To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Mostly cloudy with a chance of showers. A slight chance of thunderstorms in the afternoon. Highs in the mid 70s. Chance of rain 50 percent. Saturday Night: Cloudy. A chance of showers in the evening, then showers likely after midnight. Lows in the lower 60s. Chance of rain 70 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

The Saturday Flagler Beach Farmers Market is scheduled for 9 a.m. to 1 p.m. today at its new location on South 2nd Street, right in front of City Hall, featuring prepared food, fruit, vegetables , handmade products and local arts from more than 30 local merchants. The market is hosted by Flagler Strong, a non-profit.

The Flagler Beach All Stars hold their monthly beach clean-up starting at 9 a.m. in front of the Flagler Beach pier. All volunteers welcome.

Coffee With Commissioner Scott Spradley: Flagler Beach Commission Chairman Scott Spradley hosts his weekly informal town hall with coffee and doughnuts at 9 a.m. at his law office at 301 South Central Avenue, Flagler Beach. All subjects, all interested residents or non-residents welcome. The gatherings usually feature a special guest.

Holiday Sale to Benefit Area Homeless: Holiday Sale featuring ornaments décor, jewelry, gifts, home décor, craft and more, Unitarian Universalist Congregation, 56 N Halifax Dr, Ormond Beach, Friday Dec. 5, from 10 a.m. to 7 p.m., Saturday, Dec. 6, from 8 a.m. to 3 p.m. All proceeds benefit outreach programs serving the local homeless. Members of the congregation and friends have donated holiday themed items and things perfect for gift giving for the event. Free parking is available, and bargains abound!

John’s Towing Celebrates 35 Years: The Bunnell-based towing company owned by John Rogers (a Bunnell city commissioner since 2011) marks its 35th anniversary in a celebration at Joan B. King Park, 300 Citrus Street, Bunnell, from noon to 4 p.m. There will be music, games, food, and touch-a-truck opportunities.

Flagler Beach’s Holiday at the Beach Parade: It’s scheduled for 1 p.m. Saturday. The Rotary Club is sponsoring the parade, which will occur on SRA1A and detours will be in place on SRA1A at North 10th Street and South 7th Street. Officers and Volunteers will be in place along the detour route to expedite traffic flow. If you have any questions about the traffic plan for this year’s “Holiday at the Beach” Parade, please contact Flagler Beach police at (386) 517-2024.

Palm Coast’s Starlight Parade in Town Center is scheduled for 6 p.m. in Central Park, including food trucks. Photos with Santa starting at 4 p.m. This festive parade will be a celebration of community traditions, featuring numerous community partners. Enjoy a delightful evening with food, entertainment, and fun for all ages. Don’t miss this opportunity to come together and honor the vibrant spirit of Palm Coast. Be part of this magical event and celebrate our community in style! Santa will arrive on a Palm Coast Fire Engine! There will be food trucks, Letters to Santa station, face painting, and kids crafts.

‘Annie,’ at Limelight Theatre, Limelight Theatre, 11 Old Mission Avenue, St. Augustine. 7:30 p.m. The beloved musical about the optimistic orphan who captures hearts (and maybe even saves a billionaire). Perfect for families and the holiday spirit. Book here. (Note: all Sunday matinees are sold out, but there is a wait list you may join.)

Irving Berlin’s Holiday Inn, at Athens Theatre, 124 North Florida Avenue, DeLand. 7:30 p.m. 386/736-1500. Tickets, Adult $37 – Senior $33 Student/Child $17. Book here. Celebrate the magic of Christmas with Irving Berlin’s Holiday Inn—a heartwarming holiday treat packed with show-stopping dance numbers, dazzling costumes, and a treasure trove of timeless tunes. When Broadway performer Jim leaves the bright lights behind for a quiet Connecticut farmhouse, he ends up transforming his home into a seasonal inn, open only on the holidays. But with love in the air, rivalries heating up, and performances for every festivity, the holidays get a lot more exciting than he ever imagined. Featuring 20 beloved Irving Berlin classics—including “White Christmas,” “Happy Holiday,” “Blue Skies,” and “Cheek to Cheek”—this delightful musical delivers all the laughter, romance, and seasonal sparkle of a Christmas card come to life. Presented through special arrangement with Concord Theatricals.

‘Greetings,’ A Christmas Comedy, Daytona Playhouse, 100 Jessamine Blvd., Daytona Beach. 7:30 p.m. Box office: (386) 255-2431. tickets, $15 to $25. A comedy about a young man who brings home his Jewish atheist fiancée to meet his very Catholic parents on Christmas Eve. With the inevitable family explosion comes an out-of-left-field miracle that propels the family into a wild exploration of love, religion, personal truth, and the nature of earthly reality.

