The Palm Coast City Council is moving toward a plan to raise water and sewer rates 28 percent over the next four years and borrow $456 million over the next two years to finance some of the $700 million in repairs, expansions and new construction of a water and sewer infrastructure under strain from age and rapid growth.

The two bond issues would dwarf all previous city bond issues and its existing total debt, which stands at $134 million. The rate increases would, for a household using 4,000 gallons of water a month, result in bill increases of $40 a month by October 1, 2028, or an annual increase of nearly $500–more for households consuming more water.

Palm Coast Mayor Mike Norris and Council member Ty Miller, over Council member Theresa Pontieri’s dissent, gave the administration direction to draft an ordinance that would sum up that approach and go before the council and the public at two public hearings, on March 4 and March 18, fr approval. The hearings are likely to draw large and possibly angry crowds. If the council’s history is any guide, that kind of response may change the council’s direction, though Norris and Miller repeated a half dozen times Tuesday evening the metaphor of the can having been kicked down the road for too long. They are not willing to kick on.

Pontieri was willing to approve financing the $265 million for the most urgent need: the $265 million modernization and expansion of Waste Water Treatment 1 the sewer plant, and perhaps even $315 million for a planned third sewer plant. Beyond that, additional plans should be financed wither with grants or a longer timeline that allows existing revenue to limit the hit on rate-payers. Meanwhile, “Reconsider this total package. Just reconsider it and look at what that rate would look like for our taxpayers,” Pontieri urged.

That’s what happened in November on the council, Miller said, when the council bet too much on receiving state appropriations to defray local costs. It didn’t happen. “I’d rather just rip the band aid off and fix the system,” Miller said. “That’s what I ran on. I obviously did not run on raising your rates and putting more bills towards you. But we can’t continue to operate where our water systems are not doing what you deserve.” He added: “We can plan for success without help, but if we receive that help, we have the opportunity to reduce those rates in the future.”

According to the plan presented to the council at an evening workshop Tuesday, 70 percent of the funding program would be financed with long-term debt: the first bond issue would be $284 million, and would be issued as early as October 2025, coinciding with construction at Waste Water Treatment Plant 1 starting at the end of the year. The second would be $172 million, in October 2027. The remaining costs would be paid through customer rates and impact fees, which would also, of course finance the bonds.

Norris said that that scenario leaves the door open to reconsider the size of the second bond issue and possibly limiting future-year rate increases.

The council discussed the matter over a three-hour segment of its first-ever evening workshop, with sparse attendance. Murray Hamilton, a certified public accountant and Vice President of Raftalis, the consultancy Palm Coast hired to draft a “gap analysis” that outlines the gap between city’s infrastructure needs and its revenue, and how to close it, presented the findings alongside Carl Cote, the city’s stormwater and engineering director. Council members Charles Gambaro and Ray Stevens were absent. But Gambaro has spoken of the city’s urgent infrastructure needs in terms similar to Miller’s, suggesting that the council has the votes to move forward with the most ambitious infrastructure plan in the city’s history.

