To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Mostly sunny. A slight chance of showers in the morning, then showers and thunderstorms likely in the afternoon. Highs in the lower 90s. Chance of rain 70 percent. Friday Night: Mostly cloudy. Showers and thunderstorms likely, mainly in the evening. Lows in the lower 70s. Chance of rain 70 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

Free For All Fridays with Host David Ayres, an hour-long public affairs radio show featuring local newsmakers, personalities, public health updates and the occasional surprise guest, starts a little after 9 a.m. Pierre Tristam’s commentary is off today. See previous podcasts here. Today, Rep. Sam Greco, Palm Coast City Council member Dave Sullivan, County Commissioner Greg Hansen, On WNZF at 94.9 FM, 1550 AM, and live at Flagler Broadcasting’s YouTube channel.

The Friday Blue Forum, a discussion group organized by local Democrats, meets at 12:15 p.m. at the Flagler Democratic Office at 160 Cypress Point Parkway, Suite C214 (above Cue Note) at City Marketplace. Come and add your voice to local, state and national political issues.

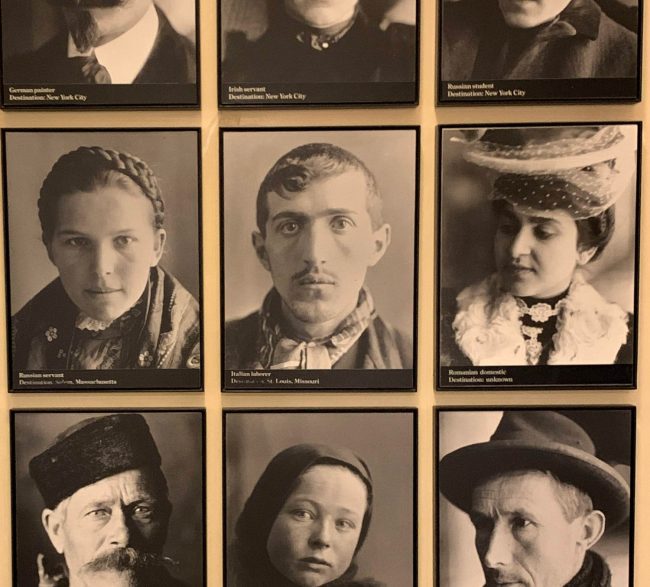

Notably: Michael Martin is one of our more interesting elected officials. He’s direct, candid, unfiltered in the best sense: he says it like it is, but he doesn’t go for showmanship or grandstanding and his bluntness is hitched to a streak of courtesy. He can be a tad verbose, but who am I to talk. He serves on the three-member East Flagler Mosquito Control District, which limits his public exposure. He’s also an applicant for Palm Coast’s charter review committee. The other day I uploaded new pictures of him in my Goggle photo database, a mass of some 200,000 pictures I’ve taken over the years for FlaglerLive, and two or three less public ones, as of that trip to Normandy or walk through post-James Washington Square. Google Photo is extremely useful. It’s also creepy. It’s face-regognition spying as John Poindexter’s Total Information Awareness‘ lunge into East German-like domestic spying, in the early days after 9/11, when he was one of George W. Bush’s spymasters, could only dream of. Poindexter and TIA were scrapped when the pinko media got hold of them, though TIA’s descendants are all over the place now, among them Google Photo. So Up goes Michael Martin’s picture, and down comes Google’s excellent matching logarithm, which brings back all pictures of Michael Martin I have ever taken. Among them: this picture of an “Italian Laborer” I took, as part of a collage of 12 images of immigrants, at Ellis Island’s museum in 2019. Which begs the question: is Michael’s ancestor immortalized on Ellis Island? I have not had time to call him to find out. But I will. Not a bad day, when we remember what immigrants are to us: we all have our Mayflowers, we all have our Ellis Island ancestors, even those never immortalized there, those who never set foot there. In other words that Italian laborer is very much Michael’s ancestor, especially if he was not, at least if Michael considers himself to be, as I am sure he does, as we all do, American

—P.T.

