A 25 percent overall increase in Palm Coast government’s budget, paired with a 7 percent property tax increase, drew an unusual number of protesting residents Wednesday to what are normally staid and barely attended annual budget hearings.

But most of the complaints were based on misperceptions or mischaracterizations of the budget, while several of those complaining will see their city taxes barely budge. The hearing illustrated a divide between readily available evidence on one hand and, on the other, cherry-picked assumptions and misreading of the evidence to reach unsupported, exaggerated or at times outright false conclusions. (Watch the hearing here.)

“I’m on a fixed income, and I object to any tax increases, Dave Flynn, a resident of Fordham Lane, told the council. “Just because my property value is increased doesn’t mean my viable cash on hands is increased. So I live within my means, I expect the government to live within its means, and I love Palm Coast.”

But Flynn won’t see a tax increase–not from the city, not from any local governments: his taxes will decrease from $1,985 he paid this year to around $1,335 due next year, according to the notice the property appraiser sent Flynn back in spring, a 33 percent decrease. (The property appraiser’s 2019 numbers were based on maximum tax rates allowable, so if there are any changes after budgets are adopted, the tax bill may only go down.) Flynn’s Palm Coast taxes on his $200,000 house are falling from $420 to $198.

The reason: Flynn has double the homestead exemptions most residents may have. In addition to the $50,000 standard exemption, Flynn filed for the $50,000 senior exemption from the county, and a similar, $50,000 exemption from the city. Both governments approved those exemptions locally, so if anything, Flynn should have been thanking the council rather than objecting, particularly since his exemptions mean that other property homeowners who don’t have those exemptions, including the council members, are subsidizing Flynn. (Council member Jack Howell is the exception: as a veteran and a senior, he pays no property taxes on his homesteaded house.)

There was also Ed Danko, who has filed to run for council member Bob Cuff’s seat. “Folks,” he told the council Wednesday evening, “we have a slogan here in Palm Coast. It’s a nice slogan, we took it from a Kevin Kostner movie: build it, and they will come. I might suggest after you approve this budget, you change that slogan, to tax it and they will run.” Danko, who only recently moved from North Carolina, may have been confusing his geography: Palm Coast has not, in fact, had such a slogan. Its current slogan is “Find Your Florida.” (But Danko after this article initially ran shared an image from the current city newsletter with an item about ongoing development headlined “Build It and They Will Come.”)

And for all of the city’s and the county’s tax increases over the years, both city and county have continued to cause a run into their jurisdictions, rather than out of them, Danko himself an example.

Turning his appearance to the council into a campaign commercial, as some candidates who have never appeared before local governments tend to do once they file their papers to run, Danko used his own favorite slogan, saying that “after I’m elected I want to assure everyone in here, I will never vote to raise your taxes. Never. I’d rather drink antifreeze than raise your taxes.”

But Danko, like many other speakers, was grossly misinformed about his own taxes, or who was taxing him.

Danko and his wife bought the 2,400-square foot house with a pool at 56 Wasserman Drive in Palm Coast in April 2018 for $305,000. Their taxes are unquestionably going up this year, but not by much, and only because they’re new arrivals, and the property lost the nearly $50,000 of accumulated, “protected” value under Save Our Homes, the Florida law that prevents homesteaded properties from seeing tax increases exceeding 3 percent in any given year. Their tax bill will go from $3,311 to a maximum of $3,647, a $336 difference.

Palm Coast has hardly anything to do with it: Danko’s Palm Coast taxes are going up $15. His county taxes are going up $12. The bulk of his tax increase is due to school taxes, and those rates aren’t even set by the Flagler County School Board. They’re set by the Legislature. The school board has no choice but to ratify them. And comparatively speaking, the Flagler school tax rate is still historically low.

