To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Patchy dense fog in the morning. Mostly sunny. Highs in the lower 80s. West winds around 5 mph, becoming north around 5 mph in the afternoon. Sunday Night: Partly cloudy. Patchy fog after midnight. Lows around 60. Northeast winds around 5 mph.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

Palm Coast Farmers’ Market at European Village: The city’s only farmers’ market is open every Sunday from noon to 4 p.m. at European Village, 101 Palm Harbor Pkwy, Palm Coast. With fruit, veggies, other goodies and live music. For Vendor Information email [email protected]

‘Around the World in 80 Days’ at City Rep Theatre, 3 p.m. Sunday. Adults, $25, youth, $15. Buckle up for a whirlwind journey with CRT’s revival of Around the World in 80 Days! This high-energy adaptation of the Jules Verne classic follows fearless Phileas Fogg as he races across the globe. With clever staging, quick-changing characters, and nonstop laughs, it’s a theatrical adventure full of heart, hilarity, and wonder. A fast-paced, fantastical adventure for the whole family. book here.

Gamble Jam: Join us for the Gamble Jam at 3 p.m. —a laid-back, toe-tappin’ tribute to the legendary Florida folk singer and storyteller, James Gamble Rogers IV! Musicians of all skill levels are welcome to bring their acoustic instruments and join the jam. Whether you’re strumming, picking, singing, or just soaking in the sounds, come be part of the magic at the Gamble Jam pavilion! The program is free with park admission! Gamble Rogers Memorial State Recreation Area at Flagler Beach, 3100 S. Oceanshore Blvd., Flagler Beach, FL. Call the Ranger Station at (386) 517-2086 for more information. The park hosts this acoustic jam session at one of the pavilions along the river to honor the memory of James Gamble Rogers IV, the Florida folk musician who lost his life in 1991 while trying to rescue a swimmer in the rough surf.

Irving Berlin’s Holiday Inn, at Athens Theatre, 124 North Florida Avenue, DeLand. 386/736-1500. Tickets, Adult $37 – Senior $33, student/Child $17. Book here. Celebrate the magic of Christmas with Irving Berlin’s Holiday Inn—a heartwarming holiday treat packed with show-stopping dance numbers, dazzling costumes, and a treasure trove of timeless tunes. When Broadway performer Jim leaves the bright lights behind for a quiet Connecticut farmhouse, he ends up transforming his home into a seasonal inn, open only on the holidays. But with love in the air, rivalries heating up, and performances for every festivity, the holidays get a lot more exciting than he ever imagined. Featuring 20 beloved Irving Berlin classics—including “White Christmas,” “Happy Holiday,” “Blue Skies,” and “Cheek to Cheek”—this delightful musical delivers all the laughter, romance, and seasonal sparkle of a Christmas card come to life. Presented through special arrangement with Concord Theatricals

Grace Community Food Pantry, 245 Education Way, Bunnell, drive-thru open today from noon to 3 p.m. The food pantry is organized by Pastor Charles Silano and Grace Community Food Pantry, a Disaster Relief Agency in Flagler County. Feeding Northeast Florida helps local children and families, seniors and active and retired military members who struggle to put food on the table. Working with local grocery stores, manufacturers, and farms we rescue high-quality food that would normally be wasted and transform it into meals for those in need. The Flagler County School District provides space for much of the food pantry storage and operations. Call 386-586-2653 to help, volunteer or donate.

ESL Bible Studies for Intermediate and Advanced Students: 9:30 to 10:25 a.m. at Grace Presbyterian Church, 1225 Royal Palms Parkway, Palm Coast. Improve your English skills while studying the Bible. This study is geared toward intermediate and advanced level English Language Learners.

Al-Anon Family Groups: Help and hope for families and friends of alcoholics. Meetings are every Sunday at Silver Dollar II Club, Suite 707, 2729 E Moody Blvd., Bunnell, and on zoom. More local meetings available and online too. Call 904-315-0233 or see the list of Flagler, Volusia, Putnam and St. Johns County meetings here.

Flagler Cares is in the midst of its Second Annual “Keep the Holiday Lights On” campaign. The health and social care coordinating organization is inviting residents and businesses to support local families in need of a modest financial bridge to keep their power on this holiday season. This initiative encourages neighbors to help neighbors by sponsoring homes to ensure struggling families can keep their lights on through December. The goal is to sponsor 100 homes at $100 per home, covering one month’s electric bill for families who might otherwise face utility cut-offs during the holidays. Supporters are welcome to contribute any amount to help brighten the season for their fellow residents. Donations can be made now through the end of the year on the “Keep the Holiday Lights On” webpage at www.flaglercares.org/holiday. Check donations may also be mailed or dropped off at Flagler Cares, 160 Cypress Point Parkway, Suite B302, Palm Coast, FL 32164. As homes are sponsored, donors can watch the campaign’s progress online as homes on the page light up — a symbol of the community’s shared compassion and care.