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

ESL Bible Studies for Intermediate and Advanced Students

Grace Community Food Pantry on Education Way

Palm Coast Farmers’ Market at European Village

Stetson University Concert Choir in Concert with Orlando Philharmonic

Al-Anon Family Groups

Temple Beth Shalom Blessing of the Pets

Nar-Anon Family Group

Palm Coast Charter Review Committee Meeting

Bunnell City Commission Meeting

For the full calendar, go here.

Imagine: somewhere in the prehistoric distance a man holds up in his hand a crude instrument—a brand, perhaps, or something like a daub or a broom bearing pigment-and fixes the wonderful image in his mind’s eye to a wall or rock. In that instant is accomplished really and symbolically the advent of art. That man, apart from his remarkable creation, is all but impossible to recall, and yet he is there in our human parentage, deep in our racial memory. In our modern, sophisticated terms, he is primitive and preliterate, and in the long reach of time he is utterly without distinction, except: he draws. And his contribution to posterity is inestimable; he makes a profound difference in our lives who succeed him by millennia. For all the stories of all the world proceed from the moment in which he makes his mark. All literatures issue from his hand.

–From the opening of The Columbia History of Literature (1988).

Dennis C Rathsam says

Rassmusin poll today shows TRUMP at 56% apruval RATING…..The economy is doing better, blue collar jobs got a 2% raise. 77 million Americans put TRUMP in the Whitehouse! 99% back what he.s doing. The border is CLOSED! I think the Fl heat has melted your jackass brains. All you do is bash TRUMP…. your all like the boy who cried wolf, Democrats have nothing to offer, they have no plan…{ except to lie & destroy the truth} hell they can’t even agree on a leader, as the ship keeps sinking. Maybe they should ellect the auto pen. Every day I wake up to democrates complaining, its a broken record now. The more you keep lying about TRUMP, the more his agenda kicks ass. Democrats, with Kamala, showed their STUPITITY, All they did to prepare for the ELLECTION, was to piss away millions! Lie, and call TRUMP every name in the book….Howed that workout for ya? Now your doing the same thing. Real patriots see through the CNN bullshit, {they lost more viewers after the ELLECTION} Many got the pink slip, many took a cut in pay. Bill ORiely carries on! NEWSMAX is killing all the democrat lies.{ notice they all say the same thing that was written for them.} It’s a great day to be a Republican, a great 4 years for America. Peace through strength. Cant wait for Pierres army of geniuses to attack me again. I hold my head up high, Im with the majority Im a proud member of the Grand Ole Party. AOC, TALIB, & OMAR, the communists in the democrat party have the party divided….You have to be a fool to vote for them. But alas as the USS Democrat sinks in the Gulf of America, there’s no life jackets, now row boats to escape, just a cool breeze from Maralago!

Pierre Tristam says

Rasmussen is run by the descendants of the people who ran Napoleon’s and Saddam Hussein’s plebiscites. That said, alchemy and polling of all stripes are now concubines.

Pogo says

@Elsewhere

https://www.youtube.com/watch?v=vqGMdQuZ-bY

And so it goes

https://www.google.com/search?q=iran+destroys+research+center

Hooray for Putin and its gang…

Endless dark money says

When tyranny becomes law, rebellion becomes duty!

No money for hungry kids but plenty to drop bombs?

Ray W, says

Earlier this week, in the context of the outbreak last Friday of military hostilities between Iran and Israel, Forbes reported that in 25 U.S. states, average gasoline prices had just recently dropped below $3 per gallon at the pump.

Nationwide, the average pump price for a gallon of gas remains at $3.13, roughly the same average price it was on January 20th of this year.

GasBuddy’s head petroleum analyst, Patrick de Haan, to the reporter that he expects “national gas prices to increase between five and 15 cents ‘over the next week or two'” due to the conflict, as crude oil futures jumped over 7% on receipt of the news.

Per an investor note by Richard Jostwick, an oil analyst with S&P Global Commodity Insights, the increase in gas prices will likely have a short-term impact, so long as the conflict does not escalate to the point of impacting international oil supply.

According to a source with the EIA, the worldwide stockpile of emergency crude oil reserves sits at 1.2 billion barrels.

In a related note, according to Baker-Hughes, its weekly rig count survey revealed yet another drop in U.S. oil and gas rigs in use for the eighth straight week, this week by four more rigs.

