To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Mostly cloudy with showers and thunderstorms. Lows in the lower 70s. Highs around 90. Chance of rain 90 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

Nobody wants to do anything today.

Nar-Anon Family Groups offers hope and help for families and friends of addicts through a 12-step program, 6 p.m. at St. Mark by the Sea Lutheran Church, 303 Palm Coast Pkwy NE, Palm Coast, Fellowship Hall Entrance. See the website, www.nar-anon.org, or call (800) 477-6291. Find virtual meetings here.

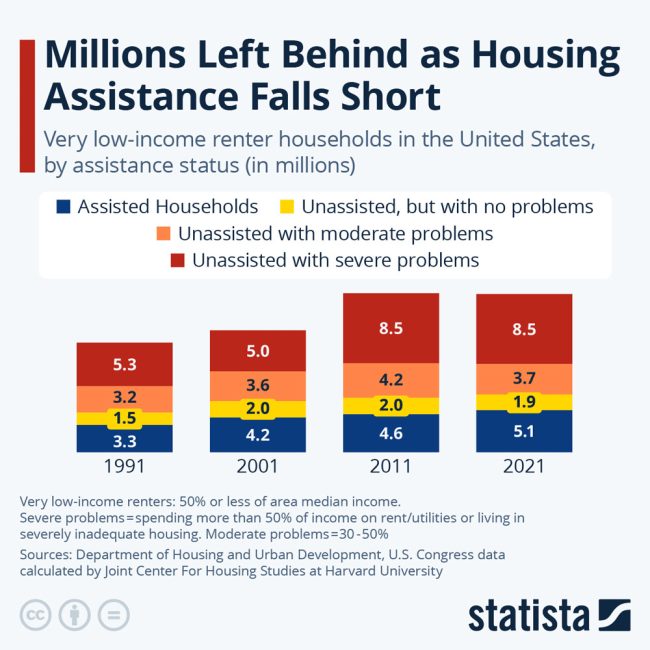

Notably: From Statista: “Millions of people who are eligible to receive housing assistance in the United States are being left without it, according to a new report by Harvard University’s Joint Center for Housing Studies. In 2021 (latest available data), a record high 8.5 million very low-income renter households with severe housing problems went without federal housing assistance, marking an increase of 3.3 million households since 1991. Severe problems here include spending more than 50 percent of income on rent and utilities or living in severely inadequate housing. The report writers warn that the proposed reductions in federal resources for crucial housing support would leave even more people with severe housing problems. They explain: “Rental assistance programs like Housing Choice Vouchers, public housing, and Low-Income Housing Tax Credits provide lifelines for roughly 5.1 million households. Most households assisted by the US Department of Housing and Urban Development (HUD) have extremely low incomes and include children, older adults, or a person with a disability. These programs, which assist vulnerable households and expand the supply of affordable housing, are already underfunded.”

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

December 2025

Free For All Fridays With Host David Ayres on WNZF

Scenic A1A Pride Meeting

Friday Blue Forum

Acoustic Jam Circle At The Community Center In The Hammock

Rotary’s Fantasy Lights Festival in Palm Coast’s Town Center

Kwanzaa Celebration

Flagler Beach Farmers Market

Coffee With Flagler Beach Commission Chair Scott Spradley

Grace Community Food Pantry on Education Way

Gamble Jam at Gamble Rogers Memorial State Recreation Area

Rotary’s Fantasy Lights Festival in Palm Coast’s Town Center

For the full calendar, go here.

Spreading his fog, and throwing in a dinosaur for good measure, Dickens makes this the most powerful beginning of all his novels, as he rolls out the dark, dirty English earth and sky to set the theme of the book. It will take on the worst aspects of the legal system – its inhumanity, sloth, corruption and obstruction – as a basis for a larger matter, the bad governance of society as a whole; and it will show the physical sickness of London – its toxic water, rotten housing, bursting graveyards and festering sewerage – as part of the effects of that bad governance. There will be almost none of the high-spirited comedy of the early novels: most of the jokes in Bleak House are edged with horror. Dickens is writing as a poet, taking as much delight in delineating wickedness and dark places as goodness and beauty. His imagination, always bold, now offers scenes as odd and inspired as Shakespeare’s…”

–From Claire Tomalin’s Charles Dickens: A Life (2011).