So despite moving into a new house and losing all homestead exemption protections, Danko will still see a limited tax effect, because he benefits from a $100,000 homestead exemption. His tax bill’s increase this year, modest as it is, will likely be the highest such increase for several years to come as his protected values begin to accrue, while his exemptions shift the tax burden to other taxpayers in the city, presumably those whose votes he will seek as he will claim, with demonstrable inaccuracy from the get-go, that he would drink antifreeze before raising their taxes: his tax status inherently does so already.

“Senior exemptions are a pretty big exemption,” Flagler County Property Appraiser Jay Gardner said today, speaking by phone from a conference. “Any break that someone gets I don’t care what it is, the people who aren’t receiving it are the ones who are paying for it.”

The numbers are startling: as of today, total property in Palm Coast is valued at $8.3 billion. If all properties were taxed at the current city tax rate without exemptions, the city would be generating $39 million. But property taxes generate just $24 million. Regular homestead exemptions take out their share. But the exemption Flynn, Newland and other seniors qualify for takes out an additional $148 million in value, denying the city $695,000 in revenue that has to be made up somewhere. Compound that with other exemptions, and those who are paying fairer share of taxes end up being burdened significantly more than the Flynns and Newlands of the city.

“You can’t come up with an exemption, a cap, a break that doesn’t cost taxpayers money. There’s no free ride,” Gardner said.

Similar story with Denton Newland of Fountain Gate Lane. He wondered if there was a taxpayer “watchdog group” in Palm Coast as he took to the podium before council members Wednesday evening, answering his own wryly rhetorical question. “There isn’t. Well, I think there will be now,” Newland warned. “I don’t like it when it hits my pocket book. I’ll be seeing you.”

But nothing has hit his pocketbook. If Newland does see a tax increase on his $178,500 house, it will be, at most, a $22 increase in total, from all government agencies, including the school board. His Palm Coast taxes are going up $13. He, too, enjoys a $100,000 exemption and is subsidized by other taxpayers.

There briefly was a watchdog group a few years ago, but it floundered on its own, gravely misinformed facts and allegations–so grave that its legal actions were first tossed out of court, then declared frivolous, and it was ordered to pay the county–the agency it was watching over–legal fees it had incurred. If there hasn’t been another successful “watchdog” group since, it’s largely for the same reason that a majority of residents don’t feel the need to show up at budget hearings, understanding their rather simple tax notices for what they’ve meant for the past decade or more: taxes have been mostly flat, regardless of tax rates, and services, judging from the city’s annual surveys, have been mostly applauded, with three of the city’s two most expensive services (fire, police, parks) getting the highest marks.

As Palm Coast’s tax rate and tax burden was the target of one batch of mischaracterizations Wednesday evening, the size of the city’s budget was the target of another.

The general fund budget, where residents’ taxes go, is going up by less than $3 million, and half that increase is generated by new construction that doesn’t touch existing residents. Increases in the rest of the budget are better understood as increases in fee-based services rather than in the size of government. Those services are mostly their own enterprises, but since they’re run by the government, the bottom line shows up in the overall figures.

For example, $10 million of the increase is due to the increase in the monthly stormwater fee, which pays for drainage in the city, but as a self-sustaining, independently-funded department separate from all others (and funded with your money, of course). The city’s water and sewer utility, which residents pay for as they would any utility, through their monthly utility bills, also increased fees, and accounts for another $10 million in the overall increase of the budget, most of it in the capital improvement fund that pays for upkeep or additions to water and sewer plants. Absent that upkeep, residents would be protesting before the council in droves much larger than droplets of antifreeze.

Recreation, fire and transportation impact fees, which are levied on new development, not on existing residents, account for another $10 million, with much of that money slated for widening the north end of Old Kings Road. And so on: a few minutes’ look at the actual numbers removes the mystery about the budget’s size and explains its purposes. See the full chart, with all funds’ comparisons between last year and this year, below.