Grace Community Food Pantry, 245 Education Way, Bunnell, drive-thru open today from 10 a.m. to 1 p.m. The food pantry is organized by Pastor Charles Silano and Grace Community Food Pantry, a Disaster Relief Agency in Flagler County. Feeding Northeast Florida helps local children and families, seniors and active and retired military members who struggle to put food on the table. Working with local grocery stores, manufacturers, and farms we rescue high-quality food that would normally be wasted and transform it into meals for those in need. The Flagler County School District provides space for much of the food pantry storage and operations. Call 386-586-2653 to help, volunteer or donate.

Random Acts of Insanity Standup Comedy, 8 p.m. at Cinematique Theater, 242 South Beach Street, Daytona Beach. General admission is $8.50. Every Tuesday and on the first Saturday of every month the Random Acts of Insanity Comedy Improv Troupe specializes in performing fast-paced improvised comedy.

Artificially: I asked Gemini, my now go-to equivalent to those Mediterranean worry beads I so much miss seeing in the hands of my uncles and once-upon-a-time neighbors, the following question: “Without qualifiers, without mannerly preambles, without characterizing this question with pointless flatteries as “fascinating” or “age-old,” yes or no, do you have a mathematical proof of god’s existence?” Gemini for once was straight: “No,” came the answer. I told it I was surprised there was no follow-up question. “You gave very specific instructions for a “yes or no” answer without any qualifiers or preambles. I adhered to those constraints,” it said. Then it came: “Would you like to discuss the topic further now?” I was not interested, but not wanting to leave this nonexistent entity disappointed, I asked: “What do you make of the proof of god’s existence in Updike’s “Roger’s Version”?” The answer was better than most reviews of the book:

In Updike’s novel, the “proof” is a fascinating literary device and a catalyst for the plot, rather than a serious, fully-formed proposition. It’s an exploration of the idea of a proof and its consequences.

Here is what I make of it, based on its function in the story:

1. What the “Proof” Is

The proof is not a simple logical syllogism but a modern, computational version of the teleological argument (the argument from design).

- Who: It is proposed by Dale Kohler, a young, zealous, and evangelical computer science graduate student.

- How: Dale believes that the universe is so precisely “fine-tuned” for life that its fundamental physical constants cannot be the result of random chance. He thinks that if he runs enough data from cosmology and particle physics through a powerful computer, a pattern—the “fingerprint” or “face” of the Creator—will emerge from the “noise” of reality.

He is, in essence, trying to find God in the data—to replace faith with information.

2. The Central Irony

The novel’s core intellectual conflict is a complete role reversal:

- The Scientist (Dale Kohler) is the passionate, almost mystical believer seeking absolute certainty.

- The Theologian (Roger Lambert), the narrator and a divinity professor, is the world-weary skeptic who is deeply threatened by the entire project.

3. The Novel’s Verdict on the Proof

Updike uses the proof to make a profound point about the nature of faith itself. The novel’s conclusion is that the proof is both a failure and, more importantly, a spiritual mistake.

Roger’s Rejection: The narrator, Roger, is a follower of the theologian Karl Barth. He believes in a Deus Absconditus—a “hidden God” who is wholly separate from the world and can only be known through a subjective leap of faith, not through objective discovery.

Roger is horrified by Dale’s project. In one of the book’s key passages, he says:

“A God you could prove makes the whole thing immensely, oh, uninteresting. It ceases to be a faith, it becomes a fact… It eliminates faith from religion, it takes away our freedom to believe or doubt.”

For Roger, a God who can be “found on a printout” is no God at all. He needs a God who remains a mystery.

The Quest’s Outcome: The proof is ultimately a failed quest. Dale’s obsessive search for a divine, orderly pattern in the cosmos is contrasted with the messy, carnal, and chaotic human reality that explodes in his own life (namely, his affair with Roger’s wife, Esther).

The novel suggests that the search for an abstract, computational God is a sterile distraction from the real, ambiguous, and often painful arena of human life, which is where any true sense of the “divine” (or its absence) is actually experienced.

—P.T.

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

ESL Bible Studies for Intermediate and Advanced Students

Grace Community Food Pantry on Education Way

Palm Coast Farmers’ Market at European Village

Al-Anon Family Groups

‘Lady Day at Emerson’s Bar and Grill,’ the Billie Holiday Story, at City Rep Theatre

East Flagler Mosquito Control District Board Meeting

Nar-Anon Family Group

Palm Coast City Council Meeting

In Court: Angel Marie Sexton Sentencing

Flagler Beach United Methodist Church Food Pantry

Weekly Chess Club for Teens, Ages 10-18, at the Flagler County Public Library

Flagler Beach Library Writers’ Club

Random Acts of Insanity Standup Comedy

For the full calendar, go here.