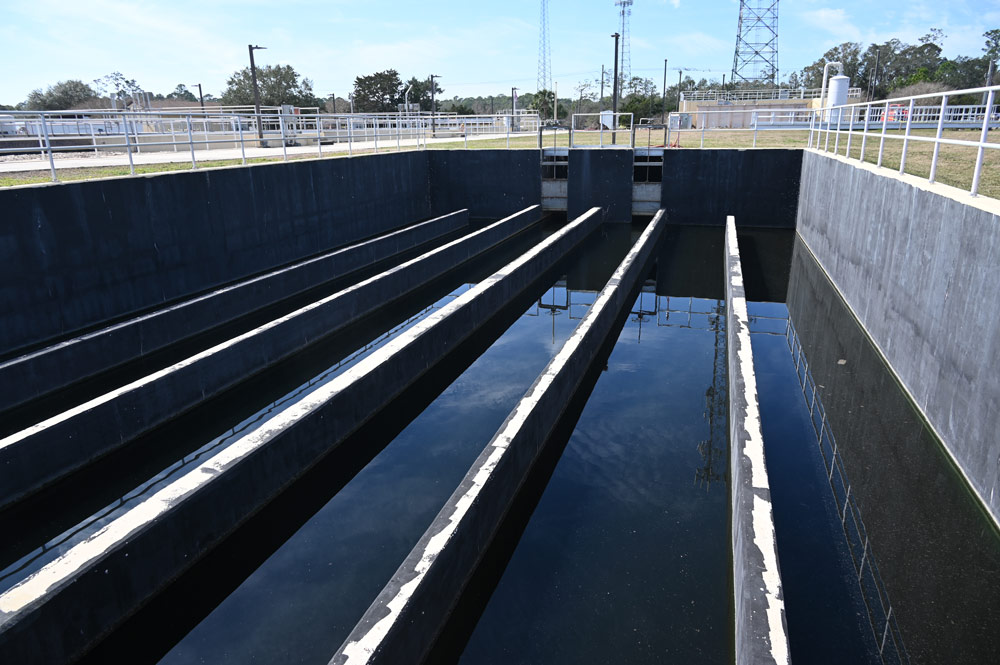

Beyond the most critical needs at Waste Water Treatment Plant 1, which is under a state consent order because it’s often over capacity, the consultant and the city list nine additional projects that need financing. Those include a $58 million expansion of two of the city’s three water plants, $27 million for wellfield expansions, $25.6 million to upgrade the city’s PEP tanks, and numerous other projects. The list is not exhaustive.

The city is also planning a third waste water treatment plant. Where will it go? That’s not clear yet. That’ll be driven by the gravity center of future development. “We don’t know where people are going to build,” Cote said. The cost of that plant was not listed. The third plant will not be needed for current entitlements–the remaining ITT lots in the older portion of Palm Coast, or the subdivisions the council has approved to date.

The consultant places the cost of the wastewater treatment plant’s improvements at $265 million, not the $240 million council members were given as recently as last week. When he adds all the other necessary utility infrastructure projects the city has identified, the overall costs rise to $700 million. “We believe the use of revenue bonds is an appropriate means to recover those costs from customers who will benefit from the improvements over an extended period of time,” Hamilton said.

The utility has revenue of $70 million, without impact fees. That will rise to an estimated $79 million by 2029, by Hamilton’s calculation. Hamilton’s figure appears to be grossly low-balled. Between 2016 and 2021, revenue for water and wastewater, including charges for service and impact fees, increased from $28.2 million to $66.7 million, or by an average increase of $7.7 million per year. That average includes years when impact fee revenue was very low. Excluding impact fees, revenue grew from $27.8 million in 2016 to $47.7 million in 2021–an average of $4 million a year.

Absent a severe recession, it is almost inconceivable that, based on current trends and the city’s own bullish projections, average annual growth will suddenly slow to $2.2 million a year. The low-balling appears to be designed to make the overall proposal for steep rate increases and bonding figures justifiable.

Based on current numbers the utility is covering its operating costs, leaving some $30 million to finance debt, reserves and capital expenses. In Council member Theresa Pontieri’s estimate, almost $18 million could go toward repair or renew and replacement, or “R&R.”

That breakdown bluntly and unequivocally shows that growth does not pay for itself–not by a long shot: while impact fee revenue will assume a share of the debt financing, rate-payers will bear the heavier burden for two reasons: first, while impact fee revenue fluctuates up and down, rates do not, and only go up. Bond-holders look at rates before they look at impact fees, knowing that in a downturn, rate-payers will be filling the gap. Second, impact fee revenue may be applied only toward expansion of plants or new construction of plants–not repair and replacement.

“There are some limitations with” impact fees, Cote told the council, “because it’s not guaranteed revenue, so you can’t pledge only future impact fees that may or may not come to fruition.” That “pledge” is to bond-holders.

The figures underscored Pontieri’s opposition to lumping all projects on the back of bond issues and locking in higher rates. “Our current residents, due to the exponential amount of growth very quickly, are having to pay for that growth,” Pontieri said. “And I’ve said it from this seat, and I’ll continue to say it from this this seat. I am ardently against that. I think that growth should be paying for itself.” She concedes that it never does. But for that reason, she’s willing to finance the $265 million sewer plant, but not beyond that for now. “I’m seeing $265 million as a big ask already, so we got to stop it somewhere,” she said. “My position is that we need to trim this down even more.”

