To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Mostly sunny, with a high near 77. Wednesday Night: A 20 percent chance of showers before 2am. Partly cloudy, with a low around 54. Breezy.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

Flagler Cares hosts its quarterly Help Night from 3 to 7 p.m. at the Flagler County Village Community Room, 160 Cypress Point Parkway, Suite B304, Palm Coast. Help Night is organized and hosted by Flagler Cares and other community partners as a one-stop help event. Representatives from Flagler County Human Services, Early Learning Coalition, EasterSeals, Family Life Center, Florida Legal Services, Lions Club, and many other organizations will be available to provide information and resources. The event is open to the public, free to attend, and will offer assistance with obtaining various services including autism screenings, fair housing legal consultations, Marketplace Navigation, childcare services, SNAP and Medicaid application assistance, behavioral health services, and much more. Free hearing and vision screenings for children will be available and coordinated by the Early Learning Coalition. Plus, don’t miss our Back 2 School Rummage Sale! Find heavily discounted clothing, shoes, accessories, home décor, and more with all proceeds going directly to support our youth programs. For more information about this event, please call 386-319-9483 ext. 0, or email [email protected].

Weekly Chess Club for Teens, Ages 9-18, at the Flagler County Public Library: Do you enjoy Chess, trying out new moves, or even like some friendly competition? Come visit the Flagler County Public Library at the Teen Spot every Wednesday from 4 to 5 p.m. for Chess Club. Everyone is welcome, for beginners who want to learn how to play all the way to advanced players. For more information contact the Youth Service department 386-446-6763 ext. 3714 or email us at [email protected]

Separation Chat, Open Discussion: The Atlantic Chapter of Americans United for the Separation of Church and State hosts an open, freewheeling discussion on the topic here in our community, around Florida and throughout the United States, noon to 1 p.m. at Pine Lakes Golf Club Clubhouse Pub & Grillroom (no purchase is necessary), 400 Pine Lakes Pkwy, Palm Coast (0.7 miles from Belle Terre Parkway). Call (386) 445-0852 for best directions. All are welcome! Everyone’s voice is important. For further information email [email protected] or call Merrill at 804-914-4460.

The Circle of Light Course in Miracles study group meets at a private residence in Palm Coast every Wednesday at 1:20 PM. There is a $2 love donation that goes to the store for the use of their room. If you have your own book, please bring it. All students of the Course are welcome. There is also an introductory group at 1:00 PM. The group is facilitated by Aynne McAvoy, who can be reached at [email protected] for location and information.

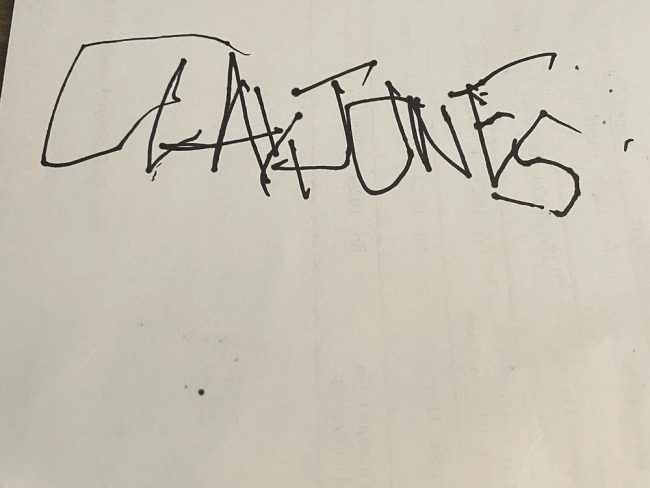

Clay Jones update: Clay wrote on Oct. 24: “A few days ago, someone asked me if I had tried to draw yet. Even though it wasn’t a rude question, it kinda pisses me off. I feel like the person who asked the question didn’t really appreciate that I had suffered a stroke. It’s not like I’m gonna start drawing cartoons again tomorrow. But today, Ii-Linh, an occupational therapy trainer, made me write my name. This result is after several attempts. It’s frustrating right now that there are so many issues that I can’t hit. More than one person has asked me about using AI to create cartoons with my ideas. This is a non-starter for me. AI is bullshit. I believe if I were the type of person who would use AI, then I wouldn’t have the overwhelming amount of support I have right now. Anyone who even suggests that I would use AI does not have any idea what kind of person I am. To give you an idea of how unethical AI is, Daryl Cagle is using it. Think about it like this: Of all the great people in the history of the world, from Albert Einstein, Abraham Lincoln, Kurt Cobain, to Martin Luther King, who are they trying to replicate with AI? The dumb blonde chick from Three’s Company. Then again, we could’ve had an intelligent president instead of the one that we have right now. […] I am supposed to check out of the rehab center on Wednesday. I don’t know where I’m going to be after that, whether I am going home or to another center. A lot of people love to give me advice about this, but the problem with that is, nobody knows all the exact details about my medication or my situation. I do appreciate that so many people care and want to help, but I think a lot of people need to slow their roll a little bit. A lot of people like to give advice without listening. Now I would ask that you appreciate the work that goes into this blog. Writing by dictating into the microphone and typing with one finger is a real pain in the ass. The other issue is that I don’t feel like I can give the attention required to blog every day when I’m going through physical therapy. It is so freaking hard.”

