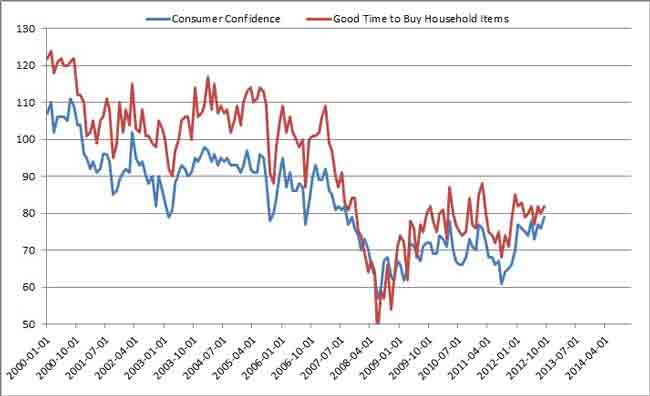

Consumer confidence among Floridians rose in September to a post-recession high of 79 compared to the revised August reading of 76. All five of the five components that make up consumer confidence increased, according to the latest analysis by the University of Florida’s Bureau of Economic and Business Research.

“The last time Florida consumer confidence hit 79 was in October, 2007,” said Chris McCarty, the Survey Director. “At that time confidence was on its way down as the housing crisis was getting underway. This month’s index comes at a time when the economy is still in recovery. Much of the increase in confidence in September was from lower income households and from seniors. Some of this may have to do with the elections around the corner and anticipation of what it will mean for the future of entitlement programs. So far news about the potential consequences of the fiscal cliff has not unnerved Floridians.”

Gov. Rick Scott seized on the new numbers. “The fact that Florida’s consumer confidence is at a five-year high is more good news and evidence that our state is moving in the right direction,” he said in a statement.

Perceptions of personal finances now compared to a year ago rose one point to 62 while expectations of personal finances a year from now rose one point to 86. Expectations of U.S. economic conditions over the next year rose three points to 78 while expectations of U.S. economic conditions over the next five years rose two points to 84. Perceptions as to whether it is a good time to buy big ticket items rose two points to 82.

Economic indicators affecting Floridians are somewhat mixed. Unemployment in August was again unchanged at 8.8 percent, well above the 5.5 to 6 percent that has been considered the natural level of unemployment. The drag on employment continues to be losses in construction and government, and August saw a decline of 10,000 people in the labor force. The reduction in the labor force has been a focus of concern both in Florida and in the U.S. The median price for a single family home in August was up 5.8 percent over the previous year at $147,000 although down slightly from July. The stock market is getting closer to the all-time record and this along with increases in housing are certainly a boost to consumers’ sense of wealth. Gas prices remain elevated and in the long term will only go higher. While inflation is currently under control, consumers should expect increases in prices next year particularly as the effects of the drought hitting much of the U.S. makes its way into food prices.

The recent policy by the Federal Reserve to guarantee low interest rates until at least 2015 is a two-edged sword. While it will stimulate consumption, particularly in the housing market, it is difficult for those approaching retirement who typically put assets into interest-bearing accounts which are considered safer than investments such as the stock market. Seniors may have to change their investment strategies to keep up with inflation next year.

“October will be an interesting month for consumer confidence,” said McCarty. “The presidential debate on October 3rd will focus on domestic policy and will almost certainly include a direct question about the fiscal cliff in January. Those Floridians who are still not aware of the potential effects of the looming cuts and tax increases will certainly know about them after that. There are enormous differences in consumer confidence between Floridians who support Obama (averaging 98) and those who support Romney (averaging 63).

Obama levels are consistent with pre-recession highs while Romney levels are near all-time lows. As most people realize, the economy is center stage in this election with Obama supporters seeing a recovery taking hold and Romney supporters seeing an economy in danger of slipping back into recession. Whether Floridians react negatively or positively to the debates remains to be seen, but it will largely determine consumer confidence as we get past the election and into the holiday shopping season.”

Karma says

And yet the Fed tells us the exact opposite. Here is the reason stocks dove around the world and we had the largest sell off in 3 months. FORWARD

http://news.yahoo.com/world-stocks-dive-growth-pessimism-mounts-084812096–finance.html

Outsider says

Some people are beginning to realize that the fed’s latest action is not really a policy they expect to work, but a last ditch, Hail Mary pass signaling the failure of their policies. They’ve already increased banks excess reserves by nearly 20 fold, and that didn’t spur a “recovery” so why would another 80 billion a month make any difference? These fools keep looking backwards to the Great Depression for clues, but this is a whole nother ball game. The money printing is only delaying the day of reckoning that will certainly come, and making the fall that much harder. They ignore the 10,000 pound elephant in the room, 16 trillion dollars in debt and counting that we will most definitely default on one way or another. Once that happens, and foreign investors dump the dollar and the federal government can no longer borrow to maintain our current standard of living, we will have to face reality. Until then, it’s all just happy talk, smiling faces, and denial coming out of our elected officials and so-called financial wizards. All this because our “leaders” can’t say “no,” nor will we elect those who would.

