property values increased from $10 billion last year to $10.9 billion this year, a 9.29 percent increase of nearly $1 billion. That does not mean Palm Coast government will generate $3.77 million in new money, if it were to keep the current tax rate.

Only $525 million of the increase in values is taxable. So Palm Coast’s new revenue will be closer to $2.2 million, if it keeps its current tax rate of $4.1893 per $1,000 in taxable value.

Property taxes generate the revenue necessary to pay for police, fire, streets, parks, public works, social services, libraries and so on.

Local governments focus especially on new construction, because it is considered as close to free money as there is: new construction is taxed at the full, existing rate and is outside calculations of the so-called rolled back rate–the property tax rate a local government would have to adopt in the coming year if it is to take in as much revenue as it did last year, and avoid a tax increase as Florida law defines it.

Palm Coast and Flagler County governments have in recent years favored modest–and rather symbolic–decreases in their property tax rates, with the exception of three years ago, when Palm Coast went back to rollback for the first time in its history. The city council had intended the move to be paired with the addition of a new fee. But a maladroit council had not planned the pairing properly, which upset residents. The council ended up at rollback, without the new fee, and having to cut $3 million from the budget its administration had prepared. The council did not repeat the mistake last year.

While new construction has powered the local economy, the inventory of available houses, townhouses and manufactured homes (or mobile homes) has been climbing sharply since 2023, suggesting that fewer people are moving into Palm Coast and the county even as house construction has kept up a busy pace.

The inventory of town homes is at a post-crash peak of nearly 500, after bottoming out at around 50 in mid-2021, according to April figures by the Flagler County Association of Realtors. The inventory of single-family homes hit a 13-year high in April, at nearly 1,500 houses, and still climbing. The supply of homes in Flagler County is now over six months.

Counties and cities are just beginning their budget season, with all budgets and tax rates for the coming fiscal year to be voted in by Oct. 1.

Atwp says

A short of about 3 million. What is the problem, people are paying their property taxes. I’m a budget person usually there are three reasons that cause a financial shortfall, not enough money coming in, mismanagement, or sticky fingers. The biggest problem is usually mismanagement. Hopefully they will get things taken care of.

Robert says

My home values go down , but taxes go up! Scam!

Pig Farmer says

Stay probably has enough extra in his expansive budget to cover the entire shortfall.