”

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

ESL Bible Studies for Intermediate and Advanced Students

Grace Community Food Pantry on Education Way

Palm Coast Farmers’ Market at European Village

Al-Anon Family Groups

‘Lady Day at Emerson’s Bar and Grill,’ the Billie Holiday Story, at City Rep Theatre

East Flagler Mosquito Control District Board Meeting

Nar-Anon Family Group

For the full calendar, go here.

In October [2008] Christian right leaders launched a series of attacks on Obama, predicting doomsday if he were elected. More than the usual jeremiads, they seemed to be signs of desperation. Stephen Strang titled one of his weekly emails to readers, “Life as We Know It Will End if Obama Is Elected,” writing that gay rights and abortion rights would be strengthened, taxes would rise, and “people who hate Christianity will be emboldened to attack our freedoms.” 1os Focus Action published a lengthy “Letter from 2012 in Obama’s America,” imagining what the future would look like if Obama won. In its crystal ball it saw:

- The U.S. Supreme Court with a liberal majority has forced the Boy Scouts to disband because of its decision they would have to “hire homosexual scoutmasters and allow them to sleep in tents with young boys.”

- Tens of thousands of Christian teachers in public schools have quit or been fired; private Christian schools have been closed; home schooling is all but outlawed; and many parents have taken their families to Australia and New Zealand.

- Health care has been nationalized with long lines for surgery and no access to hospitals for people over eighty.

- Because of Obama’s reluctance to use force, terrorists have attacked four American cities; Iran has exploded a nuclear bomb on Tel Aviv; and Russia has captured and occupied the Baltic States and Eastern Europe.

- Conservative talk radio has been shut down; dozens of Bush officials have been imprisoned; and Obama has repressed dissent to the point that “hardly any brave citizen dares to resist the new government policies anymore.”

–From Frances FitzGerald’s The Evangelicals (2017).

Pogo says

Sherry says

HUGS and Love, Dear Clay! You’ve Got This!

Ray W. says

This from the Wall Street Journal about today’s Fed decision to cut lending rates by one-quarter point.

Here are some bullet points from the article:

– The Fed lending rate, as high as 5.4% for most of 2024, drops to between 3.75% to 4.0%, down from last month’s rates of 4.0% to 4.25%, on a 10-2 vote. One voting member voted to hold rates steady. Another voted for a half-point cut.

– According to the reporter, “[t]he easiest part of unwinding the central bank’s aggressive rate increases may be over, however, as officials debate how much further to go. That thorny task has been complicated by a data blackout resulting from the government shutdown.”

Said William English, a former senior Fed advisor an current professor at the Yale School of Management, in the reporter’s assessment, “[t]he lack of timely and comprehensive data means ‘they haven’t learned that much since September, and that leaves them presumably closer to where they were in September, but with wider uncertainty bands around it.”

He added:

“You’d be worried as a policymaker that something’s happening and you’re just missing it.

– In a separate move, after Fed officials had recently detected during this past week evidence from “overnight lending markets” that the nation’s bank were “no longer awash in surplus cash”, the Fed voted to stop in December a 42-month-long practice of shrinking the Fed’s $6.6 trillion “asset portfolio”, a practice designed to “passively unwind pandemic stimulus.”

– During the news conference traditionally held after the announcement of the lending rate decision, Fed Chair Powell, per the reporter, “pushed back against market expectations that assume a December rate cut.”

Fed Chair Powell said during the news conference:

“It’s not to be seen as a foregone conclusion. In fact, far from it.” He added that policymakers had “strongly different views about how to proceed in December.”

From the reporter’s perspective, Powell’s comments about these strongly differing views reveal a dichotomy of economic thought:

“On the one hand, officials don’t want to cut rates more than necessary and spur stronger activity that could keep inflation above target. … At the same time, other officials don’t want to ignore signs that trade policy changes or the lagged effects of past increases are biting rate-sensitive sectors of the economy, including housing, and squeezing spending by low-income consumers and small businesses.”

