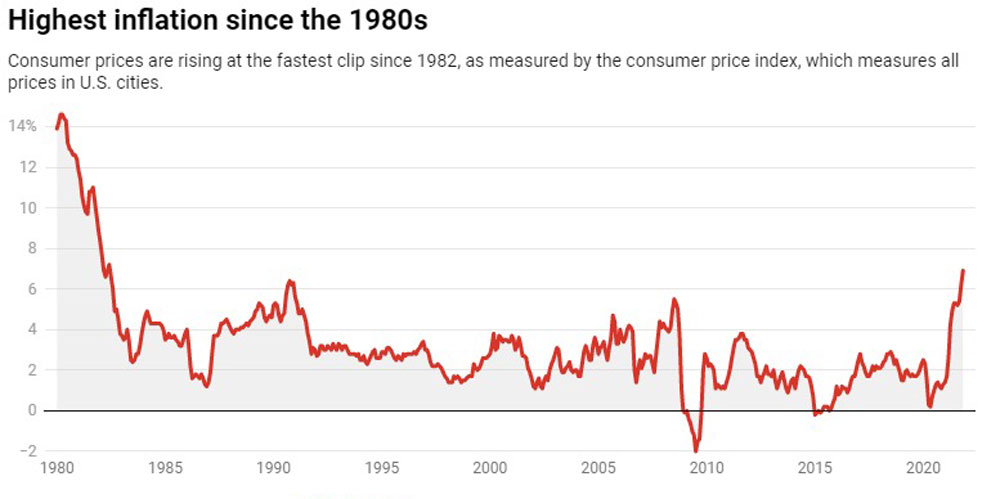

Consumer prices jumped 6.8% in November 2021 from a year earlier – the fastest rate of increase since 1982, according to Bureau of Labor Statistics data published on Dec. 10, 2021. The biggest jumps during the month were in energy, used cars and clothing. The Conversation U.S. asked University of South Carolina economist William Hauk to explain what’s driving the recent increase in inflation and how it affects consumers, companies and the economy.

![]()

1. Why is inflation running so high?

There are two basic reasons why inflation has been increasing: supply and demand.

Starting with the latter, consumers are on a spending spree after having spent most of 2020 at home bingeing on Netflix. Now that more people are vaccinated, many feel increasingly confident going to the stores again and are demanding more goods and services.

Adding support to households’ buying power are the stimulus checks and other pandemic-related aid that have gone out to American families during the pandemic. The resulting increase in spending has been good for stimulating the economy, but more demand typically results in higher prices.

The increased demand might not be too bad for inflation on its own, but the U.S. economy is also experiencing significant supply chain problems tied to the COVID-19 pandemic. This is driving up the cost of production and reducing the supply of goods, also pushing up prices.

What’s more, wages are jumping as well – up 4.8% in November from a year earlier – as employers in many industries offer more money to retain or hire people. This news is great for workers, but companies often have to pass on these higher costs to consumers.

2. Is inflation always bad?

Inflation isn’t always bad news. A little bit is actually quite healthy for an economy.

If prices are falling – something known as deflation – companies may be hesitant to invest in new plants and equipment, and unemployment might rise. And inflation can make it easier for some households with higher wages to pay off debts.

However, inflation running at 5% or higher is a phenomenon the U.S. hasn’t seen since the early 1980s. Economists like myself believe that higher-than-normal inflation is bad for the economy for many reasons.

For consumers, higher prices on essential goods like food and gasoline may become unaffordable for people whose paychecks aren’t rising as much. But even when their wages are rising, higher inflation makes it harder for consumers to tell if a particular good is getting more expensive relative to other goods, or just in line with the average price increase. This can make it harder for people to budget appropriately.

What is true for households is true for companies as well. Businesses see the prices of key inputs, like oil or microchips, rise. They may want to pass on these costs to consumers, but could be limited in their ability to do so. As a result, they may have to cut back production, increasing supply chain problems.

3. What are the biggest risks?

If inflation stays elevated for too long, it can lead to something economists call hyperinflation. This is when expectations that prices will be keep rising fuels more inflation, which reduces the real value of every dollar in your pocket.

In the most extreme cases – think Zimbabwe in the late 2000s – spiraling prices can lead to a collapse in a currency’s value. People will want to spend any money they have as soon as they get it for fear that prices will rise even over short periods of time.

The U.S. is nowhere near this situation, but central banks like the Federal Reserve want to avoid it at all costs so they typically step in to try to reduce inflation before it gets out of control.

