To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Patchy fog in the morning. Sunny. Highs in the mid 90s. Southwest winds around 5 mph, increasing to around 10 mph in the afternoon. Thursday Night: Mostly clear. Lows in the mid 60s. Southwest winds 5 to 10 mph.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

The Palm Coast Code Enforcement Board holds a special hearing to hear the appeal of a solicitor whose permit was denied, at 10 a.m. at City Hall.

Town of Marineland Commission Meeting, 6 p.m. in the main conference room at the GTMNERR Marineland, 9741 N Oceanshore Boulevard, St. Augustine. See the town’s website here.

Model Yacht Club Races at the Pond in Palm Coast’s Central Park, from noon to 2 p.m. in Central Park in Town Center, 975 Central Ave. Join Bill Wells, Bob Rupp and other members of the Palm Coast Model Yacht Club, watch them race or join the races with your own model yacht. No dues to join the club, which meets at the pond in Central Park every Thursday.

The Palm Coast Democratic Club holds an “After Dark” Recap Meeting (previous daytime business meeting) at 6 p.m. on the third Thursday of each month to accommodate working Democrats. We will meet at the Flagler Democratic Party Headquarters in City Marketplace, 160 Cypress Point Parkway, Suite C214, Palm Coast. Hope you will join us. This gathering is open to the public at no charge. No advance arrangements are necessary. Call (386) 283-4883 for best directions or (561)-235-2065 for more information.

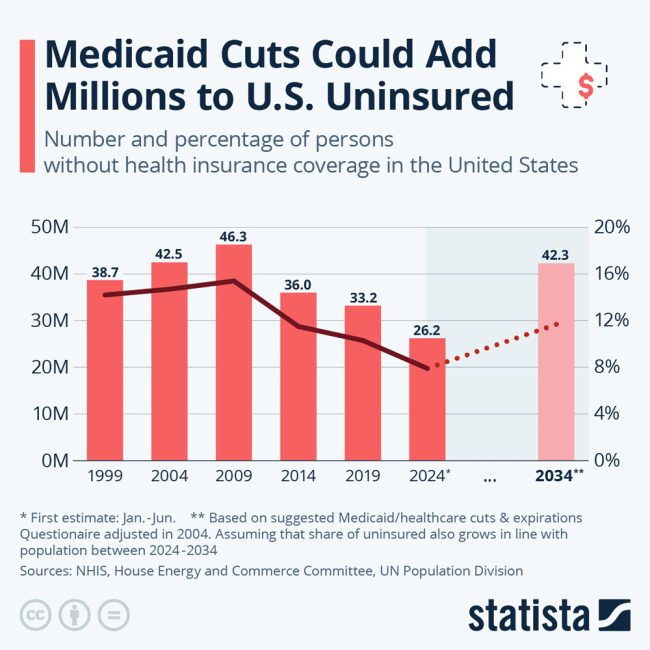

Notably: It’s like when David Stockman was Ronald Reagan’s director of the Office of Management and Budget. The easiest place to cut was spending on the poor. From Statista: “According to estimations by the Congressional Budget Office, the number of uninsured Americans could rise by 13.7 million over the course of the next ten years due to healthcare legislation currently proposed or left to expire. Proposed cuts to Medicaid as part of the budget bill, updated Sunday, would be responsible for the loss of 7.7 million insurance holders, while separate legislation on the ACA insurance marketplace will cause 0.9 million more uninsured Americans. Finally, the expiration of the 2021 expanded premium tax credits is expected to make 4.2 million more people uninsured. A calculation by Statista, which assumed that the number of uninsured Americans will additionally rise in line with population growth until 2034, shows that in ten years, 42.3 million U.S. residents could once again be without health insurance. While this is still lower that the pre-ACA high of 46.3 million in 2009, it would signal a reversal of the trend of fewer Americans being uninsured recently. The 2034 number represents 11.7 percent of Americans, while in 2009, 15.4 percent in the country had no health insurance coverage.”

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Flagler Beach United Methodist Church Food Pantry

Flagler County Drug Court Convenes

Model Yacht Club Races at the Pond in Palm Coast’s Town Center

Palm Coast Beautification and Environmental Advisory Committee

Flagler Beach City Commission Meeting

Free For All Fridays With Host David Ayres on WNZF

Scenic A1A Pride Meeting

Friday Blue Forum

Acoustic Jam Circle At The Community Center In The Hammock

Flagler Beach Farmers Market

Coffee With Flagler Beach Commission Chair Scott Spradley

Grace Community Food Pantry on Education Way

Gamble Jam at Gamble Rogers Memorial State Recreation Area

Stetson University Concert Choir in Concert with Orlando Philharmonic

For the full calendar, go here.