Oil rigs in operation now count 438. Natural gas rigs are at 111. Five rigs are “unclassified.” Compared to a year ago, the total number of rigs in operation are down by 34 rigs.

Make of this what you will.

Me?

What with crude oil and natural gas being international commodities, any conflict in the Middle East can be enough to raise fears of supply interruptions. Fear alone is enough to drive up prices in the jittery near-term. Nonetheless, gas prices at the pump, after slowly rising for a variety of reasons in the first few months after President Trump took office, had finally begun to trend down. Now this.

As for the rig count totals, industry article after industry article reflect reduction after reduction in industry demand for use of oil and gas rigs. Some of this can be attributed to increases in drilling efficiency. Just over 10 years ago, as many as 2000 drilling rigs were in operation as national production rose from five million barrels per day to just under 10 million barrels per day, but better technology allowed for more accurate drill directing and for longer horizontal drill bore lengths, which can result in significantly more oil released per bore.

A short while ago I went to the Texas Railroad Commission site, which regulates drilling activities in Texas, to check on permit applications and well completion records. Both counts are down over last year’s counts.

American energy extractors are simply not exploring for new sources of oil and gas as broadly as they once did. Drill, Baby, Drill was a fine pre-election political mantra, but the once political promise is simply unlikely to come true in today’s energy marketplace. Overall American crude oil production is down from its record peak last December, albeit only slightly, with little or no increase expected in the future, based on corporate reports on future investment plans.

Ray W, says

Twice per year, Fed Chair Powell testifies under oath on separate days to each house of Congress. Immediately prior to his testimony, the Fed releases a Monetary Policy Report. Today, the Fed released the second of this year’s two reports.

The Summary of the report reads thus:

“Inflation has continued to moderate this year, though it remains somewhat elevated. The labor market is in solid shape, with a moderate pace of job gains so far this year and the unemployment rate at a low level. Although growth in real gross domestic product (GDP) is reported to have paused in the first quarter, growth in private domestic final demand was moderate, reflecting a modest increase in consumer spending and a jump in capital spending. However, measures of household and business sentiment have declined this year amid concerns about the effects of higher tariffs on inflation and employment as well as heightened uncertainty about the economic outlook.

“With the labor market at or near maximum employment and inflation continuing to moderate, the Federal Open Market Committee (FOMC) has maintained the target range for the federal funds rate at 41/4 to 41/2 percent. The FOMC’s current stance of monetary policy leaves it well positioned to wait for more clarity on the outlook for inflation and economic activity and to respond in a timely way to potential economic developments. The Federal Reserve has also continued to reduce its holdings of Treasury and agency mortgage-backed securities and, beginning in April, further slowed the pace of decline to facilitate a smooth transition to ample reserve balances. The FOMC is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective. In considering the extend and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

Make of this what you will.

Ray W, says

In a different comment to FlaglerLive readers, I focused on the Fed’s Summary of its semi-annual report, this time 81 pages in sum.

Barron’s devoted its own assessment of the report. Here are some bullet points from the Barron’s article:

– “The Federal Reserve says inflation is easing. But reduced immigration and rising tariffs could complicate the process.”

– “… [I]mmigration has ‘slowed sharply’ since mid-2024. Growth in the supply of labor has weakened and the rate of participation in the workforce has edged down. While job growth is moderating, that shift could make staff harder to find just as gains in wages have started to flatten.”

– “But officials aren’t declaring victory. The report highlights several risks that could slow or reverse recent gains, including a tighter supply of labor, tariff-related price pressures, and rising expectations for inflation over the short-term.”

– “Actual price increases have also begun to show up for some kinds of goods. The report points to a small pickup in inflation for appliances, electronics, and other durable goods affected by trade policy. Manufacturers are also reporting higher input costs, thought the Fed was careful not to overstate the trend, saying it is ‘still early to assess’ the full effects of recent tariff actions.”

Make of this what you will.

Me?

I remain convinced that it is still too early to predict what the on-again/off-again tariff policy will do to the overall U.S. economy. At first, I took the position that no one could know what effect the tariffs would have because they were a bigger one-time jump than had been seen in nearly a century. But the high tariffs were paused within a short time, except for Chinese goods, which were jacked up to 145% for a time, then reduced to 30%.