Dennis C Rathsam says

Two more victories for President TRUMP!!!! The jackass party cant stop this juggernaut, TRUMP fights for Americans & delivers. Democrates just fight each other!

Pogo says

@Not difficult

… to imagine — and believe:

… Charles Dickens, found alive today; says it’s indeed unfortunate that nothing has improved.

Ray W, says

According to Business Insider, Jim Farley, Ford’s CEO, engaged in a panel discussion during this past Friday’s Aspen Ideas Festival.

Mr. Farley spoke of his “six or seven” trips last year to China:

“It’s the most humbling thing I have ever seen. Seventy percent of all EVs in the world, electric vehicles, are made in China. … They have far superior in-vehicle technology. Huawei and Xiaomi are in every car. … You get in, you don’t have to pair your phone. Automatically, your whole digital life is mirrored in the car. … Beyond that, their cost, their quality of their vehicles is far superior to what I see in the West. … We are in a global competition with China, and it’s not just EVs. And if we lose this, we do not have a future Ford.”

Ford, he added, cannot yet offer anything similar to China’s level of in-vehicle digital technology because Western tech giants such as Google and Apple “decided not to go in the car business.”

Make of this what you will.

Me?

For over six months now I have been commenting on CEO Farley’s statements from October of last year during a British-based podcast, during which podcast he said that if Chinese EVs were permitted entry into the American automobile marketplace sans tariffs, it would be an “extinction level event” for all three American automakers. He added that during a trip to China in 2024, he had test-driven Xiaomi’s initial offering in the EV marketplace, the SU7. He had one flown to Chicago, after which arrival he drove it for the next six months as his primary form of transportation. He said he didn’t want to give it up because it has returned “fun” to his driving experience.

Xiaomi has just released its second model to its vehicle lineup, the YU7. According to automotive industry articles, the company received 200,000 preorders for the YU7, designed as a Tesla Model Y competitor, in the first three minutes after the order portal opened; it sells for $35,000.

Ray W, says

In a Sunday editorial column, the conservative-leaning Wall Street Journal opined that President Trump’s “attacks” on Republican Senators Rand Paul (Kentucky) and Thom Tillis (North Carolina) could turn out to be counterproductive, given Tillis’ recent announcement that he would not run for reelection next year.

The editorial read:

“A common feature of Donald Trump’s two terms as President is that he can’t stand political prosperity. When events are going in his direction, he has an uncanny habit of handing his opponents a sword.

The editorial went on:

“The GOP has a 53-47 majority now, but Susan Collins always has a tough race in Maine if she decides to run again. Democrats are targeting Joni Ernst in Iowa. In the suicide-isn’t-painless department, Texas Attorney Gerneral Ken Paxton is challenging GOP incumbent Sen. John Cornyn. Mr. Paxton may be the only Republican who could lose in Texas given his record of harassing business with lawsuits, impeachment, and other embarrassments.”

Make of this what you will.

Ray W, says

I remember the newspaper articles from the late 1980s when it was common belief that Japan’s share of the world’s GDP was about to surpass that produced by the United States. So, a recent editorial by Marc Novicoff published by The Atlantic titled, The Birth-Rate Crisis Isn’t as Bad as You’ve Heard — It’s Worse, caught my attention but not for the primary focus of the editorial.

The primary focus of the editorial was that a population paradigm, derived from “the gold-standard United Nations ‘World Population Prospects'”, appears to be deeply flawed, in that its long-term demographic assumptions based on predicted birth rates were not being actualized in real life, i.e., that actual birth rates in individual countries all over the world were not reflecting anticipated birth rates.

