Four of the five Palm Coast City Council members voiced opposition today to adopting the rolled-back property tax rate as they did last year, with one week to go before they have to vote on a tentative rate. Nevertheless, the fifth and lone dissenter, Ed Danko, inexplicably carried the day staving off a decision and keeping the rollback proposal alive.

property taxes

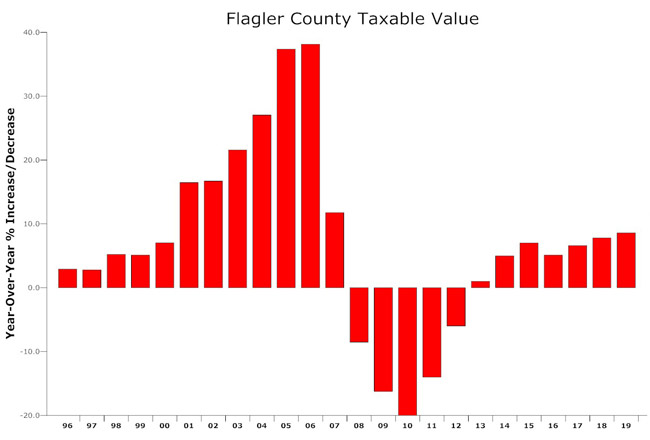

Flagler Property Values Rise Nearly 9%, Higher in Cities, Providing Windfall For Local Budgets

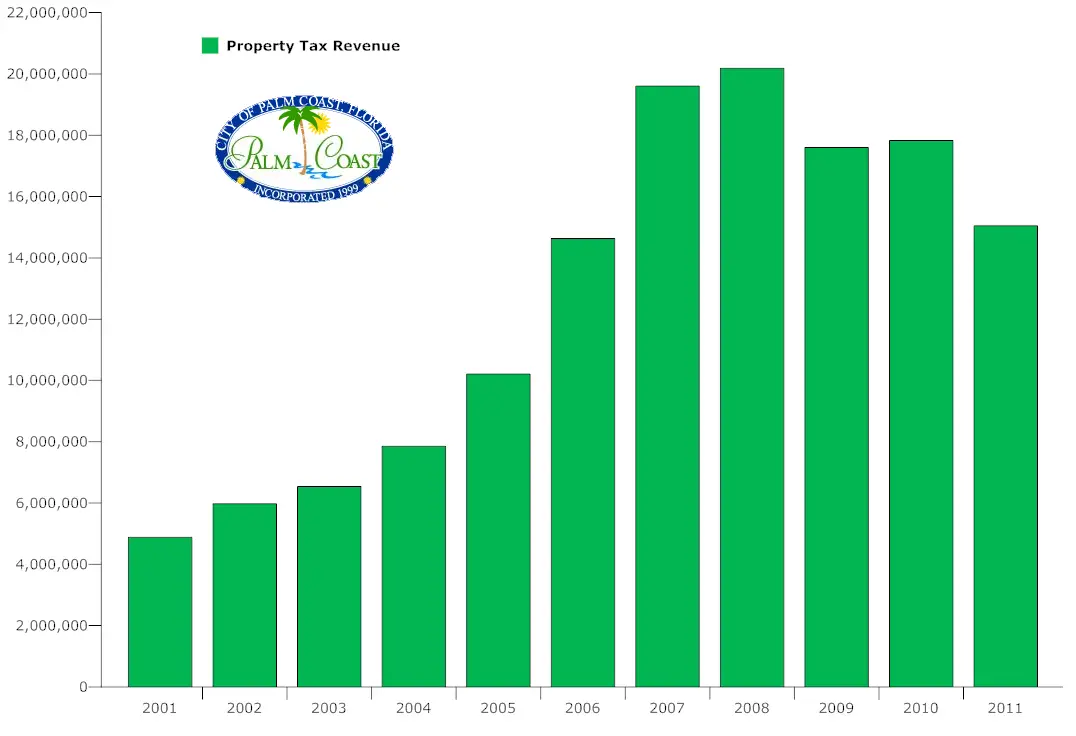

Property values are a driver of local government budgets. Generally, as values increase, local property tax revenue rises, assuming governments don’t proportionately reduce their tax rates.

Palm Coast Taxes Would Rise Modestly For Most in $37 Million General Fund Budget

The owner of a median-priced house in Palm Coast would see taxes rise from $28 to $33 next year, depending on which tax rate the council adopts.

Taxes Will Stay Flat For Most Property Owners in Flagler and Its Cities in 2017

Taxes have increased in Flagler County and in all five cities, but will be largely offset by a tax decrease in school taxes, while values have increased only marginally.

