Florida’s sales tax holiday on school supplies, clothing, shoes and other select accessories is this weekend–starting at a minute after midnight Friday, Aug. 3, through midnight Sunday, Aug. 5.

sales taxes

Sales Tax ‘Holiday’ For Disaster-Preparedness Supplies Set For June 1-7 Across Florida

Expanded from three days last year, the tax holiday has drawn added attention after Florida experienced hurricanes in 2016 and 2017 after a decade’s calm.

In Some States, Sales Tax Holidays Lose Luster as Hype Overshadows Cost

Tax holidays don’t increase buying but merely concentrate it around specific dates. They’re regressive. They’re more political than useful: in Florida, the Legislature turned down Gov. Scott’s request for 10 days.

In Brief: Senators Back Tax Exemption for Diapers

Initial estimates point to a reduction of General Revenue receipts of $21.7 million in 2017-18, with a $52.1 million recurring impact, and a reduction of local government revenue by $5.6 million in 2017-18.

From a New Branch Library to a West Side Fire Station, Flagler Commissioners Weigh Sales Tax-Funded Projects

Most of the $2-million-a-year sales tax revenue the county commission voted in almost two years ago is spoken for–a new jail, a new sheriff’s HQ–but a few million dollars remain spendable. The administration is proposing a long wish list that commissioners will now rank.

Your Amazon Holiday Is Over: Giant Starts Collecting Sales Tax in Florida in 2 Weeks

For Floridians who are supposed to pay the taxes but haven’t, the announcement of Amazon’s entry into the state’s brick-and-mortar retail landscape could mean about $80 million a year in sales taxes, according to one business lobbying group.

Kiss Your Tax-Free Amazon Orders Goodbye: Company’s I-4 Warehouses On the Way

The confirmation by Amazon.com that it will build a pair of massive “fulfillment” centers along the Interstate 4 corridor means that sometime in the next two years Floridians will have to start paying sales taxes on purchases from the online retail giant.

Sen. Dorothy Hukill Proposes Cutting Sales Tax on Commercial Rental Property to 5%

Senate Finance and Tax Chairwoman Dorothy Hukill of Port Orange’s proposal could cut $250 million a year from state revenue. Business leaders want the tax, currently at 6%, eliminated altogether as Gov. Rick Scott travels the state on a tax-cutting tour.

Hillsborough Grants Amazon $6.6 Million Gift as Tax Watch Endorses Online Sales Levy

The Hillsborough County Commission is the first of several local communities expected to throw tax-supported incentives at Amazon, as the usually anti-tax Florida TaxWatch declared support for online sales tax collection once Amazon starts doing business from a physical location in Florida.

Florida Loses Out on Amazon Deal, and Up to 3,000 Jobs, Over Sales Tax Fumes

In a statement issued Thursday, Gov. Rick Scott’s administration implied that if Amazon were to locate in Florida and begin collecting taxes, that would amount to a tax increase on Florida residents who use the popular shopping portal.

Online Sales Tax On Its Way, But Phone, Cable and Web Service Taxes Would Be Cut

The measure would offset the increased revenue brought in by the measure by lowering other taxes, including the communications services tax charged on phone service, cable, and satellite TV and internet connections.

Snubbing Voters, Lame-Duck County Enacts 20-Year Sales Tax While Slashing Cities’ Shares

Many questions remained unanswered about the use of the money and the size of the proposed jail it’s supposed to pay for as the Flagler County Commission voted 4-1 to enact a sales tax it feared the public would not have approved at the ballot box this November.

Another Blow for the County: Palm Coast Rejects Flagler’s Sales Tax “Compromise”

Citing the county’s “Taj Mahal” of an administration building and the city’s future growth needs (and revenue), the Palm Coast council on Tuesday stuck to its refusal to change the way sales tax revenue is split, a blow for county government.

Going Nose to Nose, Palm Coast and The County Remain Split on Half-Cent Sales Tax

Palm Coast wants to keep the split of the half-cent sales tax revenue what it is today. Flagler County wants to change the formula, which would decrease Palm Coast’s share by $500,000. The disagreement is jeopardizing a unified approach on a sales tax referendum both sides say is critical to their revenue needs.