The problem is the main way it does that is by raising interest rates, which slows the economy. If the Fed is forced to raise interest rates too quickly, it can even cause a recession and result in higher unemployment – as the U.S. experienced in the early 1980s, around the last time inflation was this high. Then-Fed chair Paul Volcker did manage to rein in inflation from as high as about 14% in 1980 – at the cost of double-digit unemployment rates.

Americans are not yet seeing inflation nearly that high, but preventing the U.S. from getting there is almost certainly on the mind of Jerome Powell, who currently leads the Fed.

![]()

William Hauk is Associate Professor of Economics at the University of South Carolina.

![]()

![]()

Jimbo99 says

Just me, but Supply & Demand is not the only reason for inflation. Take the Economic Stimulus checks of any era. The Government announces everyone will get either a $ 600 or a $ 1,200 stimulus check in some formula to determine that stimulus check. Every wolf out there knows you are getting $ 600 at least and it becomes a mad dash to get that money short term or even in the long term as normalized pricing over a year or two. That has nothing to do with the Supply & Demand for any given product or it’s alternative. Take gasoline. Biden had Trump’s reserve of fuel to release into the economy over Thanksgiving holidays. DeSantis, didn’t he relax the 25 cents of taxes to incentivize holiday travel ? Even if DeSantis relaxed the taxes, fuel would theoretically drop 25 cents a gallon. And it didn’t which is further evidence of price gouging. Gasoline, manufactured at lower costs, sold at higher prices. Those profits from that reserve went from $ 2/gallon to $3.50/gallon. Here’s the rub with gasoline, it evaporates or even contaminates with moisture when stored. Once any gasoline is stored, it’s on the clock as to depleting or spoilage just because of science & physics. Increased prices are really price gouging for the pandemic, not inflation. In a normal world inflation is never going to be what we are experiencing. People come out of the pandemic buying more goods ? That’s nonsense. Here’s the math on that, your car gets the same gas mileage it always has, what the gouge is becomes the price of fuel that it takes to fill that 20 gallon tank up. Anyone actually think consumption went down over the last 2 years simply is ignoring the fact that the population has grown, even with all the Covid deaths.

Here’s another thing about the scamdemic America. If Biden is signing off on trillions of dollars, those CEO’s & corporations are going to raise prices to pay themselves better. And the projects will take years to actually get done. Take the FCSO building, is that going to be done at the end of 2022. We’re financing that with inflated prices. The lies are there as a shortage, but let me guess, they’ll always seem to find the materials to finish that building, even add a storage facility as I understand it, as an addition to the original contract/order. See mankind is like that, tell someone you have so much to spend, it’ll cost that every time and they’ll be more than happy to finance the rest of an overcharge. And all this is going on as the minimum wage isn’t even close to $ 15/hour ? The nepotism & cronyism is always going to get paid more than $ 15/hour, but the masses, they have to live with being trickled on until it reaches $ 15/hour. This is a world that does things cheap as possible, it’s the profit motive behind Capitalism.

Dennis CRathsam says

Theres only one person to blame JOE BIDEN! He has brought us back in time, to the days of that other moron democrat JIMMY CARTER! Had Biden done nothing, left Trumps plan in place. He would be doing just great. But in his zest to kill everything Trump he has destroyed our country. Everything Biden has touched, has turn out bad….very bad.

joe says

We would benefit by more citizens having patience (as well as being better informed). Recent history shows a consistent pattern – Republican administration creates a mess and leaves it for Democrats to clean up. Too many are disappointed when it takes longer than a year to clean up the mess, and Trump left Biden a real shit mess. (and media coverage looking to create (once again) the “Dems can’t do anything right” meme all too happily go along.

MITCH says

Crime has a lot to do with Inflation year round. Businesses that experience crimes such as looting/riot destruction/shop lifting/destructive thief/intellectual thief/etc.. all have rising costs in Insurance/Security/Repairs/Replacements/etc.. and all these costs are passed along to the consumer. Ignoring crimes year round encourages/supports Inflation year round.

Timothy Patrick Welch says

Why is inflation running so high? People expect higher prices in the future (because of deficit spending) and the mad rush to buy now at the lower current value… Just wait until the American dollar looses measurable value relative to China yuan.

Is inflation always bad? Are you on a fixed income? Inflation is of grave concern to the fiscal health American entitlement programs with their inflation adjustment requirements.

What are the biggest risks? The American dollar looses world dominance and Chinese yuan becomes currency of choice, while at the same time your nest egg suffers stock and bond market losses and inflation related value loss.

Biggest risk might be… waiting to raise interest rates until after mid-term elections. This would indicate the current administration values mid-term election results more than the well being of citizens.