A seemingly Looney Tunes-inspired Palm Coast City Council has rarely gone where it did today, whether its members were for or against the budget proposal before them.

A 4-1 majority of the city council agreed to raise property taxes 15 percent for next year’s budget despite the highest year-over-year tax revenue increase in 16 years and the strongest growth in a decade and a half, all while claiming that the tax increase was necessary in order to lower taxes for a future generation. Mayor David Alfin bookended his argument with the peculiar evocation of Ronald Reagan and Garfield, the lazy and fat cartoon character, not the assassinated 20th president.

The council did so in the name of preserving quality of life and planning for the future, with a focus on planning for more growth that, eventually, in the mayor’s words, would help bring down taxes–a remarkable statement contradicted by this year’s numbers: it’s been the highest growth year in a decade and a half, yet the city is sharply increasing taxes.

The decision today was by consensus. The formal decision, by actual vote, will take place in two public hearings in September.

There will not be a surge of opposition when the city approves its budget in those hearings because the tax increase will be nominal for most homesteaded property owners, who make up the bulk of the city’s households: for them, the tax increase, if any, is limited to a maximum of 3 percent. The sharper increase will be felt by commercial and industrial property owners, and by renters, who pay a disproportionate share of property taxes and end up subsidizing homesteaded property owners to a degree.

Palm Coast’s current property tax rate is $4.61 per $1,000 in taxable value, what’s referred to as a millage rate of 4.61. By law, if a government adopts any tax rate that increases revenue over the previous year’s, that’s considered a tax increase. So even if the rate stays the same, as long as revenue increases, it goes down as a tax increase, since most people will actually pay more in taxes. (See millage explained here.) A house valued at $200,000, with a $50,000 homestead (which knocks off $50,000 from the house’s taxable value), would pay $691 in Palm Coast taxes. (It would pay more in county, school and other taxes. School taxes are increasing more sharply after many years of decline.)

For homesteaded property owners, even if the home value increased by 15 to 20 percent, as values on many homes in Palm Coast did, that property owner will only see a marginal tax increase of around $20.

The tax increase underpins the city’s $248 million budget, including a $53 million general fund budget–the portion of the budget that pays for police, fire, code enforcement and other essential city services. The bulk of the rest of the budget, including the city’s massive utility department, depends on its own fee-based sources of revenue and does not affect property taxes. The general fund budget is increasing by 7 percent, and includes an alarmingly low reserve of just $750,000 next year–alarmingly, because the city has customarily carried a far higher reserve. The number of employees supported by the general fund will increase by 12, to 256. The separately funded city utility department, its single largest operation, will see staffing increase from 153 to 160.

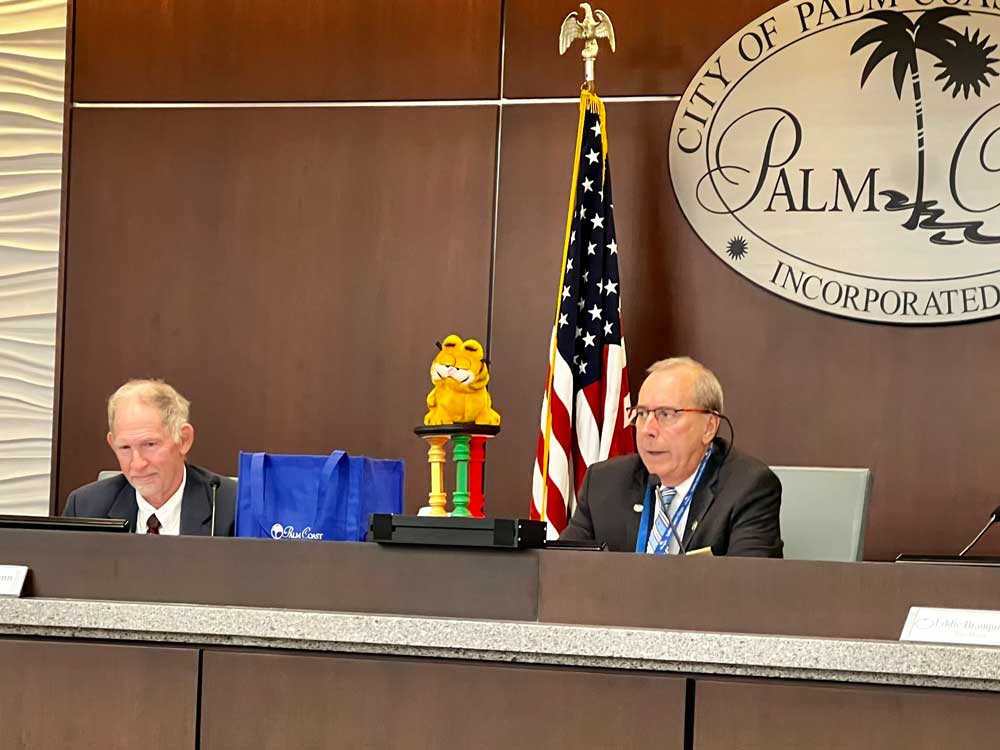

Palm Coast Mayor David Alfin typically prepares a written statement when he wants to make the case for something of particular import. So he did today. But he called on “a friend” to help him. Phineas? Ferb? Stewie Griffin? No. He propped a plush and leaded-lidded Garfield on a three-legged stool to ostensibly “summarize the complications of the budget process.” The three legs of the stool represented revenue, expenditures and, in gold, the quality of life “that we all enjoy.”

