Last Updated: 9:22 a.m.

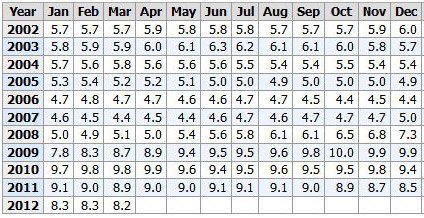

While the U.S. unemployment rate fell to 8.2 percent in March, job creation was disappointing, at 120,000, about half the expected numbers, lending further credence to evidence of a fitful, not robust, recovery.

The Wall Street consensus before the jobs report was released this morning was for 210,000 additional jobs. That expectation was based on a report by ADP, the payroll processor, that some 209,000 private sector jobs had been created in March, with small businesses of 49 employees or less creating half the jobs, and on a Labor Department report released yesterday that showed first-time filings for unemployment falling to their lowest point since April 2008. Those indicators may yet ripple into more positive job-creation figures in May. Meanwhile, the weaker numbers will be fodder for Republican presidential candidates, whose strongest case to replace President Obama depends on an under-performing economy.

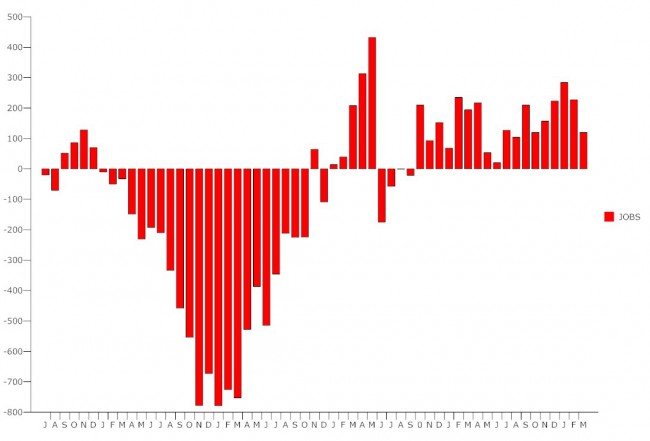

While the economy has added jobs for the 18th consecutive month–and while the 8.2 percent unemployment rate is the lowest since January 2009, when it was 7.8 percent–the 120,000 figure is the lowest since October. And while it adds to a total of 3.6 million jobs created since February 2010, even a monthly job-creation level of 200,000 would be considered weak two years into a full-fledged recovery. And the economy is still very far from recouping the more than 8 million jobs lost since the beginning of the Great Recession, going back to the waning days of the Bush administration and through the first half of the Obama administration.

There were several positive signs in the jobs report. First, the number of people employed part time against their will (because they could not find full-time work or had their hours reduced) fell from 8.1 million to 7.7 million.

Second, the broader, truer measure of unemployment and under-employment, the so-called U-6 measure, which includes all the unemployed, including those who have quit looking for work or those working part-time against their will, fell sharply, from 14.9 percent to 14.5 percent, and is down from 16.2 percent a year ago. So while the unemployment rate is not falling fast, more people are feeling confident that they can re-enter the workforce.

Third, wages are going up faster than they have at almost any point in the recovery. Average hourly earnings for all employees on private payrolls rose by 5 cents, or 0.2 percent, to $23.39. Over the past 12 months, average hourly earnings have increased by 2.1 percent, barely better than the rate of inflation.

A few highlights from the Labor Department’s report: Manufacturing employment rose by 37,000, with gains in motor vehicles and parts (12,000 jobs), machinery (7,000), fabricated metals (5,000), and paper manufacturing (3,000). Factory employment has been a relatively strong point in the recovery, rising by 470,000 since a recent low point in January 2010, but the figure dims somewhat considering that the U.S. trade deficit reached $473 billion in 2011, the highest deficit since 2008, and continued to widen in 2012. In other words manufacturing job creation at home is not what it could be, if exports were stronger. Exports are being depressed by the European debt crisis, a slowdown in the Chinese economy, and higher oil prices.

Employment in March also rose by 37,000 in leisure and hospitality, including bars (what the government likes to refer to as “drinking places”). Health care also added 26,000 jobs. Employment in financial activities was up by 15,000. Professional and business services added 31,000 jobs. Temp jobs were flat.

On the negative side, retail trade employment fell by 34,000, led by a 32,000 drop in merchandise stores (though building material and garden supply stores–the Home Depots and Lowes– actually saw an increase of 5,000 jobs. Employment in mining, construction, wholesale trade, transportation and warehousing, and information, was flat. Government jobs fell by another 1,000.