The commitment I seek is not to outworn views but to old values that will never wear out. Programs may sometimes become obsolete, but the ideal of fairness always endures. Circumstances may change, but the work of compassion must continue. It is surely correct that we cannot solve problems by throwing money at them, but it is also correct that we dare not throw out our national problems onto a scrap heap of inattention and indifference. The poor may be out of political fashion, but they are not without human needs. The middle class may be angry, but they have not lost the dream that all Americans can advance together. The demand of our people in 1980 is not for smaller government or bigger government but for better government. Some say that government is always bad and that spending for basic social programs is the root of our economic evils. But we reply: The present inflation and recession cost our economy 200 billion dollars a year. We reply: Inflation and unemployment are the biggest spenders of all. The task of leadership in 1980 is not to parade scapegoats or to seek refuge in reaction, but to match our power to the possibilities of progress. While others talked of free enterprise, it was the Democratic Party that acted and we ended excessive regulation in the airline and trucking industry, and we restored competition to the marketplace. And I take some satisfaction that this deregulation legislation that I sponsored and passed in the Congress of the United States.

–From Ted Kennedy’s address at the 1980 National Democratic Convention, Aug. 12, 1980.

Pogo says

@And then Ted died within sight of single payer health care

… and Mass elected a Republican Party Ken doll bimbo who killed it.

Comes now RFK Jr!

God, she, he, it, whatever, f— it anyway, is silent as ever.

And so it goes.

Ray W, says

According to an article published by Reuters, today marks the beginning of a two-day Federal Reserve conference.

Gleaned from a transcript from discussions held during the most recent Fed meeting, one subject of this week’s conference will be to weigh the continued usefulness of a 2020 shift in U.S. central bank strategy “that put more weight on the goal of full employment and pledged not to use a low jobless rate as a reason in itself to raise interest rates.”

I saved three different articles from three different sources that offer perspectives on this technically dense subject.

From the Reuters publication, one side of this week’s Fed conference debate comes from a policy recommendation published by former Cleveland Fed President Loretta Mester earlier this year, in which she argues that there are lessons to be learned from the pandemic and that one of those lessons is that a tight labor market (too many open jobs and too few available workers) can increase inflationary pressure.

According to Ms. Mester, the 2020 framework did not allocate enough weight to the “tight labor market” possibility. The framework, she wrote, “should … acknowledge that the FOMC uses indications from the labor market to help it forecast inflation. … It should reinforce the forward-looking and pre-emptive nature of setting appropriate monetary policy.” Ms. Mester’s opinion piece, according to the reporter, has been positively echoed by other economists.

A different economist, Jon Faust, fellow at Johns Hopkins University’s Center for Financial Economics, thinks otherwise, in that he believes the 2020 framework revision did not play much of a role in the inflation that followed the pandemic.

According to Mr. Faust, “The inflation we observed has muddied the picture about the framework revisions considerably. I don’t think the framework revisions played any role. I don’t think they deserve more than a footnote. … The employment revisions in particular – I hope the spirit remains; that we don’t take steps that would probably raise unemployment unless we see some risk on the other side.”

According to the reporter’s assessment, the 2020 economic revision spearheaded by Fed Chair Powell addressed what economists deemed an unusual economic period occurring only between 2010 and 2020. Fed economists during the pandemic, it seems to the reporter, looked backwards to create a “framework” that allowed them to factor into their decision-making process a possible continuation of the unusual decade-long economic period, but the strategy, in retrospect, seems to have been ill-considered in light of the economic effects of the pandemic.

Here’s how the reporter described the operating impact of the 2020 framework:

“As translated into its monetary policy statements at the time and coupled with other policies the Fed was using to battle the pandemic’s economic fallout, the framework arguably slowed the central bank’s response to the emerging inflation wave while policymakers waited to deliver on their commitment to restoring full employment.”

In other words, the Fed’s 2020 revision to its economic policy framework led to it reacting only to “shortfalls” from maximum employment, i.e., acting only to support job growth and never acting to curb it as a possible inflation risk.

From the recently released Fed meeting transcript, the discussion this week will be whether it might be wiser to respond to “deviations” that might arise from tight labor markets raising inflation risks, so as to warrant an earlier rate increase.

A quote from the Fed transcript was: “Participants indicated that they thought it would be appropriate to reconsider the shortfalls language.”

In the end, the reporter opined that Fed Chair Powell, and others, now think that lending rates should have been raised sooner rather than later in the months after the pandemic’s onset.

Make of this what you will.

Me?

Over the past couple of years, I have posted comment after comment derived from article after article that economists think that the Fed had a role in how the inflationary period following the pandemic played itself out.

The Reuters articles is just one more in that long string of articles, yet its perspective intrigues me.

An economist argues that the Fed’s 2020 revision to its economic framework restricted the Fed into looking backwards in time to events during a unique 10-year period for economic guidance after the pandemic, when it should have been freer to have been more forward-looking to tight labor conditions as they arose.

In 2022, federal statistics had over 12 million unfilled posted job openings when prior to the pandemic the number had never been above 8 million. As the saying goes, if that isn’t evidence of a tight labor market, what is?