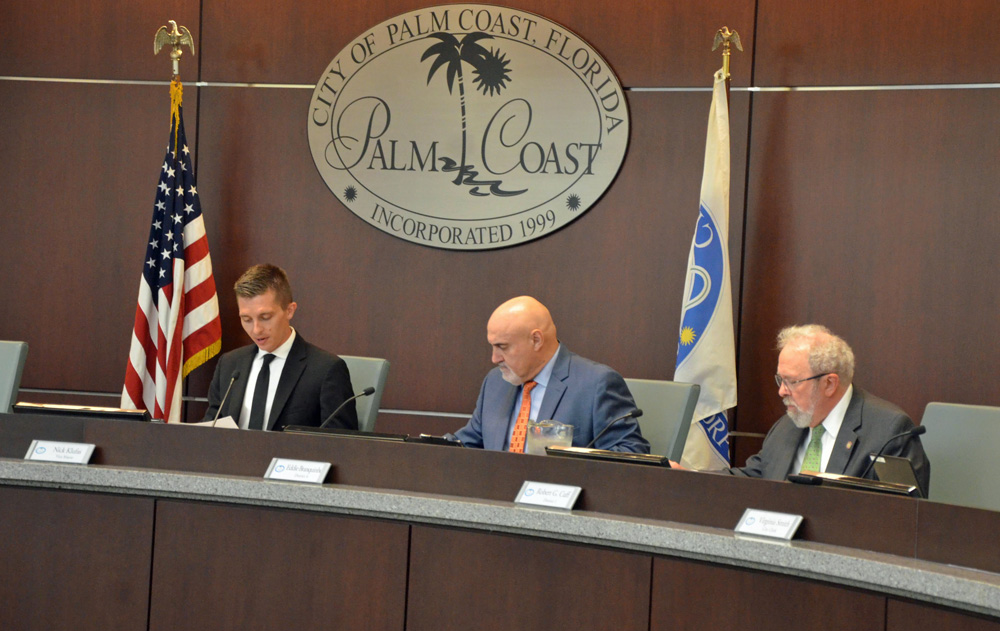

“The $202 million mark is a bit striking but that also includes all the Old Kings expansion grants and the funds that carried over from last year,” Nick Klufas, the vice mayor who chaired Wednesday’s meeting, said. On several occasions he explained the numbers–as did City Manager Matt Morton, as did Finance Director Helena Alves–though some members of the audience seemed primed to object regardless. “So even though that number is percentage wise, not just our millage rate staying the same, there is money that is being carried over from the previous budget and then also all the grants for this operating fiscal year that are being compiled into that $202 million number.”

If the council had a bellwether of discontent with the city’s finances, it was Howell, whose assumptions before he got on the council were best shadowed by rigorous fact-checking. He was convinced the city’s books were cooked. He wanted a “forensic audit” and made it a goal to have one. On Wednesday, he spoke like a city convert.

“I had mentioned when I campaigned and when I got elected I had talked about the possibility of looking at a forensic audit of our books,” Howell said, “because I just wasn’t comfortable with some things on the campaign trail I picked up. Then when I got into office, it was time that the auditors were here. I sat down with the auditors and I checked them out. And they told me they would be more than happy to do a fiscal audit, or a forensic audit, if I had some strong suspicions. So I asked them, and I said look, if you’re going through the books, would you–if you see anything that you’re uneasy with, let me know. Then would be the time that if we needed to pursue a forensic area to study that, we could do that. And as it turned out they found no issues whatsoever, which attests to the fine workmanship of our fiscal director here.”

The council approved both next year’s tax rate and the budget in 4-0 votes. (Mayor Milissa Holland was absent.) The tax rate will remain the same, at $4.6989 per $1,000 in taxable value. A $175,000 house with a $50,000 homestead exemption will pay $587.

It’s helped Howell to see government’s operations from the inside, though an inside look isn’t necessary, given the city’s published numbers. Some of those numbers are below.

