The Flagler County school district is caught in a feedback loop draining its budget as enrollment drops: more students are abandoning the district for private or homeschool education paid for with public money. That reduces the amount of state money the district can count on. More limited resources may encourage more students to leave, further reducing state dollars going to the district.

Presenting a grim report of what’s ahead, John Cerra of the Cerra Consulting Group, the school district’s legislative consultant, told the School Board on Tuesday that the continuing loss of students to “school choice” options “will be extremely challenging for the board to continue to make their budget moving forward.”

Statewide public school districts lost a collective 1 percent of students this year even as the statewide education budget rose by 1.69 percent, or $945 million. Per student, the increase equates to 1.59 percent, with Flagler getting a 2.36 percent increase.

But local districts won’t see most of that money. “Most of that increase was within the vouchers,” Cerra told the board at a workshop. “We will not be able to spend a lot of those dollars.” In a rare bright spot, the recently ended legislative sessions safeguarded full funding for acceleration programs such as the International Baccalaureate, Advanced Placement and the Cambridge AICE program.

But it left flat mental health and school safety funding, in effect causing a decline in those funds as districts lose purchasing power. Districts, including Flagler schools, are seeing deficits ahead and choices to make.

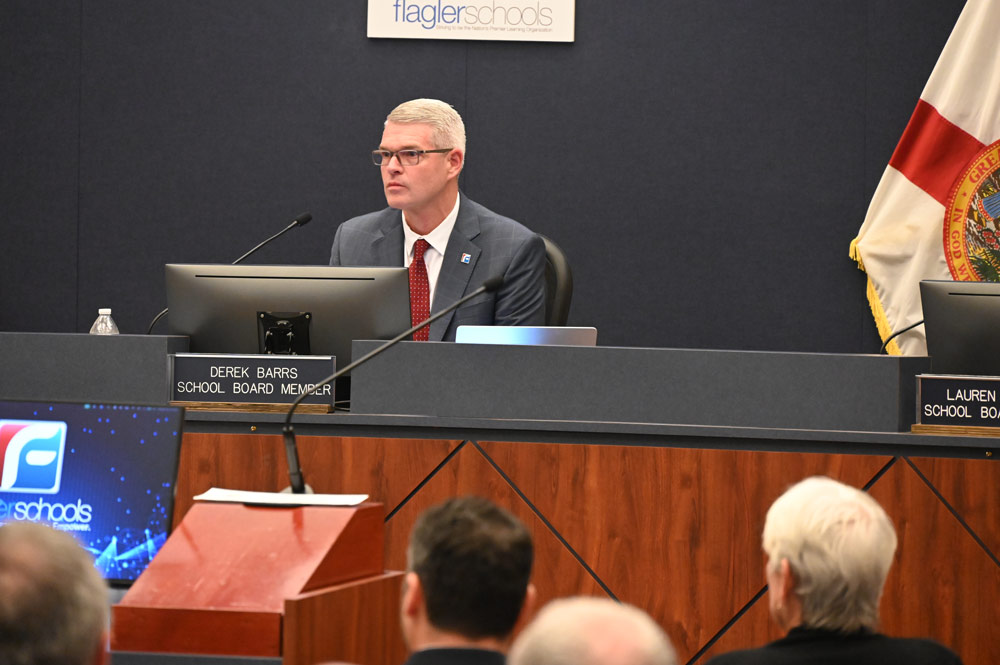

“It’s not like this is a shock to anyone that’s in this room of where we are,” School Board member Derek Barrs said. “We could be in a whole lot worse shape. But we’re not in a great shape. We’re still going to have to make some hard decisions coming up in the future here, and that’s the cold, hard facts. And I think that’s what everyone in this room and people are listening need to have that understanding.”

Barrs said that leaves the district with no choice but to convince the community that in the “school choice” world, “this really sets the stage for us to set ourselves apart of being the best choice.”

Flagler district officials estimate that about 2,000 local students are in the voucher system, though a large portion were never in public schools to begin with. But that portion of students leaving public schools for vouchers is growing. Flagler County schools’ population has not increased in 18 years even as the county’s population has increased by about 33 percent in that span. The district is expecting a net drop of 432 students–a 3 percent decline–when the new school year begins in August.