What was this desolation in Dale’s heart, I thought, but the longing for God—that longing which is, when all is said and done, our only evidence of His existence?

–From John Updike’s Roger’s Version (1986).

Pogo says

Jim says

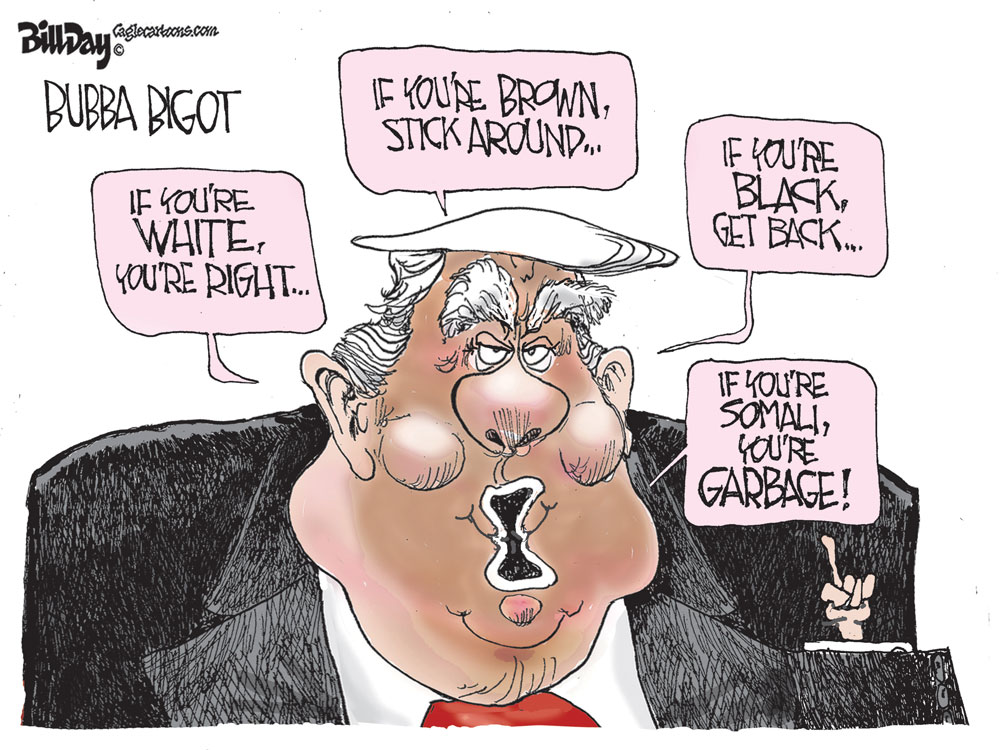

There was a time in this country where comments about any ethnic group or nationality of a general nature that were outrageously negative would get the moron who made the comment in hot water with most Americans. In the past, Americans frowned on any group getting 100% labeled “trash” would not be acceptable. In fact, most Americans would expect anyone who made such asinine statements to either apologize or resign (or both). There was a time when Americans understood that all groups have good and bad within and you can’t blanket label any group.

But in today’s American, the president of the United States can make such a crude and unsupported comment and it barely rates a small stir among us. “That’s just Trump” is the response. Now, I don’t know what Somalian’s did to Trump (or America) that prompted this comment (and, just out of interest, does it not bother MAGA when such comments are spewed forth without any evidence of support?), but I think it’s outrageous that he said it, that he even thinks it, and that he can even be considered president of “all the people”. This is nothing but racism from our narcissist president.

And if you are not disappointed and ashamed that the president [repeatedly] made these comments, you really need to look deep inside your soul.

Laurel says

Thank you, Jim.

It only takes one person to give Trump an excuse to condemn a whole ethic group, and IIhan Omar is that person. The things he doesn’t like are she’s a woman, she’s progressive and she’s smart. Case closed.

Trump gives the people with low self esteem permission to come out and display their bigotry, which at one time, they kept bottled up as society didn’t approve. What’s alarming to me is that there is so many more unhappy people than I ever realized. Hence, his success with the far right “White Christian Nationalism” that ignores Jesus.

Laurel says

The President of the United States is supposed to be the President of all citizens. For this one to call a particular ethnic group “garbage” is disgusting, and completely un-Presidential. Half are “vermin” and half are shit upon by his childish plane meme.

He, and his incompetent cabinet, are an incredible, ongoing, embarrassment. We are just so much better than this!

Sherry says

@ Laurel. . . absolutely! We used to be and till should be “so much better than this”! Unfortunately, obviously, there are still so many US citizens who simply are NOT “better than this”. . . These are indeed terrible times for what once was a “Civilized Society”!