Alfin said reducing revenue would have only one consequence. He pulled the bottom out of the green leg, and the stool, along with Garfield, tumbled off the dais. The image was more applicable to elections than to budgets, and inapplicable to this year’s budget, where reductions were never in question. But none of Alfin’s colleagues bothered challenge the shtick even as Alfin left unexplained why, of all characters used to illustrate the Palm Coast populace, he chose a rude, smug, thin-skinned and dim-witted fat cat, though there is some history thee: ITT in the 1980s licensed the character to use it in marketing Palm Coast.

It was quite a bookend from a speech that had begun more loftily: Alfin said he reviewed “every line item in every spreadsheet in the budget that has been presented” and had every question answered, then loftily launched into a prepared statement that began with the words, “President Ronald Reagan once said…” It was an odd if unwittingly, historically honest evocation to defending the significant tax increase ahead. (It is part of Reagan’s affluent mythology that he was against higher taxes. He was, but mostly against taxes for the rich. In fact, he raised taxes five times during his tenure, including a sharp increase in payroll taxes in 1983 that hit the poorest hardest.)

Alfin said he was for maintaining the same tax rate “as the past year to maintain the quality of life in our city while we invest in our future.” Then he launched into one of his extended analogies.

“A few months ago each council member determined their strategic action plan priorities to meet the needs of our citizens. We each prepared a shopping list of our most important items,” Alfin said. “Now as we implement these priorities, we cannot simply roll our shopping cart full of priority items to the checkout counter and suddenly ask to pay less. These items are needed to address complex aging infrastructure with funds and resources so we can remain financially and structurally secure into the future. What happens when we have issues with weirs, pet tanks, sidewalks, water pipes? We can’t go backwards now and try to catch up later. It’s our responsibility to maintain our community in the same manner we’ve come to expect and deserve.”

In the most revealing part of his speech, he spoke more bullishly and explicitly than any previous mayor about growth as “the solution to financial sustainability”–words certain to alarm managed-growth proponents who have asked in the past and will ask again: with what limits, what boundaries? On the other hand, when Palm Coast was first conceived in the 1960s, ITT planned it as a city of 600,000, a mark that could be in sight by century’s end if the ocean doesn’t reach it first.

The 40,000 acres Alfin was referring to as “a monumental step forward to welcoming more industries, hospitals, research centers, pharmaceutical companies and cloud based businesses to the city” are mostly already-approved developments of regional impact, or DRIs, like Neoga Lakes and Old Brick Township west of the city.

But officials usually pair development as the way to lower property taxes, not higher taxes. Alfin turned the formula on its head, deferring tax decreases to another day and borrowing the language of sacrifice: “Our leadership requires the courage to maintain our millage rate to benefit our next generations,” he said. “I therefore will vote in favor of city staff’s recommendation and approve a millage rate equal to last year’s value of 4.61 mills. And I ask my colleagues on the city council to stand alongside me. Smart managed growth is the long term remedy providing financial sustainability for Palm Coast and reduced future tax increases to residents.”

Council members Nick Klufas, Eddie Branquinho and John Fanelli seconded Alfin. Council member Ed Danko alone spoke in opposition to the tax increase. He spoke about people on fixed income who are “feeling the pain” of cost increases “just like we are as a city.” He said he saw no reason why the tax rate couldn’t be rolled back for some relief (he referred to “a full millage rollback,” meaning go back to the rate that would result in the same revenue next year as it did this year See: “What is the Roll-Back Rate in Property Taxes?“)

“Because if we can’t get through one year and offer some relief to our citizens, we’re not doing something right,” Danko said. “They’re not able to increase their budget at home. They can’t just say give me more money on their fixed incomes.” Danko was not quite correct. Social Security recipients saw a 5.9 percent increase in payments starting in December, enough to outpace any tax increase on a homesteaded house, and a more substantial increase is expected this December, as Social Security payments start reflecting the even higher inflation rate of 2022.

“I know on my house, I would save over $400 a year,” Danko said, if the tax rate went to roll-back. “That’s a chunk of change that that you could spend in our local stores.”

As he often does, Danko was grossly exaggerating. The taxable value on Danko’s W-Section home in 2021, as far as city taxes are concerned, was $163,418. In 2022, it was $171,320, a 5 percent increase. Danko paid $753 in Palm Coast property taxes in 2021. If the city keeps its property tax flat, he will pay $790 next year–$37 more (almost the exact cost of a Trump hat). If the city were to go to the rolled back rate, Danko would pay $688, a saving of just $65 from his current tax bill, and $102 less than what he would pay next year if the tax rate stays flat. (After this article published, he said in a text that the $400 referred to what he’d save from every local taxing authority going to rollback, including the county and schools.)

