The dispiriting news continues to pile up for Palm Coast Data and its Princeton, N.J.-based parent company, Amrep Corp, which released its fourth quarter and fiscal 2011 results this evening.

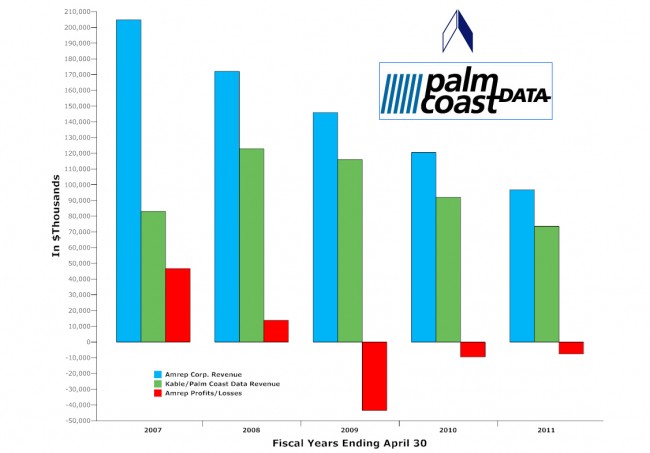

Palm Coast Data, the city’s largest private-sector employer, saw its revenue decline from $19.55 million in the fourth quarter of 2010 to $16.84 million in the fourth quarter this year, a 13.9 percent decline. Overall in 2011, Palm Coast Data, the subscription fulfillment arm of Amrep Corp., saw its revenue decline from $92 million to $73.6 million, a 16.7 percent drop in a single year, the fourth year in a row of significant declines. Last year, the division’s revenue dropped 21 percent. Since its peak of $123 million in 2008, the division’s revenue has dropped 40 percent.

Click On:

- Cancel This Subscription: Palm Coast Data Revenue Plummets Another 21% in 3Q

- Palm Coast Data Lays Off Dozens and Loses Large NRA Membership Services Account

- Palm Coast Data Parent Revenue Drops 21% in 2010, Accelerating to 24% in Last 3 Months

- Palm Coast Data Parent’s Headaches: Diving Revenue and $22.5 Million Loan Due

- Palm Coast Data’s Invitation-Only Picnic: Hot Dogs, Flattery and Suspended Disbelief

Coincidentally, 2008 was the year Palm Coast Data struck a deal with the Palm Coast city government. That year, the company consolidated its subscription fulfillment operations, closing plants in Illinois and Colorado, and merging those operations into its plant in Palm Coast. That merger was designed to better position the company against its competitors in a subscription-fulfillment industry devastated by the decline of magazine readers and the surge in Internet-based media. The Great Recession accelerated the rapid shut-down of magazines or their conversion to less-frequent publication schedules, or their migrations to web-only platforms, which don’t need companies like Palm Coast Data to manage their subscriptions. The merger hasn’t produced the desired results, though it has reduced the company’s operating expenses.

In 2008, and until the deal was announced in the fall that year, the company claimed it was considering other locations for the merger, as leverage against Palm Coast to secure a favorable deal. Yet there were no indications that any of the company’s other locations were in contention. That deal entailed Palm Coast Data promising to add 700 jobs to its existing 1,000, in exchange for $450,000 in rebates from the city, and free use of the city’s Fibernet, or high-speed internet system, for two years, though the city included a condition: the jobs had to be produced before the money would be paid. A majority of the jobs were not. The company also got $6.5 million in incentives from the state of Florida in cash and tax breaks. Some of that money is due back to the state if the jobs aren’t on the rolls.

As part of the local deal, however, the company took possession of what had been Palm Coast’s city hall, a 70,000 square foot building on Commerce Boulevard, soon buying the structure for $3 million (less than half its value at the time) and forcing the city to rent offices at City Marketplace, for $20,000 a month–and triggering a politically damaging initiative, for incumbent council members and the mayor, over prospects of building a new city hall. Those plans have been quietly shelved for now.

Palm Coast Data is part of Kable Media Services, which also ran a newsstand distribution and product services division. That division, smaller than Palm Coast Data’s fulfillment service, suffered some, but significantly smaller revenue drops over the year, with the product services segment recording a slight improvement. Kable is itself a subsidiary of Amrep, the umbrella company that bought Palm Coast Data in November 2006 for $92 million. Amrep’s greatest liability has been Amrep Southwest, a land sales company in Rio Rancho, New Mexico, that suffered enormously from the real estate bust. The average selling price per acre for Amrep Southwest in Rio Rancho this year was $40,000 per acre in the fourth quarter of 2011, compared to $83,000 in the same period last year. The real estate subsidiary’s revenue fell from $5.2 million in 2010 to $1.8 million in 2011.