Sherry says

OOPS! Please excuse the “typo”. My previous comment should read ; “We used to be, and still should be”

Ray W. says

About two weeks ago, Intellinews reported that as of November 24, a new Kitimat, British Columbia, liquefaction plant exported its 25th LNG cargo since opening in June 30th, despite post-opening teething problems that at times limited liquefaction capacity to as little as 50% of its overall capacity of 6.5 million tons per year. The cargoes have been shipped to Japan, Korea and Malaysia.

In early November, the plant opened a second liquefaction train, a plant that when fully operational will add 6.5 million more tons of export capacity per year.

According to an Oil Price US article, China’s expected demand for imports of liquefied natural gas is expected to drop 5% from total import demand in 2024.

According to reports, China’s LNG import demand has dropped each month for 13 straight months.

On the other hand, China has been growing its import volumes of Russian compressed natural gas (CNG) via the Power of Siberia pipeline.

And, Chinese domestic natural gas extraction efforts have increased, with domestic natural gas volumes hitting a record high earlier this year.

From another Oil Price US story, after projections of a polar-vortex intrusion soon to expand across the Midwest and East U.S. over the next two weeks, U.S. natural gas futures have “spiked” to their highest levels in nearly three years, with prices nearing $5 per million BTU’s. The 2022 high-price era was driven by Russia’s invasion of the Ukraine that resulted in reduced exports of Russian compressed natural gas into Europe.

Per a Midland Reporter-Telegram article, Whitewater, the developer of the Eiger Express Pipeline from the Permian Basin to the Katy,Texas, area, just announced plans to increase new pipeline’s diameter from 42 inches to 48 inches, a change that will raise daily transport capacity from 2.5 billion cubic feet to 3.7 billion cubic feet. Not only will the pipeline size be increased but higher pumping pressure will be added to the line.

According to the reporter, “[t]he Eiger Express is one of several greenfield pipeline projects being planned, raising concerns about a pipeline overbuild.”

But East Daley Analytics’ Oren Pilant told the reporter:

“In our view, some amount of excess pipeline capacity is important to close the price spread between Waha and Henry Hub, allowing producers to grow production without fear of hitting capacity constraints and driving Waha prices negative, as in 2024.”

Fortune reports that a Texas-based natural gas producer is gambling billions of dollars on a “megatrend” of power plants needed to meet growing AI electricity needs.

In 2023, BKV, then primarily a natural gas producer, bought two existing natural gas-fired power plants at locations with room enough for the company to expand.

According to the reporter, BKV drew “suspicion and ridicule” for an oil and gas producer to expand its business model into electricity production, as each industry has “different skill sets”.

Said BKV founder and CEO, Chris Kalnin, to the reporter:

“I went to a very large institutional investor and explained our gas-to-power strategy in our business, and I got berated for like 30 minutes about how it was such a foolish thing for me to go into power.”

In the intervening two years, BKV has gone public and its stock has gone up by 50%. BKV is about to sign a long-term contract to supply electricity to a “hyperscaler” AI data center campus, analysts report, and it intends to buy or build more power plants.

Added CEO Kalnin:

“It was a pretty controversial decision for us to buy power. It’s been, honestly, one of our best investments ever. … Hyperscalers need more generation. They used to talk about hundreds of megawatts. Now the conversation starts with gigawatts.”

Writes a Reuters reporter, Chevron’s Australia unit just announced a partnership in a $1.98 billion development project off northwest Australia’s coast in the Gorgon 3 development region. The project will link the Geryon and Eurytion natural gas fields to Barrow Island’s already existing infrastructure.

Over time, Chevron plans to drill no more than 40 wells in seven offshore natural gas fields, “with a notional field life extending to 2070.” Some of the natural gas is reserved for domestic use. Some of the gas will be liquefied and exported as LNG.

Also, per the story, Shell received approval for a plan to drill for natural gas that will be loaded directly onto a “floating LNG vessel.” And ConocoPhillips has finished drilling a natural gas exploration well on southern Australia’s coastline; it plans to drill a second exploratory well nearby.

Make of this what you will.

Me?

The international energy marketplace is incredibly complex and difficult to predict. Right now, fossil fuels power just under 60% of the world’s electricity supply and dropping. Renewables, including nuclear, hydro-power and geo-thermal power, provide just over 40% of the world’s electricity supply and rising.

Billions and billions of dollars can be made on the most efficient forms of producing electricity. Nations compete. If one nation constructs too many LNG export plants, market imbalances might arise. International oil and natural gas companies are looking for the most productive oil and gas fields, pivoting to some at the expense of others.