Council member John Fanelli, an appointed member of the council who will be replaced by an elected member in November, echoed Alfin and Klufas even as he gave credence to the difficulties of people on fixed incomes (about 29 percent of Palm Coast’s population is 65 and older, according to the latest Census estimate. The median household income is $58,000.)

Council member Eddie Branquinho, speaking through a computer connection from Portugal, spoke approvingly of Alfin’s approach, and said he found it “borderline hypocritical that we asked for a 370 percent raise” for council members, “settle for 150, and now we asked every department to do more with less.” He was referring to the council’s Alfin-led salary increase, enacted earlier this year. It doesn’t kick in until November. Branquinho had opposed the increase. Now, he lent his full support to the mayor’s approach, also in the name of preserving “quality of life” in the city.

The first budget hearing, when the council’s 4-1 vote is expected, is to be held at 5:15 p.m. on Thursday, September 8, at City Hall.

![]()

protonbeam says

Disgusting, bloated, self serving local government out of control. Lower future future taxes is a bald faced lie. All the liabilities created through new employees, added infrastructure and the like will further strain budgets. Unqualified City Leadership and naive Mayor and Council. Ms. Bevan has zero qualifications to manage Palm Coast and Alfin can and will shill anything. I cant believe I am actually going to admit Danko made a good decision.

Just say no to pickleball says

What in God’s name did I just read? We’ve elected a board that will argue about increasing impact fees, but then bring out a stuffed cat to tell us why Pickleball is good for us. This is what we get when we elect a salami salesman.

FlaglerLive says

It was the county commission that opposed the school board’s initial request for higher impact fees, not Palm Coast.

Call me Ishmael says

I have personally spoken to city council members who insist impact fees are adequate.

On another note, the mayor’s Garfield-on-the-stool demonstration was the most insulting, condescending schtick I’ve ever witnessed by an elected official.

Your constituents aren’t children, Mr. Mayor, and you ain’t so smart. Slick, maybe, but not smart.

James says

I wonder how long Alfin worked on that Garfield routine? Can you visualize this guy talking to that thing for a few hours at home trying to get his delivery down. I wonder if he had long conversations with it? Personally, I’d like to hear what Garfield has to say. It’s not his fault that he was so shamelessly used to distract our attention from the fact that they’ve just passed a 15% property tax increase. He did this under duress. In fact, if we can get past that whole “he’s a stuffed puppet” thing, I think he’d make a great mayor.

Just kidding (I think). One last joke for the road. :-)

Hey, and another thing, did Alfin expense that stuffed toy to the city since he used it for “official business purposes?”

Used. To be a 1% er now I'm a 15% er..... says

Protonbeam,

You are correct we have no City Manager experience run the City. Under Ms. Bevens leadership we are paying more for everything.

That leadership is reflected down the ranks with some of the most incompetent staff.

The management of the Holland Park debacle is an example.

I no longer trust this Council and management of the City.

Everyone is getting voted out next round.

Danko is the worst but at least he asked the City Staff to reduce their budgets.

It looks like that was never accomplished.

How on Earth did the Procurement department get an award?????

Realist says

The mayor is a moron and needs to be recalled. Cannot wait to vote against him when re runs for reelection.

Charles says

Can’t wait until Alfin is out, he has done nothing positive for the taxpayers of PC. He gave himself a raise against citizens wishes, he now agree’s to raise property taxes 15 percent. What a guy, NOT. He is a one term mayor, you can be sure of that.

Jimbo99 says

“Council members Nick Klufas, Eddie Branquinho and John Fanelli seconded Alfin.”

These folks need to be voted out & replaced, how many of them were in power over the last few years for all the fiascos of county & city government, the Holland era ending in the Splash Pad resignation to get Alfin elected for the Tennis Center Expansion project and the rest of this nightmare & train wreck. When do the new tax rates take effect ? Look at the assessed taxable value for your home, it may have gone up enough to wipe out any Homestead exemption eligibility. We can only hope the real estate market collapses for taxation. Houses appreciated ? Sell your house and go try to get one for that same amount without going deeper into debt for it. Thanks for spending our money on things we don’t want. I hope that Garfield stuffed toy and any of the rest of that prop came out of your own pocket & not any budget that taxpayers are bilked for. I’d hate to think we’re buying stuffed toys for lame presentations that result in tax increases.

Denali says

Hell, he’s just getting started. We have three plus years more of this bovine excrement to wade through.

Justsayin says

With the historic job gains over the last 18 months, I think it’s a great idea. Thankfully we are not in a recession, we should be willing to pay a little bit more.

Bill says

Yeah, I love when my raise gets taken by taxes and inflation.

