By Jeffrey Kucik and Don Leonard

The Biden administration is likely celebrating a better-than-expected jobs report, which showed surging employment and wages. However, for millions of working Americans, being employed doesn’t guarantee a living income.

As scholars interested in the well-being of workers, we believe that the economy runs better when people aren’t forced to choose between paying rent, buying food or getting medicine. Yet too many are compelled to do just that.

Determining just how many workers struggle to make ends meet is a complicated task. A worker’s minimum survival budget can vary considerably based on where the person lives and how many people are in the family.

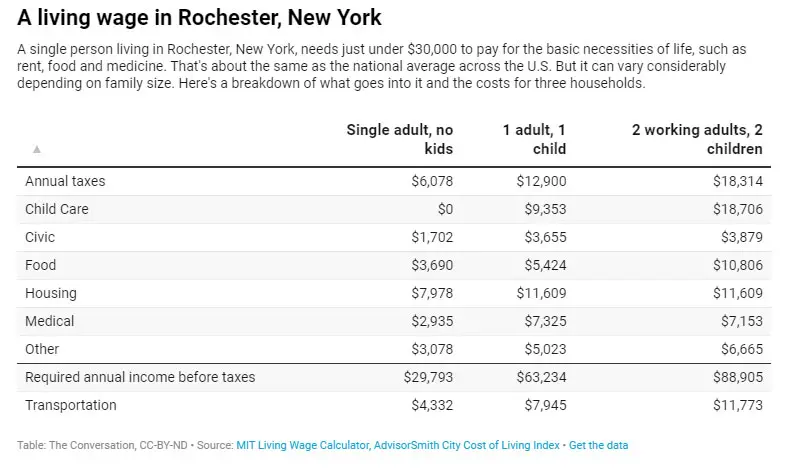

Take Rochester, New York. It has a cost of living that’s closest to the national average across 509 U.S. metropolitan areas, according to the City Cost of Living Index compiled by the research firm AdvisorSmith.

MIT’s living wage calculator shows that a single adult living in Rochester needs at least US$30,000 a year to cover the cost of housing, food, transportation and other basic needs.

But in San Francisco, which AdvisorSmith data indicate is the U.S. city with the highest cost of living, affording just the basics costs $47,587, mainly due to significantly higher taxes and rents.

The city with the lowest cost of living is Beckley, West Virginia. Even there, a childless worker still needs to earn about $28,200 to make essential ends meet. Again, the average American city has a cost of living of around $30,000 a year for a single person.

Of course, costs add up quickly for households with more than one person. Two adults in Rochester need over $48,000 a year, while a single parent with one child needs more than $63,000. In San Francisco, a single parent would need to earn $101,000 a year just to scrape by.

So that’s what it takes to survive in today’s America. About $30,000 a year for a single person without dependents in the average city – a little less in some cities, and much, much more for families and anyone who lives in a major city like San Francisco or New York.

But we estimate that at least 27 million U.S. workers don’t earn enough to hit that very low threshold of $30,000, based on the latest occupation wage data from the Bureau of Labor Statistics, a government agency, from May 2020. We believe this is a conservative estimate and that the number of people with jobs who earn less than what’s necessary to afford the necessities of life is likely much higher.

Low-income occupations encompass a wide range of jobs, from bus drivers to cleaners to administrative assistants. However, the majority of those 27 million workers are concentrated in two industries: retail trade and leisure and hospitality. These two industries are among America’s largest employers and pay the lowest average wages.

For example, the median salary for cashiers was $28,850 in early 2020, with 2.5 million of the nation’s 5 million cashiers earning less than that. Or take retail sales. There, 75% of workers – about 1.8 million – were earning less than $27,080 a year.

It’s the same story for leisure and hospitality, the industry that took the hardest hit from the COVID-19 pandemic, hemorrhaging 6 million jobs in April 2020 as much of the U.S. economy shut down. At the time, close to a million waiters and waitresses were earning less than the median income of $23,740.

Of course, millions of those jobs have returned, and wages have been surging this year – though only slightly more than inflation. But that doesn’t change the basic math that roughly 1 in 6 workers is making less than what’s necessary for an adult with no kids to survive.

That’s why it’s hardly surprising that 40% of U.S. households reported in 2018 that they couldn’t afford an emergency $400 expense.