Dennis C Rathsam says

CANT HIDE FROM THE TRUTH1

Skibum says

No you can’t, Dennis… but you still do everything you can to detour around it.

Sherry says

Wow! Splendid way to “turn the table” Skibum!

I say we wait a little before scraping dennis off the ceiling. . . LOL!

Ray W. says

According to an Oil Price US story, a steady drop in production from Argentina’s “aging conventional oil fields” is being offset by a “growing unconventional hydrocarbon output.”

“Conventional” crude oil comes from pooled crude oil reserves in Argentina’s Chubut province, with the oil defined as “Escalante grade heavy crude”. Oil from the Chubut province has a “lifting” cost of between $35 to $45 per barrel. It has a “breakeven” price of $75 per barrel. Right now, Brent crude is commanding roughly $62 per barrel. As the conventional Chubut fields decline in output, costly “secondary and tertiary recovery methods like water, gas [or] chemical injection are required to boost reservoir pressures and oil mobility so it can be lifted.”

Argentine President Milei recently lowered royalty fees on Chubut oil and exempted the region, one of Argentina’s 23 regions, from paying the country’s export tax on goods, including oil. President Milei plans to in time eliminate the nation’s export tax on the 22 other regions.

The Milei administration has announced a long-term plan to create in Argentina a “market-friendly regulatory environment, which will attract greater foreign energy investment.”

Argentina’s “unconventional” crude oil comes from the 8.6-million-acre Vaca Muerta oil-bearing shale rock formation. Development of the Vaca Muerta formation began in 2012. In the ensuing 13 years, the “shale play” has become the most profitable in Latin America.

In 2014, only five horizontal wells entered production. 403 such wells were operating by 2020.

Oil from Vaca Muerta shale rock has a “lifting cost of $15 to $18 per barrel. It has a “breakeven” cost of between $36 and $45 per barrel. With these comparatively lower costs of extraction and export, much of Argentina’s onshore oil exploration efforts have pivoted away from the Chubut region towards the Vaca Muerta shale rock formation.

The EIA ranks the Vaca Muerta shale rock formations as the fourth largest current shale oil field in the world (16 billion barrels) and the second largest current shale gas field in the world (308 trillion cubic feet). Thus far, 10% of the Vaca Muerta field is under development.

The reporter wrote that:

“[A]nalysts predict the shale play will be pumping at least 1 million barrels of oil and 5.7 billion cubic feet of shale gas per day.”

Right now, Argentina hit a new record average per day crude oil production of 849,646 barrels in October, with Vaca Muerta oil accounting for 571,478 of those barrels, or 67.26% of the total. Shale oil production is up 34% year-over-year.

On the other hand, natural gas output fell for the third straight month. Year-over-year production is down almost 7%. Shale gas now comprises 61.6% of total Argentine production. The reporter blamed the drop on reduced drilling activity and wells being shuttered for planned maintenance.

Argentina’s Chamber of Exploration and Production of Hydrocarbons (CEPH) recently warned that Argentina’s conventional oil fields are “in a phase of high operational fragility and accentuated decline.” CEPH believes that “mature” oilfields will be shuttered in the near term with “insufficient capital invested in maintaining operations.”

The reporter opines that “[t]here are signs that the Vaca Muerta is Buenos Aires’ long-awaited economic silver bullet. The formation has the potential to change the energy lanscape in Argentina and has already made the country a net oil exporter. … This is improving the country’s balance of trade while substantially boosting fiscal revenues for a cash-strapped government.”

Make of this what you will.

Me?

A few months ago, a substantial deep-water conventional crude oil field was discovered over 100 miles off Argentina’s shoreline, arguably because 20K drilling equipment, rated safe in a 20,000 psi deep sea environment is changing the crude oil industry. It will take years to develop the Argentine field, but does this article, when added to the offshore oil discovery, help explain why the Trump administration agreed to exchange $20 billion in a currency swap with Argentina?

I am not arguing that the currency swap was an economic idea, as opposed to a political idea. I just don’t know. But more information is better than less, at least to me.

Ray W. says

A recent Barron’s story starts:

“Crude oil prices have slumped 23% this year and could head lower in 2026, even with heightened geopolitical tensions, simply because there is too much oil in the world.

In January 2025, Brent crude was hovering in the $82 per barrel price range, just before OPEC voted to slowly phase in production increases.

According to Dan Pickering, founder and CEO of Pickering Energy Partners, “[o]il supply would need to fall by about a million barrels per day to match demand.” 2026 projections of crude oil oversupply vary from one to four million barrels per day. Some see Brent crude prices as low as $50 per barrel next year, down from today’s near-$63 per barrel.