No wonder the Fed is taking the position that it is best to wait a little while longer before acting on current lending rates.

Ray W, says

Here is Bloomberg’s take on today’s Fed report:

“A sharp stepdown in immigration has led the supply of workers to grow more slowly, helping to keep the labor market in balance as job growth cools, the Federal Reserve said Friday.

“‘Labor supply has increased less robustly than in previous years, with immigration appearing to have slowed sharply since the middle of last year and the labor force participation rate having declined a bit. …'”

And, “[a]s labor demand has gradually eased over the past few years, a variety of measures suggest the labor market has moved into balance and is now less tight than just before the pandemic. …”

“The report reiterated the message from Fed Chair Jerome Powell and other officials that monetary policy is well positioned for policymakers to wait for more clarity on the economic outlook.”

Make of this what you will.

Me?

For years, economists have been commenting on the strength of the American labor marketplace. Officially, the Fed announced long ago that it intended to focus on bringing the inflation rate down to 2%, even if that focus meant that the labor market would suffer, but it didn’t suffer. The original idea was to allow the jobs market to drop, even if it meant overall job losses. After 30 months of commenting on this tactic, it looks like the jobs market is finally losing steam.

This says a lot of the strength of the American economic recovery from the depths of the pandemic. Both The Economist and the Wall Street Journal were right when they opined that President Trump inherited an economy that was the “envy of the world.”

Ray W, says

During the annual St. Petersburg International Economic Forum, the Governor of the Central Bank of Russia, Elvira Nabiullina, told attendees:

“We experienced fairly high growth for two years because unused resources were engaged.” She was talking of labor and production capacity and “banking system capital reserves and the National Wealth Fund (NWF). … Now we must understand that many of these resources are truly exhausted.”

Production capacity is above 80%, the highest percentage in modern Russian history.

The national unemployment rate is at 2.3%, due to mass emigration and high demand for military labor. The nation needs 2 million more workers.

The NWF’s currency reserve has fallen to roughly $21 billion, which I have read from a number of sources dating from immediately prior to the 2022 invasion of the Ukraine was at roughly $350 billion. Liquidity is at roughly one-third of its prewar level, at $35 billion.

Gold reserves, once at 400 tons, are down to 139.5 tons.

Overall corporate profits dropped by a third in March. The oil and gas sector felt a 50% drop in profits in March.

Industrial growth has nearly stalled, with 1.2% expansion from January through April.

In June, the independent Central Bank lowered the lending rate from 21% to 20%, in the face of government pressure to lower it further.

Make of this what you will.

Me?

With the Russian-born population long in decline since the breakup of the Soviet Union, Russia still depends heavily on immigrants to balance its economy. But in the wake of a mass killing blamed on Tajik terrorists, the Russian government forcibly deported hundreds of thousands of Tajik immigrants. Now the overall Russian labor market is suffering from too few workers.

The dude says

Of course Dennis omits pertinent facts.

The pole he quotes is of “likely voters” which is significant…

But the very next paragraph states this:

“The latest figures include 36% who Strongly Approve of the job Trump is doing and 39% who Strongly Disapprove. This gives him a Presidential Approval Index rating of- 3. (see trends)”

So his highly reasoned and highly astute observations are based on lies by omission at best, but more than likely just lies based on his limited intellect and understanding of those numbers thingys.

Oh the “STUPITITY”… it hurts…

This is why we are where we are today

Ray W, says

Also speaking to the St. Petersburg International Economic Forum, per the Associated Press, Russia’s Economy Minister Maxim Reshetnikov told attendees:

“Russia’s economy is ‘on the brin of going into a recession.’ … [T]he numbers indicate cooling, but all our numbers are (like) a rearview mirror. Judging by the way businesses currently feel and the indicators, we are already, it seems to me, on the brink of going into recession.”

Make of this what you will.

Ray W, says

According to Reuters, amid a flood of “cheap EVs”, China’s entry into the Brazilian car marketplace, the sixth largest by volume in the world, has triggered a national backlash.

Legacy carmakers like Volkswagen, Stellantis (Jeep) and GM have been building cars in Brazil for decades.

In 2024, the government reversed its 2015 decision to eliminate all tariffs on all types of EV imports in order to speed the adoption of EVs by the populace. The new tariff structure is intended to promote domestic production of EVs.

