Your school taxes, by far the largest portion of your property tax bill, will most likely be declining significantly next year, contrasting sharply with public perceptions that taxes are going up. The drop may give other taxing authorities, including Palm Coast and Flagler County, more room to maneuver against public pressure not to raise so much as tax rates, which don’t necessarily translate into tax increases since property values have been collapsing.

The decline in the school portion of the bill will take place even though the Flagler County School Board is preparing to increase its portion of the property tax rate by a fraction.

Click On:

- Tax Fears and $2 Million Gap Have Palm Coast Talking Firehouse Layoffs or End to EMS

- “You Smirked, Mr. Chairman”: Tea Party Puts County Commission On Notice

- Facing $6 Million Hit, County Begins Long Budget Season as Tax Hike Appears Inevitable

- County Property Values Fall Another 14%; Palm Coast: -12%; Tax Rates Heading Up

- Facing $3.5 Million Deficit, Flagler Schools Eye Shorter Calendar, Bus Routes, Reserves

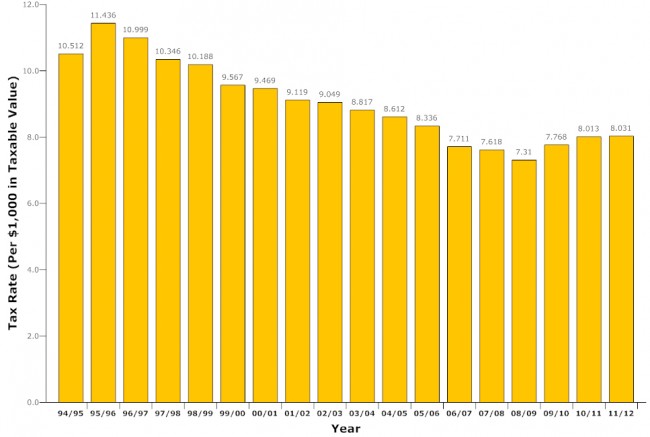

Tuesday morning, the board agreed to advertise the maximum tax rate it may levy next year. That rate will be $8.031 per $1,000 in taxable value, an almost invisible increase from the current rate of $8.013. The less-than 2 penny increase in the rate equates to 0.2 percent, a statistically insignificant number. In real terms, that means if you live in a $150,000 house with a $50,000 homestead exemption, the school portion of your property tax bill will be $1,003.88, a $2.25 increase from your bill on that house this year.

That’s assuming that your property value stayed the same. But if your house is like almost everyone else’s in the county, your property value dropped considerably–by 13 percent or so. That $150,000 house would have lost close to $20,000 in value. So in fact, your taxable value would be reduced to $105,000, and your school portion of the tax bill would amount to $843, not $1,003.88.

School taxes constitute from 40 percent to 60 percent of property owners’ tax bills, depending on where they live in the county (the proportion is smaller in the cities, which have an additional tax). So a drop in school taxes drags the entire bill down.

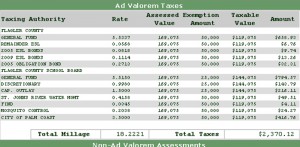

The school board’s portion? $1,154, or 49 percent of the total.

As with most of his neighbors, Dance’s property value fell considerably this year. His house is assessed at $144,353, a $24,722 drop, or 14.6 percent–almost precisely the average drop county-wide. His taxable value on the school portion of the bill will be $119,353. So if Dance and his colleagues end up approving the new tax rate in September that they agreed to advertise today, Dance’s school tax bill will be $959–a $195 tax break.

Dance, like all Flagler County residents, will also see a 26 percent decline in the taxes they pay the water management district. It’s not yet clear where the county and Palm Coast will set their tax rates. Flagler Beach is likely to raise its rate, but not so much as to result in an increase on property owners’ tax bills.

Bottom line: most Flagler County residents are getting a tax cut by way of the school board, keeping in mind that local school board members had virtually nothing to do with the decision (although they will be tempted to take credit for it). The tax rate is set almost entirely by the state.

Still, the implication of a lower tax bill for other taxing authorities may be significant. The reduction now gives Palm Coast and the county more room to maneuver, at least to set their tax rate in such a way as to bring in close to the same revenue they were bringing in this year.

