To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Sunny. A slight chance of rain in the morning, then a chance of showers and thunderstorms in the afternoon. Highs in the upper 80s. East winds 5 to 10 mph. Chance of rain 30 percent. Tuesday Night: Mostly clear. A chance of showers and thunderstorms in the evening. Lows in the upper 60s. Southeast winds 5 to 10 mph. Chance of rain 30 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Flagler Beach here.

- tropical cyclone activity here, and even more details here.

Today at a Glance:

The Residential Drainage Citizens Advisory Committee holds its inaugural meeting at 3 p.m. at City Hall. The council appointed the committee to study potential solutions for drainage issues affecting homes in Palm Coast’s older neighborhoods, where new construction is creating new flooding issues. According to the city’s scope for the committee, it “shall research potential resolutions to identified issues,” the resolution states. “The Committee shall identify potential funding sources for identified resolutions. The Committee shall formulate findings and recommendations in relation to potential assistance and remedies for identified damages.”

The Flagler County School Board meets at 3 p.m. in workshop to go over the items on its upcoming school board meeting two weeks hence. The board meets in the training room on the third floor of the Government Services Building, 1769 East Moody Boulevard, Bunnell. Board meeting documents are available here.

The Palm Coast City Council meets at 6 p.m. at City Hall. For agendas, minutes, and audio access to the meetings, go here. For meeting agendas, audio and video, go here.

The Bunnell Planning, Zoning and Appeals Board meets at 6 p.m. at the Government Services Building, 1769 East Moody Boulevard, Bunnell. The board consists of Carl Lilavois, Chair; Manuel Madaleno, Nealon Joseph, Gary Masten and Lyn Lafferty.

The Flagler Beach Library Writers’ Club meets at 5 p.m. at the library, 315 South Seventh Street, Flagler Beach.

Flagler Beach’s Planning and Architectural Review Board meets at 5:30 p.m. at City Hall, 105 S 2nd Street. For agendas and minutes, go here.

Random Acts of Insanity Standup Comedy, 8 p.m. at Cinematique Theater, 242 South Beach Street, Daytona Beach. General admission is $8.50. Every Tuesday and on the first Saturday of ever