As an example, the UN birth prediction for Colombia in 2024 was 701,000 births, with a 2.5% chance of as few as 553,000 births. In actuality, Colombian women birthed 445,000 children, a fertility rate of 1.06 births per woman, down more than half from 2008, with 2.1 births per woman considered “replacement rate.”

But it was the editorial’s side focus on Japan’s long-faltering economy that caught my eye:

“If you’re not sure why this is all so alarming, consider Japan, the canonical example of the threat that low fertility poses to a country’s economic prospects. At its peak in 1994, the Japanese economy made up 18 percent of world GDP, but eventually, the country’s demographics caught up with it. Now, Japan’s median age is 50 years old, and the country’s GDP makes up just 4 percent of the global economy. Measured per hours worked, Japan’s economic growth has always been strong, but at some point, you just don’t have enough workers.”

Make of this what you will.

Me?

In a short 30 years, even though its GDP output per worker remained competitive, Japan’s share of the world’s GDP output in goods and services shrank from 18% to 4%, all because its worker pool could not keep pace, largely due to the nation’s overly strict immigration requirements.

We have long needed immigrants in their millions. We need more of them right now, and we will need even more immigrants in the future if we wish to maintain our economic standing in the world. It is one thing to remain competitive in output per worker; it is another thing entirely to remain competitive in overall national GDP.

Ray W, says

Seeking Alpha interpreted an investor note issued by Apollo Chief Economist Torsten Slok in its article titled, “Apollo warns that the Fed is bracing for a stagflation storm.”

In the investor note, Mr. Slok points out that prior to every Fed policy meeting, every voting member of the Federal Open Market Committee provides a forecast of the short-term future of the economy and assesses current risks to inflation and to labor market conditions.

Mr. Slok points out that prior to the most recent two-day meeting of the FOMC not one of the voting members anticipated either inflation falling or employment improving. This suggests a “unified concern” over perceived deteriorating macroeconomic conditions, driven by recent elevated energy prices, anticipated re-imposed trade tariffs, and continued tightening of immigration policies. It also suggests a convergence of risks, per the author of the article, including “persistent price pressures” and “weakening labor market dynamics.”

Make of this what you will.

Me?

For over a century, the Fed has been tasked by legislation to manage the economy and increase jobs, and nothing else; it was designed from the outset to be independent from political pressures. In other words, the Fed is forbidden by law to adopt economic policies based on political pressures.

Right now, the economy is beginning to show signs of rising inflation at the same time that jobs reports show a weakening of the job market.

Stagflation is defined as a period of both rising inflation and increasing unemployment. The last time the United States saw off and on stagflation was between 1968 and 1983. Mr. Slok is suggesting to Apollo’s investors that stagflation may be just around the corner.

He might be right. He might be wrong. I don’t know. I don’t know what will happen in our economy three months from now any more than any other FlaglerLive commenter. The best I can do is try to be a curious student of the thoughts and commentaries of the best economic minds I can find.

Some FlaglerLive commenters argue that Fed Chair Powell needs to bend to the administration’s demands and lower the central bank’s lending rates. One of them says the central bank’s lending rate should be lowered to 1% immediately, though I wish he would have used the term “deficit” instead of the term “debt” in his comment.

It strikes me that were the Fed to bend to the administration’s demands and immediately lower the central bank’s lending rate to 1% and then three months from now we come to see the effects of rising inflation due to the implementation of oft-delayed tariffs and we come to see job losses due to rising supply chain costs and reduced personal spending, then reducing central bank lending rates to 1% might turn out to be the absolute worst thing that we could have done to our economy. I agree with Fed Chair Powell that the better course is to wait and see.

The FOMC has 12 voting members, but a total of 17 economists drawn from the both the central Fed and from each of the 12 regional Feds; they meet and openly discuss scenarios before the 12 voting members vote on short-term Fed policy choices. These 17 economists are drawn from a wide number of economic subspecialities so as to provide as broad a view of the current state of the economy as possible. If all 12 voting members voice caution, given impending economic trends, that, to me, merits serious consideration.