Right now, imported Chinese EVs hold a greater than 80% share of the nascent Brazilian EV marketplace.

The new tariffs, starting at 10%, will increase every six months to an eventual 35% overall car import tariff by the end of 2026. Among other Brazilian corporate entities, Brazil’s auto association recently petitioned the Brazilian government to speed up the increase in tariffs; the petition remains under review.

The government told the Reuters reporter:

“The schedule for the gradual resumption of tariffs, with decreasing quotas, was established to allow companies to continue with their development plans and respect the maturity of manufacturing in the country.”

BYD, a Chinese EV manufacturer, bought in 2023 a former Ford factory, but it is not expected to be fully functional until December 2026. According to labor union leaders, BYD has yet to contact local parts suppliers to provide Brazilian-made parts and components for final assembly at the plant. “Even if the factory is here – what value is it really adding if the components, development, and technology is all from abroad?” union confederation spokesman da Silva told the reporter.

GWM, another Chinese carmaker bought a former Mercedes factory in 2021, but it too is not yet operational, though operations should begin later this year. The goal is to produce 50,000 EVs per year from the factory. GWM is in contract talks with some 100 Brazil-based suppliers

The reporter noted that while Brazil possesses “abundant” mineral resources, such as lithium for battery manufacturing, the infrastructure to manufacture many of the unique components for electric vehicles has yet to fully develop.

Make of this what you will.

Me?

BYD has long been recognized for its business model of producing in-house the vast majority of the parts and components for its personal transport models, from computer chips to batteries, to headlight assemblies, to dashboards, etc., thereby controlling overall vehicle assembly costs. Whether it will bend to Brazil’s model of local manufacturers providing the same components and parts has yet to be determined. Given the size of the South American populace, and the asserted quantity and availability of the continent’s raw mineral resources, it might be wise for BYD to construct an EV battery plant in Brazil.

Ray W, says

CNBC reports that during Wednesday’s press conference after the conclusion of the Federal Reserve’s two-day meeting of the Federal Open Market Committee (FOMC), Fed Chair Powell spoke of the participant’s expectations that the “core personal consumption expenditures price index”, excluding the more volatile food and energy values, would rise to a 3.1% inflation rate for the year, up from the March forecast of 2.8% inflation rate for the year.

2025 GDP growth, once expected to be 1.7% for the year, was downgraded to an expectation of 1.4%.

Fed Chair Powell added:

“Everyone that I know is forecasting a meaningful increase in inflation in coming months from tariffs because someone has to pay for the tariffs. … It will be someone in that chain that I mentioned, between the manufacturer, the exporter, the importer, the retailer, ultimately somebody putting it into a good of some kind or just the consumer buying it. … All through that chain, people will be trying not to be the ones who can take up the cost but ultimately, the cost of the tariff has to be paid. And some of it will fall on the consumer.”

Of the 19 voting FOMC members, seven said no to any cuts to the Fed’s current lending rate this year. Twelve were split between either one or two lending rate cuts by the end of 2025, but not right now.

Make of this what you will.

Ray W, says

The Cool Down devoted an article to what is to me a unique method of extracting valuable minerals from used lithium batteries.

The process, called either “biomining” or “bioleaching”, involves the use of genetically engineered microorganisms (bacteria) to break down ores; the process debuted in the 60s to extract copper from waste rocks. More efficient recycling methods permits less expensive new batteries and a lesser environmental impact from mining raw materials all the way to reprocessing already refined “essential minerals.”

Finally, according to a reporter, a company, Cellcycle, has developed a process to extract lithium from EV batteries via engineered bacteria.

A Cellcycle marketing manager said:

“Bacteria have a proven track record in other areas and industries, and are capable of recovering every kind of critical mineral you can think of. These bacteria have existed longer than humankind, they’re 50 million years old and have shaped our coasts, islands, the way that metal is formed and produced.”

Make of this what you will.

Me?

Decades ago, few in America were involved in developing one, many, or all of the many facets of EV battery technology. As the electrification process overtakes that of internal combustion engine technology (ICE), as it already has in a number of countries other than the U.S., the superiority of EVs will continue to evolve.