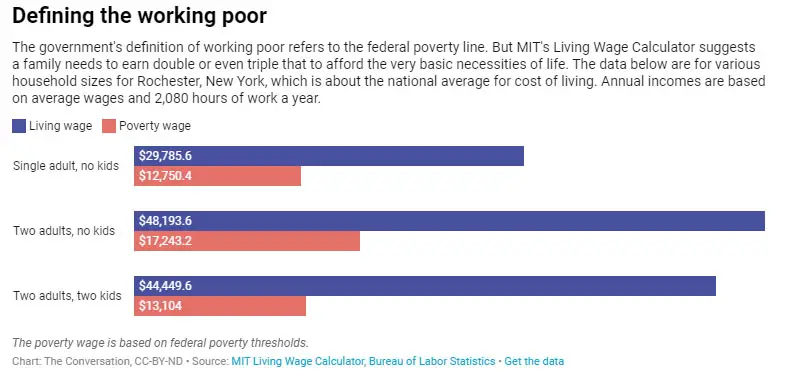

To us, these figures should cause policymakers to redefine who counts among the “working poor.” A 2021 Bureau of Labor Statistics report estimated that in 2019 about 6.3 million workers earned less than the poverty rate.

But this situation drastically understates the scope of the working poor because the federal poverty line is unrealistically low – only $12,880 for an individual. The official poverty line was created to determine eligibility for Medicaid and other government benefits that support low-income people, not to indicate how much a person needs to actually get by.

Writer James Truslow Adams coined the phrase “The American Dream” in 1931 to describe a society in which he hoped anyone could attain the “fullest stature of which they are innately capable.” That depended on having a good job that paid a living wage.

Unfortunately, for many millions of hard-working Americans, the “better and richer and fuller” life Adams wrote about remains just a dream.

![]()

Jeffrey Kucik is Assistant Professor of Political Science at the University of Arizona. Don Leonard is Assistant Professor of Practice in City and Regional Planning at The Ohio State University.

![]()

![]()

Jimbo99 says

This should be the poverty line, not the Government’s $ 12.9K/year nonsense. That $3K/year for healthcare, that’s just the monthly premiums. If you actually get sick there are the doughnut holes in Unaffordable Healthcare that are out of pocket to you. This really is a 6 figure income per year world if you want to live like anything more than an abused & neglected pet by any employer. Demand better from them. Otherwise the execs are stealing your best life and leveraging your labor & good health to line their pockets. Ask yourself why Bezos & other billionaires can develop redundant space programs and you’re eating crappy Ramen Noodles ?

cgm says

work 80 -90 hours a week like I did so I could get ahead and then retire at 60. stop whining.

Stretchem says

It’s a different world my man. There are no pensions. There’s very little corporate profit sharing. 401k’s rarely get matched anymore. Even employee healthcare premiums are through the roof now. Corporate loyalty is dead, thus in turn there’s no employee loyalty. Why the holy f**k should I or anyone else put in 80-90 hours a week for nothing tangible in return? The only people benefiting from this modern economy are the C-level executives in the Fortune 2000 and the politicians who are in their pockets. There’s never been a greater income disparity in the entire existence of our country, and every year, every quarterly earnings report, it gets greater and greater and we all choose to do absolutely nothing about it.

bud man says

“nothing tangible in return” by working long hours? how about paying the rent or mortgage and putting food on the table. pay for car insurance and payments plus utilities plus day care and all other types of expenses. Maybe you are advocating people staying at home on the government dole complaining about woe is me. students must stay in school and get a real education because not everyone is going to be a pro rap star or athlete-

commuter says

But if you can’t find any jobs offering overtime, or one is only able to make $13/hr with a certificate or a degree, even paying rent is challenging.

Almost half of the households in Flagler County earn less than what it takes to pay the market rate rent for a two bedroom apartment. That’s entire households! There are more people in our community paying a higher percentage of their incomes for that “tangible return,” as basic as it is, called “home,” than what they should be.

Nearly 30% of our entire population is paying almost half of their paychecks just for rent!! That doesn’t include water, electric, gas for employment, health insurance, etc.

Commuter says

Most jobs don’t offer overtime, though. You’re lucky if you find them, and I look at paystubs and can see that people who are working overtime still aren’t making that much.

There are more people in the world. Manufacturing requires fewer bodies, and there’s a higher need for retail. Workers just don’t have the same options they used to. People working two part-time jobs or one 40/hr job aren’t too stupid to find a job that pays more or that offers overtime. They just can’t find it.

A.j says

Please save your money. Spend wisely.

Land of no turn signals says says

I see a lot of new cars out there and the hoopdies have bling bling wheels.

Joe3 says

Live below your means ..

Get a better paying job ..

Work for yourself, start your own business ..

Become a politician ..

Ramen noodles & peanut butter sandwiches ? .. .. WHATEVER IT TAKES

bud man has the right idea: People must stay in school and get a real education because not everyone is going to be a pro rap star or athlete

Greg says

It’s only going to get worse with the free stuff democrats want to give away. Inflation will eat away at everything you need. Gas will be $4.00 a gallon within a few years. The poor and middle class will pay fir these freebies. Conrad Burnie Sanders will assure America goes broke just like Russia did. The best days of America are over. Best start learning to speak mandarin. China will rule the world and bankrupt America will never be able to stop them.