The Flagler County Commission on Monday voted to give its constitutional officers an extra month–until June 1–to turn in their proposed budgets for the fiscal year beginning Oct.1, ahead of what County Administrator Heidi Petito described as a year of “uncertainty.” The commission also appeared to agree, without a formal vote, to reduce the tax rate next year, though that may end up being more of a symbolic than an substantial reduction.

Taxes

Roundabout Will Be Built on Old Kings Road by Bulow Plantation, at Entrance to Radiance Development

The Flagler County Commission approved spending roughly $2.5 million to build a roundabout on Old Kings Road, at the intersection with the entrance to Bulow Plantation and what will be the entrance to the Radiance development–what used to be known as Eagle Lakes.

The Child Tax Credit Changed My Life. Bring It Back.

A myth exists in America that financial well-being follows if we just work hard and make good choices. But it’s not that simple. At some point, most of us face unforeseen obstacles — from physical or mental health challenges to lost jobs, economic downturns, and natural disasters. Along with low wages and other structural causes of poverty, that puts financial well-being out of reach for about 140 million people in this country.

Flagler County Approves Higher Taxes, Palm Coast Stays Level, But Claims of ‘Historic’ Rollback Are Inaccurate

Palm Coast and Flagler County government this week adopted their budgets and tax rates for the 2023-24 fiscal year with little controversy and so few people in the audience at final hearings that you could count them on one hand. The county raised taxes, the city kept its taxes flat. Palm Coast going back to the rolled back rate was not unique, as some council members claimed or thought.

Flagler Beach Will Consider New Impact Fees for Fire, Police, Parks, and Library, and Higher Fees for Water and Sewer

The Flagler Beach City Commission Thursday will vote on what could be the single-largest tax increase on development in the city’s history. The city is considering adopting higher impact fees on water and sewer connection, and imposing new impact fees for police, fire, parks and recreation services, which it has not had until now.

Flagler County Beats Sharp Retreat on Raising Sales Tax or on Increasing Road Levy on Daytona North

It’s messaging in a bit of a shamble, the Flagler County Commission on Monday beat a retreat on two fronts: it will not seek cities’ support in an attempt to raise the sales tax an additional half penny. And it will not raise the special tax Daytona North residents pay for road maintenance. Both issues had been controversial. The retreats underscore a combination of lacking, poor and conflicting messaging from the County Commission on one side and a rueful public reaction to both proposals on the other.

Rise in Electric Vehicle May Be Denting Florida’s Gas Tax Revenue

As more motorists drive electric vehicles, the change could put a dent in gasoline taxes, which play a key role in funding transportation projects in Florida, according to an analysis by state economists.

Impacting Services, Palm Coast Cuts $2.7 Million from Initial 2024 Budget to Comply with Council’s Lower Tax Rate

While these are budget cuts only in relation to the initially planned budget for next year, they nevertheless will have the effects of actual budget cuts in many regards, because they go against the grain of growth in the budget intended to maintain services and what City Manager Denise Bevan referred to as the city’s customary forward-looking approach.

County’s Sales Tax Hike Rings Hollow as Attorney Defends Commissioner’s Unilateral Request for Delay

Reeling in a school’s worth of red herrings, County Attorney Al Hadeed today fervently defended the authority of County Commissioner Dave Sullivan to ask Flagler Beach government a week and a half ago to pull from discussion a request from the County Commission for support of a proposed increase in the sales tax.

Flagler County’s Sales Tax Fraud

Flagler County government is attempting to convince cities and the public to support an increase in the sales tax using false information, deceptive reasoning and cowardly politics. Local governments have legitimate needs for more revenue, but fooling the electorate isn’t the way to do it.

Without Evidence of Wrongdoing, Palm Coast Council Orders Expensive, Unprecedented Forensic Audit

The Palm Coast City Council Tuesday evening agreed to an unprecedented and very expensive forensic audit of city finances, the sort of audit usually predicated on suspicions of wrongdoing, despite a lack of evidence of any wrongdoing and routine, annual audits and a finance department that just as routinely wins annual awards for transparency. The council was responding to public demands driven more by ideology and general dissatisfaction than facts.

Flagler County Uses False Information as It Asks Cities to Support Increase in Sales Tax

Flagler County government is disseminating false information about the proportion of the local sales tax paid by visitors as it seeks letters of support from Palm Coast, Flagler Beach, Bunnell and Beverly Beach to increase the county’s sales tax by half a percent.

Palm Coast Franchise Fee Killed Again as FPL Balks at Referendum; City Must Cut Budget $2.8 Million

The Palm Coast City Council is set to abandon the unpopular franchise fee it proposed adding to electric bills only last week. City Council member Theresa Pontieri said today she will withdraw the motion that she’d made on July 18. The reason, according to the city manager: Florida Power and Light won’t accept the city’s terms.