Notably: Newspapers are discovering graphics as a storytelling form. At the beginning of November Le Temps, the Swiss French-language daily, launched a series of reports on the American resistance to Trump–not as traditional reporting, though it’s very much been that, but as a graphic series (calling it comics doesn’t fit). The five-part series is written and illustrated by Patrick Chappatte, a Lebanese-Swiss cartoonist whose work appears all over the globe. It’s no different than standard reporting, but in drawings. In the first installment he interviewed Donald Ayer, deputy Attorney General from 1989 to 1990 under President George H. W. Bush and former clerk for William Rehnquist, who told Chappatte that American democracy is hanging by a thread. He interviewed Ardem Patapoutian, the Lebanese-American Nobel prize winner in biology for his work in molecular research, who worries about ICE throwing him out, and he inerviewed Terry Moran, who was thrown out by ABC News after a 26-year career there, all because he wrote, not in so many words, that Stephen Miller is a “world class hater.” Good journalism, Moran tells Chappatte, is still one of the best way to fight back. “Trump is getting ready to fundamentally change our democracy,” Moran says. “It’s the most important story of my career.” The series continued along those lines. The New York Times has been doing likewise. On Oct. 21 and Nov. 20, it ran a graphic OpEd reported by Jake Halpern and illustrated by Michael Sloan called “Separation,” “a series following one Honduran family as they navigate America’s shifting immigration landscape. The story is based on firsthand reporting, legal documents and excerpts from the eldest son’s journal.” It’s ongoing. As is the demolition of democracy both projects are documenting.

Notably: Newspapers are discovering graphics as a storytelling form. At the beginning of November Le Temps, the Swiss French-language daily, launched a series of reports on the American resistance to Trump–not as traditional reporting, though it’s very much been that, but as a graphic series (calling it comics doesn’t fit). The five-part series is written and illustrated by Patrick Chappatte, a Lebanese-Swiss cartoonist whose work appears all over the globe. It’s no different than standard reporting, but in drawings. In the first installment he interviewed Donald Ayer, deputy Attorney General from 1989 to 1990 under President George H. W. Bush and former clerk for William Rehnquist, who told Chappatte that American democracy is hanging by a thread. He interviewed Ardem Patapoutian, the Lebanese-American Nobel prize winner in biology for his work in molecular research, who worries about ICE throwing him out, and he inerviewed Terry Moran, who was thrown out by ABC News after a 26-year career there, all because he wrote, not in so many words, that Stephen Miller is a “world class hater.” Good journalism, Moran tells Chappatte, is still one of the best way to fight back. “Trump is getting ready to fundamentally change our democracy,” Moran says. “It’s the most important story of my career.” The series continued along those lines. The New York Times has been doing likewise. On Oct. 21 and Nov. 20, it ran a graphic OpEd reported by Jake Halpern and illustrated by Michael Sloan called “Separation,” “a series following one Honduran family as they navigate America’s shifting immigration landscape. The story is based on firsthand reporting, legal documents and excerpts from the eldest son’s journal.” It’s ongoing. As is the demolition of democracy both projects are documenting.

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Flagler County Commission Morning Meeting

Beverly Beach Town Commission meeting

Nar-Anon Family Group

Flagler Beach United Methodist Church Food Pantry

Weekly Chess Club for Teens, Ages 10-18, at the Flagler County Public Library

Flagler Beach Library Writers’ Club

Flagler Beach Planning and Architectural Review Board

Palm Coast City Council Meeting

Bunnell Planning, Zoning and Appeals Board

Flagler Beach United Methodist Church Food Pantry Evening Hours

Random Acts of Insanity Standup Comedy

For the full calendar, go here.

I like cartoons. I used to try to do them myself, sent a batch every week to the New Yorker, all rejected of course. I just ly couldn’t draw very well. I like the ones that are drawn well better than the situations.

–Flannery O’Connor, in one of her letters.

Laurel says

Now Mandami is Trump’s best friend! Hilarious!

Laurel says

Um, Mandami and Trump are BFFs…maga?

🦗🦗🦗🦗🦗🦗😂

Laurel says

By the way, Karoline Doorknocker Cross Leavett, said “He’s being honest!” Oh, Karoline, how do your remain so comfortable with twisting and lying, and with a smile on your face? Did you learn that in Sunday School? She is cute, though, and Trump values that in women. No much more.