As Ford’s CEO says, the EV industry is in the Model T stage of development. The ICE industry, to him, is nearing the end of its development potential.

Skibum says

Dennis, polls are a lot like statistics… you can always cherry pick and find one that you like if you search hard enough. Polls are only as good as the questions they ask. I could gather a group of 100 people, ask each question a certain way and get their responses, then ask similar questions another way to elicit my desired responses and lo and behold, would not be surprised to hear completely different takes on those issues. That is why I have never relied on polls for anything, nor do I choose to participate because many people can be swayed one way or the other like they are pawns in someone’s chess game.

I know how I feel about important issues, and I don’t need anyone to tell me how I should feel, how I should vote, etc. And lastly I will just say this… for ANYONE to hold up as a role model for themselves or their children a life long schemer, fraudster, and convicted felon, well I personally will never trust such a person’s advice or so-called poll results or even statements like “the sky is blue” without looking outside to see for myself.

Sherry says

Not to confuse Maga with actual facts. . . the latest major polls of trump’s approval ratings:

FOX 46% Approve 54% Disapprove

PEW 41% Approve 58% Disapprove

RASMUSSEN 52% Approve 47% Disapprove

ECONOMIST 44% Approve 53% Disapprove

MORNING CONSULT 46% Approve 52% Disapprove

REUTERS 42% Approve 54% Disapprove

NBC 43% Approve 55% Disapprove

For an average of 44.85% Approval VS 53.28% Disapproval rating for trump.

An estimated 5 MILLION people turned out to protest against trump last Saturday. Fox and Maga would tell you they are all paid instigators. What does your common sense tell you?

Ray W, says

Yes, this is my fourth comment on Fed Chair Powell’s press conference that occurred after the conclusion of this week’s Fed conference (the first Fed conference since President Trump declared “Liberation Day” on April 2nd). This week’s conference involved 19 Fed economists.

As I commented earlier, seven of the 19 attendees voted for no lending rate reductions during the remainder of the year. The other twelve split their votes for either one or two lending rate reductions this year, but not right now.

In my opinion, a Wall Street Journal reporter, Nick Timiraos, wrote the most comprehensive assessment of several of the Fed conference issues, with his story beginning as follows:

“Federal Reserve officials left the door open to cutting interest rates in the second half of the year but indicated they were in no hurry to do so when they held rates steady Wednesday.”

During the press conference, Fed Chair Powell expressed the basis for at least some of the Fed’s reasoning for leaving lending rates as they are:

“We haven’t been through a situation like this and think we have to be humble about our ability to forecast it.”

Per the story, the Fed has set its foundational priorities:

“Currently, the Fed doesn’t set interest rates with an eye on helping manage federal borrowing expenses and instead s focused on maintaining low and stable inflation with a sturdy labor market.”

The WSJ reporter then addressed a number of points:

“The Fed is on hold because it sees risks no matter what it does. Inflation has declined close to — but hasn’t quite reached — the Fed’s 2% goal after four years running above the target.

“Cut rates too soon, and the Fed risks reigniting inflation. Many economists expect businesses to raise prices owing to higher import costs, and rate cuts could fuel more economic activity at the wrong time. The Fed doesn’t want to be in a situation where, one year from now, inflation has jumped back above 3% and stayed there.

“Wait too long, and economic uncertainty plus rising costs from tariffs could squeeze company profits, leading to layoffs and a recession. …”

“To resume rate cuts that they started last year, Fed officials are likely to need to see either labor markets soften or stronger evidence that price increases triggered by tariffs will be relatively muted. Projections released Wednesday suggest officials were open-minded about whether they would have that evidence by the fall. …

“Economic projections show officials expect inflation and unemployment to rise this year by more than they projected in March. That is a potentially messy combination for a central bank because it could force officials to choose between focusing on shoring up the labor market by lowering interest rates or defending against higher inflation by keeping rates where they are.”

“While the unemployment rate has remained at a relatively low level this year, some data point to softness in the labor market. The number of people collecting unemployment benefits for an extended period is near a three-year high. Job growth has been revised down in recent months. …

“For the Fed, a cooling job market could help with inflation by reducing wage pressures and consumer spending power. …”

Make of this what you will.

Me?