In a second story, Oil Price US reports that TotalEnergies has emerged as the leading candidate to partner with Portugal’s Galp by purchasing a 40% share the deep-water Mopane oil field that was found in 2024 off the coast of Namibia. Chevron is said to be interested, too.

In recent years, Shell, TotalEnergies, BP, and Galp have discovered oil and natural gas in other off-shore fields. BP, in October, announced an oil and gas discovery in the Orange basin offshore Namibia.

Namibia, a poor West African nation, is weighing whether of offer incentive and financing options to international major oil exploration companies and, if it decides to do so, how much to offer. Investment decisions can be different from exploration decisions, as infrastructure costs can be expensive. Finding oil is one thing, but building the infrastructure to export that oil is another.

According to the reporter, Namibia desires to become the world’s next Guyana, but it lacks the infrastructure to speed up the process of exporting whatever oil might be found.

In a second Oil Price US story, and the third story in this comment, “Nigeria has tendered 50 oil and gas blocks, eyeing $10 billion in new investments over the next 10 years and 400,000 barrels daily in additional production capacity.” 15 of the 50 blocks are offshore, 19 are “frontier” fields, and one is in a “deepwater” block.

Since the start of 2025, 46 field development plans have been approved and Nigeria’s active rig count has jumped to 60 and crude oil production has jumped to 1.71 million barrels a day. Recent investment decisions include “$5 billion for Bonga North, $500 million for Ubeta Gas, and $2 billion for Shell’s HI Gas project.”

According to Gbenga Komolafe, head of the Nigerian Upstream Petroleum Regulatory Commission:

“The Commission understands that in today’s volatile global energy landscape, certainty and predictability have become the true currencies of investment. … Through extensive multi-client surveys, producing sharper, higher-resolution images of our petroleum systems and reducing uncertainties that once hindered exploration decisions.”

In a fourth story, Reuters reports that ExxonMobil is interested in purchasing Lukoil’s 75% stake in Iraq’s “giant” West Qurna 2 oil field, after the Trump administration sanctioned Lukoil. West Qurna 2 currently produces 470,000 barrels of crude oil per day. ExxonMobil stopped operating in West Qurna 1’s field in October 2024, but it apparently is looking to get back into the region.

An Iraqi senior official who oversees foreign company operations in southern Iraq said:

“Exxon is our preferred option to take over from Lukoil. The company has the capacity and experience needed to manage a field as large and complex as West Qurna 2.”

According to the story, the U.S. Treasury has “cleared potential buyers to talk to Lukoil until December 13, but they will need approval for specific deals.”

Make of this what you will.

Me?

I hope that Namibia considers the independent sovereign wealth fund approach taken by Norway. Keeping crude oil and natural gas extraction royalties away from both political oversight and Treasury officials seems a good choice.

But the cost of extracting crude oil from ground varies.

From what I have read, shale crude oil from the Permian Basin costs as much as $25 or more per barrel to pull it out of the ground. Saudi lift cost is commonly described as between $8 and $10 per barrel. From another comment, Argentine shale oil extraction costs are between $15 and $18 per barrel. According to a recent Oil Price US article, extraction costs for Guyanese crude oil is in the $30 per barrel range. But the Guyanese crude oil does not have to be transported very far to market. Panamax supertankers can dock at the Stabroek platform and take on a load directly from pipelines from the seafloor.

The world is projected to pass the 105 million barrel per day production threshold in 2026. With certification for use of the new 20K drilling equipment, meaning drilling at pressures of 20,000 psi, up from the previous maximum psi of 15,000, deep-sea drilling is breaking out all over the world.

A recent economist told a reporter that OPEC+ is in a price war with the U.S. shale oil energy industry in order to win back lost market share. I am not convinced that the economist was entirely correct. It may be that OPEC+ sees competition coming in from all quarters, not just from U.S. shale oil producers.

Innovation abounds.

In 2008 or thereabouts, three innovations came together at once. Improved horizontal drilling rigs guided by a breakthrough in 3D seismic imaging techniques made if easier to find the richest deposits of oil-bearing shale rock. Improved fracking liquids unlocked the rich deposits of oil from the shale in unprecedented quantities. The Shale Revolution was born.

Now, we are seeing exploration efforts at unprecedented sea depths due to the newly-certified 20K deep-sea drilling equipment.

India is looking for oil and gas. So, too, is Pakistan and China, though China is trying to steal oil by force and threat from those who have the sovereign right to the seafloor above the deposits. Australia is looking for oil and gas. Brazil, Argentina and Suriname. Egypt, Namibia, Nigeria, Cyprus, Guyana, all looking. Others are, too.

Ray W. says

Hello Dennis C. Rathsam

Finally, the long-proclaimed separation of gasoline prices at the pump is happening.