Stock markets in the United States and Europe are closed today for Good Friday, and the bond market will open for only a few hours, so the market’s reaction to today’s numbers will have to wait until Monday

Yellowstone says

Those that make an issue about the unemployment picture need to look backward 6 years. Who was it that sold your job overseas?

What an amazing demonstration of the actions in 2007 and 2008. What an improvement in the past few years. Do you really believe this dilemma can be fixed with a ‘flip of the switch’?

How long will it take to get all those jobs back – and do you think that will ever happen?

When you go to vote – vote those guys out – or you’ll undoubtedly get another layoff notices.

B. Claire says

New jobs # will continue to grow…despite GOP hopes to the contrary.

This # : Unemployment Down to 8.2%. …going to cause a little heartburn to the rightie oppostion :)

The Truth says

Jobs are being added, and that is definitely a good sign.

The GOP believes in tax breaks for the rich and tax breaks to move jobs overseas to reduce costs of products for those in the U.S. This is a joke.

The GOP is losing momentum. Their failed policies are being exposed each and every day.

palmcoaster says

@Yellowstone. Well said.

First of all citizens get out and vote and vote for the preservation of our jobs, against outsourcing, for our rights and against gouging.

Layla says

Good reading:

The big March jobs miss — and why the real unemployment rate sure ain’t 8.2%

http://blog.american.com/2012/04/the-big-march-jobs-miss-and-why-the-real-unemployment-sure-aint-8-2/

Jojo says

The numbers for unemployment are skewed. It is far from scientific. Today, a lot of the states have reduced the amount of time to receive benefits. Once you complete those benefits the individual is no longer counted as unemployed and disappears from the figures, What happens to these people. Well, move in with parents, friends, give up looking, apply for assistance, beg, food pantries, shelters, welfare, gov’t stipends for college and return for retraining in other areas of employment.

I’m laughing 8.2%. I have a bridge to sell you if you believe those figures.

The Truth says

If you can’t find a job with how long you receive unemployment in this state, it’s time to be a little more open to other positions. I realize we are still in a very fragile state when it comes to the job market, particularly here in Flagler County, but many people who are searching for jobs stick their nose up to jobs that are “beneath them”. We have to be open to doing whatever we can to provide for our family, and if that means working someplace we would rather not work until something better comes a long then that’s what we do.

Gia says

You’ve got leave with the reality of life. There will be no recovery before another 5 years.

Layla says

I would suggest we all do a little reading up on outsourcing. Thought this article was pretty good. You’re going to have to look back a lot further than 6 years ago.

https://wikis.nyu.edu/ek6/modernamerica/index.php/Industry/Outsourcing

Devrie says

I don’t see how anyone can believe that the unemployed in Florida would rather be unemployed then have a job. The maximum benefits you get are minimum wage regardless of your prior income. If you lose a job that pays $50,000 a year, and you can’t find work that even matches $30,000 (which is usually the case in FL), you’ll only get the 14K from unemployment. Florida motivates people to get jobs. Most people would take a job over the bare minimum they get on unemployment. The jobs just don’t pay very well. If unemployment is declining in FL, then I’d guess it’s got more to do with people moving out of state then anything! LOL

marty says

“The jobs just don’t pay very well”

And why would they? For how many years has Florida been marketed to the “job creators” as a place that’s “business friendly” and “has a low cost of doing business”? What do you think they mean by that?

(Whisper)- “We don’t have unions here, and you don’t have to pay very much”.

What kind of economy are we hoping to build with low-wage, part-time work?

Question to the “job creators” – (from personal experience) – If, in your job solicitation and/or your actual orientation material, you tell me that as either a prospective or an actual employee, that I am the most important part of your business, the face of your company, and that your very success is dependent on your customers’ interaction with me – if those are your words, what should I expect to find when I look at the salary scale? Let’s see…..nope, don’t see my position there…..let’s go down….nope, not there…down further…nope…hmmmmm, here I am- right at the bottom- the minimum wage. (Which tells me that if the law allowed, you’d pay me even less)

Now, Florida’s minimum wage is higher than the Federal minimum, so that’s good, right? Let’s see……where does that put me now? Wow- 8 cents an hour more.

So….nice words, but your real value of me is a number….and not a very good one.

Add in the number of people who have “found a job”, but one paying 1/2 or less of what they made before, and the real unemployment problem is way worse…but, the recession’s over, right?