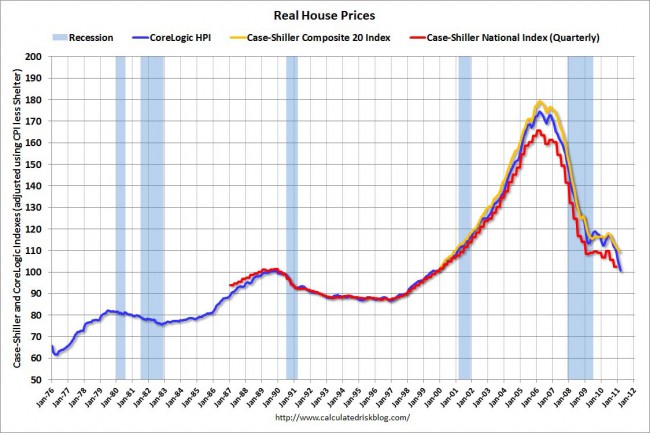

Despite what appears to be an economic recovery and some job creation, housing prices have fallen to a new low, declining to their lowest level since mid-2002, according to figures released this morning by Standard & Poor’s/Case-Shiller Index of 20 large cities. The 20-city composite index’s new recession low reflects an annual decline of 5.1 percent compared with the first quarter of 2010, and a 4.2 percent decline from the last quarter of 2010.

Click On:

- In a Shift, and Despite Glut, State Approves 5,000-Home Palm Coast Development

- North By Northwest: State Rejects Palm Coast’s Sprawling Growth Horizon

The numbers are compounding a deepening housing crisis that has sent home ownership down sharply, to 66.4 percent last year, down from 69.2 percent in 2004, and housing-unit vacancy rates nearly three times their levels 10 years ago. In Flagler County, the 2010 Census revealed that out of 48,595 housing units, 9,409 are vacant (not including occasional-use housing), for a vacancy rate of 19.4 percent.

Ironically, the Palm Coast City Council today is discussing approval of a settlement agreement with the Department of Community Affairs, the state’s growth-management agency, that clears the way for two massive developments on Palm Coast’s west side. The two developments would, at build-out, add 12,000 homes to the city’s and the county’s housing stock.

Nationally, with an index value of 138.16, the 20-City Composite fell below its earlier reported April 2009 low of 139.26. Prices have fallen 33.1 percent from their peak in July 2006 in what has become the worst housing crisis since the Great Depression. Fewer people are choosing to own a home, opting instead to rent.

“This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “The National Index, the 20-City Composite and 12 MSAs all hit new lows with data reported through March 2011. The National Index fell 4.2% over the first quarter alone, and is down 5.1% compared to its year-ago level. Home prices continue on their downward spiral with no relief in sight. Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities – Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (Ore.) and Tampa – fell to their lowest levels as measured by the current housing cycle. Washington D.C. was the only MSA displaying positive trends with an annual growth rate of +4.3% and a 1.1% increase from its February level.

“The rebound in prices seen in 2009 and 2010 was largely due to the first-time home buyers tax credit. Excluding the results of that policy, there has been no recovery or even stabilization in home prices during or after the recent recession. Further, while last year saw signs of an economic recovery, the most recent data do not point to renewed gains. Looking deeper into the monthly data, 18 MSAs and both Composites were down in March over February. The only two which weren’t, are Washington DC, up 1.1%, and Seattle, up 0.1%. Atlanta, Cleveland, Detroit and Las Vegas are the markets where average home prices are now below their January 2000 levels. With a March index level of 100.27, Phoenix is not far off.”

lawabidingcitizen says

It would really be difficult to find a random group of people less able to think logically than the elected officials in this county, including Palm Coast and Flagler Beach. They continue doing business-as-usual — making decisions that might have made sense 25 years ago, but are now nonsensical. They, like the rest of us, have no idea what the future might bring, so why tie up a huge swathe of the county with agreements that we’ll probably have reason to regret?

They should all take a deep breath, make draconian massive cuts in the budget, especially the “economic development” departments and then go home and read a good book. Let the staff run necessary city/county services and stop meddling in things about which they have no clue.

[email protected] says

lawabiding citzen, they are allowiing because maybe someone on the council is in bed with the developers. we have over 5000 vacant homes inthe city now, i know this as a fact. we now are going to add more with no jobs and the jobs you find are paying 8-10 and hour here with no benifits. i now bellieve we have a bunch of idiots running the city. you just cannot believe them anymore, remember palm coast data all the jobs, remember one council member leaving the scene of an accident. the trust is gone.

just a citizen says

This City is turning into a Sh** Hole.

Layla says

This will continue to be the case until THEY STOP BUILDING. I’ll bet we have the highest number of vacant properties in the state and we’re still building more. That’s NOT helping home prices.

And to make matters worse, our Council members never met a builder they didn’t love. Do you suppose it is the fees they collect or the campaign contributions?

Layla says

Everyone must come to the next few council meetings and confront these people. They are running away with your tax dollars. If we can’t get them to ban development, there is always recall.