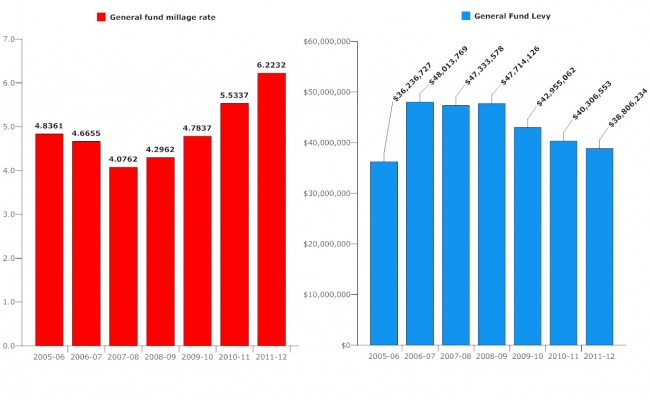

The Flagler County Commission today agreed to adopt a 2012 tax rate that would increase by about 12 percent over last year’s, but before you clear your throat to howl, you may want to take out your calculator instead.

It’ll most likely show that your tax bill overall will decrease for at least three reasons: Your school and water management property taxes are going down significantly; and the county tax rate, while higher than last year’s, remains lower than the break-even rate if the county were to bring in the same amount of revenue next year as it did this year. In other words, the average value of properties in Flagler County has fallen by 14.4 percent. The tax rate is going up by 12 percent–not enough to match the fall in valuation.

Click On:

- Flagler Property Tax Bills Set to Drop Markedly As School Board Keeps 2012 Levy Flat

- 2010: County Tax Rate Going Up 15.4% Even as Revenue and Government Services Stall

- What You Always Wanted to Know About Mills & Millage

Take the typical $150,000 house. This year, if that house were in the county, it would have paid county, school, water management district, mosquito control and Florida Inland Navigation District taxes for a combined tax rate of $14.7221 per $1,000 in taxable value. With a $50,000 homestead exemption (but just $25,000 for school taxes), that house would have paid $1,672.54.

The tax rate on that house is rising to $15.69225, so you’d assume that the tax bill, in turn, will rise to $1,770.

Not likely.

If that house has followed the local trend and lost 14 percent of its value, it’s no longer a $150,000 house, but a $129,000 house. So its tax bill will be $1,440.50, which represents a $232 tax cut. Homeowners who are still “giving back” the savings that they accrued in previous years, thanks to the 3 percent cap on year-over-year increases in their assessments, may see smaller benefits from the drop in valuations. Some will see higher tax bills. But the net effect of this year’s tax rates will be a general decline, particularly due to the school board holding the line on taxes. The school board represents the largest chunk of any local property tax bill.

For all that, county officials still expect to hear complaints from property owners who equate a rise in the tax rate with an automatic tax increase.

“We’re taking in less money every year. That’s the best way we can explain it,” County Administrator Craig Coffey said.

The county tax rate may yet change very modestly by next week, when the county commission will set its so-called “trim” rate officially. That’s the rate that will go to property owners as the proposed tax rate for next year. When commissioners set the actual tax rate in September, they may lower it from the trim rate, They may not raise it. In the end, County Commission Chairman Alan Peterson said, the final tax rate is likely to be very close to the one the commission agreed to earlier today.

Two areas of the budget the county has yet to settle: the budget of Supervisor of Elections Kimberle Weeks, an the budget of Enterprise Flagler, the public-private economic development partnership that, for now, is embattled at best. The county has earmarked $120,000 for it for next year, close to the amount it budgeted this year, and close to the amount Palm Coast has been budgeting annually. But Palm Coast may no longer be interested in being part of the organization. The Palm Coast City Council is discussing its budget Tuesday, and may decide its role in Enterprise Flagler then.

Consolidation of fire services between Palm Coast and the county has also been discussed in both county and city governments. But only cursively. It it were to happen, it won;t happen this year, Peterson said.

“If you consolidate,” Peterson said, “it would mean that Palm Coast would have to provide the county with some money to essentially hire as many firefighters as the consiolidation made sense, so I would say no, it’s not something that could happen prior to the beginning of the next fiscal year, because we have to send our trim notices next Monday.”

Peterson, at any rate–like Mayor Jon Netts–has more questions than answers on consolidation, and both cast doubt on the notion that there is much duplication of services despite the two departments’ existence. “Other than an attempt to save some potential loss of jobs, and perhaps a better benefit package for the Palm Coast firefighters if it was consolidated with the county, I’m not sure I see anything beyond what’s being proposed,” Peterson said. Nevertheless, he stressed that he would want to consider the idea, but more at length–and not during this summer’s budget season.