Sherry says

The “Truth” about trump’s big bad deficit exploding bill from Robert Reich:

Friends,

One of my objectives in this daily letter is to equip you with the facts you need. As the Senate approaches a vote on Trump’s giant “big beautiful” tax and budget bill, I want to be as clear as possible about it.

First, it will cost a budget-busting $3.3 trillion. According to new estimates by the nonpartisan Congressional Budget Office, the Senate bill would add at least $3.3 trillion to the already out-of-control national debt over a decade. That’s nearly $1 trillion more than the House-passed version.

Second, it will cause 11.8 million Americans to lose their health coverage. The Senate version would result in even deeper cuts in federal support for health insurance, and more Americans losing coverage, than the House version. Federal spending on Medicaid, Medicare, and Obamacare would be reduced by more than $1.1 trillion over that period — with more than $1 trillion of those cuts coming from Medicaid alone.

All told, this will leave 11.8 million more Americans uninsured by 2034.

Third, it will cut food stamps and other nutrition assistance for lower-income Americans. According to the CBO, the legislation will not only cut Medicaid by about 18 percent, it will cut Supplemental Nutrition Assistance Program (food stamps) by roughly 20 percent. These cuts will constitute the most dramatic reductions in safety net spending in modern U.S. history.

Fourth, it will overwhelmingly benefit the rich and big corporations. The CBO projects that those in the bottom tenth of the income distribution will end up poorer, while the top tenth will be substantially richer.

The bill also makes permanent the business tax cuts from the 2017 legislation, further benefiting the largest corporations.

Finally, it will not help the economy. Trickle-down economics has proven to be a cruel hoax. Over the last 50 years, Congress has passed four major bills that cut taxes: the 1981 Reagan tax cuts; the 2001 and 2003 George W. Bush tax cuts; and the 2017 Trump tax cuts. Each time, the same three arguments were made in favor of the tax cuts: (1) They’d pay for themselves. (2) They’d supercharge economic growth. (3) They’d benefit everyone.

All have been proven wrong. Here’s what in fact happened:

(1) Did the tax cuts pay for themselves?

No. Rather than paying for themselves, the Reagan, Bush, and Trump tax cuts each significantly increased the federal deficit. In total, those tax cuts have added over $10.4 trillion to the federal deficit since 1981 compared to the Congressional Budget Office’s baseline projections.

(2) Did the tax cuts supercharge economic growth, create millions of jobs, and raise wages?

Absolutely not. Rather than growing, the economy shrank after passage of the Reagan tax cuts. And unemployment surged to over 10 percent. Following the enactment of the Bush and Trump tax cuts, the economy did grow a bit, but at rates much lower than their supporters predicted.

(3) Did the tax cuts benefit everyone?

Heavens, no. Rather than benefiting everyone, the savings from the Reagan, Bush, and Trump tax cuts flowed mainly to the richest Americans. The average tax cut for households in the top 1 percent under the Reagan tax cut ($47,147) was 68 times larger than the average tax cut for middle-class households ($695). The Bush tax cut for households in the top 1 percent was 16 times larger than the average tax cut for the middle class. The 2017 Trump tax cut for households in the top 1 percent was 36 times larger than for middle-class households.

Summary: If the bill now being considered by the Senate is enacted, 11.8 million Americans will lose their health insurance, millions will fall into poverty, and the national debt will increase by $3.3 trillion, all to provide a major tax cut mainly to the rich and big corporations. There is no justification for this.

Never before in the history of this nation has such a large redistribution of income been directed upward, for no reason at all. It comes at a time of near-record inequalities of income and wealth.

What you can do: Call your senators and tell them to vote “no” on this calamitous tax and budget bill. Congressional switchboard: (202) 224-3121.

Beyond this, help ensure that senators who vote in favor of this monstrosity are booted out of the Senate as soon as they’re up for reelection.

Sherry says

If you or your loved ones are having difficulty leaving Maga. . . Help is here! Take a few moments: https://leavingmaga.org/our-story/

It could open a door to peace. . .