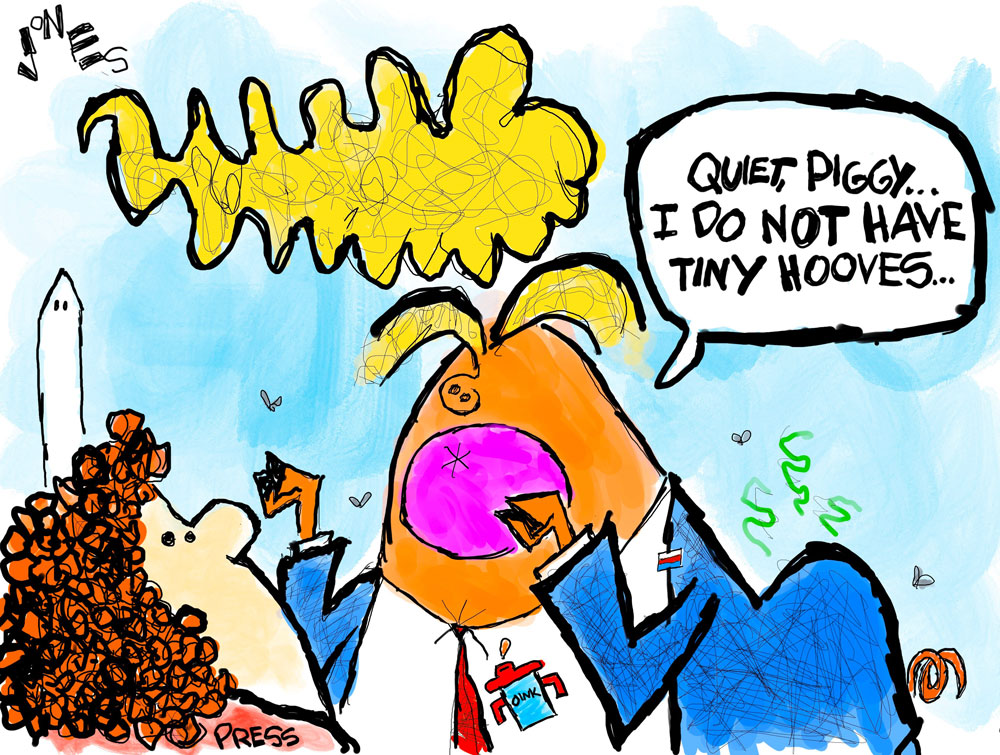

Can you imagine any other, and I do mean any other, President of the United States calling a female reporter “piggy”? Go ahead, and try to figure a single President who would stoop so low.

He doesn’t much like females, does he? No, he doesn’t. Especially smart, bold women. I would wager that no one would accuse Trump and Melania has a true romance of the heart. Just a guess.

Laurel says

“you” not “your”

I never did excel in that female dominated career in typing.

Ray W. says

According to a Men’s Journal story, Nissan, a company facing significant financial headwinds, remains a potential industry leader in innovative battery technology. Indeed, Nissan may be one of the first of several carmakers to bring solid-state lithium-ion EV batteries to mass-production.

Nissan, writes the reporter, now partners with an American battery start-up, LiCap Technologies. LiCap “specializes in a critical process necessary for the production of cells: dry coating.” A “wet-coating process”, comparatively expensive and time-consuming, is used in traditional EV battery manufacturing.

Today, says the reporter, the average manufacturing cost of all types of EV battery storage capacity is $115 per kWh. LiCap’s dry coating method is much less costly, at $75 per kWh, plus the dry coating process requires less time in building the batteries. Dry coating also offers a “greater degree of quality control.”

Drawing from a Nikkei report, the reporter stated that:

“Nissan’s batteries have met the performance metrics needed by the company to justify mass production. Nissan has already begun running a pilot production line for its solid-state EV batteries.”

What all of this means, according to the reporter, is that Nissan’s new solid-state batteries will double the range of Nissan’s current EV line-up, i.e., it’s Leaf would come from the showroom with a range of 600 miles or more on a single charge.

The reporter predicts:

“… Solid-state batteries could represent an entirely new chapter for electric vehicles. With reduced costs and greater commercial viability as a result, automakers will be able to offer their cars to a broader audience. Not only could this renew interest in EVs and increase the rate of adoption over traditional gasoline, but it may also represent a nail in the coffin for gasoline-powered cars. With unmatched efficiency and truly impressive range, buying a gas car becomes more of a personal choice than one made for financial reasons. However, while several automakers are working on solid-state batteries, we’re likely still years away from mass-market vehicles shipping with these battery packs.”

Make of this what you will.

Me?

When the reporter writes of “shipping” vehicles with solid-state battery packs, is he saying a mouthful? Will these batteries come in foreign-made vehicles? Is he admitting that America’s Big-3 legacy automakers are falling further and further behind in the personal transportation future?

Yes, it is an American start-up that possesses the technology, i.e., the patents, to drive the solid-state battery revolution that is just years away, but it is Nissan that recognized the value of the American talent, not Chrysler or Ford or GM.

Let’s face it. An American start-up made commercially viable a “dry coating” process but American legacy automakers did not take advantage of it. Nissan swooped in and will in almost all likelihood reap the benefits of the American idea; its new battery manufacturing process will likely offer a greater than than one-third cut in manufacturing costs to produce a battery that has twice the range of current batteries.

I have been arguing this for some time.

In 2008, American researchers developed the lithium-ferrous-phosphate (LFP) battery. Patents were issued. A factory was built. American legacy automakers looked the other way. The company went bankrupt. A Chinese company bought the patents out of the ashes and further developed the battery. Now, LFP batteries are one of the most common battery pack options out there and American legacy car companies are paying Chinese battery makers to ship to America the LFP batteries they need for their cars and light trucks.

We, as an industry, stupidly looked backwards instead of forwards. This is the message of Ford’s CEO. He says the Chinese EV industry is 10 years ahead of our own. A race is on to catch up. If we lose this race, he says, the American Big 3 legacy carmakers will be facing an “extinction level event.” These are his words, uttered out loud.