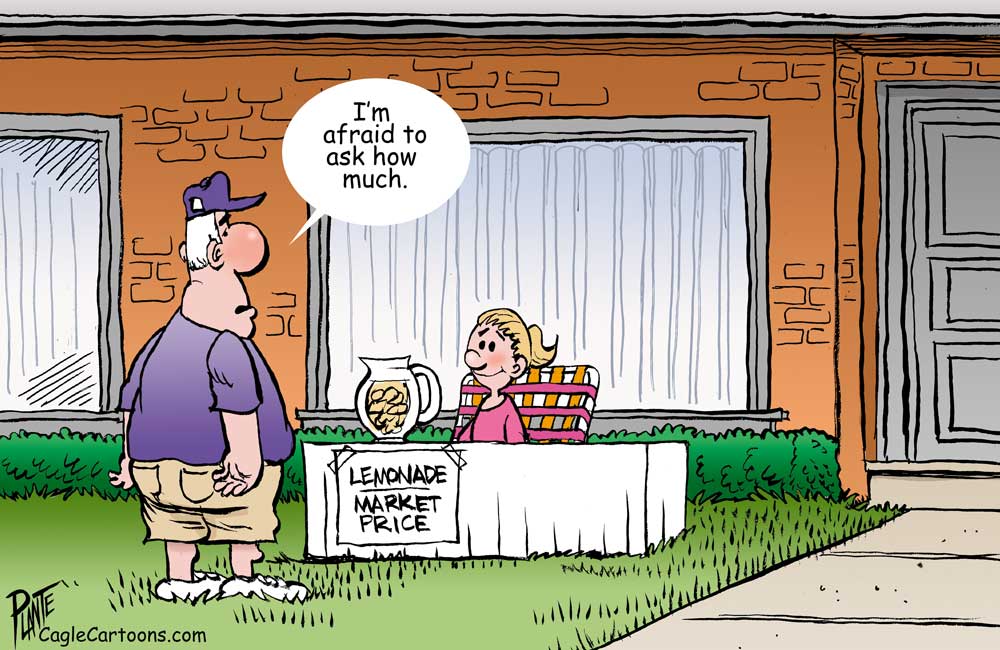

Notably: On Monday a few kids set up a lemonade stand on the shared path (we don;t just say “sidewalk” anymore” just north of the northeast corner at Point Pleasant and Belle Terre Parkway. One of the kids was the runner, taking the drinks and the money back and forth between cars (the kids were advertising the stand to traffic on Belle Terre, but earning their sales from the more leisurely traffic on Point Pleasant, which could at least idle at the stop sign), one held up the signs, and a third kept the merchandize looking stocked and glistening under a global warming-hot sun. It looked like they were doing well, both selling and nodding back to Norman Rockwell. Except for this. The price of a lemonade: $2! My son Luka and I were making a run to Publix (who are we to complain about a $2 lemonade when we shop at Publix, where a cilantro leaf costs $2? But for the record: we’d have gone to Aldi, where we usually find our shopping pleasures, but Cheryl needed the kind of flank steak we can’t find there.) When he heard me grumble about the price like one of those old Muppet Show grumps, he reminded me that even kids have to keep up with inflation. He was right. $2 today would have been $1.11 in 2000, and 35 cents in 1975, when kids were selling lemonade for 25 cents a cup, as I recall from movie clips (I was still in Lebanon at the time where, one summer around then, my brother and I tried a french fry stand, going all the way: we planted our own potatoes. I think our yield was around four or five potatoes. We sold the business to passing dust.) So the kids off Point Pleasant couldn’t have been too far off, and when you consider how colleges have jacked up their costs by 1,000 percent since I was college (that’s not an exaggeration: see the proof in the May 17 Briefing), they were selling at Aldi prices when they could’ve pushed for Publix. We did not, alas, buy a cup, too startled were we by the phenomenon on the way out, and too conscious of the dangerous turn off Belle Terre, where I have covered my share of wrecks, on the way back. I did unkindly remark to my son that I was not so sure about what ingredients we’d end up with, which of course caused him to contribute the video below.

—P.T.

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Palm Coast City Council Meeting

In Court: Angel Marie Sexton Sentencing

Flagler Beach United Methodist Church Food Pantry

In Court: Kristopher Henriqson

Weekly Chess Club for Teens, Ages 10-18, at the Flagler County Public Library

Flagler Beach Library Writers’ Club

Random Acts of Insanity Standup Comedy

Contractor Review Board Meeting

Flagler County’s Technical Review Committee Meeting

Flagler Tiger Bay Club Guest Speaker: Jeff Brandes

Separation Chat: Open Discussion

The Circle of Light A Course in Miracles Study Group

Palm Coast Planning and Land Development Board

For the full calendar, go here.

It’s only October, but already Nicky Beldoch is exhibiting symptoms of student ennui. The other day, when his mother asked him the best thing about school, he said lunch. Most boring? Art history. No surprise, given that he has homework every night and has been anxious about an oral report he has to deliver in science. But Nicky is 5, and he is in kindergarten. And while his mother, naturally, says that he is smarter than the average kindergartner, his day at Public School 9 on the Upper West Side of Manhattan looks much like the average day in kindergartens across the country. Once an idyll of graham crackers, fingerpainting and naps, the ”children’s garden” has become a thicket of academic challenges, a result of increased state testing in the elementary grades that demands students know more, sooner. States and school districts are writing formal curriculums for kindergarten, requiring students to learn skills like simple addition and reading that once were taught in first grade. More school districts are offering a full seven-hour day of kindergarten because they found that traditional three-hour programs did not allow time for the math, language arts and science lessons that are becoming standard fare. The changes hold true in poor schools as well as rich, in small suburban schools as well as large urban ones.

–From “No Time for Napping in Today’s Kindergarten,” by Kate Zernike, New York Times, Oct. 23, 2000.

Ray W. says

According to a CNN Business article, [t]he number of job openings (8.06 million), shrank for the second month in a row, setting a new three-year low amid further signs of cooling in the labor market.”