When the Fed began raising lending rates in 2022, the stated purpose was to keep inflation from running out of control. With unfunded federal stimulus money in their trillions of dollars being pumped into the demand side of the economy, and with worldwide supply chains having been disrupted by the pandemic, inflation was gathering momentum. Some economists claimed the Fed waited too long before initiating lending rate increases, but the jury seems out on that issue.

Nonetheless, with the Fed focused on stymying inflation, it was thought that an increase in demand for labor might put too much pressure on wages, further contributing to inflation.

Fortunately, we experienced a boon in immigration, so the labor market never reached a level of imbalance thought probable by the increase in spending brought on by the stimulus money.

So here we are.

The labor market is finally softening right at the same time that levels of immigration into the country are lowering. The snatching two immigrants here, 100 immigrants there, 30 immigrants in the fields, 70 immigrants from meatpacking plants, may provide for extensive news coverage, but it still doesn’t add up to the one million deportees per year promised by J.D. Vance earlier this year.

According to fiscal year 2025 Department of Homeland Security figures through June 10th, as reported by Time, which began last October 1st, 207,000 people have been deported in more than eight months, compared to 271,000 deported during fiscal year 2024.

Deportation numbers, called “removals” in Homeland Security data, do not include those turned away at the border; those turned away are classified as “returns” in the data.

I looked up historical Homeland Security “removal” and “return” figures, respectively, for the first three of the Trump years (the pandemic skewed the fourth year’s data).

Fiscal year 2017: 287,093 — 100,695.

Fiscal year 2018: 328,761 — 159,940.

Fiscal year 2019: 359,885 — 171,445.

The pace of actual 2025 deportations, however, has picked up in recent months. Who knows what the final figure for the year will be?

As a reminder to all FlaglerLive readers, after President Trump ordered the killing of a bipartisan immigration bill last year that would have greatly increased fiscal year 2025 funding for ICE and Customs operations, he is now asking Congress for nearly $170 billion in additional funds, after already having greatly overspent the amount Congress granted for fiscal year 2025.

Ed P says

Consider this, if the Fed reduced interest rates just 1% the savings for taxpayers on the refinancing of our national debt is estimated 1.7 trillion over 10 years.

Helps explain why Trump is impatient.

Of course he wants to stimulate the economy but the incredible savings to the tax payers can’t be over looked.

Laurel says

We ordered a somewhat large item on Amazon, that looked, and read to be a really well made item, at a good cost. Turns out it is from Canada. It has been stuck in customs for “inspection” and “tariffs” since June 11th, where tracking stops. Today is June 22. No product in sight. Amazon has apologized, and the shipper has apologized, and has given us the option to cancel the order, which I have not yet decided on. I may have to settle for a lessor item, at a higher cost, that does not need to go through customs. This suggests two things to me: 1.) customs is severely backed up due to Trump’s absurd tariffs, or 2.) Someone on the U.S. side is being an asshole, because of Trump’s ideology. Either way, Canada, as shipper, is punished, and us as consumers are punished. Freakin’ stupid! I can’t believe we have to put up with stupid for another three years.

Now, we are in an unconstitutional war, not vetted by Congress.

Way to go, Trump!

For those a little on the slow side, this last statement was sarcasm.

Ray W, says

I just saw Ed P.’s comment.

Once again, Ed P. proves that on occasion he doesn’t know much of what he is talking about.

The lending rate for Treasury bonds is not set by the Fed; it is set by those who bid on purchasing the T-Bills that need to be sold to finance current federal debt and refinance past federal debt that has matured.

The Fed could reduce its lending rate to one percent and those participating in the bond marketplace would continue to bid up or down a separate lending rate for T-Bills, depending on their perception of risk. Inappropriately lowering the Fed lending rate might actually drive T-Bill lending rates higher due to a perception of increased economic risk.

Thank you for allowing me to improve on another of your barely correct comments.

The correct comment for you to submit would be if people and entities bidding on T-bills became convinced that it would be in their economic best interest to bid down the yield on T-bills to 1%, the savings would be $1.9 trillion over 10 years, regardless of what the Fed did.

Why would you ever listen to anything any one member of the professional lying class that sits atop one of our two political parties? None of them have your best interest at heart. At least I repeatedly encourage you to engage in the pursuit of heaven’s gift of reason that so often comes from the exercise of intellectual rigor.