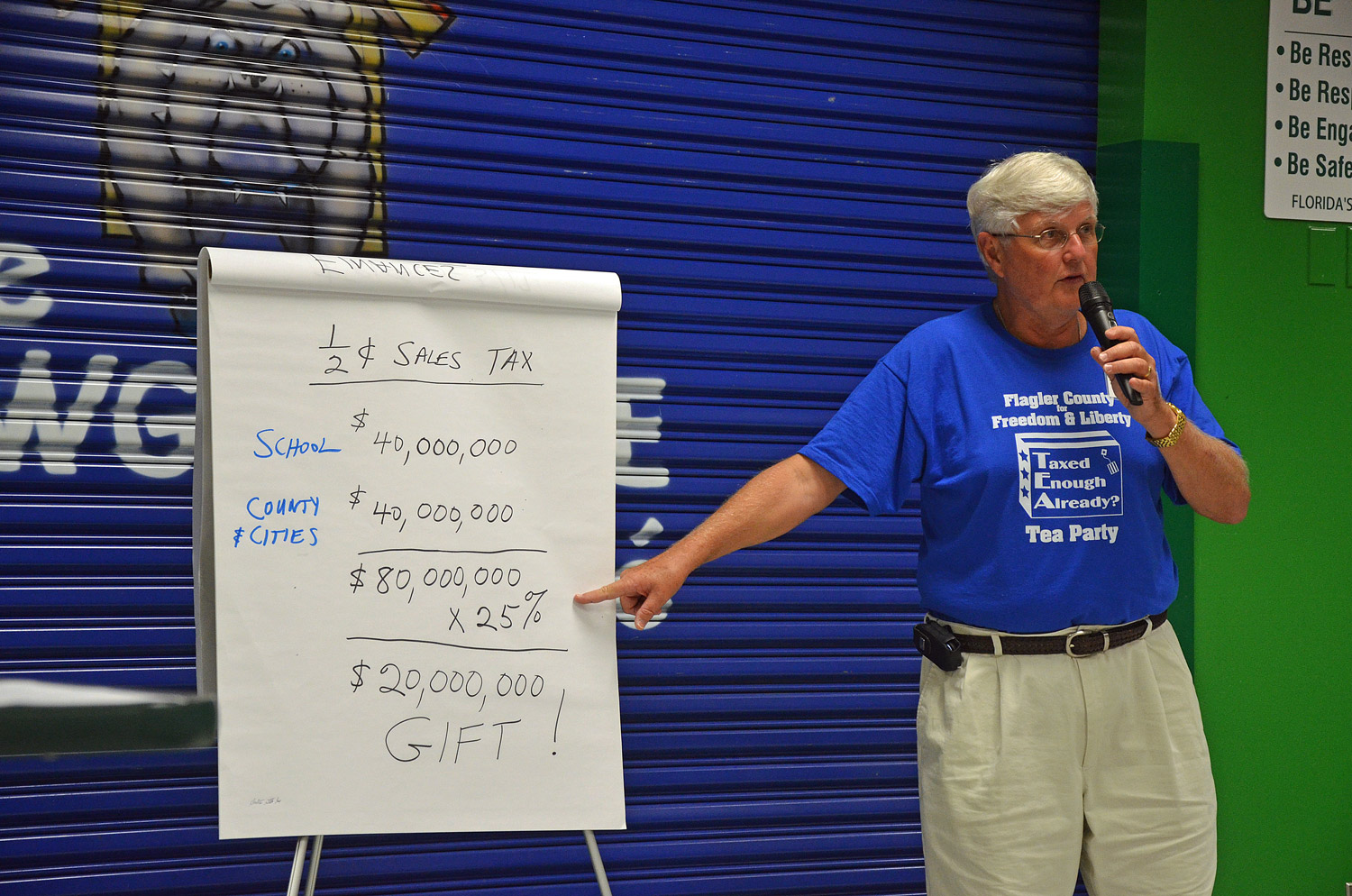

Tea Party’s Tom Lawrence, Back to His Roots, Endorses ½-Cent Sales Tax Before 135 Partiers

Tom Lawrence, the ardent anti-tax tea party chairman, was the champion of the sales tax Palm Coast lobbied for 10 years ago. He urged the Flagler tea party membership to support the tax again at the polls this year, boosting county government’s arguments for the tax, which Palm Coast so far has not embraced enthusiastically.

In a Blow to the County, Palm Coast Explores Switch from Sales Tax to New Utility Taxes

The Palm Coast City Council is exploring dropping a half-cent sales tax surcharge it’s been levying with the county for 10 years, and adopting instead new utility taxes without need for voter approval or splitting revenue with the county.

Counterpunch: Priceline and Travelocity Sue Over Tourist-Development Bed Taxes

The case is of interest to Flagler, whose Tourist Development Council has been aggressively pursuing avenues, including a lawsuit of its own, to compel online companies to pay their fair share of sales and bed taxes.

County Raises Bed Tax to 4%, a Victory for Milissa Holland’s Tourism Marketing Thrust

The higher tax, Milissa Holland argued, will broaden Flagler County’s marketing power, drawing more visitors and creating more jobs for local, small businesses.

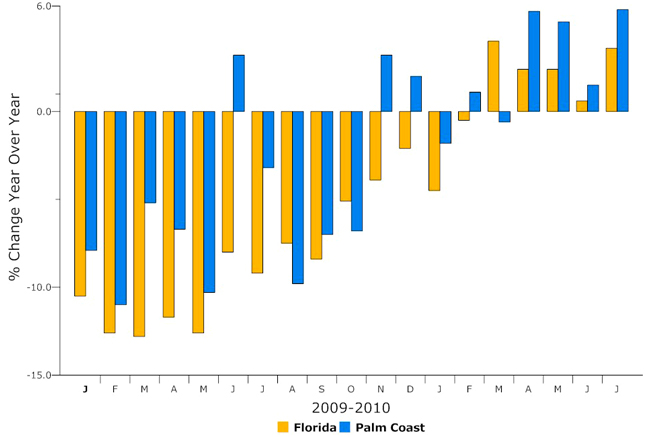

Palm Coast Consistently Beating Florida As Taxable Sales Indicators Continue to Improve

Tourism and retail sales, and fewer people traveling elsewhere to buy goods, are keeping Palm Coast’s taxable sales among the most-improved in the state, compared with 2009.