Even Jay Gardner, Flagler County’s property appraiser since 2004, was surprised: after rising by just under 6 percent last year, property valuations this year jumped on average by 9.2 percent countywide, and 10.2 percent in Palm Coast.

“That is more of a wow than I expected,” Gardner said.

The jump was even steeper in Bunnell: 12.67 percent, driven again by booming construction in its Grand Reserve development. It was 7.87 percent in Flagler Beach. Marineland lost value, by 2.48 percent.

Palm Coast will benefit from the addition of nearly $255 million worth of new construction. The county’s equivalent is $362 million, and for Flagler County schools, it’s $383 million.

That new construction value is what Gardner refers to as “free money.” Tax revenue generated from that new construction is not counted against a government’s tax rate. In other words, Palm Coast will realize $1.2 million in additional revenue, thanks to new construction. It can go to the rolled-back rate, still get that new money, and not be considered to have imposed a tax increase. (See: “What Is the Rolled-Back Rate?”)

Put another way: Palm Coast will have $1.2 million in additional revenue even if it doesn’t raise taxes. For the county, additional construction means a $2.9 million windfall.

“That new construction is free money, doesn’t count against rollback,” Gardner said, “but most of the increase in taxable value is not a windfall for them. Now they may treat it like it is, but they’d have to admit in those public hearings that it’s a tax increase.” That means even if governments keep their tax rate flat, it’ll be a substantial tax increase for many this year.

Local governments are just beginning the summer’s work on their budgets, which culminates with setting next year’s property tax rates. The property appraiser’s preliminary valuation numbers are provided to them so they know what to expect for their coffers against cost of services, and whether to raise, lower or keep taxes flat. The numbers are closely watched by law enforcement and public safety agencies: those agencies calibrate their requests for additional personnel or other expansions based in part on those numbers, which point to growth–which provides the rationale, if not always tied to demonstrable need, for the agencies’ requests.

The numbers Gardner provided FlaglerLive today point to a bigger cushion than governments expected despite the Year of Covid, and will be compounded by millions of new dollars in government coffers drawn from the federal government’s stimulus. The two combined means that tax increases are very unlikely, and tax decreases possible. Elected officials have nothing to do with the windfalls, but those obsessed with antifreeze may not have to worry about drinking it this year while others can pretend to their constituents believe that they held the line on taxes.

Here’s what the new valuation numbers mean for individual homeowners.

A house valued at $175,000 in Palm Coast last year is now valued at $192,500. It does not mean that the property taxes on that house will jump in proportion–not if it is homesteaded, anyway, as a majority of residential properties in the city are, at least if property tax rates remain roughly where they are today. The “Save-Our-Homes” cap of 3 percent limits any tax-valuation increase on a homesteaded property to 3 percent or to the increase in the consumer price index as of January, whichever is lower. This year, the CPI was 1.4 percent. So that’s the cap that will apply to taxable valuations on homesteaded properties.

Conversely, it does mean that non-homesteaded properties–commercial properties, rentals, vacation rentals, second homes–will feel the full effect of the valuation increase as a tax increase, even if tax rates stay flat.

For example, that house valued at $175,000 last year, if it was in its first year of homesteading, would have paid $2,473 in total taxes (Palm Coast, county, school board and other taxable agencies.) If it’s now valued at 192,500, its taxable value will have risen a maximum of only $2,450, for a total taxable value of $177,450. The rest of its value is “protected” from taxes by the Save-Our-Homes amendment. Assuming the combined tax rate remains the same this year, the tax bill will be $2,521, an increase of $71.

The same house, if it’s not homesteaded, will have no Save-Our-Home cap, so it will see its tax bill increase to $2,819, or by $346.

Commercial and other non-homesteaded properties’ taxable valuations are capped 10 percent, but there’s hardly a year when valuations jump so much as to make the cap relevant. Even this year, with valuations in palm Coast jumping on average 10.22 percent, that 0.22 percent that the government will not capture is not statistically so significant as to dent revenues.

So big box stores will see the same percentage increase in their valuations as other non-homesteaded properties, but far bigger tax bills: the Publix property on Belle Terre in Town center, for example (which includes adjacent shops: Publix is their landlord), has seen its taxable value grow steadily year after year. It was $6.67 million in 2020, paying a total of $131,957 in property taxes (still not enough to cover the salary of the city or county manager. The figure doesn’t include an additional levy of $12,725 from the Town Center Community Development District.). Assuming a 10 percent increase in valuation and the same tax rate, that Publix property will be have a taxable valued of $7.34 million, and will pay $145,213, an increase of $13,256 (not including the CDD levy). Look for that increase in the price of your ketchup.

Of course, the various governments either raise or lower their tax rates, and even if they lower them, it doesn’t necessarily mean that it’s a tax cut. For that to be the case, the tax rate must be rolled back below the rolled-back rate–that is the rate at which a local government will take in the same amount of revenue this year as it did the previous year. By law, even if a government reduces the tax rate but not enough to meet the rolled-back rate (or below), then it’s still considered a tax increase, and your local government has to present it that way.

Typically in recent years local governments have patted themselves on the back by either keeping the tax rate flat or reducing it by a few decimal points, even though the reduction was not enough to match roll-back.