Palm Coast in Ugly Meeting Votes to Lower Tax Rate Substantially and Add New, Modest Fee for Now

In another unseemly, disconcerting meeting that included coarse language and flaring tempers from the dais and rowdy and name-calling behavior from a floor thronged with residents, the Palm Coast City Council today substantially lowered the property tax rate in one vote and with another approved new fee or tax–a very modest one for now–on power bills.

Tampa Is Latest City to Unveil Climate Action Plan, Tapping Tax Credits

Tampa’s plan comes just days after two federal agencies released guidance that will for the first time allow local and state governments and nonprofit organizations to access clean energy tax credits that come from 2022’s Inflation Reduction Act, which contained nearly $370 billion in climate provisions.

Its Streets Degrading, Palm Coast Looks for Electric Vehicles to Pay Their Fair Share of Road Taxes

Neither Florida nor Palm Coast tax electric vehicles’ energy consumption, though EVs drive and damage local roads just as other vehicles do. The Palm Coast City Council, faced with a $52 million road-repair bill over the next five years, is looking for new revenue, and targeting EVs. But they may not be a lucrative source just yet.

Two-Week Sales Tax ‘Holiday’ for Disaster Preparedness

The State of Florida is offering disaster preparedness financial assistance through two programs: the 2023 Disaster Preparedness Sales Tax Holiday and the UNITE Florida Sheltering at Home for Recovery Continuation (SHRC) Program.

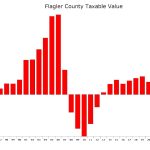

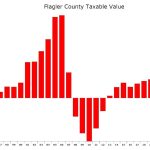

Flagler’s Property Values Still Rose Robustly, Continuing Potential Windfall For Local Governments

Property values didn’t rise as sharply this year as they did in 2022. But the increase is still the second-highest in 16 years, generating substantial new revenue for local government budgets.

Lawmakers Pushing to Increase Homestead Tax Break at Local Governments’ Expense

A proposal to change the state’s Save Our Homes property-tax cap from 3 to 2 percent, significantly diminishing local governments’ revenue, cleared its first legislative committee on Wednesday, despite concerns that it might force counties to cut services or shift the tax burden.

Only the Richest Ancient Athenians Paid Taxes – and they Bragged About It

In ancient Athens, only the very wealthiest people paid direct taxes, and these went to fund the city-state’s most important national expenses – the navy and honors for the gods. While today it might sound astonishing, most of these top taxpayers not only paid happily, but boasted about how much they paid.

Amendment 3: Is Yet Another Homestead Exemptions Needed, Or Prudent?

Florida voters could offer significant property tax exemptions to Florida’s teachers, firefighters, active-duty members of the U.S. military, and other specified professions, amid a relatively hostile housing market. But a well-meaning tax exemption may bring about other complications, such as a loss of local government tax revenue.

8.7% Cost of Living Raise in Social Security Checks Is Biggest Since 1981: 6 Questions Answered

How are Social Security benefits adjusted for inflation? Are the benefits taxable? What other government programs typically get a COLA? Does the tax system also adjust for inflation? Why does the government adjust benefits for inflation?

Gas Price Rise Erases Much of the Discount from Suspension of Florida’s Gas Tax

Flagler and Florida gas prices took an unexpected turn higher last week despite a cut in the gas tax timed by the GOP-dominated Legislature to coincide with the November election.

This Time Without Temper Tantrums or Deceptions, Palm Coast Adopts Tax Rate and Budget

The Palm Coast City Council approved the 2022-23 budget and the city’s property tax rate at its second and final hearing with a series of 4-1 votes. Compared to previous tax hearings at the county and the city this season, the hearing was anticlimactic, with all but numbers getting filled in and ratified.

Judge Clears Way for Challenge to Law Allowing State to Override Local Police Budget Decisions

A Leon County Circuit judge on Tuesday cleared the way for a lawsuit challenging part of a controversial protest law that gives the governor and Cabinet the authority to override local governments’ decisions about police spending.

Three Flagler Commissioners Largely Indifferent to Consequences Of Budget ‘Blown Up at the Last Minute’

The three Flagler County Commissioners who blew up the budget last Wednesday–Don O’Brien, Greg Hansen and Joe Mullins–were not interested in a detailed discussion of the consequences of their actions even as the county administrator had prepared a set of options to deal with their action and conditions, and constitutional officers even today were begging commissioners to let them know what their budget would be.