To Pontieri, the utility is generating enough revenue to cover operations and maintenance, with additional revenue that goes to debt service and capital improvements, but not the $15 million a year in needed capital maintenance. Operating expenses represent only 55 percent of the operating budget, with debt service and capital improvements and maintenance accounting for the rest.

“To me, if we weren’t relying on taxpayers to pay for all of these, sure, let’s do them all. Why not? But we are. So I have to think to myself, what do we absolutely need in this moment? And for me, the only thing we need in this moment is expansion, rehabilitation of Wastewater Treatment Facility 1. These other items that are on here, yeah, I agree that these probably need to get done at some point. But do we need to raise rates at this level over the next five years? Because you’re talking about a lot. The percentage over in that aggregate is a lot of money.” She does not expect bills to go down if more revenue is generated. So the rates must be set at the right point now. “If we overshoot this,” she said, the money won’t come back to rate-payers.

But several of the additional projects are there to prevent the city from facing another consent order from the state, Johnston said, while Hamilton discouraged looking at the two bond issues as if one were optional. They go together, he said.

The original cost of Waste Water Treatment Plant 1’s upgrades and expansion was placed at $80 million several years ago, Miller noted. “It was pushed down the road, and now it’s $265 [million],” Miller said, “so if we’re talking about cost savings, paying for it sooner than later, or getting it started now, when we can capture that cost before it grows, it is a service to the community. Because of that, I’d rather be paying some of this stuff now, than asking in four years to raise rates again, extremely.” (The initial $80 million was for the expansion of the plant only, and a more limited expansion than now planned, and not for its conversion to modern technology.)

“We just have to go through the process of shifting that weight over to unburden those people in that monthly bill as far as their city utility,” Norris said. “But we can’t keep kicking the can down the road.” He added: “We have to do it. We don’t have a choice in it.” He said the can-kicking has been happening for more than a decade. That’s not quite accurate: Last November’s kicks aside, the council raised impact fees and utility rates in 2018, and raised utility rates in 2011, both times for five-year cycles. It just did not plan for a boom-bust-boom cycles that threw population and demand projections out of whack.

Last November, the city administration recommended a 21.5 percent rate increase that would have phased in from May 2024 to October 2026. The administration also recommended increasing development impact fees for water 35.72 percent over the same time span, and 25 percent for wastewater. (See the proposed chart here.) The council voted to forego the rate increase and only raise impact fees. It was as if the council were can-kicking Rockettes.

Palm Coast was not yet under a consent order from the state to expand Waste Water Treatment Plant 1–the conversion of its technology alone costing $90 million, and the expansion costing $180 million. That consent order has been a masked blessing for the administration and the council, because it has given both the necessary cover to craft the enormous infrastructure package and tell the opposition: we have no choice.

Miller asked about consequences if the city does not satisfy the consent decree. He only got half an answer: the city would face fines if it does not comply with the order by 2028 or complete projects that would invalidate the fines. The fines are not burdensome: What he wasn’t told is that if the city violates its consent order, bond-rating agencies would punish the city with a downgrade, which would substantially increase the city’s cost of borrowing and financing its needed capital improvements. Those cost increases would be measured in the millions, compared to the thousands, in fines from the Department of Environmental Protection. “Generally, the higher the credit rating assigned to the bonds, the lower the interest rate on the bonds due to a lower risk,” Hamilton said.

In the end, it’s not entirely the council members who are voting, but the bond-holders.

![]()

KLR says

Don’t you think that you all should’ve been working on the infrastructure that’s the roads are water sewer all that before all of you just went crazy with approving these subdivisions where there’s hundreds upon hundreds upon hundreds of homes being built. Palm Coast utilities are so ridiculously expensive and I don’t know how anybody can afford the water and sewer bills And now you wanna go raise the rates again. Poor planning on your part should not mean that those that reside within your city limits need to bear the brunt of that meaning they should not have to be settled with an almost 50% increase in their water sewer rates.

Terry John says

“Growth should pay for itself” Maybe the realtors think the prices of unsold palm coast homes are due to high impact fees. Putting the funding on the rest of us with… fixed incomes. Id like to know funding priorities for the new tennis center, road resurfacing, a new utilities garage, & whatever else increased water bills & property taxes this town thinx the tax payers can afford. Priorities indeed.

the other Doug says

Politics is the only place where failing to plan means planning -for someone else- to fail.