As an aside, were the Fed to suddenly reduce today’s lending rate in one swoop to 1% in a pre-inflationary economic environment, there is reason to believe that the American economy might quickly overheat due to a job market that is still short of an adequate supply of workers, which might quickly drive up inflation.

When the Fed reduced its lending rate to 0% in the months after the pandemic at the same time that it increased the quantity of credit available to lending institutions, its primary purpose was to heat up a rapidly cooling economy. We aren’t in that situation anymore.

The primary purpose today of keeping the Fed’s lending rates where they are, as repeatedly stated by Fed officials, is to continue a long-term attempt to force inflation down to the Fed’s adopted 2% target level, without simultaneously impacting the labor market. It’s a delicate balance for the Fed, based on conflicting economic data.

Ed P says

Ray W,

You are wrong. Business and financials are in my wheel house. In simple laymen’s terms:

Lower interest rates absolutely provides savings for servicing government debt. It could provide the possibilities of refinancing existing debt at a more favorable rate.

Treasury Securities (some) can be called early to to lower government debt. Future borrowing would prove cheaper at lower rates. There are always investors for treasuries- at any rate.

I never advocated for a one time 1% cut. I was stating what would occur if even a 1% future reduction occurred.

I’m guessing this post will be fact checked. Here’s your question:

How much savings on national debt occurs with a 1% federal rate reduction?

Sherry says

I asked Google AI how the treasury would be affected if the wealthy “millionaires and billionaires” paid their full share of income taxes. Here is the result. . . please, everyone take a good read, and really “think” about this:

Studies indicate that if US billionaires paid their full share of income taxes, a significant amount of revenue could be added to the US Treasury.

ESTIMATES OF POTENTIAL REVENUE:

IRS Commissioner Danny Werfel: States that millionaires and billionaires evade over $150 billion annually in taxes.

US Treasury Estimates: Indicate that the top 1% of wealthy individuals underpay their taxes by $163 billion per year.

PROPOSED TAX REFORMS:

Billionaire Minimum Income Tax (BMIT): This proposal would require households worth over $100 million to pay a 20% annual minimum tax, potentially generating substantial revenue, according to Congressman Steve Cohen’s office.

Closing the Billionaire Borrowing Loophole: Equitable Growth estimates this could raise over $100 billion over 10 years.

Taxing Unrealized Capital Gains and Ending Step-Up in Basis: The Treasury Department estimates this could raise $500 billion in revenue over ten years.

Reforming Capital Gains Taxes: Including raising the top rate for millionaires and ending stepped-up basis, could generate $344 billion in revenue.

Modest Wealth Tax: Oxfam found that a 3% tax on wealth over $1 billion could raise nearly $52 billion from the 10 richest billionaires alone.

METHODS OF TAX AVOIDANCE:

Billionaires use various strategies to minimize their tax burden, including:

Borrowing against assets: Instead of selling appreciated assets and paying capital gains taxes, they take out loans using assets as collateral, allowing them to access cash tax-free.

“Buy, Borrow, Die” strategy: Acquiring appreciating assets, borrowing against them, and passing them to heirs with a stepped-up cost basis, avoiding capital gains taxes.

Tax-Loss Harvesting: Selling investments when they are low to offset capital gains and reduce tax liability.

Sticking high-tax income into tax-advantaged accounts and policies: Utilizing retirement accounts, private placement insurance policies, and foundations.

Converting personal assets into business expenses: Deducting costs associated with personal assets like yachts, private jets, and vacation properties.

It is important to note: While these estimates provide insights into potential revenue gains, the exact amount added to the US Treasury would depend on various factors, including specific policy changes, compliance rates, and economic conditions.

Ed P says

Any yet, these same billionaires are following the congressional approved tax laws.

Does anyone on this site pay extra taxes beyond the required?

Also noted, they “evade” (legally) by contributing 1/3 of all charitable contributions and 86% of charitable contributions made at death.

The top 1% already pay about 40.4 percent of all taxes collected.

1.54 million tax payers pay 40.4 percent while 153.8 million, yes, (153,800,000) tax payers pay the rest….seems fair?

Who do you think creates businesses that create jobs…

Those same 1%