The Flagler County administration issued a tightly argued and at times caustic memo that draws a line between facts and polemics and between legal and speculative arguments in the ongoing debate over school impact fees,. While it corrects the school district in no uncertain terms on several points of law–or math–it also comes close to ridiculing the Flagler Home Builders Association’s arguments as simplistic. It also appears to forge a way out of the impasse for the County Commission.

impact fees

School District’s Request to Double Impact Fees Turns Into Hostile Inquisition by County Commission and Builders

In an unexpected turn, what the Flagler County school district thought was a mere formality before the County Commission turned into a 90-minute grilling by commissioners and a parade of doubt by builders who consider the district’s request to double impact fees ill-thought and ill-timed.

In ‘Huge Deal,’ Flagler School Board Votes to Double Impact Fees on New Construction, 1st Increase in 16 Years

The school board in a series of unanimous votes Tuesday approved a doubling in school impact fees, the one-time levy imposed on new construction and designed to defray the cost of new schools required by a growing population. The “huge deal,” in the words of Board Attorney Kristy Gavin, will increase the single-family home impact fee from $3,600 to $7,175.

New Law Bars Local Governments from Increasing Impact Fees More than Once Every Four Years

The law now in effect prevents local governments from increasing impact fees more than once every four years and limits the increases to 50 percent. Increases between 25 and 50 percent would have to be spread over four years. Smaller increases would be phased in over two years.

Palm Coast Council Raises Parks and Fire Fees on Builders, Largely Returning to Pre-2012 Levels