Karma says

The real part about this story is the fiscal cliff. I hope people start educating themselves on what could happen Jan 1 2012. From taxes to unemployment, next year could be worse than anything that happened over the last 6 years with your paycheck.

Many of the articles I have read say congress has been talking about a solution to the pending problem, and the answer is move the date back further before any cuts can take place. At some point we have face the problem that has been created over the last 12 years.

Here is a great explanation of what the Fiscal Cliff is from The ACCF Center for Policy Research:

http://accf.org/news/op-ed/the-horrific-accident-awaiting-us-over-the-fiscal-cliff

Outsider says

I disagree. The fiscal cliff will be the equivalent of dipping your little toe in the water before you jump into the pool. In fact, the proposed solution to the fiscal cliff is just more of the same stuff that got us into the irreversible situation of massive debt, money printing, and not-too-distant inflation that will be unstoppable. We will not be able to pay the interest rates demanded by “investors” from our bonds, and we will either immediately default, or more likely print yet more money to pay those .rates, which in turn will fuel yet more inflation. Either way, we’ll run out of suckers, the fed will ultimately be unable to hold back real market forces via bogus fiscal and monetary policy and the fit will hit the shan.

Dorothea says

@Karma

The Republican controlled House of Representatives took a prolonged vacation before taking up the expiration of the Bush tax cuts. Thanks for posting the ramifications of ignoring this “Fiscal Cliff “problem. But put the blame where it belongs, on Congress.

First vacation in August:

http://www.tampabay.com/opinion/editorials/congress-takes-a-vacation-from-nations-problems/1244530

Number of days in session until the election in November: 0

http://www.house.gov/legislative/

Karma says

@Dorthea

No where in my post did I mention anything about Republicans or Democrats. I only mentioned that congress has talked about moving back the date. You talk so much about congress not doing their job, yet we have not had a Federal budget in three years.

But since you want to talk Partisan politics, look who was against the Simpson-Bowles final report. You guessed it, Barrack Hussein Obama

http://www.nytimes.com/2012/02/27/us/politics/obamas-unacknowledged-debt-to-bowles-simpson-plan.html?pagewanted=all&_r=0

4 Democrats, 3 Republicans and the Head of the SEIU Andy Stern voted against it. Democrats are responsible for the bill not getting the Super Majority. Please stop blaming Paul Ryan, You own this one.

http://online.wsj.com/article/SB10000872396390443864204577623332790836376.html

And why is congress dragging there feet,same shit, different day. Tax the Rich. Somehow taxing the rich will solve all the problems we have with our debt. Sorry to tell you it won’t.

http://www.washingtonpost.com/opinions/ruth-marcus-raising-taxes-wont-be-enough-to-balance-budget/2012/09/27/c282e810-08cb-11e2-afff-d6c7f20a83bf_story.html

http://www.heritage.org/federalbudget/tax-wealthy-deficits

Karma says

Here is some more Partisan Politics on the matter. Again today the Department of labor has asked many defense contractors to hold off on giving out pink slips until after the election even though the law requires a 60 notice.http://thehill.com/blogs/defcon-hill/industry/259305-omb-tells-contractors-once-again-dont-issue-layoff-notices

With sequester in less than 100 days away, Democrats still want the defense cuts included.

http://www.nationalreview.com/articles/328438/cantor-and-cuts-robert-costa

http://www.cbsnews.com/8301-503544_162-20089412-503544/barney-frank-start-deficit-reduction-with-big-defense-cuts-/

Dorothea says

@Karma

I read through your links and not sure what you are trying to prove. They were mostly opinion pieces by Republican supporting writers. Barney Frank, who is not seeking re-election, recommends debt reduction with defense cuts. Not very surprising in the scheme of things since Romney’s prescription for debt reduction is ADDING One Trillion dollars to the defense budget.

Found in your voluminous research material was this:

“But all three House Republicans on the panel opposed the plan. [Simpson-Bowles] One was Mr. Ryan, a darling of small-government conservatives and a Republican with presidential ambitions, who was about to become chairman of the Budget Committee. ”

Thanks for adding to my Sunday morning’s reads.