To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Partly sunny with a chance of showers. A slight chance of thunderstorms in the morning, then a chance of thunderstorms in the afternoon. Highs around 90. Chance of rain 40 percent. Friday Night: Mostly cloudy with a chance of showers and thunderstorms. Lows in the upper 60s. Chance of rain 50 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

Free For All Fridays with Host David Ayres, an hour-long public affairs radio show featuring local newsmakers, personalities, public health updates and the occasional surprise guest, starts a little after 9 a.m. after FlaglerLive Editor Pierre Tristam’s Reality Check. See previous podcasts here. On WNZF at 94.9 FM, 1550 AM, and live at Flagler Broadcasting’s YouTube channel.

Public Workshops to Discuss Impact Fees, 10 a.m. at the Palm Coast Community Center, 305 Palm Coast Parkway NE. The City of Palm Coast invites residents, business owners, and stakeholders to attend two upcoming public workshops to discuss potential amendments to the City’s Transportation, Fire, and Parks Impact Fees. These meetings provide an opportunity for the community to learn more about the impact fee structure, understand the proposed changes, and share feedback directly with City staff and City Council. Impact fees are one-time charges assessed on new development to help fund the infrastructure and public services needed to support a growing community. All members of the public are encouraged to attend and participate. Your input is an important part of this process as the City evaluates how to maintain and improve the quality of life, public safety, and sustainable growth. For more information, please contact the City’s Planning Division at 386-986-3736 during regular business hours, Monday through Friday, from 8:00 a.m. to 5:00 p.m.

The Friday Blue Forum, a discussion group organized by local Democrats, meets at 12:15 p.m. at the Flagler Democratic Office at 160 Cypress Point Parkway, Suite C214 (above Cue Note) at City Marketplace. Come and add your voice to local, state and national political issues.