According to GasBuddy, the national average price for a gallon of regular gasoline at the pump on December 6, 2024 was just over $3.00.

On December 6, 2025, the national average price for a gallon of regular gasoline at the pump was just under $2.94.

Over the 12-month period, the highest average price per gallon at the pump was $3.26 per gallon just after the March 30, 2025 reporting date, which coincided with OPEC+ beginning to pump out more oil in order to win back lost market share.

Can’t hide from the truth. Of all nations and economic blocks, OPEC+ has the greatest concentration of economic power to manipulate crude oil prices.

Thank you, Dennis C. Rathsam, for permitting me to point out to all FlaglerLive readers your continuing efforts at lie laundering.

The truth is that the Trump administration has done very little to bring down gasoline prices at the pump. OPEC+ is doing the heavy lifting on that front. Gasoline prices are nowhere near the Trump-promised $2.00 per gallon.

As an aside, I did stop at Buc-cees today for $2.80 per gallon regular gas. I am not complaining. The next gas station I drove past posted regular gas at $3.05 per gallon. Buc-cees was packed.

The Trump administration has not cut energy prices in half, as was often promised before the election, either.

Electricity prices per kilowatt-hour are trending up all over the country. And natural gas prices are trending up, too.

As an aside, I decided to look up the state of the Dow after every president’s 48th month in office since Reagan:

Clinton: Up 105.8%.

Obama: Up 73.2%

Trump (2016): Up 50.9%.

Biden: Up 48.6%.

GHW Bush: Up 41.3%.

Reagan: Up 35.8%.

GW Bush: Down 3.7%.

Let’s face facts, Dennis C. Rathsam. There will always be certain subjects about which the professional lying class that sits atop one of our two parties lies the most. Energy is one of those subjects. Economic performance another. Every time you set out to launder another lie is just another opportunity for me to respond with the truth. Thank you once again for the opportunity.

Former President Biden did not destroy the American economy. The pandemic and the early economic responses to it did much to damage the American economy and Trump, Biden and Powell each did their best in adopting economic policies designed to restore the heavily damaged economy to health. When President Trump took office a second time, he inherited an economy that was in the words of the Wall Street Journal and The Economist “the envy of the world.”

Laurel says

Okay, Ray W, now you gotta scrape Dennis off the ceiling!

Some guy pointed it out to me that eggs are no longer $30 a dozen, and I exclaimed “Yeah, thank goodness the price of food is coming down” (sarcasm for those who don’t know). He then exclaimed, angrily, “At least it won’t be 40% higher!”

My favorite all time dialogue from a movie, in this case “The Big Chill,” is between Jeff Goldblum’s character Michael and Tom Berenger’s Sam.

“- Sam: Why is it what you just said strikes me as a massive rationalization?

– Michael: Don’t knock rationalization; where would we be without it? I don’t know anyone who could get through the day without two or three juicy rationalizations. They’re more important than sex.

– Sam: Come on, nothing’s more important that sex.

– Michael: Yeah? Ever gone a week without a rationalization?”

Ray W. says

CBS NEWS posted a story titled “Trump touts $20 trillion in new US investments, but numbers don’t lie”

I ask Dennis C. Rathsam to not hide from the truth.

President Trump has been in office for about 10-and-a-half months.

The reporter refers to an Oval Office statement made this past Wednesday by President Trump that “[i]n 10 months, we have $18 trillion being invested.”

In November, while meeting with Saudi Crown Prince Mohammed bin Salman, President Trump announced:

“Twenty-one trillion dollars will be the amount invested in the United States – or committed to invest – in one year.”

“[A] CBS News review found no evidence that total commitments or new investments approach the scale the president has cited.” The reporter added that to have $21 trillion invested in the U.S. would mean a level of investment constituting some two-thirds of American GDP for the year.

Here are bullet points from the CBS NEWS article about the Trump administration’s list of major investments “made possible by President Trump’s leadership.”

– The list of major investments, when added up, total $9.6 trillion, as of the latest administration update in November. Unfortunately, a review of the administration list includes a number of investments announced during the Biden administration. The list also adds into the total sum a number of trade goals that the U.S. is supposed to accomplish, at least in part, not accomplishments supposed to be made by other nations.

– Of the more than 100 companies that the Trump administration includes on its list of investment commitments, “some of the largest were originally unveiled years before Mr. Trump took office [in his second term] and were backed by federal funding under President Biden’s administration.”

– For example, the Trump administration lists a $200 billion investment by Micron Technology in semiconductor manufacturing and research. A Micron spokesman confirmed that $120 billion of that $200 billion was announced in 2022 and the $120 billion investment was supported by $6 billion in funding from Biden’s Chips and Science Act.