This council has been done dirty by a decade of passed councils who rubber stamped every development and refused to put any money into infrastructure.

Still, the fact that the citizens of PC now have to bear the financial burden of a decade of poor planning is ridiculous.

Sue says

Lets not forget the past few years who approved all the housing! A few realtor on city council didn’t help!! I just drove citation Blvd end to end and I couldn’t believe all the land clearing and how much Gran Landings has added its insane and the new development down towards hwy1 !! Seminole will be another Belle Terre and wait for all that traffic on 100! Stop any new approvals of building!!!

me says

Poor planning as usual. We can thank Alfin and all his building buddies that were throwing up developments on every spare piece of land they could sink their teeth into for greedy profits.

Let have them all pay for the increases, stop penalizing the taxpayers of Palm Coast.

Joey says

It’s time to start trimming budgets – especially the circus act in charge of planting and replanting and replanting trees and shrubs !!!

Tony says

This is what you get when the leadership is all republicans !!!!

Dennis C Rathsam says

Call on Stuff em In Alvin, tell him to write a check. GROWTH is the cause of this, the stupitity of mayors Netts{ RIP} to now. How do you folks live with yourselves? You’ve gone hog wild? Who has an extra $ 40. a month? Seniors on a fixed income will be hurt the most, then families with children. In essence, your kicking us out of Palm Coast! Each new home should have a $ 7,000 dollar water fee! Why should the people suffer who,ve been here already ? 10 years here you pay 1/2! Maybe I.ll drill 4 free water…..

PB says

Maybe we can make the national news. Everyone has to be #1 at something. You can fill in the blank.

Palm Coast Florida is #1 at _____________

BillC says

Glub glub glub more development is drowning PC deeper into debt.

Endless dark money says

Haha it’s not just seniors the endless greed has priced normal folks out of life. If had health insurance through my job . I would spend 1 paycheck for rent the other for insurance. Maybe 200 left over for the month to support a family and I make over 60k. Needless to say we are uninsured haha. Hell companies today can make you “exempt” for 38k per year so it doesn’t matter how many hours you work. This whole country is a scam to make the billionaires even richer. Time to start over.

Late To The Party says

Will impact fees also be raised at the March 4 and March 18 meetings?

FlaglerLive says

No. Only the consumer rates.

Land of no turn signals says says

Great job raises all around.

Foresee says

The mirage that more development = more prosperity is selling Palm Coast down the drain.

Wtf says

This city is ran like a circus. We need to put a microscope on all the city departments, and start trimming some fat. Every time I see a city worker in my neighborhood, you have 2 working, and 3 standing around, same goes when you walk into the city building. So much waste I can see it easily from the outside, I could only imagine digging deeper. These people are out of control, and punishing its residents at almost every turn.

The dude says

Of course the previous councils were also duly elected. And I have no doubt in my mind whatsoever that some of you here voted for those council members.

Some of you seem to forget this in your efforts to escape your own accountability for this whole farce.

T says

So it’s the city’s fault rapid growth but we pay the price why they get millions to build lmao sound like vote regrets lmao

S. Peters says

This is what happens when you keep voting for money grubbing Republicans. Sorry, but it’s the truth. Tried to go over the toll bridge yesterday and traffic was backed up going east. I thought there was an accident or emergency. Toll guy said it’s always like this now. Hmmm, been here since 97. hasn’t always been like this. Way too much traffic, people in this small county. We don’t have the infrastructure to handle all these people. But cha ching!!! Developers are happy and they don’t have to live here.

Down the drain says

Impact fees collected for this are gone ? Where and for what ?

JimboXYZ says

For the resurfacing of roads that is short of repaving them to kick the can down the road again. I warned that it was too ambitious to grow for the “Vision of 2050” during an inflationary Bidenomics from day 1 in 2021. the only money spent should’ve been on infrastructure to support a population of 92K, not the growth to 130+K. Bunnell should get 8,000 new houses & Palm Coast should’ve never grown as fast as it did. If Developers truly had to pay the environmental impact fees that reflect the real costs of their development they wouldn’t have put together those proposals and if the City knew wtf they doing, they would’ve made sure that Biden’s Build Back Better was actually funded. This was nothing more than the fiscally incompetent experts shifting the burden on those that don’t have the cushions of money to be paying for it all. Who in their right mind expands & grows when interest rates go up for financing this lack of Vision of 2050. Whoever came up with that slogan has no vision, isn’t an expert. Instead of having a solid community of stable owners for the future, we will have a debt ridden unstable economy of transient renters. As these properties age, wait another 20 years when all of them need repairs and the parasites that have been milking them for rental revenue income sell them off or needing new roofing, HVAC, water heaters & windows. It’ll be the same cycle of Bidenomics & Bush era property flipping that has always been fraud & abuse.