Gov. Scott Sought $1 Billion in Tax Cuts. Senate Cuts It Down to $129 Million.

The new tax-cut package will combine with about $290 million earmarked to hold down local property taxes that would otherwise go into the state’s school-funding formula.

$780 Million More for Education in Florida, But a $500 Million Property Tax Increase

The special session’s much-touted tax cut of $427 million is wiped out by a nearly $500 million tax increase to pay for education funding increases.

Attention Homeowners: Now’s The Deadline For Homestead Exemption Applications

Today is the deadline to file for a Homestead Exemption in Flagler County. If you miss the deadline, the Flagler County Property Appraiser’s office may be able to work with you within a reasonable window of time.

Facing Mandatory Spending, County May Raise Taxes by Nearly $100 for Median Home

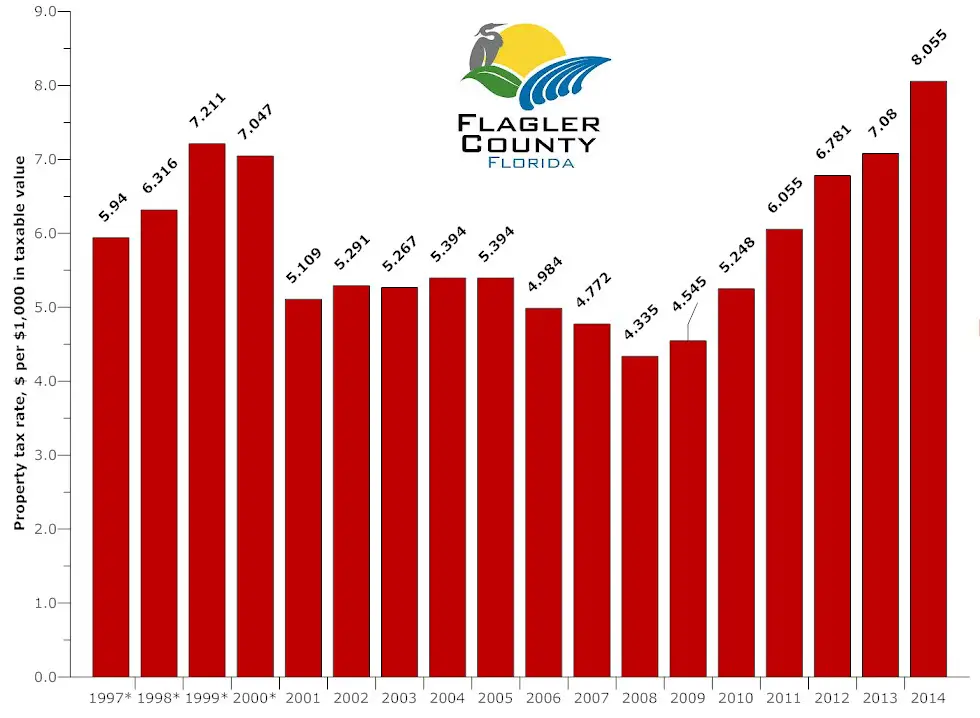

In previous years, tax rate increases didn’t mean much because they were either entirely or more than offset by decreases in property values. The end result was lower tax bills for most, even as tax rates went up. That’s over. And tax rates are set to go up in every city, too.

Palm Coast Mayor Netts Says Amendment 4 Takes Taxes From “Screwy” to “Screwier”

Other Flagler government leaders joined Jon Netts in criticism of of proposed Constitutional Amendment 4, which would limit the tax liability of commercial, rental and vacant properties while lowering the tax liability of first-time home-buyers, but at the expense of local government revenue, which has been battered since 2007.

Property Tax Amendments on November 6 Ballot Would Cut Local Revenue Further

Florida voters in November will face a flurry of proposed amendments to reduce property tax levies for groups ranging from first-time homebuyers to disabled veterans, while preventing increases on those whose homes lose value.

What is the Roll-Back Rate in Property Taxes?

The roll-back or rolled-back rate is defined as it applies to property values and tax rates at budget time for local governments and property owners.

12% Property Tax Increase and Reserves Will Close $4.6 Million County Budget Gap

The Flagler County Commission agreed in principle to raise the property tax 12 percent and use a combination of reserves and other one-time dollars to close what, going into the budget season, had been a gaping deficit provoked by new expenses, accounting issues and falling property values.