![]()

Palm Coast Budget, 2019-20

| City Council | |||

| City Manager | |||

| Communications and Marketing | |||

| Purchasing | |||

| Economic Development | |||

| City Clerk | |||

| Human Resources | |||

| City Attorney | |||

| Financial Services | |||

| Community Development | |||

| Fire Department | |||

| Policing Contract with Sheriff's Office | |||

| Public Works | |||

| Engineering | |||

| Parks and Recreation | |||

| City Pool | |||

| Tennis Center | |||

| Golf Course | |||

| Non-Departmental (*) | |||

| General Fund Total | |||

| Community Development Block Grants | |||

| Police Education | |||

| Special Events | |||

| Street Improvements | |||

| Recreation Impact Fees | |||

| Fire Impact Fees | |||

| Transportation Impact Fees | |||

| Old Kings Road Tax District | |||

| Business Assistance | |||

| Town Center Community Redevelopment | |||

| Capital Projects | |||

| Special Revenue Funds Totals | |||

| Utility | |||

| Utility Capital Projects | |||

| Garbage (Waste Pro) | |||

| Stormwater Management | |||

| Building permits | |||

| IT Enterprise | |||

| Enterprise Funds Totals | |||

| Self-Insured Health | |||

| Fleet Management | |||

| Communications | |||

| Facilities Maintenance | |||

| IT Internal Service | |||

| Internal Service Funds Totals | |||

| Budget Totals | |||

Jack Howell says

Great job on explaining the tax increase in the Palm Coast Budget for 2020. What I found interesting is that many of the citizens that presented their concerns last night did not do their due diligence in preparing for the budget hearing. Most were misinformed and did not checkout the city website to get the numbers and explanations. In many cases, they were “shooting from the hip”. Our city finance director is on top of her game and is straight-forward in responding to citizen’s questions. While this was my first budget evolution with the city, I have planned to attended every city staff/meeting, within the city departments, when the budget process begins for the next fiscal year 2021. It is incumbent upon my position as a steward of public funds to make sure that funds are allocated for need items not for wanted items!

Thomas Conrad says

The City of Palm Coast spends money like it is free. Friends, it is not free to those who have to pay the taxes.

The Mayor and Council have forgotten the value of thrift.

palmcoaster says

Thank you FlaglerLive for publishing for us all, the record straight.

Did anyone in Mr, Ed Danko’s group read our Flagler County Notice of Proposed Property Taxes we all received in the mail a while ago, before speaking in the Council Meeting budget podium? I wish they would have read it before spreading the wrong message and generating financial baseless concern among the Palm Coast or County taxpayers residents. My home taxes that has only one 50,000 homestead exception notified to increase $16 in 2019 from $3,108 to $3,034. This is a fact no rumors or fake media. Just read your Flagler County Notice of Proposed Property Taxes.

At least at local level lets base our issues in real facts not wrong or distorted assumptions.

palmcoaster says

My comment is to read #3,018 not $3,108. Sorry my goof.

Virgil says

Facts have no place in Danko’s election program. He and his people trade on misinformation from the standpoints of their own poor knowledge bases. Danko’s own published quote: “…will drink antifreeze rather than raise taxes…”. Guess what? As Editor Tristam points out, Danko is already partly responsible for this increase by way of his own substantial exemptions. He has already raised your taxes and is still just a terrible flailing candidate for an office about which he knows nothing and never will. Pass the coolant! Virgil

John Kent says

Jack Howell was elected on the promise to take a good look at City of Palm Coast expenditures. Yet we have never heard if he kept his promise.

Mr. Howell, so how are fulfilling your promise to us, residents of the city?

Are those expenses justified or just frivolous throw around of our money?

Can’t wait to hear from you on that matter.