Analysts predict that some 85 million cars and light trucks will be sold all around the globe in 2025. Electric vehicles will constitute some 25% of that total. Whatever the average selling price turns out to be, the math is simple: 85 million times X equals direct economic impact. Choosing a hypothetical average of $30,000 per vehicle sold (it is likely more than that), the personal transport marketplace generates $2.45 trillion per year. Twenty-five percent of $2.45 trillion is just over $600 billion.

Why did we, as a legacy car industry, two decades ago decide to give away to China what could have remained ours? America led the world in emerging battery technology. No longer.

China is on track to export more than 2 million EVs in 2025, up 90% over 2024. Some of that could have been ours.

Chinese car companies are building battery plants and car factories all over the world. Brazil, Mexico, Hungary, Turkey, Pakistan, Malaysia, Thailand, Germany, each sees the impact of a growing industry. Some of that could have been ours.

In 2008, the Chinese EV car industry was tiny. BYD rolled out its first EV, poorly designed and laughably unreliable, in 2008. 16 years later, BYD passed Ford to become the fourth largest carmaker in the world by unit volume. BYD no longer sells gas-powered cars, but it does sell hybrid cars that are EVs first and gas-powered second, solely to extend the vehicle’s range once batteries run low.

What happens when EV battery range doubles at lower cost? With solid-state batteries, will there remain an economic need to extend range via gasoline?

I have been waiting almost a year to comment about an EV battery replacement technology. It is not considered a battery. Batteries involve a chemical process to produces electricity.

I tried to post one comment about the technology, but somehow it disappeared.

I have been reading and thinking about how best to present the idea to the FlaglerLive community. It is an ancient field, and widespread in the electronics industry, but not in the car industry. Maybe soon.

The Chinese hold the current lead in the emerging vehicle power sector, but there is no reason why the U.S. can’t dominate the electrostatic, not chemical, field.

Should the technology become commercially viable, and it already is commercially viable in certain sectors, and has been for 20 years, gas-powered vehicles will, in almost all certainty, become a niche industry.

James says

‘… Then we found out that last week on board Air Force One, Donald Trump got angry at a female reporter for asking him about Jeffrey Epstein, and yelled at her, “Quiet piggy.””…’

Who knows? It could have been far worse, he could have tossed her off the plane.

Advice, bring a parachute… just in case.

Pogo says

@Used to be local news

https://www.bing.com/search?q=trump+new+offshore+oil+drilling

… now it’s just the Trump weather report.

Ray W. says

I just posted to the FlaglerLive community a comment about Nissan’s up-coming solid-state EV battery.

Here is Toyota’s version of the story.

According to an InsideEVs Global story, at the recent Japan Mobility Show, Toyota president of Carbon Neutral Advanced Engineering Development, Keiji Kaita, told a Car Expert reporter that its new solid-state battery design is being designed to last 40 years:

“The existing lithium battery we are making now, by the typical usage, our target is maybe 10 years, 90% capacity. … This [SSB] is maybe 40 years, 90% capacity — this is the potential we are targeting.”

According to Mr. Kaita, the upfront cost of solid state batteries will be “greater”, but over time the longevity of the new battery design will make up the difference.

Toyota presented to reporters its “Toyota’s Battery Technology Roadmap”, in which there is a “next generation” and a “further evolution” of batteries in the works. From the chart, Toyota’s solid state batteries will see production in either 2027 or 2028. Range is expected to be in excess of 620 miles. Recharge time will be, give or take, 10 minutes.

Make of this what you will.

Me?

The EV race is far from won. Ford’s CEO says EV technology is having its Model T moment. There is every reason to believe that American inventiveness, if fostered by American legacy automakers, can overcome the hole that American political leaders dug for us all.

Yet again, economists estimate that the American oil and natural gas sector will receive some $20 billion this year in government subsidies of all kinds. The Texas legislature has, in two installments, given the state’s governor $9.2 billion to loan to companies that promise to build natural gas power plants not because natural gas power plants will lower costumer utility bills, but because no one will build a natural gas power plant without the subsidy.

Can it be argued that an established energy sector that cannot stand on its own does not bode well for Texas electricity rates. It’s one thing to support with government subsidies an emerging energy sector, but propping up an established energy sector just might be throwing money away.

The key to the story is that the $9.2 billion Texas program came with an escape mechanism built in. If a power plant fails in the competitive electricity marketplace, i.e., if utility companies decline to buy electricity from the plant over its 50-year lifetime, the plant will fail and a third party will come in and sell off the assets of the failed company. Texas taxpayers will shoulder the burden of the unpaid portion of the loan.

Think of this. A legal pathway out for the companies was built into the project, but not for the taxpayers.

James says

In answer to my query, yes, yes and perhaps.

Yes, the physical properties of platinum suggest it could be used in the construction of a fondue set… high melting point, malleable (but not as easily workable as gold or silver) and it doesn’t tarnish (like silver, but does require careful periodic cleaning).