FlaPharmTech says

Rates are already high. How about a sliding scale. We have 2 adults in our home, mother nature attends to the watering of vegetation. We don’t wash our cars. We flush much less than a family of six.

Oh, and HALT all new buildings that require a toilet or 2 or 3 or 4 or 5 (Hammock mansions) until this is fixed!

I’m literally and figuratively sick of this crap.

Tom says

I made a mistake to retire here! I have decided to get out of this overbuilding, overpopulation city. This is way to much stress for a retirement! Im moving out of this hell hole miserable traffic town for a nice small town bacl in West Virginia 👍

Joe D says

Reply to KLR:

Yes, indeed, you would think that these “kinda” mandatory repairs/improvements would have been made long before now, but HERE WE ARE….facing BOTH fines for not following the State Consent decree AND to have our BOND RATING…like the City’s “Credit Score,” sink costing us $millions more in interest, for borrowing any money in the future.

The reason these repairs were “kicked down the road,” is likely that Politicians wanted to keep getting re-elected, and raising all these fees and rates wouldn’t make them very popular , AND people were going to get ANGRY (no kidding)!

Well here we ARE….we can’t put this off any more. In a recent comment on this BLOG, I suggested that the WORKABLE option was to raise 1/2 of the cost in fees, and borrow the remaining 1/2, and finance over 5-10 years…what my prior pre-retirement City did to replace the water lines and sewer lines over a 25 year period…looks like that’s the best (although still painful) option.

Tony Mack says

We’ve been here now going on 15 years and have seen many changes imposed, neglected, ignored and altered by all the so-called expert council members. Really — my 13 year old granddaughter runs a better Sim City on her computer than anyone who was ever elected to run Palm Coast.

As Mayer of her SimCity, roads are built, industry thrives, schools expand, and taxes stabilize to meet growth. But hey, she is only 13…

NJ says

“We the People” of Palm Coast DEMAND that the $107,000,000.00 Approved for Palm Coast Westward Expansion Road Loop be TRANSFERRED to the Palm Coast Waste Water Plant #1 Expansion Account! Also, Palm Coast must STOP issuing Building Permits-NOW because there is NO place to send additional Waste Water! The GREEDY Developers KNEW that Waste Water Plant #1 could NOT take any additional Waste Water! “We the People” of Palm Coast are NOT going to pay for the Profits of Greedy Developers! Time to UNITE and MARCH AGAINST the GREEDY Developers! If the Greedy Developers suite the city of Palm Coast, then “We the People” of Palm Coast must suite the Greedy Developers!

Crystal Lang says

NJ – You forgot to mention a few things. 1) The new building that they really do not need. During COVID they all worked from home and I’m sure everything got done, so why do they need a new building. 2) Mayor and Counsel members should have given up their salaries since we are the ones who pay them for not listening to us. So the current Mayor and Counsel should give up their salaries. 3) they really need to forget about the roads for right now cause with the increases we are getting slammed with I will be using my gas money for that so I for one will not be out on the roads because I will have no money for gas. 4) The fixing of the bumps on Belle Terre should be eliminated, it should have been done the right way the first time around. The bumps are just fine. And lastly 5) at the most it should take 2 employees to dig a hole not 5 (1 digging and 4 watching).

My sewer thing on my lawn was cracked 1 year after it was installed. The city hired a company to take it out and install a new one ok great thank you however, the company they hired drove over my newly regraded swale and damaged it. Contacted the city filed a claim and guess what it’s now going on 2-1/2 years and they still have not addressed the issue. My claim has been closed out by the city 3 times. But I guess I should not complain because I get to have lakefront property again without having to pay the extra taxes. And taxes that’s a whole other story for another day.