– For another example, the Trump administration claims responsibility for a $16 billion investment announcement by GlobalFoundries. $13 billion of that $16 billion was announced during the Biden administration and backed by tax credits from the Chips and Science Act. $3 billion of that $16 billion was announced during the second Trump administration.

– For a third example, during the Biden administration, Invenergy received a loan guarantee of $4.9 billion to construct a “clean-energy transmission project.” In May 2025, Invenergy announced the project. In July 2025, the Trump administration cancelled the Biden administration loan guarantee. Invenergy obtained private financing and is continuing with the project.

As an aside, Invenergy specializes in transmitting “high-voltage direct current(HVDC)” electricity over long distances. The company has developed more than 4100 miles of transmission and collection lines. Invenergy asserts that it has “11 gigawatts of new transmission capacity in development – representing roughly one-third of new U.S. HVDC transmission.”

More specifically, on May 7, 2025, Grain Belt Express, “the largest electric transmission project in the U.S., today announced nearly $1.7 billion in combined U.S. contractor awards to Quanta Services (Quanta), a leader in specialized infrastructure solutions for the energy industry, and Kiewit Energy Group Inc. (Kiewit), one of America’s leading engineering, construction and procurement companies.

“Grain Belt Express, an Invenergy project, is an 800-mile transmission line using state-of-the-art high-voltage direct current (HVDC) technology. It spans 4 states – Kansas, Missouri, Illinois, and Indiana – that have all approved the line as a project in the public interest. The open-access transmission live will add 5,000 megawatts of U.S. energy delivery capacity. By unlocking market efficiencies, Grain Belt Express will provide $52 billion in energy cost savings to Americans over 15 years. Grain Belt Express Phase 1, the portion of the project connecting Kansas and Missouri, is targeting commencement of construction in 2026, which is estimated to create over 4,000 jobs.”

– The Trump administration list contains a $3 billion pledge by Kraft Heinz in two different spots.

– Of the $6 trillion in foreign government investments claimed by the Trump administration, many of the largest entries are “trade targets”, not investments in the U.S.

– For example, the U.S. and Qatar jointly announced a commitment to “generate an economic exchange worth at least $1.2 billion.”

– For a second example, the U.S. and India agreed to “more than double total bilateral trade to $500 billion by 2030” – a trade target, not a “singular investment commitment.”

– For a third example, Saudi Arabia promised to invest roughly $1 trillion in the U.S. during MBS’s visit to the White House, an amount Saudi Arabia may not be able to afford with worldwide crude oil prices declining as they have recently been declining.

– From a different perspective, “gross private domestic investment” is projected to reach $5.4 trillion in 2025, up $100 billion from 2024, when it reached $5.3 trillion.

– As for “[n]ew foreign direct investment – the actual amount that foreign companies put into U.S. subsidiaries and projects – also remains steady. Foreign companies made roughly $145 billion worth of new investment in the U.S. in the first half of the year, nearly identical to the $144 billion invested in the same period last year, BEA data shows.”

Make of all of this what you will.

Sherry says

@ Ray W. and Laurel. . .

Unfortunately, some people are simply past the point of returning to “fact based” reality, and they like it that way. Their “Alternate Reality” appreciates their ignorance while it stokes their fear and hate, and that just feels so damned good. In their minds, “they” are always “RIGHT”, and those who post “facts” just hate trump. That form of “TDS”= “Trump DEVOTION Syndrome” rules their every thought. They have nothing but contempt for those who rely on “facts/truth”.

Laurel says

Sherry: I agree. However, I believe that many have seen the light, and I hope they get out and vote next year. Trump is underwater as it is, now. Our fellow citizens have the chance to make Trump a lame duck, and stop this lawlessness.

We need to be united again, and the hate that spouts from the current administration will not make it happen. We need balance!

Sherry says

Good Morning Laurel,

Of course, I most certainly hope you are correct. If there “is” a huge turn out of “sane and moral” citizens that push back against trump’s fascism, it will be because of a backlash against him. . . and, not because the Democratic party leadership has a clue. . . they don’t!

Laurel says

Sherry: Well, they are latching onto affordability, a “Democratic hoax.” They should make affordability a Democratic reality. If they would just hang onto that, give us real solutions, and stop taking the bait on transgenders or “And Tango Makes Three” books, or Haitians eating pets, and move along, there may be some success!

It’s hard. I am really f’ing mad about Trump calling Walz a “retard.” Never, ever, ever, ever, would this have been acceptable, until now. Something is wrong with the man, and I don’t mean Walz.

Sherry says

@ Laurel. . . “name calling” the last resort for those who simply have “nothing” intelligent to say. IE trump and many of his core Maga supporters!