Eric says

I can’t believe you just added that at the end of your comment! “Thankfully we’re not in a recession”. Do you rely on MSM to tell you what to think? I guess so, since we literally ARE in a recession. Two quarters or more of negative growth is the definition and that’s what we’ve have, despite what your media masters tell you.

Justsayin says

Sir, your way of thinking is pre 2022. Janet Yellen says we are just in a transition. Not a recession.

John Chism says

Your hero Janet Yellen is a doddering fool and a puppet for the Biden box checking lunatics. My investments tell me everything I need to know about how deep a recession this country is in. Open your eyes and do some classical book learning on economics…you know, stuff that is important! Quit watching MSNBC and use your own brains!

Local double taxpayer says

Well….so much for groceries! Plus they will get your gas money u would have used to get those groceries.

The ORIGINAL land of no turn signals says

Somebody has to pay for there historic raise.You wanted Alfin enjoy .

Vince says

So bad! They increased their salary then raised property taxes?! Are yall seeing this? I’m so glad my business is in Bunnell and my house is in unincorporated flagler county! Palm coast and the residents should figure something out? Is this what ask you people from Ohio, Nj and Ny want?!

Move to Flagler estates please says

Don’t give them any info on unincorporated areas…they will move out here then vote in people to raise our taxes too then complain all over again about what the accomplished.

BILL says

OK! Call me stupid. I voted for Alfin, but never again, as well as his present cohorts. I would even vote for Cocchiola at this point

Laurel says

Can you imagine that ITT envisioned a city two thirds the size of Jacksonville, the largest city in Florida, on what is literally swamp land in Florida? Brilliant. Is that what you want Palm Coast? Better figure it out now.

It’s never enough, is it? Government officials tell us, over and over again, that growth will make our lives better and more affordable. No, it won’t.

Looks like Garfield, the only one with brains, got the leg pulled out from him. Looks like you will too.

James says

Yeah, the folks running this slow motion train wreck are so far out of touch… it’s not even worth joking about anymore.

Only one thing left to do now in my opinion… I don’t know about you people, but my gas tank is full.

Regret? says

Betcha all wishing you voted Lowe like I did.

Mark says

Nope, not at all. Did not need a bat s*** crazy one on the board.

Someone says

No, The outcome would have been the same or much worse….

YankeeExPat says

Nope, ….. a “Sovereign Citizen” would not have helped in this situation or any other quite frankly!

Jimbo99 says

Alfin now resorting to theatrics & drama to gouge & tax. Bet it was entertaining, but he ended it with the usual extortion for more tax money for something that simply isn’t better for 115K citizens as taxpayers. And like all real estate taxation, it will be divided among the number of homes, not the overutilztion & occupancy o those dwellings. Somehow 2 people in the same size home will end up paying for the 5-6 in a same sized home next door. The driveway swale & lawn parkers of overutilization vs those that are right sized for the 2/2 or 3/2. And again, where are the impact fees being collected that actually defray the cost of the additional burdens ? So we get the Alfin, telling us we can’t go back, pushing forward for more unaffordable inflation. The lower prices of gasoline, now offset by higher taxes. When one appears to be settling in, the next gouge happens. Meanwhile food, insurance, healthcare costs just continue to go up. Real estate Alfin, a mayor from an industry that has upcharged homes for decades for higher commissions. All of a sudden the assessments & tax rates always appreciate for the next round of inflation and lies of better quality of life. Mullins at least said he was going to fight for lower taxes. The one’s we have claiming to represent the taxpayer have caved. I get Mullins sometimes, he had to be rude at times, when the others keep coming around, won’t ever relent on the issues themselves. And they always hold up Seniors & children as human shields, the emotional of that. Lower taxes is better for seniors on fixed incomes, better for children for making sure they get a balanced diet for food in their stomachs, clothes on their backs, roof over their heads.

“Palm Coast Mayor David Alfin typically prepares a written statement when he wants to make the case for something of particular import. So he did today. But he called on “a friend” to help him. Phineas? Ferb? Stewie Griffin? No. He propped a plush and leaded-lidded Garfield on a three-legged stool to ostensibly “summarize the complications of the budget process.” The three legs of the stool represented revenue, expenditures and, in gold, the quality of life “that we all enjoy.”

Alfin said reducing revenue would have only one consequence. He pulled the bottom out of the green leg, and the stool, along with Garfield, tumbled off the dais. The image was more applicable to elections than to budgets, and inapplicable to this year’s budget, where reductions were never in question. But none of Alfin’s colleagues bothered challenge the shtick even as Alfin left unexplained why, of all characters used to illustrate the Palm Coast populace, he chose a rude, smug, thin-skinned and dim-witted fat cat, though there is some history thee: ITT in the 1980s licensed the character to use it in marketing Palm Coast.”

Art says

Flagler county got $22 million in Covid 19 money, record year gain in tax revenues $12 to $17 million more than last year (what did they do with it ALL) and we get higher taxes, trash in the ponds, dead wild animals on the road, 5 houses per acre new construction, mega sheriff command center, BIG government buildings that aren’t kept up.