Steve Whalen says

Of course what is not mentioned is that non homestead residents, or snow birds, find their taxes took quite a jump. Even so, Palm Coast taxes are still lower than others, but it is still hard to swallow a 12.5 per cent increase like mine without any explanation why.

palmcoaster says

I am sure very glad that we elected Jack Howell for city council as he delivered his promise of fiscal responsibility and attention to lobby for what the city residents need and request. The various improvements of residential street Florida Park Drive one of them designated a No Truck Road who’s ordinance is about to be completed this Monday at 2.30 PM by city traffic engineering department in City Hall is one of them. We need and want to keep our original designated residential roads as such to preserve the quality of life of its residents preventing big semis using it. as a cut thru Also the volunteer work that councilman Jack Howell does with Teens in Flight https://www.teens-in-flight.com/ to help our teen pilots that lost a parent in our current wars or have other needs to achieve their hours of flight training to get their needed licenses to enter our military flight teams or our commercial airlines in much need of pilots. Given costly schooling piilots, like medical family practice MD’s are in shortage in our country and awareness of it makes Jack a real hero for our teen pilots as well. Jack is also working very hard to bring to this County and Palm Coast aviation related businesses corporations to generate much needed higher paid jobs . So for all the above and more we are sure happy with Jack Howell in our Palm Coast city council.

BW says

The bottom line to the complaints here is someone staging a political stunt, and these individuals do not represent the residents Palm Coast at large. It is obvious as well who these types of politicians target for their movements and capitalize on ignorance of others. The reality is that property values are increasing and population is increasing. Taxes are going to naturally increase. The millage rate didn’t change. So values moved the needle there. As the City continues to grow demands grow. A lot of the expenditure is on infrastructure types of things such as streets, lighting, storm water, etc. which is needed. I think it’s ok to voice concern, but I also do not vote for those who simply complain and do not offer up solutions. I look for candidates who bring something to the table of substance.

Fiscal says

Danko is not the answer…NO experience at all. Has he always paid his taxes? Is he fiscally responsible?

Palm Coast needs financial help says

This budget is ridiculous- there are numerous places to cut.

VB says

I just moved here and closed Jan21, my house is valued at 250,000 I am on a fixed budget of 2,000 month, realtor lied to me told me max tax bill was 3500 just filed homestead but this year I will owe almost 4,400. If you increase budget 7 percent I will owe almost 4800 might have to sell this house sooner then I planned. My neighbor only pays 600 a year, she filed for multiple deductions, I have no children in the school system and never have way too steep for me. On top of that my house passed inspection but the builder did really shoddy work and is now rescinding his warranty, only paid for it as a ploy to sell his substandard house. My impression of building standards in Palm coast is really poor work, wooden front doors, no impact resistant windows, and screws on the outside of back french door so anyone can easily remove door, how did this house ever pass inspection?

Laura Gollon says

Save Palm Coast says

NOBODY was missed informed. It is a 25% increase. And property taxes are going out of control.

Gardner and Howell should reigned.

A.J. says

Tax increases do happen a lot of times. I know I have to pay taxes on my properyt. My concern is government officials using tax dollars in an unwise manner. Some officials steal tax money, such as using the money for their personal gain. When improvements need to be addressrd, a lot of time the money isn’t available. I’ve seen in some cities, some neighbors are ignored, they pay taxes also. Hopefully this city will start to use tax dollars in a fair manner to serve every tax payer in Palm Coast.

Anja Rudolph says

Complaints from the same people who migrated south for lower taxes but keep voting for people who raise taxes. PC is the NY/NJ of the South. Newcomers are shocked when their taxes shoot up shortly after purchasing new homes and most failed to do their research of course…before moving here. Still one of the most affordable places to live for newcomers, but long time residents carry higher taxes as a result of all of this influx, but think back to 2008-2016 and thank your lucky stars PC didn’t slide farther down before the upturn. Pay off your mortgage as your first priority and then deal with taxes and utilities. Why spend 305k on new construction when you could’ve purchased in the 180-225k range and done some upgrades instead? Shiny and new costs more, duh.