Decrying Misinformation in Face of Another Wave of Opposition, Palm Coast Approves Budget and Tax Hike, 4-1

Rejecting the second wave of pleas and demands from residents this week for a substantial property tax cut, and decrying disinformation, the Palm Coast City Council this evening voted 4-1 to adopt a budget that would keep the city’s tax rate flat, but equate on paper to a somewhat misleading 15 percent tax increase.

In Latest Switch, County Will Cut Tax Rate, Fund Sheriff’s Full Request, and Take a $1.9 Million Hit on Budget

The Flagler County Commission this evening voted 3-2 to cut the tax rate by a tenth of a point and fully fund the sheriff’s budget request, closing what had been a $700,000 difference between the county’s proposal and the sheriff’s request. The result will be a $1.9 million hit on the budget the administration had submitted to the commission ahead of today’s public hearing, the first of two to adopt next year’s budget and tax rate.

After Din of Opposition and Another Screaming Match, Palm Coast Council Will Consider Cuts in Tax Hike

Palm Coast City Council members Tuesday evening agreed to suggest budget cuts ahead of Thursday’s budget hearings in hopes of possibly lowering the proposed 15 percent property tax increase, after hearing from about 30 residents who complained about their taxes. The council did so after some of its members again degraded into an ugly screaming match.

Flagler Beach Commission Set to Approve Budget With 13% Tax Increase

The Flagler Beach City Commission is set to vote next week on a proposed budget that would raise the city’s property tax rate slightly and equate to a 13 percent tax increase for non-homesteaded property owners like businesses and renters.

Florida Tax Collection Is $3.85 Billion Higher Than Forecast for Year

With inflation pushing up prices of taxable items, Florida’s general revenue substantially topped expectations in June and in the recently completed state fiscal year. General-revenue collections in June were $978.7 million, or 27.6 percent, higher than projected.

Study: Flagler’s Beaches Are Eroding Critically, and Will Cost County Alone $5 to $13 Million a Year to Slow

The most comprehensive study to date about Flagler County’s beaches paints a stark picture of the consequences of climate change and sea level rise, accelerating erosion, potentially crushing costs to local taxpayers to slow down the erosion with beach renourishment, and few sources of funding to do so.

Palm Coast Taxes Would Rise About 14% To Pay for 7% Budget Increase, Including 5 More Deputies

In its first comprehensive recommendation to the Palm Coast City Council for the coming year’s budget, the city administration is proposing a 7 percent budget increase that includes money for five new sheriff’s deputies, two new firefighters and a fire inspector, and nine additional administrative positions. But it would require a tax increase.

Taxable Values Surge at Highest Pace in 16 Years, Setting Up Windfall for Government

Taxable values in Flagler County rose 18 percent in 2021, higher than initially estimated two months ago. Values rose nearly 20 percent in Palm Coast, 14.5 percent in Flagler Beach and 22 percent in Bunnell. The school board’s taxable values increased by 25 percent. For local governments, the surging values can translate to surging revenue–if the governments do not hold the line on tax rates.

School District’s Half-Penny Sales Surtax Renewal, for Tech and Safety, Will Be on the November Ballot

The Flagler County Commission Monday evening approved on a 4-0 vote placing a referendum on the Nov. 8 ballot to renew for the third time the school district’s half-penny sales surtax. The vote was not a surprise, though it reflects a shift from Commissioner Joe Mullins, who earlier this month was signaling opposition to the tax.

DeSantis Signs Disney-Punishing Bill, Would Shift Nearly $1 Billion in Debt to Taxpayers

If the special taxing district is dissolved, Disney’s nearly $1 billion debt obligations, revenues and responsibilities would be transferred to Osceola and Orange counties’ taxpayers and those of the small cities of Lake Buena Vista and Bay Lake.

Court Says City-Owned Golf Course Managed By a Private Company Can Be Required to Pay Property Taxes

The court decision could potentially have ramifications in Flagler Beach, where the city owns Ocean Palms Golf Club, a nine-hole golf course, but has been leasing it to a private company since 2015, tax-free. The decision this week suggests local property appraisers may legally deny a local government’s exemption for such privately run amenities.

Taxpayers: Expect Serious Delays from IRS This Year

Over 15 million returns and 5 million pieces of taxpayer correspondence from 2021 sit untouched – including 6 million original 1040s. Amended 2021 returns are taking more than 20 weeks to process. It’s not just complicated returns that are getting delayed. Even simple individual returns are caught in the backlog.

Florida Legislators Are Stealing Money from Environmentally-Sensitive Lands Pot, Without Consequences

In 2014, 75 percent of Florida voters approved an amendment to the state Constitution that said the Legislature had to spend a certain amount of money buying environmentally sensitive land. Legislators have been illegally appropriating hundreds of millions of dollars away from the intended purpose of the amendment.