Global warming, quit cutting the trees down, like the 25 old huge trees in the new Radiance development on old kings.

Time for talks on a charter county cause the county and cities are getting way too expensive for little Flagler County

Hugo says

Don’t forget we are getting an increase in garbage pick up cost .. for service reduction.

Disgruntled Harris says

That’s probably to offset the whatever millions of dollars used to purchase new fleet, including a $500k+ fire truck… You know, for all the fires in Palm Coast. Read the other article about fleet purchases. How bout we fix/maintain what we already have?! No. How bout let’s raise utility fees and taxes? Great idea! Seriously, who’s making these decisions

Dan says

About the fire department, why do they have a battalion commander when we only have 5 stations? Exactly what battalion is he managing? Why do they have to make a run to every minor accident, why? This is not about safety, it’s about holding up the tax payer for unnecessary expenses. Safety is not measured by always having something present that is not warranted, it’s about being there when something major happens. If you took out all of the runs from the fire department for fender benders, then we have 90% more than we need.

Also, as we grow, the developers and new residents should pay higher taxes to provide for the infrastructure needed to accommodate them. Not the local residents who already have paid, you raise taxes on them, not us. Why is that so hard for some, I’ve considered running for office here to try and help. But I cannot afford to take the pay cut, there should be a volunteer group of leaders from the citizens that is consulted before these changes are forced upon us.

Dennis says

Time to sell and move on. Palm coast and Flagler county is a mess.

MITCH says

Is it legal to use taxes to drive people out of their homes for people that might move here?

Michael Cocchiola says

I am generally against tax increases because they hit young citizens just getting by and retired citizens on fixed incomes (I’m one!). But, if we are investing in the future of the city, I’m willing to listen more to the rationale and pay a bit more if it’s a good investment in Palm Coast’s future.

We’ll all have a chance to present our views on this. Invest some thinking time on this and ask good questions. Rants and rage won’t help anyone.

Denali says

“Social Security recipients saw a 5.9 percent increase in payments starting in December, enough to outpace any tax increase on a homesteaded house”. While this is true, it does not paint the full picture.

Medicare Part B costs increased 13% this year and are anticipated to rise another 17% next year. Part B supplements went us, prescription drugs went up, groceries have skyrocketed, gasoline went up, the FLP bill went up, our water bill went up, trash service went up, my blood pressure went up. In all honesty aside from my savings account I cannot think of anything that did not increase this year.

Using myself as an example, my social security went up $1250 this year. My Medicare Part B went up $258; my Part B Supplement went up $240, groceries will probably go up $350; gasoline will be about $400; trash will be $108; FLP will be about $110. Not including prescription drugs, the utility bill, dining out, auto repairs, and all the other taxing agencies with their hands out, I am at $1466 in increased out-of-pocket costs. That leaves me about $216 in the hole which isn’t the complete story because of the unaccounted for expenses.

So yes, that 5.9% Social Security bump will outpace any real estate tax increase. But, when all the other increases are factored in, the average Social Security recipient will actually have less to spend than last year. Guess the senior population had best be looking for gainful employment – wonder how many greeters Walmart is hiring?

A.j says

Said before will say it again. Vote Repubs get dirty scrubs. Now your bank account is smaller. 15% property value increase. The story say people will see a small increase in their property tax. That small increase can mean the difference between keeping or loosing their home, food or no food , med money or no meds, and so forth. These Caucasian Repubs don’t care for you Repubs voters. Keep voting yourself out of freedoms and now probably a place to stay. Good I hope they will run this state and city to the ground. Please Repubs ruin this city and state. Show the blind Repub voters you don’t give hoot about them. Voters please wake up. No abortion rights, soon they will tell you who to have sex with. Are you voters sure you want more greedy Repubs. Dems we must vote these people out of office. Dems we must stop this train wreck before it kill all of us. The Repubs are crazy, they don’t care about any of us.Please we must vote these crazy people out of office. Please vote Dems.

Deborah Coffey says

The latest is that the Repubs want to ban divorce. We will all be handmaidens soon in a country run by the Christo-Fascists.

Dennis C Rathsam says

This is like a bad dream…. An ultiment nightmare….The creature of the black lagoon is our 1/2 ass mayor….In the short turm of being our mayor he has destroyed our once peacefully city! His plan for P.C SUCKS!!!!! Recall this incompitant moron before we are all forced to leave….From garbage to taxes Alvin has fucked us everyday he,s been in office!

jeffery c. seib says

This is a sad continuation of a Palm Coast city council that can’t, even in this year of higher costs to consumers, listen to the people and hold off on any tax increase. One thing that will come out of this is we can finally bury the notion, constantly pushed off on the unwary, that growth pays for itself. This meeting, with nary a soul present, was the axe falling. These next city council meetings on the budget are just window dressing to further pull the wool over the Palm Coast public. Remember this, once a tax increase is passed, it will never go away and will be used by these folks, I won’t call them leaders because their leadership skills are poor, to justify ever increasing city budgets until the lid comes off. Good luck everybody.