John Stove says

#1 Building Moratorium NOW….until Utilities have caught up

#2 Reduce all budgets to just fund CORE SERVICES (Roads, Water & Sewer), no Parks, Golf Course etc etc funding

#3 Stopping purchasing new fleet equipment, maintain what you own instead

This is the worst run city i have ever seen….does no one know how to do 10-15 year Capital Improvement planning along with subsequent funding?

Imbecilic Morons

Pig Farmer says

But they will spend OUR money on a fancy new operations building AND were pushing for an expensive sports facility. Let’s not forget the loop road out west that would be paid by us, but benefit developers.

CathyP says

Has anyone taken a closer look at the costs? Can a governing body of people who do not have the deep knowledge or experience (project management, cost estimates, timelines, operating and budget allocation, etc) really be well-equipped to handle an infrastructure project if this magnitude? Who has the contracts? How were the bids handled? Is this the best, most efficient and forward-thinking process? Is there any “fluff” in this expenditure? Can the builders who are clearly benefitting from the explosive growth shoulder some of this expense?

No easy solution but trying to push the financial burden onto the backs and wallets of the taxpayer without complete transparency, common sense and educated analysis is a recipe for disaster

Just Saying says

Hey Palm Coast, just keep listening to the realtors and developers, they don’t have an ulterior motive.

Nephew Of Uncle Sam says

You all got what you Voted for over the years. Keep on Voting for the GOP and maybe it will get better, HA!

Laurel says

I said a couple years ago, that growth never lows your taxes. Well, here we are. We can call it mismanagement, but to me, it looks more like the voted in real estate people, who kept their friends, and developers, happy, not constituents. They got what they wanted, and now most of them are gone, and the public is holding the bag. Yet, development continues, with claims from our representatives that they cannot stop people from doing what they want on their own properties. But, zoning is constantly changed to give developers what they want.

“Westward Ho!” Cried Alfin.

This is greed, but it is not gentrification. Sorry, but the houses that will be left behind will not appeal to the rich, nor will the swamp land they were built on. People will leave, and find more affordable living, with a better quality of life, elsewhere. Those “jobs, jobs, jobs” will not be filled, and tourism will begin to fail. The planning, and abuse of this city is untenable.

We moved to the Hammock because it reminded us of old Florida, it was rural, and we could cross the bridge for a city. Palm Coast has been f**king it up ever since. Such a shame. The greed of the real estate people, their place in civil office, and the excessive development has ruined the area. Now, since local government loves to charge the Hammock 25% more, we will be hit extra hard for the city’s lack of proper growth maintenance even though we are not a part of the city.

Such narrow, selfish thinking on the part of these real estate people. Let’s see how easy it will be for them to sell a house in the near future.

John says

I would say at least 60 percent of these costs from “growth” should be paid by the developers and homebuilders creating these communities. If growth was because people hired homebuilders on scattered lots, that’d be one thing and much more paced. The issue doesn’t stem from THAT growth. It stems from 4,000 homes in a couple years in planned subdivisions.

Paul says

Tree city, when we built a holiday builder’s home on Kathrine trail we called mayor Holland, about saving some trees on our lot. She said it was entirely up yo the builder’s. Wow N.J. is same junk. We recommend they change the name from tree city. 4 per acre is a short cut to over crowding. 1 or maybe 2 in family emergency. But 4 is the narcissist greed . Narcissist run for office. They have no integrity. Look it up stop voting for psychopaths like Don trump. Runio. Graham etc

Rick L says

Maybe we need Elon Musk here in Palm Coast to reveal why .. maybe let’s go back to when these huge builders are coming in and the building department along with Jason Delarenso waive impact fees either eliminating or cutting then in half

Those impacts are what suppose to finance new interstrucure not the residents that already had paid those fees when they had built. This the kick back that happens when you have fixes guarding the peoples hen house!

Crystal Lang says

Has any0ne read the interview on Palm Coast Observer with Ayres, McMillan, DeLorenzo, Johnston and Cote. It’s very interesting. I would like to read some comments on that interview.

Paradise Lost says

I’ve said it many times on this site, the Florida housing boom is bust, it’s over. Home prices are plummeting. Good luck selling a home in PC today. A fact the greedy developers and politicians seem to ignore.