Every other local government is facing de-stabilizing drops in revenue because of the continuing decline in property values. Those governments are also facing another kind of destabilizing factor: public throngs, usually led by tea party members, threatening to vote out politicians who raise property tax rates–whether the rise in rates actually results in an increase in tax bills or not. So far, Palm Coast and county politicians have not been able to convince that segment of the public that even though tax rates have risen, tax bills have not done so nearly as much–and in many cases, have dropped considerably.

In inflation-adjusted terms, rare is the property owner who lived in Palm Coast in 2003 who is paying higher property taxes today than he or she were paying in 2003. But tax discussions are just as often divorced from rational analysis, let alone historical or political perspective.

The school board’s brief meeting this morning included a run-through of the budget that the new tax rate would be funding in part–and reflects the declining amount of state contributions to the local school budget. The state will be contributing $39.5 million, local taxes will contribute $64.6 million, and federal revenue will add $9.7 million, for a total of $113.9 million in revenue to the school board. The general fund portion of that, including a $9 million reserve and $2.2 million in transfers, will be $98 million. The overall budget, including capital funds, debt payments and federal revenue, will be $146.9 million.

The district is budgeting for $91.7 million in general fund expenses next year, of which $74.2 million will account for salaries and benefits (or 81 percent)benefits account for $74.2 million.

District-wide administrative costs, including school board expenses but not including each school’s administration, will cost $3.3 million.

Val Jaffee says

(Last month the Washington Post used Palm Coast for the second time in 11 months to illustrate the rut of Florida’s economy, and the dismal state of its real estate economy, dragged in large part by a 13.8 percent unemployment rate, https://flaglerlive.com/25443/flagler-real-estate)

I have to agree with the local tea party on this one. Until we restructure the salaries of higher ups in local gov’t to reflect the income demographic and financial resources of the local economy, and until/unless we eliminate/reduce wasteful spending (including summits, retreats, seminars, conferences, or whatever it is they’re called), I am not in favor of paying more taxes. We are in this very dire state of affairs because of these very people getting paid these very huge salaries.

Therefore, I cannot in good conscience support an increase in taxes to not only to keep these very people in office, but to add insult to injury, to support those who want a 2% salary increase to boot!

These people have proven that they are incompetent at the various offices of gov’t, and that their only concern is that of looking out for their self interest and that of their cronies. And everyone else be damned, kids included! Unbelievable

PCer says

Val,

Did you read the article? You will not be paying more taxes unless your property value increased. What you actually pay will be less – the rate will be higher (barely) but your out of pocket is still less. This means that the schools will have to continue to offer great programs with less money.

Val Jaffee says

@ PCer – Did YOU read the article?

“You will not be paying more taxes unless your property value increased. What you actually pay will be less – the rate will be higher (barely) but your out of pocket is still less.”

Here’s what I got out of your article. Even though I will be paying less, the rate will be HIGHER. Well if my property value is going to decline, damn right I want my property tax dollars to reflect the decline in my property value. That’s like buying a shirt at retail with taxes included for $20.00 and buying the same shirt at 50% off and paying $15.00 with tax included. The tax rate is adjusted to defray loss even though the shirt is worth 50% less.

“The decline in the school portion of the bill will take place even though the Flagler County School Board is preparing to increase its portion of the property tax rate by a fraction.”

AKA housing values have drastically declined so the % increase though small, is still an increase but is not translated into an increase because of declining home values. What the district needs to do is adjust their bloated budget in keeping with the realities of our local economy.

To quote Mr Devine’s comment to the News Journal in today’s paper, “the district serves a greater number of high poverty students”. Hence, the greater number of families in this district are high poverty and cannot, at this time, afford to pay the overblown salaries of gov’t employees in this district. If these folks feel differently, well ‘Wal Mart is hiring and the door swings both ways!’

Here’s more from the article

“Still, the implication of a lower tax bill for other taxing authorities may be significant. The reduction now gives Palm Coast and the county more room to maneuver, at least to set their tax rate in such a way as to bring in close to the same revenue they were bringing in this year.”

Now, How do they propose to bring in the SAME REVENUE via taxes when property values are declining?

palmcoaster says

By raising the mill….Val.

Johnny B says

So…raise rates and maintain the tax bill? When our values actually increase we get killed. Who is the dim bulb that thought up this plan?