– While the reporter did not focus on this, the policymakers whom Fed Chair Powell referred to are the seven members of the FOMC, plus the 12 regional bank presidents who attend Fed meeting to determine lending rate decisions. Only 12 of the 19 who attend the meetings have voting rights.

– The reporter focused on last year’s three lending rate cuts near the end of the year. After the three cuts, the Fed immediately ceased any further cuts “amid concerns inflation might be proving sticky.” From many of my past comments, the inflation rate for years had been slowly coming down. It had reached a year-over-year level of 2.3% just before the first of the Fed’s three lending rate cuts in 2024. The Fed, seeing the slight rise in inflation, decided time was ripe to stop cutting lending rates. But after the three rate cuts, inflation immediately began ticking upwards. Within a few months after President Trump took office, the year-over-year inflation began ticking back down until it returned to that 2.3% year-over-year level. Then came the April tariff announcements. The year-over-year inflation rate began ticking up again. Last month saw an inflation rate at 3%, year-over-year.

Back to the Journal story.

– Writes the reporter:

“For much of this year, debates turned on what it would take to return to lowering rates given that most officials judged rates were high enough to restrain growth. … That changed this summer, when labor-market reports showed job growth slowed sharply despite somewhat firmer inflation readings. … Without clear data showing meaningful job-market deterioration, it is difficult to build support for rate cuts that are larger than a quarter point. Meanwhile, with each quarter-point reduction, the question of when to stop becomes more pressing.”

– On the subject of easing lending rates, another former senior Fed advisor and current chief economist for BNY Investments, Vincent Reinhart, told the reporter, in part in the reporter’s words:

“Recent comments from Powell and other Fed leaders in the run-up to Wednesday’s decision suggested ‘the data has to disqualify further easing, and that’s a higher hurdle.’ … Given the data blackout, ‘it’s really hard for them not to cut in December. It’s easier to keep on going than to stop.'”

– While inflation had once been the focus of Fed thought, the labor market now “sits at the center of the debate.” Tariffs, in the minds of some officials, are looking like a one-off economic event, and as the labor market cools, “any inflationary fire is less likely to burn.”

– Another Fed debate arises from current immigration policy. Does the labor market slowdown reflect the economic impact of fewer immigrants entering the country? Or does it reflect a drop in business demand for workers.

Over the last three months, the labor market has added, on average, 29,000 jobs, down from the 82,000 per months over the same three months of 2024.

Wrote the reporter: “Rate cuts can boost weak demand but can’t offset fewer people seeking work. Immigration policy changes could be lowering the number of new jobs needed to hold the unemployment rate steady every month to 50,000 or less, down from about 90,000 before the pandemic and 150,000 when immigration surged after the pandemic, according to various models.”

James Bullard, past president of the St. Louis Fed from 2008 to 2023, told the reporter:

“Are they [policymakers] really adjusting their thinking to the idea that 50,000 jobs a month would be perfectly fine? I don’t know that everyone has really adjusted to that.” He added that a December rate cut “is a little dicier than markets have it right now. You’re hanging a lot on the slowdown in nonfarm payrolls.”

Make of this what you will.

Me?

Economist after economist state that 70% of GDP growth comes directly from consumer spending.

Does it make sense to argue that if fewer and fewer jobs are being created, then a reduced amount of consumer spending related to those fewer and fewer created jobs can lead to reduced GDP growth?

Over the past nearly five years, American GDP growth has outstripped nearly every other developed economy, mainly because of unparalleled job growth. America had access to significant numbers of immigrants to fill the record amount of posted unfilled job openings. Other nations did not.

As the reporter writes, there is a debate among economists that the slowdown in job creation reflects, primarily, Trump’s immigration policies. Some say yes. Others say no.

Ray W. says

Reuters reports that China’s state-owned COFCO just purchased three cargo loads of American soybeans, totaling 180,000 metric tons of product.

Said a soybean trader who works for an international trading company to the reporter:

“The volumes booked by COFCO are not that large, three cargoes for now.”

Per the reporter, the U.S. soybean export season runs from October to January, and the three cargoes will leave the U.S. in either December or January. The reporter also wrote that traders do not expect a significant resumption of Chinese purchases of soybeans, in part because the buying season is nearly complete and in part because Chinese buyers prefer Brazilian soybeans, as Brazilian soybeans have a “higher protein content”, according to Jeffrey Xu, general manager of Shanghai-based OCI, a soybean consultant. Two other soybean traders told the reporter the same thing.

Make of this what you will.