David Gee says

Never have I seen someone so out of touch as Mayor Alfin. He is totally tone deaf as we seee with this tax rate hike, garbage contract and their greedy pay raises. He is definitely a one termer. He is a disgrace and sham. I heard him say on the radio that all of us in Palm Coast are richer because our homes value has increased!! He encouraged us to take out loans on our homes value! What an embarrassment. Shame on you.

Billy jo jim Bob says

Been here 37 years , seen all the bullshit this city doesn’t have to offer, in all the years I have been here I haven’t seen anything for the kids, the splash park was a crock of shit and so was the 6.5 million dollar civic center, just more tax payer $$$. There is absolutely nothing in this town to do , you must venture out to actually enjoy yourself. Time to move on and escape all the nonsense that this town has to offer. By bye Palm Coast.

Mark says

Even those little amenities that are here they barely let the residents know about them. If I got something once a month or so showing what programs are available and what events are on the horizon I may go to more of them. Not that page that comes with the PC bill where one side is filled with mayoral BS. Oh you can try searching their website but even that isn’t user friendly.

The ORIGINAL land of no turn signals says

The rubber stamp kings!!!!

TypicalRepublicans says

That’s what happen when you elect Republicans. They love to raise taxes on the working class and poor while their rich buddies get tax breaks. This is no different. I bet if there was a vote today, they’d tell me social security and Medicare were entitlements and take them away like their party wants.

Good luck Palm Coast says

Tax and spend Alfin. I live in Palm Coast Plantation and I am so glad we sued Palm Coast when they tried to annex our property. We won and never will have to pay those rediculous elevated taxes!! This is the mayor who voted for his own pay raise!

Jack says

These leaders are morons. If you took the population increase in PC it would easily cover needed revenue, at the old milage rate. They apparently missed basic multiplication tables in elementary school. We have a city of 100,000+ people run by morons. Time for a recall vote. Flagler County is about the same.

Jimbo99 says

Just for clarification. since the TRIM Notices are arriving in the USPS delivery or are downloadable form the County Tax Office. The Palm Coast line item shows 3 values in those columns obviously. The 1st column is 2021 taxes from last year at 4,61 millage rate , a 2nd column as 2022 taxes if no changes are made to the budget as 4.01. That 2nd column indicates the millage rate was reduced by 15% with no budget changes and lower overall taxes. Then there’s the 3rd column that shows 2022 with a budget change approved & a 4.61 proposed millage rate. That also happens to be the same millage rate that 2021 taxes had. This announced tax increase, Is that the same rate that is indicated in column 3 which would be no change from 2021 millage rate ? Or is it in addition that rate which was the same for 2021 ? Are they simply rescinding any rollback from 2021’s 4.61 millage rate and the millage rate stays the same or is the 4.61 increasing yet again for another 15% to 5.3 millage rate. I guess my question is are the TRIM Notices accurate for all 3 columns for a millage rate that includes the Alfin tax increase(s).

DMFinFlorida says

If I understand your question correctly, the second column would be the roll-back rate if approved. The third column is apparently what they are approving, and even though the actual 4.61 millage rate is the same as 2021, it ends up being a tax increase because of the increase in assessed/taxable value (figured after exemptions), which is driven by the increase in market values. Say your home market value increased by 100,000 in the past year (our 2o-year-old home more than doubled in market value). That will affect your assessed value even without them taking a look at your property! Heaven forbid if you did any upgrades that might make the value even higher. So, even though the millage rate is the same 4.61, your actual taxes due go UP because of your valuation and assessed/ taxable value. It’s complicated and that’s about as simple as I can make it. I welcome input from anyone else who may have a better explanation, but I’m pretty certain that’s how it is calculated. The TRIM notices are a notification of the proposed scenario depending on how the Council votes at the final budget hearing. The number of hearings (not the same as a workshop) and type of notifications is strictly regulated by the state and must be adhered to perfectly or the state can toss out the whole thing and you have to do it over.

PB says

These comments are all well and good. Just one real question. How many people vote. We know the answer and so do the politicians!

James says

Yeah, well I VOTED… and I DIDN’T vote for ALVIN! For the record I voted for that retired IT guy… can’t even recall his name now… perhaps someone does out there. Ya know, the guy that a few folks here had questions about his finances due to his wife’s past medical problems. Well, that wasn’t a big issue with me, and even though Alvin looked like a reasonable choice, he seemed more of a last minute “draftee” that the local Republican machine put up to the job to put the “breaks on” before “the car went over the cliff.”

That guy seemed reasonable to me, and I think he happened to be a Democrat, so in my opinion he had no chance anyway, so I voted for him. Look, the same situation occurred with this fellow Fanelli in my opinion… but in his case, we didn’t even get a chance to vote on his appointment… right?

So don’t assume we don’t vote, or that we all have nothing to complain about.

Mabel Dunbar says

That man was Doug Courtney.