Still, Superintendent LaShakia Moore tried to put a brighter spin on the district’s future. “We are a choice, and we have 13,000 plus students whose families choose us, and we need to remain the best choice for those students and their families,” she said.

Even though Flagler schools are getting a net 2.36 percent increase in state funding, “there are a lot of factors that will not make that 2.36 a true increase,” Cerra said. The legislature is requiring Flagler schools to spend an additional $2.2 million on state mandates while providing only $1.9 million in additional funding. That creates a $300,000 deficit for a district ending the current fiscal year with having to close a $2.5 million deficit.

“Other local commitments for next year, including health insurance increases and planned raises would require another $3.5 million that Flagler Schools does not have in this state budget,” Cerra’s presentation cautioned.

“We are having our own issue,” Cerra said of Flagler schools. “Other districts are having a worse time dealing with vouchers and the new budget situation.”

One of those issues is the accountability of the voucher program. Districts are desperate for data to ensure that parents aren’t double-dipping–sending their students to public schools while cashing in on the roughly $8,000 per student per year available through the voucher program. Lawmakers were supposed to fix that this year. The state Department of Education is required to submit calculations ensuring that families aren’t double-dipping. “This was supposed to be a part of the bill. Unfortunately, it did not come through with the final negotiations,” Cerra said. In an interview earlier this year, Flagler Schools Superintendent LaShakia Moore said there is a $48 million difference between the money withheld from districts and the money awarded to families as vouchers. That figure, she said, is indicative of the double-dipping.

Other challenges: “There were no increases to safe schools and the mental health allocation, which was interesting, because it’s the first time in about eight years that there was no increases to those,” Cerra said.

The Safe Schools program pays for the Flagler school district’s half of the cost of Flagler County Sheriff’s deputies in each of the district’s nine schools (two at each of the high schools). The County Commission pays the other half. Those costs increase every year, so the school district will have to absorb the additional costs.

“We had an unfortunate incident at the Florida State University,” Cerra said, referring to Phoenix Ikner, the 20-year-old son of a cop, shooting and killing two people and injuring six on campus in mid-April. “You would have figured that these increases would have gone up because of the need,” Cerra said of mental health and safe-school funding.

Florida Retirement System costs are also going up, and staff raises are ahead, adding pressure to the budget.

The consultants said the legislative session that just ended dashed some hopes for initiatives that would have helped the district. “John and I were disappointed about the outcome with rural Renaissance,” Bob Cerra told the board, referring to a plan the Senate passed unanimously to improve health care, education, transportation and economic development in counties like Flagler. “There were some real opportunities there that would have helped the district in its budgeting and provided opportunities to move some of our core issues forward. I do believe that the senate president will be bringing that back next year.”

The budget lawmakers eventually passed did little for education. Tax cuts were limited to eliminating the tax businesses pay on rent. The legislature had already reduced that tax to 2 percent over the years, as opposed to the regular 6 percent tax.

The bill also creates a monthlong sales tax “holiday” for school supplies, every year for the length of August. The suspension exempts from both the state and local sales taxes (including the school district’s own half-penny sales tax) school supplies costing $50 or less and clothes costing $100 or less, as well as personal computers and accessories costing $1,500 or less.

Numerous items were added to the list of permanent exemptions from the sales tax, including batteries, smoke detectors, fire extinguishers, portable generators, bicycle helmets, sunscreen and insect repellent. Lawmakers for inexplicable reasons also exempted gold, silver and platinum bullion sales from the sales tax.

![]()

Bo Peep says

Yeah well they have themselves to blame for bringing a leftist agenda and politics into the classroom. We took religion out of it and we are not putting accepting the word into it.

Disgusted says

So the plan is working, re-direct (steal) public taxpayer funds for private, for profit, charter and religious schools at the expense of public school system. Forcing the public schools to raise local taxes in an attempt to offset these thefts. Personally, I do not want my taxes used to further indoctrinate our youth with sometimes extreme religious views. Public taxpayer monies should never be used to fund these private schools. Just another step in the master plan to privatize the public schools systems, so tax dollars are diverted to buy the votes of those on the receiving end and to continue to fund their political lobbying. Many have no problems with this effort, as long as the monies are going to “Christian” schools, they would raise holy hell if would be going toward schools with different religious beliefs. It is kind of funny in a way, the powers that be, want total control of what is taught in our public schools and how it is taught and who teaches it, but they support funding schools that don’t have such controls placed on them.