Today’s more substantial discussion for the commission centered on the county’s reserves. Coffey proposed raising the level of reserves by $162,000 to bring the total closer in line with a county mandate, which calls for keeping reserves as close to 15 percent of the budget as possible. The reserves are well below that at the moment. Peterson was opposed to raising the reserves this year. He was outnumbered by the rest of the commission, which endorsed Coffey’s proposal. The budgeted reserves would rise to $6.8 million.

The administrator also proposed increasing the reserves for the county’s Fire Flight helicopter by $125,000. That’s the fund that will eventually be used to replace the helicopter. But commissioners were opposed to that increase.

Savings this year were accomplished mostl–but not entirely–without lay-offs, Coffey said, though some positions were vacated and left unfilled. The library lost a half-time employee. Carver Gym lost an employee, and another was transferred to the school board. There may be a few more job shuffles or layoffs in late fall.

And for the third year in a row, county employees will have no raises.

T says

First of all, the millage rate is NOT the same as “taxes”

Secondly, the reason that a (vocal) minority of citizens could potentially see a moderate increase in their own tax bills is because of the (hideous) “save our homes” legislation which artificially limited the taxable value of some properties. During the boom it was possible for 2 identical houses in the same neighborhood appraised at the same value to have vastly different tax bills. For example, if home “A” was purchased more recently, it paid taxes based on the actual appraised value and if home “B” was purchased years earlier, it paid taxes based on a limited taxable value, such that home “A” paid $4000 in taxes, while home “B” paid $1000 in taxes. Now that the appraised values have plummeted, the millage rate must go up in order to maintain the same revenue for the municipalities. But because our courageous and hard-working local governments have cut their budgets substantially, home “A” could now pay $2500 in taxes while home “B could pay $1500 in taxes, which in my opinion is much more equitable. This example represents a change in the combined taxes from house “A” and house “B” from $5000 combined to $4000 combined, which represents a drop in tax revenue for the government even though home “B” is paying slightly higher taxes.

Moreover I am personally infuriated that owners of home “B” would dare complain after enjoying substantial benefits in recent years and are still enjoying an artificially reduced tax burden. If I had my way, I would eliminate “save our homes” and make both home “A” and home “B” pay $2000 each. So, for those of you that are do see an increase in your taxes, please do us all a favor and SHUT UP! You have enjoyed huge benefits and services paid for by myself and others and you are still paying LESS than your neighbors. I am still paying more taxes for the city services that you enjoy. In fact, I hope the Cities and County adopt the roll back rate which will not reduce revenue – since they have already cut budgets and laid people off (increasing unemployment) for a small vocal minority of never-satisfied children.

And Thirdly, I want to thank the County and Cities for their tremendous efforts and courageous budget cuts and for continuing to provide services to citizens while continuing to cut budgets year after year. Thank you! You are appreciated.

Nick D says

Unemployment Rate – increased to 14.6%

Property Values – dropped by 14.4%

Tax Rates – increasing by 12%

Flagler County Foreclosures – 1 in every 185 (June 2011)

School administrators and government employees – expected to get a raise with numbers like these in a down economy.

Nick D looking to move out of Flagler County – 100%

palmcoaster says

Can anyone imagine how much our taxes will be with this 12% increase when the housing market will recover and our homes values will rise up again?

Connie says

I wish my home had only decreased 14%, Owe 260 and worth about 90. But my taxes don’t reflect that.

rickg says

I wouldn’t worry too much Palmcoaster about the housing market recovering to its 2005 or 06 levels. Wall street has taken care of that. Also an increase in homeowners insurance is on the horizon, especially if Rick Scott gets his way and privatizes Citizens. That will eliminate many from being able to buy a home.

T says

palm coaster,

IF real estate values go up, the cities and county SHOULD lower the millage to the “roll back” rate, such that the tax bill remains unchanged and municipal revenue remains unchanged. If the cities and county do not lower the millage when values increase, then we are well justified in complaining to the government bodies since it means they are effectively increasing taxes by allowing the millage to remain unchanged (in the event of increasing property values).

However, the flip side of that is that when values fall the millage has to increase accordingly if we want the same servieces from the county.

T says

Nick D,

Look closely at your tax bill, unless you bought your house a decade or 2 ago, your taxes are actually decreasing. And if you did buy your house 20 years ago, then you have been paying less than your neighbors and are still paying less than your neighbors.

However, your other points are unfortunatly and sadly very true.