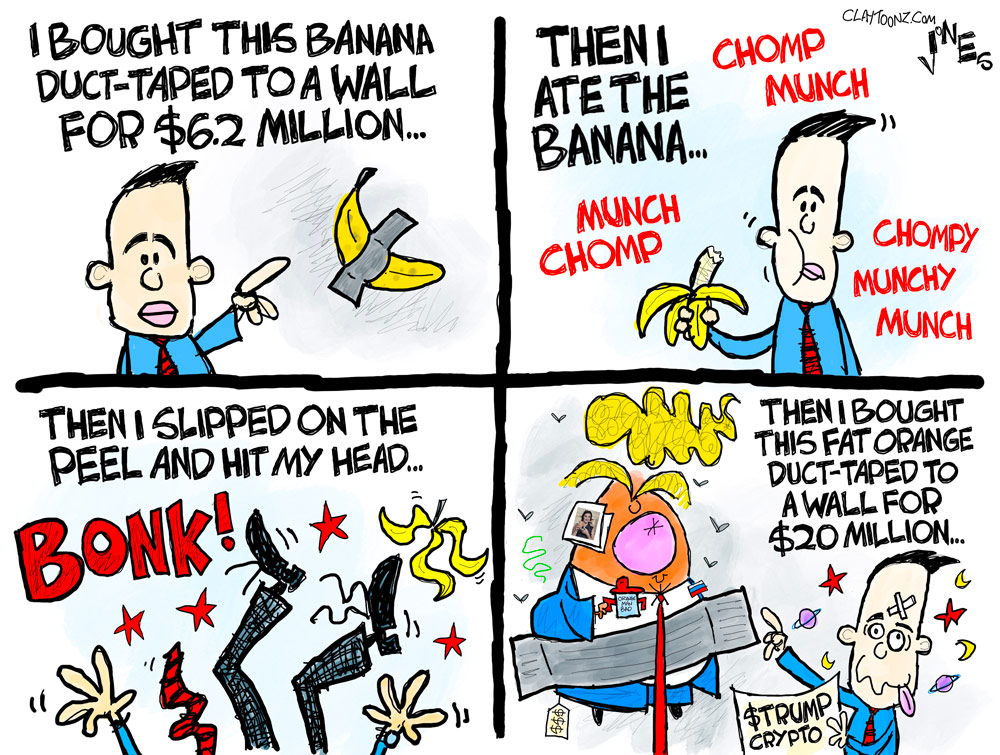

Notably: Am I the only one who finds the above cartoon racist? I don’t like to be too prickly about these things: cartoonists should have a very, very wide berth, and the line between stereotyping and caricaturing can be foggier than November in London. I was not consciously familiar with Becs, the cartoonist, until now. Becs is Alejandro Becares, an Argentine artist and teacher. He’s syndicated through Cagle, which we use, but this piece gave me pause. I was all for the Muhammad cartoons–for all their tastelessness in some cases–to have free rein (I even ran them on a site I edited before FlaglerLive, in solidarity) and I’ve always loved Charlie Hebdo’s style. We not only have the right, but occasionally the duty, to offend, at least in thought (not as much in deed). I am of course not on all fours for Trump, but in this case the piece makes me uneasy. Arab stereotypes tend to bother me. But all stereotypes do. This reminds me of how the FBI used Arab stereotypes to run its Abscam sting back in the late 1970s, dressing up some of its agents in flowing garbs. The darkened scruff around Trump’s jaw also seems to me an added touch of the Arab as a sinister character, not to mention the garb itself–as if our own western dress were somehow more acceptable, less eyebrow-raising, when both types of dress are beyond judgment, being neutral cultural facts, the way driving on the left side is in Britain and driving on the right is in Saudi Arabia. But for the cartoon to have its intended effect, a different judgment must apply to the Arab dress, doesn’t it? Obviously Becs isn’t intending to make Trump look like TE Lawrence. That would have been a more interesting (if inaccurate but ironic) twist, but I just don’t see this as more than exploitative, kind of like when the reprehensible Randy Fine equated the Palestinian-Lebanese Keffiyeh with terrorism. But I’m just not sure about the cartoon.

—P.T.

Pogo says

@Who’s ox is/was gored?

If ya get in the ring — you’re gonna get hit.

Sherry says

Maga. . . Why? Why? Why? Is this behavior OK with you?

ON JONI ERNST:

But when a constituent questioned Ernst about the reconciliation bill, things became heated. The woman, who said she had previously emailed Ernst’s office with her concerns, argued the bill’s proposed cuts seemed neither “compassionate” nor “fiscally responsible.” She accused Ernst of supporting a “tax shelter” for the wealthy.

As the audience applauded the woman, she continued, expressing concerns about the bill’s proposed cuts to SNAP benefits and Medicaid spending. Ernst said those who would lose Medicaid were not currently eligible for Medicaid.

“You are arguing — when you’re arguing about illegals that are receiving Medicaid benefits, 1.4 million, 1.4 million they’re not — they are not eligible so they will be coming off,” Ernst said. One audience member could then be heard shouting, “People are going to die.”

“Well, we all are going to die,” Ernst responded.

Audience members gasped and booed the senator, but Ernst seemed unbothered.

Ray W, says

A number of publications report that OPEC+ meets tomorrow to discuss whether to increase this coming July’s OPEC+ member nation crude oil output totals by a further 411,000 barrels per day.

Thus far this spring, OPEC nations with voting rights (not all affiliated nations have voting rights) have decided to increase crude oil production in the months of April, May and June by a combined total of 960,000 barrels per day.

The Institute for Energy Research, purportedly an industry journal, published earlier this May a commentary titled: OPEC+ to Increase Oil Production — Again.

Here is the conclusion drawn from the commentary:

“OPEC+ has announced additional oil production increases for June, adding to the increased production levels in April and May that the cartel had agreed to produce. If that trend continues, the cartel will likely replace all of the 2.2 million barrels per day it cut beginning with the COVID lockdowns to keep oil prices in the $70 per barrel range by November. The production increases will lower oil prices, which could cause challenges for U.S. shale operators because the price declines could put them below their break-even points. President Trump asked OPEC+ to increase production as he wants energy prices to fall, and it seems like Saudi Arabia is complying with his wishes, as the Saudis would like to strengthen their ties with the United States. Saudi Arabia may also be increasing OPEC’s production to punish Iraq and Kazakhstan for not keeping to their quotas.”