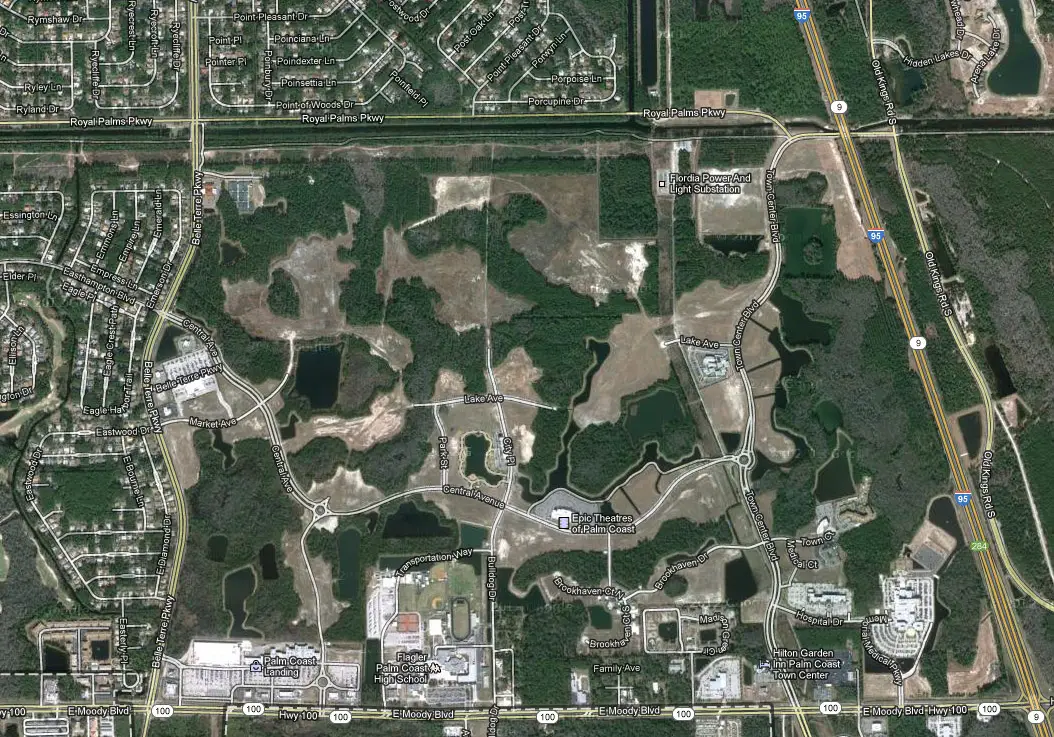

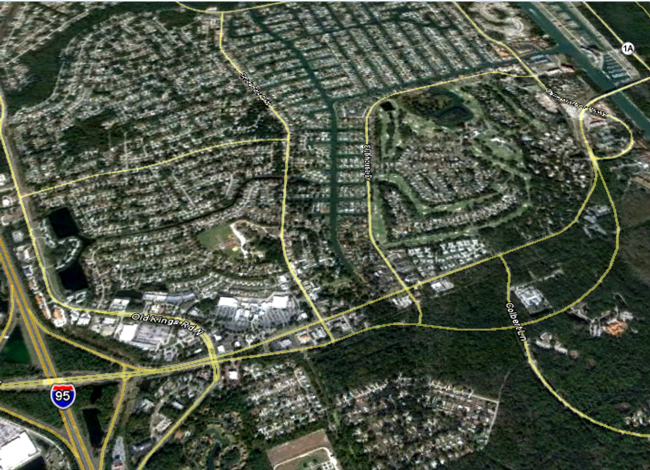

The Palm Coast City Council voted to raise fire and park impact fees, the one-time levies builders pay on residential and commercial construction. The fees will defray the cost of a new fire station in Seminole Woods and a new community center, among other plans.

Palm Coast Considers Sharply Raising One-Time Fire Levies on Future Homes and Businesses

Homeowners would see a negligible impact on fees despite a proposed 65 percent increase in the one-time levy assessed on a new home, a cost generally folded into the price of that new home. The impact fee is not levied on existing homes.

After 8-Year Moratorium, Flagler County Will Get Back To Taxing Development for Roads and Possibly More

Flagler County government today hired a firm to study impact fees, or one-time levies on new development, to pay for roads, parks, libraries, fire rescue and public buildings in what could be a significant addition to county revenue by 2020.

Palm Coast’s Ambitions for More Parks Soar, But Development Tax to Fund Them Declines

Palm Coast’s park impact fees levied on new construction are about to decline by a few hundred dollars, though the city’s ambitious plans for new parks and recreational facilities over the next few decades are unchanged.

In Startling Confrontations, DeLorenzo Takes On Palm Coast’s Jim Landon–and Impact Fees

Palm Coast City Council member Jason DeLorenzo on Tuesday questioned the veracity of City Manager Jim Landon’s numbers and his “backroom” style while making the case for a two-year moratorium for impact fees on new construction in the city in a rare, direct and sustained public challenge to the assuming city manager.

Flagler School Board Rejects Building-Tax Cut, a Blow to Builders and the Chamber

Chamber President Doug Baxter had hoped Palm Coast would “fall in line” with a building-tax moratorium of its own if the county and the school board adopted one. The county did. The school board refused to go along Tuesday evening, calling the proposal irresponsible.

As Expected, Flagler County Suspends $1,707-a-Home Building Tax for 2 Years

The county’s moratorium is relatively small, but Flagler’s chamber of commerce and its home builders association hope to get the school board to approve a moratorium next, then move to Palm Coast, where impact fees add up to $15,270.

As Flagler Governments Consider Impact Fee Cut, Evidence of Economic Benefit Is Slim

Builders and developers want the Flagler school board and Flagler County to cut impact fees–the one-time tax on construction–saying it’ll help the economy grow. But plenty of evidence says it won’t, while Flagler residents still reel from low values and empty houses that more new houses won’t help.

Impact Fees: What They Are, Who Pays Them, How Much They Pay

Whether you call them impact fees, taxes or hidden taxes, they’re a Florida and Flagler County reality. An explanation and definition of impact fees with a local rate schedule by city and county.

Palm Coast Maps Out Gentler, Kinder Impact Fees on Developers, But Questions Arise

The one-time impact fees developers pay when they build something would be lower for residential construction. Builders would get discounts for paying up front, or get to pay them on an installment plan.

St. Johns Raises Impact Fees on Residential Construction, Decreases Them on Commercial

St. John’s decision to raise impact fees on residential construction contrasts sharply with discussions in Flagler, where developers and some elected officials want a moratorium on fees. Flagler’s fees are considerably lower than St. John’s.

Impact Fee Challenges in Florida: Legislature Moving to Neutralize Local Governments

Local governments are challenging a 2009 law they consider an unfunded mandate that shifts the burden of proof from developers to governments in impact fee challenges. In a boon for developers, lawmakers are rewriting the law to make it challenge-proof.

End of the Trail for New Palm Coast Parks As Money and Visionary Plans Dry Up

Despite a deficit of park acreage in the city, Palm Coast doesn’t plan to build another park for several years. In a concession to homebuilders, nor doesn’t it plan to change the fees levied on new construction to ensure more robust park financing in future.