Allen says

Hey Alfin hope you’ve noticed you are not well liked in Palm Coast, we get it you are out for yourself. Do us all a favor and resign go sell more houses since you are pricing residents out of the area.

Jeannie 99 says

If EVERYONE refuses to pay the increase then they will have to concede. But EVERYONE has to REFUSE to PAY the increase.

DMFinFlorida says

Yeah, that sounds good in theory, but it doesn’t sit well with the Department of Revenue. They can take your house. It might take some time, but they are relentless when pursuing someone for non-payment of taxes. You can pay small increments to delay the process, but they keep tacking on penalties the longer it goes and you end up paying far more.

James says

“… Council member Eddie Branquinho, speaking through a computer connection from Portugal, spoke approvingly… ”

I guess he’s finally decided that he has indeed invested too much in PC and is looking for some property out there in Portugal.

Just my opinion.

FlaglerLive says

The councilman has family in Portugal and was visiting.

James says

All the better for him, it’s nice to have a plan B. If he hasn’t considered it he should… I know I would after moving here.

blondee says

Thanks everyone who voted this clown into office 🤡

Frederick says

Looks like we pay forFlagler Beach erosion project. So you raise our taxes to pay for their luxury homes on the beach. I did that at all my life Florida was the worst one for beach erosion projects.

Laurel says

Frederick: Are you telling us that only Flagler Beach residents use the beach? Only the “luxury homes” residents use the beach and everyone else stays home? If that’s the case, there must be thousands of homes on the beach. Guess you haven’t tried to find parking on the beach lately.

Ouch Smith says

Maybe we can use the same “Chair analogy” when he’s voted out as mayor….So for the players keeping track….1. Screwed over the Golf Course Restaurant. 2. Screwed over “US” and the Trash Company. 3. Voted themselves a Ridiculous raise. Screwed “US” again…4. Raised Taxes. Screwed Yet Again…..Cannot imagine what the next colonoscopy will be….

Bill C says

Using a Garfield doll to explain taxes to the public? How condescending! No money town fall down go boom.

hjc says

If you raise the taxes on business they in turn raise there prices.Who ends up paying for the tax increase?

Ellen says

Glad I didn’t vote for alfin, what an ass. He’s like Biden, destroying everything in sight. One and done, vote him out. Meanwhile, if we don’t go fight it, we are like stuck with it. I suspect we need to how up in force.

jeffery c. seib says

After speaking on a non-budget issue at the city council budget meeting last Tuesday during public participation I left the meeting and watched the rest at home. What an insult to the intelligence of palm coasters, a doll and stool prop. Worse were the words coming out of his mouth. People should just open their eyes and look at the growth everywhere in the last two years. Growth never pays for itself. Current residents pay extra for the new growth. If Alfin is talking big things for west of US 1, we had better hang on to our wallets. News flash for residents, no matter how many of you show up at the next city council budget meetings to voice objection to the increase, you will get the same blank stare from all of them and at the end of the day they will approve the budget with the 15% increase in taxes. Next will be fees on the utility bill. Vote them out? For whom? Last mayor’s race it was dumb versus dumber. The question is would people vote for a true choice?

AJ says

Those Democrats on the city council love raising taxes, forgot this is a Republican city. Middle class and Retires always get stuck with the bill. Should be a nice pay raise for Elected officials.

Bebi Frazier says

Kindly provide the name(s) and party affiliations of all the City Council members. And your source of “enlightenment.”

Joe Miller says

Raising taxes now to prevent tax increases for future Generations? Why, with all of the housing that’s going up in Palm Coast, condominiums, housing, townhouses, our property taxes not being held in check? Our beloved city has grown by over 150,000 people in the past 3 years and these people have built houses moved into Condominiums have moved into townhouses and are paying property taxes well with that type of influx of tax revenue our property taxes should not under any circumstances be raised. I called BS and someone’s got their hand in somebody’s pocket.

Wallingford says

I guess that Alfin wants to cement his legacy as a One Term Mayor. He alleges that only the Developers and Renters will actually pay the 15% increase. Let’s review the development process: Developer purchases tract of land and want it taxed as Vacant Land so as not to pay a high amount of taxes; as they progress with the project, they request Tax Abatement since they are strapped for Cash Flow; after the project has been finished and the abatement period is starting to wane, they request Tax Certiorari since they are not making the Return on Investment as first projected; their Taxes get lowered. When do they pay the 15% Increase? I suspect never. The Residents of PC will pay it.

Alan Lowe says

There is still time to stand up and say NO to the 15% tax increase. With hyper-inflation and a recession, this repressive tax increase couldn’t have come at a worst time. Mayor Alfin actually tried to explain his 15% tax increase by using a child’s stuffed Garfield toy, as if to imply we are all children. Even worse, 4 of the 5 City Councilmen agreed with him! Councilman Danko stood against it. We may be able to change their minds if we show up at the meetings and voice our opposition. I will fight for you, but I need you to stand with me this coming Tuesday night, September 6th, 6:00 PM at Palm Coast City Hall and oppose this insane 15% property tax increase.