Glad I don't have kids in the school system says

What happened to all the PPP money?

Education in this county is abysmal.

Plus there’s a lot of propaganda being outwardly and subliminally taught. Having been a reading mentor in several local schools, I was appalled at the bulletin boards in the schools promoting (subliminally) different types of social justice issues.

Many parents are opting to go the home school route because they don’t want their children propagandized by the government. Hence more school vouchers, as proposed by Milton Friedman in “Capitalism and Freedom” many many years ago. School vouchers equate to freedom of choice in education. Who ever said the government was the only way to educate a child? OR not educate a child as the reading, writing and math stats indicate. How many kids graduate from the Flagler County School System unable to read or comprehend even a simple sentence? I know a couple of kids at least in my neighborhood who can’t read, spell or do simple math problems.

But getting back to my first point, WHAT HAPPENED TO THE SURPLUS OF PPP MONEY awarded to Flagler Schools?

Merrill Shapiro says

Our schools–and all of us who pay for our schools–are feeling the impact of the war on public education. We need leaders, perhaps our school board members, who will act as the vanguard in the battle to push back legislation that aims to cripple our public schools.

As good as they are, Flagler County Public Schools will never overcome the bias of “perceived value.” That bias leads to the false assertion that private schools with fancy tuitions must be far better than our Public Schools which are (in too many minds) free. But too many of those private schools with fancy tuitions rely on teachers who have little training, little experience and few credentials to enter into a classroom. Our outstanding Flagler County Public Schools are staffed with educators who have relevant degrees from colleges and universities, state credentials, lots of experience. Our public school teachers are well-supervised and constantly honing their skills–something that is rare among local private schools.

School Board members arise! Our community calls upon you to take a leadership role in this war on public education!

JimboXYZ says

Oh, they’ll be just fine. Just bitter that they don’t have the enrollment to seek to build 2 new schools that are unnecessary. We all remember the dire reports in 2021 that every school would be over capacity. Palm Coast/Flagler County grew like it did and enrollments dropped. It’s easier to raise county school taxes when there’s a real problem for being overcapacity. They have their budget, live within the budget like everyone else has had to do for decades. Never ends with these types, always coming around with a fabricated crisis to spend more money for the sake of spending money, raises and yet the education product is the same as it’s always been. Watching the show like we all have, how embarrassing the 2021 models for doom & gloom of not having enough desks for every student turn int a surplus of desks. Another $ 405+ million to the STF’s $ 1/2-3/4 billion of debt ? Education is becoming even more unaffordable, we all know who to thank for that too.

https://flaglerlive.com/school-enrollment-december-2024/

Standing in the Middle of Palm Coast Parkway says

There is $48 million dollars of known theft happening in Flagler County as parents collect voucher money and send their children to Flagler County schools. That’s what is know but no one is pursuing that $48 million dollars.

On top of that are parents and grandparents that are collecting school voucher monies here while their children attend schools in other states. ‘Home schooled’ students aren’t required to show up at a Flagler County school but once an academic year. All the while these children are living with one or both parents in another jurisdiction but their parent or guardians live and collect here.

Given the magnitude of this fraud you’d think the State Education department would do something. Maybe our Sherriff should consider putting one or two LEOs on this?

https://networkforpubliceducation.org/voucher-scandals/

Eliminate the top swamp people says

This county has way too many teachers who are now in administrative positions collecting money for little or no contribution. Those “ticks” provide little to no value for education but they steal valuable resources. Fire them all!! Go bare minimum at the top and pay teachers more. I pulled my daughter out of the Flagler system because it sucks. The only good school is Old Kings Elementary. School administrators, pick up a mirror and look at your reflection…there you will find the problems.

JC says

“Plus there’s a lot of propaganda being outwardly and subliminally taught. Having been a reading mentor in several local schools, I was appalled at the bulletin boards in the schools promoting (subliminally) different types of social justice issues.

Many parents are opting to go the home school route because they don’t want their children propagandized by the government.”

In a way the parents will also teach propaganda to their children because that’s the right propaganda, and will get pissed when their children get older that they reject the propaganda that they were taught by their parents.

Barrs is still here? says

I thought Derek Barrs abandoned his post for greener pastures?

FlaglerLive says

Still awaiting Senate confirmation.