Flagler Beach Touts Taut Budget With 14.6% Tax Rate Increase and 3% Employee Raise

Though Flagler Beach’s tax rate is again increasing, most property owners will see their tax bills decrease. For Acting City Manager Bruce Campbell, budget season closes a crucial part of his on-going job interview.

Palm Coast Sets Intial Tax Rate 14% Higher With Goal of Whittling It Down By September

Palm Coast City Council members are trying desperately to hold the line on property tax increases, but will likely not succeed entirely. The final tax rate will still not translate into a tax increase for most.

County Property Values Fall Another 14%; Palm Coast: -12%; Tax Rates Heading Up

The declines, for the fourth year in a row, will define to what extent local governments must either raise taxes or cut services as they prepare next year’s budgets. Governments have little room to cut anymore, short of vitals services.

Property Tax Overhaul Passes House: Breaks For New Home Buyers, Business, Snowbirds

First-time home buyers would get a 50 percent property tax break on the value of their home. Voters would decide whether to cap property tax assessment increases for commercial properties at 5 percent.

Property Tax Reform: 50% Exemptions, Breaks for Investors, Losses for Local Governments

Supporters of the overhaul say it’ll fill up empty homes. Critics say it’ll also slash local government revenue and further shift the tax burden to current residents, exacerbating inequities.

Skipping Specifics, Scott Calls for $5 billion in Spending Cuts, $4 Billion in Tax Cuts

Gov. Rick Scott today unveiled to a tea party crowd a budget that would cut an unprecedented $5 billion and provide for $4 billion in tax cuts, $1.4 billion of which in property taxes. Scott’s details are few.

Detox for Tax Fact Cheats

It’s a resilient urban legend: the top 5 percent of earners pay over 50 percent of taxes, and over half our citizens pay no taxes. It’s also false. Time to set the record straight.

Its Initiative in Flames, Enterprise Flagler Hands Tax-and-Build Plan’s Fate to Tea Party

The Flagler County Tea Party Group will hold a straw ballot on Enterprise Flagler’s tax-and-build “economic development” initiative on Sept. 21. Enterprise Flagler may then ask the county commission to pull the measure from the ballot.

It’s Raining Taxes, Cont’d: Behind Scenes, County Manager Floats Sales Tax Increase

One proposal would increase the half-cent sales tax by a super-majority vote of the county commission, bypassing voters.

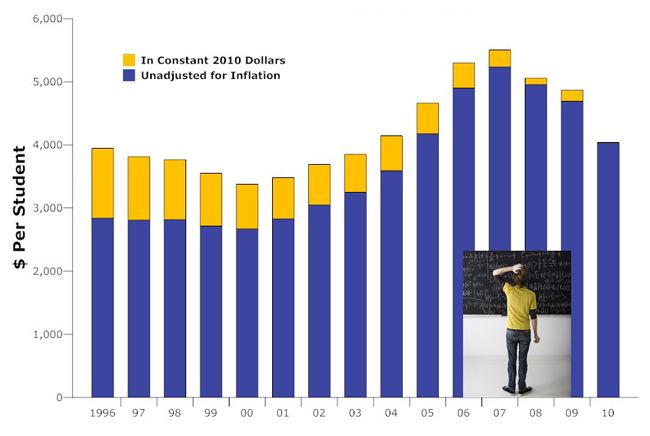

Tax-Averse Parents Send Per-Student Spending Tumbling in Flagler Schools

Per-student funding has risen and fallen over the year, but today it’s identical to what it was in 1996, even as the student population, academic expectations and administrative burdens have multiplied.

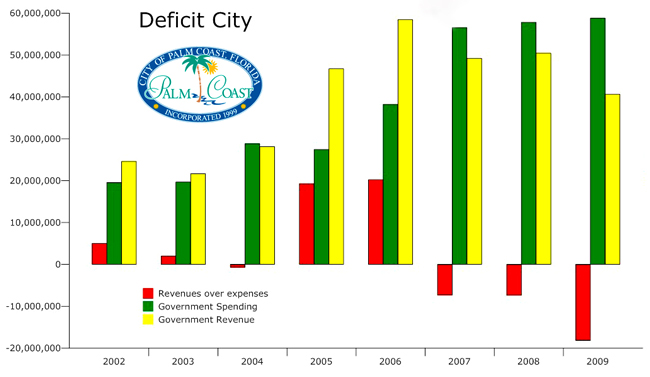

Revenue Crunch Not Yet Sobering

Palm Coast City Council’s Ambitions

Palm Coast’s flush years are over, yet City Manager Jim Landon and the council are still high on a new city hall and a water desalination plant.