Yes, it is for the most part chemically nonreactive… much like an inert gas. But long term exposure to the element in its use in the process of cooking? Hey, there’s controversy surrounding just about everything nowadays… even cast iron has its critics, and people have been cooking with cast iron for some time now (unlike platinum). Doubt anyone has studied the deleterious long term effects of platinum exposure in cooking utensils… in trace amounts or otherwise.

Finally, perhaps it’s feasible, but not practical… for the average consumer millionaire… billionaire, ummm, well.

To recreate the “MegaChef” fondue pot with forks set… which appears to use approximately five, five and a half pounds of cast iron (with approximate density of seven and a half grams per cubic centimeter)… would probably require about two pounds of platinum (density of platinum 21.45 g/cm^3).

At $1540 per ounce, that’s $49,280. Not to mention the price of the pouched ivory or ebony, perhaps another few thousand… let’s say, $59,999 total.

Will that be cash or charge?

Ray W. says

A British news outlet, perhaps more a think tank, named imarc, has a story on its site that starts as follows:

“The energy storage revolution is here, and it’s powered by graphene. While the world struggles with the limitations of conventional lithium-ion batteries, a new technology is emerging that promises to shatter every performance barrier we’ve accepted as unchangeable.”

Here are some bullet points from the article:

– The current value of the global graphene battery sector is $137.8 million. The IMARC Group projects value growth to rise to $819.2 million by 2033.

– Graphene, a “perfect hexagonal lattice of one layer of carbon atoms”, has 200 times the electrical conductivity of copper and 200 times the mechanical strength of steel.

– Graphene’s thermal conductivity value is higher than that for diamonds.

– According to the authors, three “serious” energy storage challenges face the battery industry: “charging speed, energy density, and battery lifespan.”

– Pertaining to charging speed, theoretically, graphene batteries can charge 60 times faster than the best lithium-ion cells, due to “exceptional electrical conductivity and ion mobility characteristics. Existing graphene batteries, in testing, can recharge to 80% in under five minutes.

Per the report:

“Traditional batteries suffer from slow ion diffusion bottlenecks that create charging delays and heat generation. Graphene’s unique molecular structure eliminates these limitations, allowing ions to move freely across its surface at unprecedented speeds.”

For battery storage systems, this charging potential could maximize “capture efficiencies” for intermittent production of wind and solar power.

– Pertaining to energy densities, “traditional lithium-ion batteries achieve 150-250 Wh/kg.” Graphene-enhanced batteries can reach between 500 and 1000 Wh/kg, or higher. This permits an effective doubling or quadrupling of a battery’s energy storage capacity while reducing weight. The reason for this is that one gram of graphene offers a surface area of about one-third of a football field, a surface area that provides an “unprecedented space for ion storage and movement, enabling rapid charge transfer and higher storage capacity than any conventional electrode material.”

And, “[g]raphene batteries maintain consistent performance across temperature ranges that would cripple conventional systems, reducing complex cooling requirements and improving overall system efficiency by up to 30%.”

– Pertaining to battery life and durability, “[i]ndependent testing demonstrates graphene battery systems withstanding more than 10,000 charge-discharge cycles without capacity decay — potentially lasting 5-10 times longer than conventional lithium-ion systems.”

And, “[g]raphene batteries demonstrate superior performance under extreme temperatures, humidity, and vibration conditions, making them ideal for aerospance, marine, and industrial applications where conventional batteries fail. … Graphene batteries’ non-flammable characteristics and thermal stability significantly reduce [thermal runaway risks], enabling deployment in safety-critical applications previously too-risky for battery power.”

– A new graphene production process, developed by GMG, decomposes natural gas into carbon, hydrogen and residual hydrocarbon gases. The carbon is chemically changed into graphene, a process that “provides a lower-impact production pathway compared to mining-intensive lithium-ion processes while generating valuable clean hydrogen byproducts.”

– Graphene’s “stable carbon structure enables easier recovery and reuse compared to complex lithium-ion chemistries requiring specialized recycling processes.”

– The report concludes:

“Looking ahead, graphene batteries represent more than incremental improvement -they promise entirely new applications and business models previously constrained by battery limitations. From electric aviation to grid-scale renewable energy storage, graphene batteries could catalyze transformative changes across the global energy landscape, ushering in an era where energy storage limitations become historical footnotes rather than current constraints.”

Make of this what you will.

Me?

Graphene, long theorized, was finally created in a British lab in 2004. Over the following two decades, the cost to produce graphene plummeted, with every reason to believe that it will become even cheaper to produce in coming years.

In its early years, a postage stamp sheet of graphene cost tens of thousands of dollars to produce.

Low grade commercial graphene, known as “graphene oxide”, today, can cost as little as $100 per kilogram, according to a February 2025 story by Investing News Network. That same kilogram of graphene, at a higher commercial grade, can cost $1,000. High-performance graphene, called “top-tier graphene”, can cost in excess of $10,000 per kilogram.

Who knows what graphene will cost in the near future? Graphene comprises much of the cathode in a battery. There may come a time when graphene is extraordinarily inexpensive. After all, carbon, the precursor of graphene, is one of the most abundant atoms on earth.

