The Palm Coast City Council on Tuesday unanimously approved the largest loan by far in the city’s history, a $330 million bond that will provide $280 million upfront to pay for sewer and water infrastructure improvements, and $45 million to refinance older bonds.

With principal and interest combined, the city’s total debt to be repaid over 30 years will be around $582 million. (The adopted city budget this year is $696 million, with just $68 million of that in the general fund, and the water and wastewater capital fund accounting for almost half the budget.)

The money will be in Palm Coast’s hands in about three months, when the bonds are issued. The city, through its ratepayers, will repay the bonds at an average rate of $20 million a year.

City Council member Theresa Pontieri wanted to ensure that current ratepayers will not be saddled with additional debt costs in the future, if the bond repayment calculation rests disproportionately on assumptions that future residents and ratepayers will account for an increasing share of the burden.

Her concern was historically grounded, since Palm Coast residents in 2013 saw water and sewer rates increase 17.6 percent over three years for exactly that reason: the city had assumed that it could incur capital debt on the bet that population growth would be so steep that future ratepayers would bear the brunt of the capital costs. Instead, the housing market crashed, the 2008 recession followed, as did an epidemic of foreclosures, and population growth all but stopped: city utility accounts were growing at less than 1 percent a year. Bond holders got nervous.

“I would hope if you have the rates proposed, that should make the rating agencies comfortable,” the city’s financial adviser told the council in 2013. (See: “Palm Coast Approves 17.6% Water-Rate Hike, Pleasing Bond-Holders More Than Residents.”)

“We want to make sure that we’re not depending on an influx of future growth to pay for these bonds,” Pontieri said on Tuesday. “We’re relying on utility rates and fees to pay for these, so we want to make sure we’re not projecting and needing a lot more residents coming online in order to pay for this.”

The city’s financial adviser said the city can set aside money from the bond proceeds to buy insurance, “whereas the insurer will step in and make the principal and interest payments on the debt if, for some reason, the utility system revenues aren’t sufficient to do that,” he said. But Joel Tindal, the managing director at Hilltop Securities and a city consultant, said given the city’s current bond rating, which is strong, “insurance is not necessary.”

Helena Alves, the city’s finance director, said a feasibility study that will calculate the city’s ability to repay is being completed. But she conceded that the repayments do rely in part on future connections. “It is definitely a conservative estimate,” she said.

The city charter forbids loans exceeding $15 million or in excess of three-year terms absent approval in a popular referendum. But utility bonds are not subject to that provision, which covers only the city’s general fund. The utility is a separate, “enterprise” account, expected to operate self-sufficiently.

Two candidates for council seats in this year’s election–Jeanie Duarte and Darlene Shelley–addressed the council, criticizing the bond issue. Shelley called it “more of a burden on the existing, current residents of Palm Coast,” and asked why state grants weren’t secured to pay for the capital expenses. (Pontieri has been complaining about that lack of grants, noting that the legislature had appropriated some money for Palm Coast but Gov. DeSantis vetoed it, saying grants would be available. They were not.)

Sandra Shank, who chairs the city’s planning board, serves on the city-county Affordable Housing Advisory Committee, and has long advocated for more affordable housing in the city, also opposed the bond resolution, saying future growth is “crashing,” shifting the $330 million burden to current residents.

But she was incorrect when she claimed that a 2024 referendum voters rejected would have “limited your ability to do this.” That referendum was to repeal the restriction on borrowing and long-term leases backed by the general fund. It would have had no effect on utility bonds.

Mayor Mike Norris recommended to the speakers to revisit the January 14 workshop, where the council heard details about the plans for the bond money, and the reasons for it. See: “Palm Coast Set to Take On $582 Million Debt Over 30 Years and Invest $600 Million in City’s Utility Over the Next 5.”