Overall, Amrep’s revenue dropped from $120.5 million in 2010 to $96.8 million in 2011, a $23.7 million decline, or 19.7 percent. The loss included huge write-downs of $6.8 million in real estate assets (before taxes) and $3.9 million in the company’s newsstand distribution service. Presumably, by writing off those losses in 2011–essentially, a charge for bad investments–the company is positioning itself for better numbers in coming quarters. But its main engine now is Palm Coast Data, and that engine has lost cylinders, as its revenue declines indicate, with little hope of a turn-around in the magazine industry.

Palm Coast Data has survived rough years before. In 2002, its parent company at the time Dimac Direct Marketing, had filed for bankruptcy before Palm Coast Data was acquired by Tinicum Inc., a private equity firm, which held the company until its sale to Amrep in 2006.

Nick D says

Now wait a minute; isn’t this the same Palm Coast Data that Mayor John Netts called “a great place to work in Palm Coast” during our first countywide Economic Development Summit? I guess this must go along with the city’s “Prosperity 2021 Plan.”

So, with a 16.7% decline in revenue for the fourth year in a row, when can we expect the next round of layoffs from this “great place to work?”

Alex says

Palm Coast Data and the city should reverse the old city hall building transaction.

Kari Craig says

I completely agree, Alex! Why not kick PCD out of the “City Hall”, move the emploees into the offices of those who have been laid off in the last 2 years. The City of Palm Coast can keep the $450,000 (which our city NEEDS desperately), and PCD can do what they should be doing, fitting into a space that they can afford…WITHOUT laying off more help.

Gator says

Does this report also reflect the loss they’ll take when they lost NRA? Or will that be on the next report?

As far as them adding 700 jobs, I think I remember reading that would happen in October? Also, I want to know how long they have to create these jobs when they received the incentives from the state.Is it 5, 10, 15 years? Will the good old state of Florida ever hold them accountable? Has Flagler County paid them their incentive money? Are they still using the city’s Fibernet??? Or is that from our tax dollars too. Are we tax payers supporting this company?

SO, Flagler County sold them their building for below the market value at that time, Flagler County is having to rent out offices at 20,000 a month & they are going to pay Palm Coast Data incentives…….wow, how absolutely ludicrous is that! Palm Coast Data, I’m sure are laughing their butts off!

[email protected] says

Profits will continue to go down until they replace all top management positions with people who know what they are doing plus they are top heavy with too many chiefs…

lawabidingcitizen says

Mail orders and magazines are the buggy whips of 21st century. PCD ain’t coming back and yes taxpayers are subsidizing them as we’ve been subsidizing the other down spirals in local “economic development.” I’d list them all, but it’s too depressing as we still haven’t learned our lessons and voted out all incumbents, so they’ll keep on keeping on.

Deborah says

Well as one of the employess that was displaced by this merger I am not surprised at this turn of events…. We in Co were blindsided by this deal… The customer service of PCD Fl leaves something to be desired. Clients were unhappy with the move and left…. I do not wish to see people unemployed however as the saying goes (and this is for upper management) “what goes around comes around”

FromColorado says

I agree Deborah. Coming up on 2 years without work, thanks PCD. I’ve heard some of the upper management that was responsible for moving the work from CO to FL has since been laid-off. I’m glad, they can suffer the same demise they caused us. Not to wish anyone else has to go through what I’m going through but as you stated ‘What goes around comes around”. I have many friends that moved to FL so am definately not wishing their jobs away. Good Luck!

The Band Plays on says

Today, John Meneough, President, announced he is stepping down at Palm Coast Data…

harryc says

It should be more clearly understood that the downturn in fortunes for PCD actually has very little to do with the problems faced by the publishing industry. That has simply been the party line put out by their senior management in the hope they will look less incompetent. The real issue is that they have lost hundreds of magazine clients because of poor service and sheer arrogance. The numbers do not reflect the recent loss of the American Diabetes Association and others. Hachette Magazines with around 6 million subscribers will also be leaving in September. If you think these numbers are bad – stay tuned.