Make of this what you will.

Me?

Since perhaps as early as March of 2021, I have repeatedly commented on the FlaglerLive site about OPEC’s manifold efforts to manipulate worldwide crude oil marketplace prices by voluntary cuts to its production totals.

The original phased production cuts were to total 6 million barrels per day, with Saudi Arabia voluntarily cutting another million barrels per day. Since that original February 2021 announcement, OPEC has periodically met to manipulate its overall output.

My original comments contained language drawn from various industry journals to support the argument that Saudi Arabia, the biggest of the OPEC producers, desired international oil prices of at least $76 per barrel, as that price would entirely fund the Saudi government’s budget, even at the voluntarily reduced level of production.

That OPEC+-driven era of $70 and sometimes much higher crude oil prices and the years of record profits from those manipulated prices enjoyed by American energy producers for the past four years may have already receded into the rear-view mirror, and it may mean reduced short-term profits for American energy companies.

Worldwide crude oil production already outstrips demand and economies all over the world are unsettled due to on-again, off-again tariffs, suggesting that demand for crude oil may continue to falter.

American production of crude oil hit a record monthly average high of 13.5 million barrels per day this past December. Oil production remains steady at 13.4 million barrels per day on average, but there are few signs that output of American crude oil will rise anytime soon.

Who knows what the future may bring. An American trade court just held that executive-induced tariffs, as opposed to legislative-induced tariffs, violate the language of our Constitution. An appellate court has delayed implementation of the trade court’s order, pending appellate review.

Perhaps Supreme Court guidance is needed.

The executive argument is that today’s high levels of imports constitute an emergency of the typed contemplated by 50-year-old legislation passed to define relevant constitutional language. That for the past 50 years we have had high levels of imports compared to exports suggests a non-emergency situation, but we will see how the courts define the issue.

Ray W, says

Earlier today, Barchart published a story by an oil industry analyst about some of the current figures for the energy industry.

Here are a few bullet points from the article:

– For the week ending May 23, 2025, the EIA reports that average U.S. daily crude oil production slightly rose to 13.401 million barrels per day, “modestly below the record high of 13.631 million bpd from the week of December 6.”

– US crude oil inventories are 6.2% down from the “seasonal 5-year average.”

– Gasoline inventories are down 3.1% from the “seasonal 5-year average.”

– Distillate inventories are “-17.4% below the 5-year average.”

– Baker Hughes revealed a drop in active US oil rigs by 8 to a 42-month low of 465 rigs. In December 2022, 627 rigs were operating.

– According to the article, factors supporting higher crude oil prices include January 10th U.S. sanctions imposed on Russian oil exports. Weekly vessel tracking data for the week ending May 23rd shows Russian crude oil exports falling week-to-week by 90,000 barrels per day, to a total of 3.4 million barrels per day.

– Crude oil stored on tankers not moving for at least seven days dropped 4.2% to 95.40 million barrels per day for the week ending May 23.

– The U.S. State Department placed sanctions on business concerns that ship Iranian oil to China.

– Iranian talks with the U.S. about the Iranian nuclear enrichment program are stalled.

– CNN reports that President Trump may impose new sanction of Russian oil exports.

– Senator Graham says he has enough support to pass a bill imposing 500% tariffs on any nation importing Russian crude.

– Libya is leaning towards stopping all oil and gas exports (up to 600,000 barrels per day) after a militia group “stormed” the nation’s state oil company headquarters.

A factor supporting lower crude oil prices is the recent number of OPEC+ output increases, despite OPEC also deciding to delay full restoration of its production cuts from the end of 2025 to September 2026.

Make of this what you will.

Me?

The international crude oil marketplace is incredibly complex, with unforeseen events often bolstering or disrupting the industry. Prices fluctuate daily, sometimes by wide margins. Other than OPEC, few individual energy producers can successfully manipulate the marketplace over the long-term.