This increase will affect not just homeowners, but rental properties and businesses. Businesses will be forced to pass this 15% increase on to us, the consumers and rental costs will go even higher!

The last thing we need is another increase in food, gas and consumer goods. Our senior citizens and our young people just starting out in life will be hit the hardest and may have to move away.

Mabel Dunbar says

Mayor Alfin, a FOOL, and his Follies – those who voted YES (Klufas, Branquinho, Fanelli) want to raise the Tax Rate by 15%.

Some are saying if your house homesteaded, your value won’t go up more than 3%. The VALUE of the house will not go over 3%. This Value is then multiplied by the TAX RATE. This is per the FL Save Our Homes (Homestead) Act.

“Save Our Homes is not a tax cap or complete limit on tax increases. It does not limit changes in the property tax rates.

Your property tax bills can go up by more than 3% or the current rate of inflation if your local taxing authorities increase property tax rates.

Remember, there are two parts to property taxes. Property taxes = (assessed value) X (tax rate).”

Read here for a tax attorney’s explanation which help you understand what Alfin & those who voted YES for this tax hike are planning for this city!! This is the link from where the above comes. https://forst.tax/florida-save-our-homes/

Stand up to save your lifestyle, your homes, and your finances. IF this thing passes, get out the petitions for a recall.

Most importantly, get to the City Council meeting this next Tuesday, Sept 6, 2022 at 6pm and make your voices heard. Tell them NO. Don’t sit by the wayside, wishing you did.

FlaglerLive says

The commenter is misinformed. There is no cap on the increase in the value of a home. As long as tax rates do not increase, there is a 3 percent cap on the increase in the taxable value of a home. The tax rate will not increase. So most homesteaded property owners will not see that 15 percent increase. There is also a 10 percent cap on the taxable value increase on commercial properties.

palmcoaster says

Not only this council and mayor have taken away our 1) Green Lion that help made the success of our Palm Harbor Golf Course, 2) terminated the contract with our excellent local owned garbage contractor Waste pro to hire a Spaniard revenue gathering FCC Environmental for a higher fee to us all, 3) voted NO to the 2 traffic speed calming islands in Florida Park Drive at an only a cost of 240,000 when under Holland in 2021 a budget of 300,000 was approved :https://flaglerlive.com/164771/florida-park-drive-calming/. 4) Voting for a 6.5 million new vehicle fleet for the city while increasing our taxes, (I drive a 2002 SUV no one to show off with other peoples monies). 5) give the run around to the desperate Cimarron endangered neighbors asking over 100 times in meetings and in writing for a life saving sidewalk to no avail but approving millionaire grants for the study of the west of Rte 1 expansion off the Matanzas Parkway into developers vacant lands or the millions in pickle ball courts! Or God knows how much to approve the repairs in our pockets of the rip off 7 million splash park. 6) And now adding misery by proposing a 5G, 150ft tall cell tower next 180 to 300 feet from our homes in #7 Clubhouse Drive, not in the Golf Course but next to it and one lot (ATT) over from the nursing home by intending to approve an “special exception” to the original residential zoning.. A tower that will reduce the price of our homes 20, 50 % or more and God only knows the health effects over time in our children, elderly and adult residents under it 24-7m, The same 5G tower as the one fought off already elsewhere: https://www.berkshireeagle.com/news/central_berkshires/cease-and-desist-pittsfield-board-of-health-gives-verizon-ultimatum-over-cell-tower/article_ae03b92c-845f-11ec-87d2-cb79809c6f43.html We attend meetings and speak our 3 minutes in person and write emails to all including our manager and land zone administrator as named in our city charter and so far given the run around with frivolous excuses but omitting the for profit for the city, the tower contractors and ATT.

How many times do we have to spend in costly attorney’s fees to fight the totalitarian projects of the ones we elect to represent us? This tower was successfully fought off in 2021 under Holland inside the Palm Harbor Golf Course affecting the price of homes and also potentially the health of residents in Covington Park, Oaks and Cole place and now they, in a very malicious way, try to stick it to us, for their profit, next to the golf course among our homes in #7 Clubhouse Drive affecting the residents of Courtney Place, Lane, Lake Forest, Carlson Park and all the ones starting at Cameo Court on north into the C Section. This Diamond built but ATT tower needs 4 more within a mile or less to be effective…just have to guess where, so the story will repeat among other homes if this one not stopped. Our suggested locations away from homes are being rejected so far. This 5G tower is to serve the areas south of the location off Colbert Lane and Grand Haven …so we asked please erect it there plenty vacant land in Colbert Lane and by Graham Swamp. Why do it next to our homes? Protect Palm Coast, we, are fighting it all the way like done with the same successful attorney we did before inside the PHGC, “if city keeps proceeding” with the special (totalitarian) exception to our residential zone! We oppose just the location not the tower, so please join us. This council and mayor ignore our pleas to all our miseries they are imposing on us but not answering our 3 minutes in person request! Totally unacceptable as not what they promised in their election campaign.