Election Police, Gas Tax Cut, Cryptocurrency, Deportation: 10 Things DeSantis Wants in 2022 Session

Gov. Ron DeSantis recently released a $99.7 billion budget blueprint for the 2022 legislative session and has touted a series of other proposals. Here are 10 of DeSantis’ priorities — big and small — for the session, which will start Jan. 11.

A Few Magnificent Things That Happened in 2021

It would be easy to survey the end of 2021 and see another year in wreckage. There’s the pandemic that won’t end. Rising inflation. Climate disasters. A democracy that looks creakier by the day. But there’s unusual comfort out there.

DeSantis Pitches Election-Year Budget Just Shy of $100 Billion, With Big Subsidies from Federal Aid

Saying that Florida is “clicking on all cylinders,” Gov. Ron DeSantis on Thursday proposed an election-year $99.7 billion budget that would funnel money to education, the environment and law-enforcement officers while giving motorists a temporary gas-tax break thanks to federal subsidies.

Boxed in Between Flagler School Board and Builders, County Corrects the Record on Impact Fees

The Flagler County administration issued a tightly argued and at times caustic memo that draws a line between facts and polemics and between legal and speculative arguments in the ongoing debate over school impact fees,. While it corrects the school district in no uncertain terms on several points of law–or math–it also comes close to ridiculing the Flagler Home Builders Association’s arguments as simplistic. It also appears to forge a way out of the impasse for the County Commission.

Flush With Federal Money, DeSantis Pitches Temporarily Eliminating State Gas Tax, Reducing Revenue by $1 Billion

Continuing to contrast his economic approach to the Biden White House–which ensured that Florida would get billions in Covid and infrastructure subsidies–DeSantis said the approximately 25-cent-a-gallon “gas tax relief” proposal could save the average Florida family up to $200 over a five- to six-month period, while reducing state revenue by more than $1 billion. DeSantis wants lawmakers to approve it during the legislative session that starts Jan. 11.

School District’s Request to Double Impact Fees Turns Into Hostile Inquisition by County Commission and Builders

In an unexpected turn, what the Flagler County school district thought was a mere formality before the County Commission turned into a 90-minute grilling by commissioners and a parade of doubt by builders who consider the district’s request to double impact fees ill-thought and ill-timed.

After A Fraud: A Tax Accountant Explains What To Do If You’re a Victim of an Unscrupulous Tax Preparer

Chris Kocher, a licensed CPA since 2003 and a long-time tax accountant in Bunnell, explains how to handle the fallout from revelations that numerous clients of Robert “Bob” Newsholme’s Flagler Tax Services may have been defrauded.

Number of Potential Victims Up to 57 in Bob Newsholme Tax Fraud Case as Slew of Schemes Involving Big Sums Emerge

Innumerable reports by his clients pointing to hundreds of thousands of dollars in fraud paint a picture of Bob Newsholme, the long-time owner of Flagler Tax Services, as a versatile but clumsy schemer. Newsholme seemed to have boxed himself in in a Ponzi scheme of his own making, hoping to stay ahead of the inevitable reckoning by enlarging his circle of fraud. But as it began to unravel, it unraveled very quickly. But his clients are now left to pick up the pieces–and pay what they owe to the IRS.

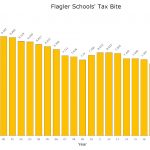

Set in Tallahassee, Flagler School Tax Rate Declines for 7th Year in a Row, and to Another Historic Low

The Flagler County School Board on Sept. 7 adopted its property tax rate and $212 million budget for 2021-22. The tax rate, set by lawmakers in Tallahassee, continues a two-and-a-half decade downward trend, to $5.865 per $1,000 in taxable value, down from $6 last year.

Palm Coast Council All in for 10 More Cops, But the Votes for a Budget and Tax Rate Aren’t Lining Up, Setting Up Showdown

The Palm Coast City Council in a disorderly special workshop meeting this evening agreed to fully fund the Flagler County Sheriff’s request for 10 additional deputies for city policing, four more than it had originally budgeted. But that’s as far as it got in agreeing to a new budget. The rest remains a churn of conflicts, setting up a potential showdown between council members at a public hearing on Thursday.

The Immense Tax Sums Religious Organizations Don’t Pay

If religious organizations in Manatee County paid property taxes, they would add $8.5 million to the tax revenue of the county annually, or 1.1% of the total, enough to cover, in just one year, the building of three newly proposed emergency medical services stations in the county, along with upgrades of EMS equipment and its 911 service.