James says

Well, wait a minute… let me think on this again. Approximately one platinum bar on a balance scale offsets three bars of cast iron of equal dimension. The needed amount by volume (not weight) would seem to be three to one to recreate the shape. That would be quite a bit more platinum.

Sorry, obviously I was never a member of Mensa.

Sherry says

Dear Clay, So happy to see you back at it! Best wishes for your full and complete recovery! Happy Holidays to you and yours!

Ray W. says

A reporter for the British-based news outlet, The Telegraph, offered the position that “The West can still win the electric car war with China”

Here are some bullet points from the article:

– History records that, in the reporter’s estimation, “[t]he most certain road to economic decline is to do what China’s Qing Dynasty did in the 19th Century — but Japan did not do under the Meiji Restoration — which was to put its head in the technological sand and cling to a dying order.”

– The reporter then paints two pictures:

First, he argues that while China has long quested for world domination in the economic sectors of EVs and batteries, its expensive effort is starting to falter, as the nation placed too many eggs in the basket of non-solid-state battery technology.

Second, he points out that the West has for far too long had far too many voices of defeatism and economic inability in those same two economic sectors, voices of defeatism fostered by the Trump administration: “The danger for the West is that it will succumb to the siren voices of defeatism and start to believe that it is already too late to compete with China in the electrotech revolution.”

– Here is how the reporter’s argument unfolds:

1. The gas-powered car industry is the “dying order” exemplified by the inaction by the leaders of the Qing Dynasty.

2. China has overbuilt its EV manufacturing sector, and it has invested in the wrong type of battery technology among the many available battery technologies. Last year, China’s battery manufacturing capacity, according to the reporter, reached 1.17 terawatt hours, more than the world’s entire demand. It’s announced goal of 6.3 terawatt hours of battery manufacturing capacity, spread over 400 battery factories is “one of the most extreme episodes of indiscriminate over-building in history.” This, again according to the reporter, means that plowing that much money into no-longer cutting edge battery technologies is nothing more than a waste on an overcapacity that will never find a market. According to Oxford University’s George Magnus, this wasteful spending is “gobbling up” some 7 to 8 percent of China’s GDP. In the reporter’s words, “[t]he market discipline of Schumpeterian clearance has been blocked, allowing industrial deformation to fester.”

Says the reporter of a growing mood in China’s EV industry: “Creeping doubts haunted the World Power Battery Conference in Sichuan this month. It was not the celebration of total victory seen in recent years.” As an example of this creeping doubt, the vice chairmen of China’s Solid State Battery Platform said: “I think predictions about solid-state batteries are like fortune telling”, arguing that Chinese researchers were, in the reporter’s telling, “nowhere close to mastering the complex metallurgy” and doubting “whether these batteries would be in commercial production in China much before the mid-2030s.”

Added Changan Automobile’s Deng Chenghao, again as interpreted by the reporter:

“[T]he whole field [of solid-state batteries] was besieged by myths and hyperbole, driven by online EV fantasists with no idea what they were talking about. … There are so many technological issues to be resolved, and we are still in the laboratory stage. We don’t know what the costs will be.”

3. The West, in opposition to this mindset of defeatism, is much more confidently investing in the future of solid-state battery technology.

Argued the reporter:

“[T]he mood was almost chipper at the recent Battery Show North America 2025 in Detroit. The halls were packed and the number of exhibitors jumped to 1,350 from the 1,150 a year earlier. … The industry seems to be looking beyond Donald Trump, and shrugging off the last hurrah of the combustion engine.”

Both Ford and GM are optimistic about the money spent to develop in collaboration with South Korea’s LG, the “latest lithium manganese-rich (LMR) batteries that are expected to reach the EV market by 2028. LMR batteries do not use cobalt at all, which resource is controlled by China mainly out of the Democratic Republic of the Congo. And, LMR batteries contain half the nickel content of current lithium batteries, nickel that comes from Indonesia. LMR batteries use “lots of cheap and ubiquitous manganese, a hard and brittle silvery metal, instead — but still surpass a 400 mile range. It has taken 10 years, but researchers have finally overcome the voltage loss and short life-cycle of these manganese batteries.”

LMR battery technology, which the reporter describes as a U.S. rival to Chinese battery technologies, “has effectively leap-frogged the lithium-iron phosphate (LFP) batteries that have swept the mass market in China, and are entirely dominated by Chinese companies”, because LMR batteries have an energy density one third higher that LFP batteries at the same cost.

The reporter pivoted to work by British battery researchers, and the mounting optimism in the UK.

Anaphite, based in Bristol, UK, has pioneered an electrode film made of dry powder (something an American company has also done).” The dry powder electrode film process “slashes cell production costs by 40% by replacing the wet coating inside batteries.” According to the reporter, China is nowhere close to developing the dry powder process, and “the invention is not easy to copy.”

Dr. Ben Walsh, with the UK Battery Innovation Programme, said:

“You don’t need 400 meters of ovens any more to dry off the moisture from the liquid coating. Anaphite really is a fantastic company with a technology that is all home-grown.”