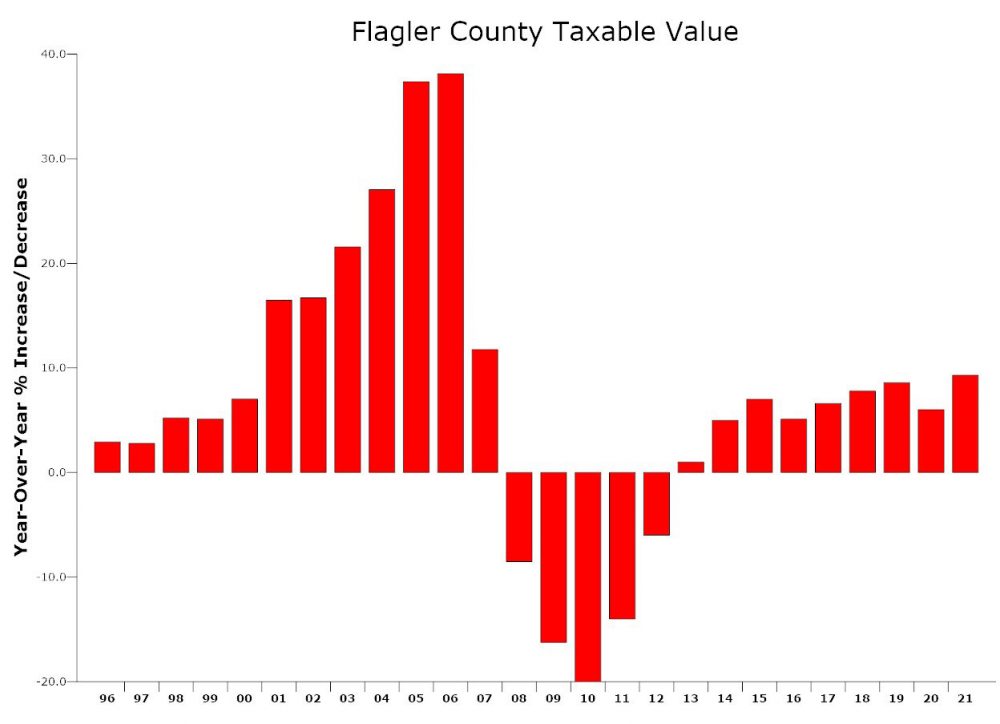

While valuations are increasing significantly, bringing back glimmers of the booming years of the middle of the last decade, Gardner said there are differences. For one, the increases are still not nearly as stratospheric as they were 15 years ago, when annual increases started zooming in 2001, to 16 percent, and higher from there: 22 percent in 2003, 37 percent in 2005, and 38 percent in 2006, when the bubble burst.

Houses are disappearing off the block very quickly after a for sale sign goes up, but unlike 2005, it’s not house-flippers and investors doing the buying, for the most part. “Now all these houses people are selling, people are moving into these houses,” Gardner said. “These people are living in these houses.” Inventory is down, and demand is high–but for livable space. “So I feel better about it than what I saw back in the crash,” even though prices are a bit higher than they should be, he said, pricing some people out of the market. “The demand hasn’t gone away, supply is still limited.”

As for next year’s valuations: Gardner says the real activity he’s seen has actually developed since January 1, after the date when his valuations were set. “The residential is just out of this world, and I’ll tell you, I’ll probably go up more next year than I did this year,” he said.

![]()

Property Values Across Flagler as of January 1, 2021, Preliminary:

Dennis C Rathsam says

Yep ….Just what Palm Coast needs, more people and more cars! Hurry up and go, only to stop at the next night a 1/2 mile away. How can this city be so skrewed up? Traffic jams are everywhere, look at Old Kings Rd, these are the slowest workers in the world! What ever happened to time is money?

GR says

I agree with Dennis C Rathsam. Way too many people and the lights here are not timed properly. I been thinking of moving.

Jack the Tipper says

Great news! Now let’s see what our “conservative” elected officials do with it. Vegas odds are 4-1 they’ll muck it all up, as most of them can’t even keep their own personal financial situations straight.

John do says

As a new resident, moved here last year. I loved how layed back & not too crowded it was. Trees, wild life, not all built up into a concrete jungle like where I came from.

Now, it’s a mess. all those great vacant plots of land, where I’d see wildlife are being gobbled up. My house is next door to one. Never thought it would be for sale. owners had it for 25 years & live in another state. Put up for sale last month with some inflated price & they will get it. I’m sad with all the growth. I saw it happen over 20 years from where I moved from.

It’s nice house values have gone up, but you can’t buy a house(not condo) in PC now for under 200K. There is not 1 on zillow.

TR says

If you think it was great just a year ago during a pandemic, you should have been here back in 1989 when I moved here. It was fantastic. But like any other good thing, the more people find out about it the more it gets ruined. It’s time for me to move on and get out of this New York/New Jersey mess. Oh and btw, I’m from New Jersey and left the mess up there back then.

Want to here something funny? When I moved here, there were only about 5 traffic light signals throughout FLAGLER COUNTY.