Joe says

@ Nick D,

If I could sell this upside down house in this piece of crap county I would be with you!!!

Yogi says

Time to start recall petitions. Our elected officials seem to be protecting the public sector while strangling the private sector. We don’t work to support government. In America e work to build wealth for ourselves and our families. The government is supposed to protect us so we can be free to do this. it is time to remind this people why we elect them.

T says

connie,

I feel your pain. Many people, including myself, are looking into just walking away from a horribly underwater house. If you are that far underwater, I would seriously consider walking away from that burden. It may take 15 years for your home’s value to finally equal what you owe. However, if you do walk away you could probably continue to live in your home for a year without paying anything. It will hurt your credit rating, but if you put a year’s worth of mortgage payments into an interest bearing savings account and you maintain a reliable income you wont need excelent credit rating.

palmcoaster says

Like I said above. Imagine what this 12% increase will do to our homes taxes when the prices will rise again what it used to be…that will happen sooner or later!

http://www.msnbc.msn.com/id/43892903/ns/business-real_estate/

Gator says

Aren’t they also raising the School taxes? So we’re suppose to be OK with this? Our Homeowners Insurance is going up too. Their just squeezing us dry. Our home is worthless, We just barley make ends meet now. My husbands hours have been cut back & I haven’t had a raise in over 16 months. But do they get it…NO. These people have had no financial hardship, they can continue to live with out having to worry about how their going to put food on the table. Plus the School Administration wants a raise too? While we sit here eating spaghetti for 3 nights & hot dogs so we can make our mortgage payment that includes our taxes? Doesn’t seem quite right. I no longer recommend ANYONE to move to Flagler County. A years back I would highly recommend people move here, but NO more & I talk to A LOT OF PEOPLE, plus there’s other media out there to share with & I do. We no longer dream about making improvements on our home. I don’t worry about selling this house, just let it go into foreclosure, I’m so exhausted at trying to fight this uphill battle.

palmcoaster says

These are the blunders these county officials elected or not, moron’s make us pay for by increasing the taxes 12%. Please read and get informed. Hold these commissioners accountable and boot them all as they still take too much Coffey!

http://www.news-journalonline.com/news/local/flagler/2011/07/26/flagler-airport-loses-tenant.html

And Palm Coast Mayor Netts and County Commissioner Peterson at the helm want to give our dearest Palm Coast Fire Department to this County Ignoramus? God help us!

palmcoaster says

Gator, here one more service taken away from Floridians, by the ones that voted for crook Rick Scott! http://www.news-journalonline.com/news/local/east-volusia/2011/07/26/funding-cuts-affect-testing-for-beach-bacteria.html

Liana G says

You know FlaglerLive, writers are the most depressed people, and with the stuff you write and cover, you’re on that list. Can we get some local cartoon humor to make living bearable around here. At least until I too can pick up stakes and leave.

Liana G says

@ T

Does these budget cuts that our courageous local gov’t made include a reduction of bloated salaries and eliminating bloated positions at the top of the salary scale. Or was it only the little people whose jobs actually matter and benifit our society let go of. You missed a spot on your nose!

palmcoaster says

Dear T, could you please give us proof, docs, data when ever any government entity lowered the millage before? Hope you all here remember my words above. What this millage 12% increase will cost us when the value of our homes will go back to what it used to be. If these county and city officials will not bleed us in favor of developers like, Ginn,Landmark, Town Center etc and/or corporations like Walmart the government budgets would be just fine and no need of lay offs or cutting our services!

palmcoaster says

County commission on a good start gathering funds from seriously overlooked places to help the budget shortfall. Every penny counts like I said in my post before. Where all these fines go….?

http://www.news-journalonline.com/news/local/flagler/2011/07/27/flagler-county-commission-seeks-clarity-on-fines.html

blondie says

@T, that is terrible advice! Just because you are underwater on your mortgage is no reason to walk away from your home. Imagine if everyone in this situation decided to do that. This city would look like a ghost town in no time flat. People that can still afford the payments should stay in that house!! A foreclosure is not something you want on your credit rating.

Liana G says

@ blondie

I agree with T on this one. Businesses do it all the time. It’s a strategic business move that works in their best interest. This screw up is on the city, officials should have paid heed to the realists who were warning about the housing bubble and limit housing permits. It happened to Texas several years ago (10 years?) and was a lesson to be learned for those who wanted to learn. Instead the city just approved an additional 3,000 more new homes to be built. That’s if the builders can find buyers.

Actually, a foreclosure is not too bad a hit on your credit rating especially since subprime lending is back in operation. Deregulation and Wall Street. Got to love this country!