The reporter then switched the story to Ilika, a British solid-state battery “champion” that already has an operating pilot assembly line for its “oxide solid electrolyte” that targets a $3,275 cut to the cost of a “large battery pack” alongside a 220 pound cut to the weight of that same pack.

In the opinion of Dr. Walsh, “[t]here is far too much doom and gloom about EVs and batteries in [the UK]. We have really got our act together, with some of the best professors and universities anywhere. … Europe is spending billions on this but it is not well coordinated. We’re actually way ahead at them, and people are taking notice around the world. We should be thinking about this as a massive opportunity for the UK to attract plants.”

Among all of this is a perceived recent political mistake made by Chinese leaders. According to the reporter, China spent decades seeking dominant control of the minerals and materials they thought were necessary for EV production. But if the solid-state battery leap takes place, that entire effort will have been for naught, as the good will thrown away by China’s “ruthless” effort to control lithium-ion battery production will be for nothing when the West sidesteps using lithium-based battery technologies. And worse, in this expensive race to control and industry China tore off its mask of friendliness when it threatened the West with a rare-earth metals embargo.

Wrote the reporter:

China’s weaponisation of rare earths and its curbs on battery technology – not just in retaliation against Trump, but against the whole democratic world – has alerted everybody to its wolf warrior intentions. … You cannot replace the mask once you have ripped it off. American and European companies will guard their technological secrets much more closely this time.”

Finished the reporter:

“The West still has everything to play for in the long fight for EV supremacy, so long as we can all block out the deafening noise of the culture war.”

Make of this what you will.

Me?

For years, I have been arguing that no one should ever take at face value anything said by any member of the professional lying class that sits atop one of our two political parties.

Trump has called EVs a “green scam.” Ford’s CEO says the opposite; EV innovation is either do or die for Ford.

Trump has called solar and wind a “scam”; it isn’t, except perhaps to those who want to pay higher electric bills.

I would not so vigorously disagree with Trump if EVs or wind or solar were still economically uncompetitive, as they were 15 years ago. But each of the three technologies has rapidly become extremely economically competitive, and the rate of disruption to a dying order isn’t slowing. It isn’t a political argument anymore. It has shifted to an economic argument, and only an economic argument.

Can we afford political posturing if it means sticking our heads in a technological sand of ignorance?

James says

The ratio of their densities yields this situation on a balance scale…

* ***

Pt Cast lron

Where * is a “standard unit volume” of material… a standard ingot of material. By weight, one ingot of Pt balances three ingots of cast iron. But these are of a standard volume, so looking at the balance from a volume perspective, it appears that by volume, one would need three units of Pt to one of cast iron.

Hence, if the density ratio is 1:3 by weight, its inverse 3:1 represents the ratio of their volumes.

The amount by weight of the needed Pt to replicate the fondue set (in volume by Pt) is then three times the weight of the cast iron… 3 • 5.5 lbs = 16.5 lbs or 264 oz.

Which would mean the Pt fondue set would cost…

$1540 • 264 = $406,560??? :O

Just-a-calculate’n.

Ray W. says

An Oil Price US reporter examined electricity changes in emerging economies, based on costs.

Here are some bullet points from her story:

– “Renewable energies are exploding in emerging economies as the economics of wind and solar make it the obvious choice in most national and regional contexts. What’s more, the rapidly changing economics of renewables are not just saving money for developing countries, they could soon be making money in considerable sums in many emerging economies.”

– A new Oxford University study suggests, if not finds, that “low- and middle-income countries stand to benefit the most from adopting renewable energies, …”

– And, renewable investments in the world’s largest 100 economies, excepting China’s, contributed $1.2 trillion to GDP growth between 2017 and 2022. Generally, for most of the 100 economies, GDP growth tied to renewables was between 2% and 5%.

– The Oxford report’s executive summary reads:

“Renewable energy drives prosperity. … Done well, it can expand affordable energy access, attract investment, create new jobs and increase productivity for the entire economy.”

– The reporter attributes the executive summary’s conclusion to “several compounding factors.”

First, “renewables have become ridiculously cheap to install and operate. Solar energy, in particular, has seen an incredible economic evolution, with prices plummeting by a positively stunning 90% since 2010. ‘Right now, silicon panels themselves are the same cost as plywood’, according to University of Cambridge Professor of Energy Materials and Optoelectronics, Sam Stranks.

– Second, spending on renewables now offers a “significantly better return on investment that fossil fuels.” And, green energy spending tends to stay local, supporting more localized supply chains and more directly augmenting local incomes, compared to fossil fuels.

– Third, “[d]ecentralized renewables like solar mini-grids or rooftop panels are also better at reaching more rural areas where grid connections can be pricey and faulty.”

– Pakistan, with spotty and pricey and often unreachable local grids, is quickly becoming “one of the world’s largest new adopters” of solar-plus-battery systems.

According to Jan Rosenow, head of Oxford’s Environmental Change Institute:

“The scale of solar being deployed in such a short period of time has not been seen, I think, anywhere ever before.”

– In recent years, Brazil, Chile, El Salvador, Morocco, Kenya, and Namibia have overtaken the U.S. in share of electricity generated by renewables. 63% of emerging markets in Africa, Asia, and Latin America now produce more of their total power generation from solar power than does the U.S.

