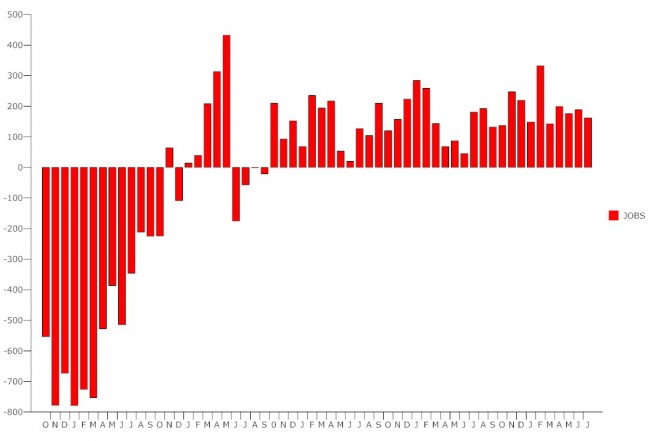

There’s nothing terribly bad about the July unemployment report, released this morning. There’s nothing terribly good about it, either: the economy added just 162,000 jobs, totals for May and June were revised downward–not by much, but 26,000 fewer jobs (for a total of 364,000 over those two months) is a move in the wrong direction. And the unemployment rate’s fall back to 7.4 percent is a two decimal point drop, to the lowest level since December 2008 (when it was 7.3 and skyrocketing). But it is a very slow improvement from the 8.1 percent rate a year ago.

In all, the unemployment picture is a reflection of austerity’s gray slog: with government spending checked by the federal sequester, state and local governments still shy about making large investments in capital or labor, and the private sector continuing to hedge its bets (sitting on cash and employing temporary workers rather than risking larger scale ventures), improvements have been only slow and sputtering, if not slowing.

Earlier this week the Commerce Department announced that the economy grew in the April to June quarter, but by only 1.7 percent, up from 1.1 percent in the previous quarter. The second-quarter figure will be revised twice, and if past trends stick, it will be revised downward. (The first quarter figure was initially 1.8 percent.)

More disappointing news: average hourly wages fell 2 cents, to $23.98, after a 10-cent increase in June. Over the year, average hourly earnings have risen

by 44 cents, or 1.9 percent, not quite enough to make up for inflation. Compounding the problem for laborers, The average workweek for all employees on private payrolls decreased by 0.1 hour in July, to 34.4 hours, and by 0.2 hours in the manufacturing sector, to 40.6 hours. Overtime declined by 0.2 hour, to 3.2 hours a week.

There remains 11.5 million unemployed people in the United States. That’s one of the official figures, representing workers actively looking for work but receiving unemployment insurance. The figure does not reflect those who have dropped out of the job hunt, or those whose unemployment benefits have run out, or those working part time because they can’t find full-time work or because their hours have been cut back.

When those groups are included, the unemployment and under-employment rate stands at 14 percent. In a reflection of the seesawing improvements and setbacks of the employment picture, the so-called U-6 “alternative measure of labor utilization” that includes all those groups actually fell from 14.3 percent the previous month.

In July, the number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 4.2 million, and accounted for 37 percent percent of the unemployed. The number of part-time workers stood at 8.2 million in July. Two other indicators of underlying strength–or weakness–in the labor market, the labor force participation rate (63.4 percent) and the employment-population ratio (58.7 percent) were virtually unchanged.

Some highlights from the employment survey: Retail trade added 47,000 jobs in July and 352,000 over the past 12 months, with general merchandise stores, vehicle and parts dealers, building material and garden supply stores and health and personal care stores all reporting modest gains. Food service and bars added 38,000 jobs. Financial activities employment increased by 15,000, with a gain of 6,000 in securities, commodity contracts, and investments. Wholesale trade added 14,000 jobs, professional and business services added 36,000, with gains in management of companies and enterprises and technical consulting services.

Manufacturing employment was essentially unchanged in July and has changed little, on net, over the past 12 months, a significant change from the previous year. Employment in health care was also unchanged. Employment in other major industries, including mining and logging, construction, transportation and warehousing, and government, showed little change in July.

Alan Krueger, chairman of the president’s Council of Economic Advisers, addressed the unemployment report at the White House blog this morning, but said nothing significantly different from last month’s blog entry.

Other reactions: “The trend in employment growth still looks more than strong enough to keep unemployment trending down,” Jim O’Sullivan, chief U.S. economist, at High Frequency Economics, tells the Wall Street Journal.

Brown Brothers Harriman released this statement: “Fewer people are working, a shorter work week and for lower pay. The Fed’s tapering decision does not rest on a single print, especially of high frequency and noisy data, but on the margins, between the FOMC statement that gave no hint of a move in September, a manufacturing PMI that showed prices falling and now a soft employment report, look for some soul searching by those who thought and acted as if reducing long term asset purchases next month was a done deal.”