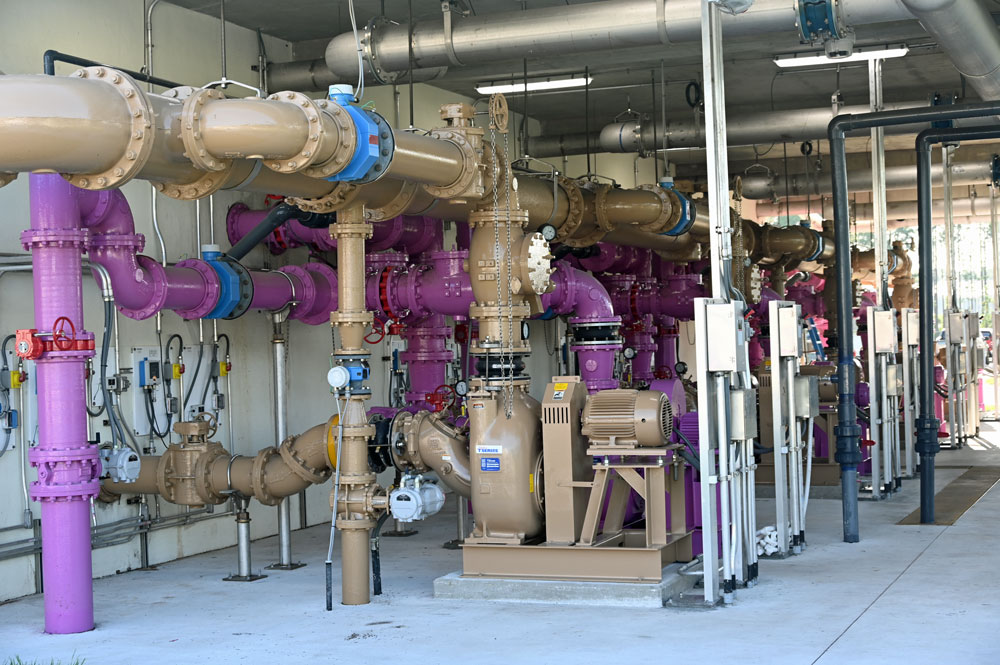

“We fought this back in the spring of last year. I actually voted against it,” Norris said. “But we’re at this position now, and we have to move forward, because we have to improve our systems. The same people who sit there and say ‘we don’t want to do that, we don’t want to do that,’ will complain about green water and chastise the city for not doing the right things on water.”

Council member Ty Miller said the issue has been studied and vetted for months. “We’ve talked about this many, many times. It’s a very serious issue,” Miller said. “I don’t think anybody ran for office to be within the first year raising rates on residents for water. It’s not something I ran on or wanted to do. It’s because our utilities are failing and need cash. They need money to fix and so we need to fix our utilities. And so that’s the investment we’re making. It’s not easy. We’re all in this together. I’m paying the same rates.”

![]()

JimboXYZ says

It’s obvious the victims of the Biden-Harris era that are current residents will pay for this poor Vision/Imagine of 2050 that nobody was after before the Covid fraud was perpetrated upon the masses if the USA. Alfin Vision victims too. Paying for this is resident based for taxation & usage. We’re still looking at a Westward expansion that is so grossly underfunded. The last 5 years is another 25 years of financial mismanagement that is criminal. Wonder how many homes Alfin’s sold for inflated commissions since he was voted out ? And all those investigations and nobody could see he was going to make money off this one way or another. David Alfin is the worst mayor the City of Palm Coast has ever had. He had a vision alright, cashing those Real Estate commission checks until he can’t sell real estate in his old age ? Thanks for ruining Palm Coast & Flagler County. Holland sucked too !

Greg says

You really don’t believe this crap do you? Almost guarantee that current taxpayers will pay the vast majority of this bill, providing for future growth.

PHIL says

If we didn’t have so much uncontrolled growth in apartment buildings here then this wouldn’t be an issue. That Town Council needs to stop approving permits for Mass buildings and tell them to go somewhere out.

Can we seriously stop all the mass building! There’s not enough roads and infrastructure in place for this many people. The roads are already crowded as is. Water and sewer cant keep up. These new apartment complexes that keep going up everywhere is just going to make traffic more congested and lines at businesses longer. Also the crime has been slowly increasing as well with more people here. Just look at the apartments in town center, cops are there all the time. Please people let’s get together and stop all the large building projects.

Deborah Coffey says

Maybe you mean, please people, let’s get together and stop voting the way we’ve voted for years…because we’re getting exactly what we voted for….

Ed Danko, former Vice-Mayor PC says

“Tax & Spend Theresa” wants to ensure that current ratepayers will not be saddled with additional debt costs in the future! Yeah, and I got a bridge to sell you in Brooklyn! But don’t worry, the city has a “uncompleted feasibility study” that will calculate the city’s ability to repay. Under the leadership of Mayor Pontieri and now Vice-Mayor Norris, you can count on one thing and that is massive rate increases for the next 30 years!

Tiredofthegames says

Thank you for crawling out from under your troll bridge to provide your worthless two sense. These water issues are due to the over-development YOU voted for. Do us all a favor and take your self-imposed raise and your development rubber stamp, and just go away.

Ed Danko, former Vice-Mayor, PC says

The waste-water issues are due to the fact the the previous City Manager never informed council about the increasing capacity issues until we had a hurricane and reached 100% capacity, one of the many reasons I cast the deciding vote to terminate here. Had we been aware of the situation we could’ve dealt with it earlier. The present council has had two years to deal with this, including securing federal and state grants, but they have failed. FYI, we are going to grow, and anyone who tells you otherwise is simply lying to you. Nothing stays the same. But hey, if you have any great solutions, then stop hiding behind an alias and step up and run for office!

JimboXYZ says

Exactly what David “Covid” Alfin was after with every approval of growth that had zero dollars, hoping for a State grant that had zero dollars for a Biden-Harris “Build Back Better” America that didn’t include a dime to build much of anything that the rest of us would be extorted to pay for in a debt crisis that will last for decades. What did we get out of 3.5 years of Alfun ? A few restaurants & a BJ’s on FL-100 & gridlock traffic that isn’t worth the misery of it all. Saddest part, Palm Coast isn’t the only victim. There’s really no place to escape, the inflation is rampant, worse than Covid could every create for misery. Covid & the fraud & abuse of the last +/- 5 years. That wasn’t in anyone’s retirement plan. The leaders of this City failed everyone with their incompetences, as the goal posts were moved. I’m still shocked that 17-18% of the city voted for Alfin in 2024 ? Norris was sandbagged walking into 2025.The upside was Alfin was out & couldn’t do further damages, it was too late he’d done enough already. Those Alfin voters must be the same one’s that were getting some form of compensation throughout the whole process of fleecing Palm Coast. Wondering, how that NBA lawsuit is going to turn out ? I can’t see that coming out to the positive for the City of Palm Coast balance sheet for being another liability.