I consider the wording of the sentence misleading, in that since the job openings statistic had never been above 8 million in the history of job openings statistics prior to the pandemic, it is not possible to use the word “low” to describe the number of open jobs. To me, if 8.06 million job openings is higher than it ever was prior to the pandemic, then a far more accurate descriptive term is that the number of job openings is “less high” than it has been for the past three years. 8.06 million job openings is still a record high number compared to any month in the history of the United States up to the onset of the pandemic. Record highs cannot be “low.”

The monthly jobs report also reflected that there were “an estimated 1.2 jobs for every job seeker. That’s the lowest ratio since June 2021, BLS data shows.”

I agree with that language.

The 1.2 openings per seeker is still above the sought after rate of 1.0 jobs per seeker that economist consider acceptable. Immediately prior to the onset of the pandemic, the rate was 0.7 jobs open per seeker. We still need many more workers than are available to bring down the open jobs rate. Either our economy cools even further, which will reduce the number of posted job openings, or we admit more immigrants into the country to satiate demand. If employers could find more workers, our economy would thrive due to the economic activity the additional workers would add. Pressures on rising wages would ease. I see that Buccee’s is advertising on its gas pumps that it starts workers at $18 per hour. $20 per hour if they work the night shift. These are for the most basic jobs. Janitorial workers start at $21 per hour and $23 per hour for the night shift. This is in Daytona Beach, not California. If anyone thinks that a tight labor market does not lead to higher wages is fooling herself. Buccee’s is competing for workers and willing to pay for it. Can higher wages impact inflation? It seems so, though perhaps not automatically so.

According to the article, the number of job layoffs fell from April’s 1.6 million to 1.52 million. Quits of all types rose to 3.51 million, up 100,000 from April. Adding layoffs to quits totals 5.03 million workers leaving jobs for whatever reason. New hires were 5.64 million in May. The historical weekly average number of people applying for unemployment insurance since 1968 is roughly 365k per month. The last time I checked a couple of weeks ago, the four-week rolling average was around 230k per week. That is some 40% below average. People just around being laid off as much as usual and when they are laid off they are not applying for unemployment insurance. Can it be argued that employers are trying to keep workers and workers who do lose their jobs due to layoffs are quickly getting new jobs?

The author also wrote, “[t]he job market has been historically strong during the past couple of years, providing a firm foundation for hearty consumer spending that has propelled the economy forward despite dueling pressures of elevated inflation and high interest rates.”

Is it true that a historically strong job market leads to more people earning more money and then spending more money? Does spending money by workers who obtain jobs propel an economy forward? Does anyone doubt that a strong jobs market is a boon to an economy?

I know that a statistician would say there are flaws in my methodology, due in significant part to the average age of the immigrants we are adding each year to our overall population being far lower than the average age of our American-born population. I argue that children, wherever born, place different pressures (schools) on an economy than do older people, who have greatly increased medical needs, but a rough estimate of the number of jobs that we need to create each month to keep up with our population growth is fairly simple to determine. If we are adding over 3 million new Americans to our population each year (we are), and if a labor participation rate of 64% is considered a healthy number (63.7% as of last month), then 64% of 3 million new people equals 1.92 million. Divided by 12 means that we need to add an estimated 160,000 jobs per month just to keep up with population growth. Personally, I believe the break-even rate is between 130k-140k new jobs per month, based on years of curious reading, but we have enough economists among the FlaglerLive readership to correct or improve on my estimates. I say “correct” because I could be wrong. I say “improve on” because I could be right, but less right than I could be.

Since Census figures show that just over 500,000 American-born residents were added to our overall population last year, and we need at least 130k new workers each month (maybe as many as 160k), is it reasonable too argue that it appears that we need many more immigrants to fill the both the current unfilled open jobs and all the newly created jobs we keep adding in order to keep our economy growing? That we might just need millions more immigrants, else we risk higher inflation due to pressures on employers to raise wages to compete for too few workers? Is it possible that if we cannot find enough new workers, domestic or immigrant, to keep our economy strong, recession might be in our future?