Julia Coronado, an economist at BNP Paribas, tells Bloomberg News: “A deterioration in the quality of jobs is a recurring theme in recent reports. Aggregate hours worked fell 0.1% despite job gains as the workweek declined, and wage growth fell 0.1% in July leading the annual pace to slow to 1.9% from 2.1%, partially reversing a modest rebound that had been underway earlier in the year. Despite the decline in the unemployment rate, we think the combination of weak GDP growth and a slowing in hiring reduce the likelihood the Fed will proceed with the first tapering of QE in September. We still see December as the most likely scenario. Hiring had been surprisingly robust in light of slower GDP, but job growth tends to be the lagging indicator and the prospect is for more subdued numbers in coming months. The July report is by no means a disaster, but it does highlight slow progress on the Fed’s mandates.”

Outsider says

Barack Obama; had enough yet?

Lonewolf says

Looks like Obama’s done a fine job since the GOP tanked the economy

The Truth says

George W. Bush – when you think it can’t get any worse, remember me?

Gia says

Most of these jobs are partime jobs

The Truth says

You’re right – and why is this? This is happening because companies continue to avoid paying for their employee’s healthcare. In the society we live in, it’s rare to find a company to pay for your health insurance. Those who have it provided feel there isn’t a problem, but we have a serious problem. Companies continue to pad their profits in ANY WAY POSSIBLE while avoiding to provide benefits like paid leave and health insurance. It’s disgraceful.

Of course, if you’re a Republican you will just blame Obama.

Shocked, I tell you... says

@ the Truth: I blame them both. Now what?

marty says

“Barack Obama; had enough yet? “

I really feel sorry for people like you- you have to be either willfully ignorant or totally uninformed. Were you not alive during the Bush years? Did you not look at the chart above?

We were LOSING 750,000 jobs a month when Obama took office. We’re NOWHERE near where we should be, but to blame Obama as if it’s all his fault makes you one of the above – or a FOX New watcher.

Sherry Epley says

To all those who look to the federal government to create jobs, please “think” beyond the FOX right winged blame game, if you possibly can. Do we really want our government to increase the deficit by hiring more people?

For increased employment, look to the private sector businesses who scour the world for the “cheapest” labor in third world countries, while raking in record profits. . . but only for their over paid CEOs, officers and high level managers. There no longer is loyalty to the American worker. . . the unions are busted. . .the focus is on the “bottom line”. . . and the wealthy are becoming even wealthier. NOTHING is “trickling down” . . . American Greed is showing its ugly face, and we do not want to see it. . . because it is not just effecting the minorities anymore.

Or maybe it is just easier to be a vombie of FOX and blame everything on President Obama. How easy it is to forget the free fall of jobs lost under the Bush administration. The government can’t “buy” us out of this problem.

Outsider says

News flash, people: George Bush has been out of office for nearly five years, more than enough time to get a real recovery going, assuming you’re not implementing policies that defeat each other. Let’s remember, the economic crisis was caused primarily by the mortgage fiasco. Need I remind you that Fannie Mae, which is known to have cooked it’s own books under the direction of Franklin Raines, a Democrat, repeatedly rebuffed efforts to reign in the irresponsible lending practices it engaged in. Raines had no interest in scrutinizing the loose lending policies that netted him 100 million dollars. Yes, when he got caught he happily handed back five million as “punishment.” Nonetheless, the Bush administration tried a dozen times to tighten up the mortgage ship, only to be rebuffed by the likes of Maxine Waters and Rep. Meeks, who was personally insulted that anyone questioned his hero, Franklin Raines. With the resulting credit crisis and loan defaults, the economic crisis of 2008 was born. Along comes Obama, who never ran so much as a lemonade stand to save the day. Through loose money policies (printing) the banks excess reserves went from $48 billion before the crisis to over $1.2 trillion. The money supply, M1 went from $800 billion to over $2.5 trillion in short order. In other words, the liquidity crisis was beyond over, yet businesses still were not borrowing and investing; they really didn’t need to as they eventually ended up sitting on mountains of cash, but they still did not invest out of fear of what The Great One would do next. And that fear was proven justified with passage of Obamacare, another multi-trillion dollar entitlement launched right at the time of the largest deficits in history. With that came more taxes and more uncertainty. Now, we have the fed printing $85 billion a month to put into an economy that’s already floating in Monopoly money, with Obama expecting a different result than the last four years of money printing have given, somehow thinking there’s a correlation between how much money you print and how many high quality, full-time jobs you. Nope, all you get is inflated assets values, higher interest rates, and another bubble to collapse somewhere else.

http://search.yahoo.com/tablet/s?p=video+congress+franklin+raines+defying+federal+regulators&fr=ipad