Taken from a CNN story:

“Some countries are pulling off stunningly fast energy transitions, adding so much solar so rapidly, it’s become a major source of electricity over the course of years — not decades.”

Concludes the reporter:

“Despite continued challenges faced by the clean energy transition and an anti-renewable policy shift in the world’s largest economy, it seems like renewables may simply be too cheap to fail. ‘We have a plentiful and cheap source of electricity that can be built quickly, almost anywhere in the world’, NewScientist recently posited. ‘Is it fanciful to imagine that solar could one day power everything?'”

Make of this what you will.

Me?

There was a time when renewable energy was a political policy issues, one that split our two parties. No more. The issue is now solely economic. Renewables are cheaper than fossil fuels. The issue cannot even be debated on economic grounds.

Yes, I have heard the arguments about EV battery manufacturing involving poisonous mining techniques. Crude oil weighs about seven pounds per gallon. There are 42 gallons in a barrel. That means each barrel extracted from the ground means a ton of toxic liquid that when refined becomes even more toxic. American extracts over 13.5 million barrels of crude oil per day, which means that just under two million tons of a toxic liquid are extracted from the ground. The world extracts over 100 million barrels of crude oil per day, which means that some 14 million tons of toxic liquid is extracted each day. Day after day after day. This doesn’t count natural gas and natural gas liquids.

In emerging economies that lack local supplies of natural gas, fossil fuels must be transported into the country to generate electricity. Decentralized local energy mini-grids powered by solar panels and tempered by battery storage makes far more long-term economic sense than shipping in fossil fuels.

America held the lead in solar power innovation a mere 20 years ago. Now, we don’t. Did our political leaders risk our economic future by placing their heads in the sand?

Ray W. says

An Oil Price US reporter wrote of a wave a Permian Basin natural gas pipelines purportedly being built.

“Next year, a total of 12 projects for new or expanded gas pipelines are set to be completed in Texas, Louisiana, and Oklahoma. These projects are set to boost the U.S. Gulf Coast region’s capacity to transport natural gas by 13%, per data compiled by Bloomberg on the basis of EIA estimates.”

Since the author mentioned reliance on an EIA document, I looked for it. While I don’t know if I found the exact one or not, but on September 10, 2024, the EIA published another of what it calls IN-BRIEF ANALYSIS papers, this one titled “Natural gas pipeline capacity from the Permian Basin is set to increase.”

Prior to September 10, 2024, published the EIA, one major national gas pipeline had been completed and was about to open operations, and permits had been approved for four more major new Permian Basin natural gas pipelines, with another two projects having been announced, and that is just for the Permian Basin.

Based upon the data published in the EIA report, and due to the fact that projects of this size do not get built overnight, it seems likely to infer that many, if not all, of the 12 natural gas pipeline projects that will open by the end of 2026 mentioned in the story were first permitted and then started construction during the years of the Biden administration.

I suspect that the entire FlaglerLive community knows who will claim credit for the pipelines as each of them opens for operation.

As an aside, I found a June 2025 article published by Gasoutlook about the price mechanisms in the U.S. natural gas industry.

The author of that story adopted the position that OPEC+ is in a price war with U.S. crude oil producers.

Ed Hirs, described as an energy fellow at the University of Houston, told the reporter:

“If OPEC continues with this price war, that will continue to put a damper on production in the Permian basin and certainly that will have a negative impact on gas production.”

Mr. Hirs added:

“We have plenty of natural gas. … Quite honestly, most of the players in that market can undercut the U.S. The marginal cost of a thousand cubic feet of gas in Qatar is about 5 cents. … If LNG gets to a price war situation, we are going to find ourselves in a similar boat to what we are in with oil. We are definitely the high-cost producer.”

With crude oil prices in the low-$60s per barrel, oil drilling activity is likely to slow down. With such a slowdown will come a natural gas slowdown. According to the reporter, “a wide range of market players are counting on continued growth in Permian NGL production.” If greater pricing challenges emerge during the 2025 OPEC+ price war, today’s natural gas outlook will change.

Make of this what you will.

Me?

The nation is littered with abandoned promising energy projects. Plans are great, but getting permits and then financing takes time. Construction takes time. Energy markets change by the minute. The CEO of Cheniere Energy claimed that it took seven years for his company to get from the permitting process to a working LNG plant opening for business.

James says

By the way (in price per ounce)…

gold (density 19.32 g/cm^3):

$4055 • (19.32 / 7.5) • 5.5 • 16 = $919,219.84

silver (density 10.49 g/cm^3):

$50 • (10.49 / 7.5) • 5.5 • 16 = $6154.13

copper (density 8.935 g/cm^3):

$3.55 • (8.935 / 7.5) • 5.5 • 16 = $372.17.

Just if you were wondering… I’m guessing probably not at this point.

Sherry says

You are funny and silly James! HO! HO! HO! Happy Holidays!

James says

Considering the effects gold has had on people throughout the ages, could exposure to platinum really be considered safe?

Just say’n.

Happy Holidays Sherry!