FlaglerLive commenter after FlaglerLive commenter was complaining early in 2021 that they could not find enough workers to fill their job needs, blaming the problem on lazy people. What fools they were. We simply lacked the workers to fill the jobs and people will abandon a crappy job in favor of a better one, given the choice.

We threw trillions of dollars into a plunging economy at a time when supply chains were snarled during the shutdowns. So many people wanted to spend their excess money, but there were not enough workers to produce the goods, much less distribute them. We needed every immigrant we could get in their millions, and they still weren’t enough to fill the labor vacuum. It took almost three years to get the unfilled post jobs openings number down to normal levels.

Anyone who argues that “Bidenflation” accurately explains what happened to our economy after the pandemic is simply laundering lies. Economists know better. FlaglerLive commenters ought to know better.

To those FlaglerLive commenters who continue to argue that President Biden is solely responsible for the post-pandemic inflation we all endured, please consider my mother’s announcements to the TV during my childhood as we watched political debates: “He’s talking to hear his head roar.”

Sherry says

Factual Information You Would Never Find on Fox. This from Heather Cox Richardson:

On May 8, political scientists Steven Levitsky, Lucan Way, and Daniel Ziblatt published an op-ed in the New York Times reminding readers that most modern authoritarian leaders are elected. They maintain their power by using the power of the government—arrests, tax audits, defamation suits, politically targeted investigations, and so on—to punish and silence their opponents. They either buy or bully the media and civil society until opposing voices cave to their power.

Levitsky, Way, and Ziblatt call this system “competitive authoritarianism.” A country that has fallen to it still holds elections, but the party in power has so weighted the system in its favor that it’s virtually impossible for it to lose.

The way to tell if the United States has crossed the line from democracy to competitive authoritarianism, the political scientists explain, is to see if people feel safe opposing those in power. Can they safely protest? Publish criticism of the government? Support opposition candidates? Or does taking a stand against those in power lead to punishment either by the government or by government supporters?

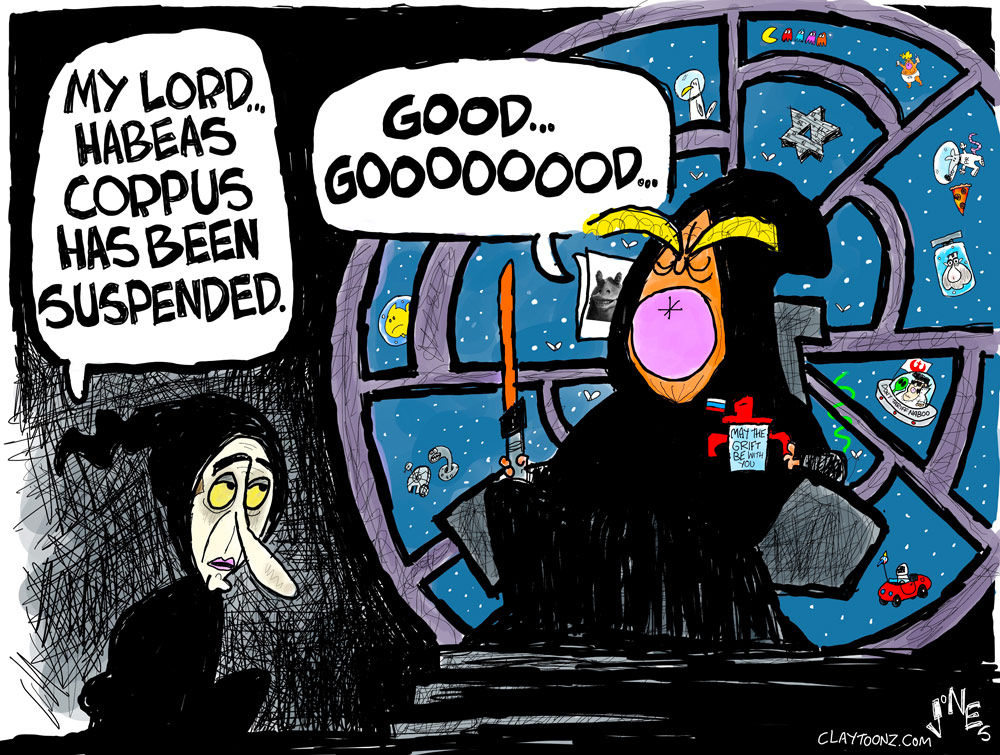

Looking at the many ways the Trump administration has been harassing critics, law firms, universities, judges, and media stations, they conclude that “America has crossed the line into competitive authoritarianism.”

Since they made that observation less than a week ago, there has been more evidence of the administration’s attempt to consolidate power.

After the National Intelligence Council (NIC), the nation’s top body for analyzing intelligence, produced a report that contradicted President Donald J. Trump’s assertion that the Venezuelan government was directing the actions of the Tren de Aragua (TdA) gang, Director of National Intelligence Tulsi Gabbard fired acting NIC chair Michael Collins and his deputy, Maria Langan-Reikhof. The administration used the claim that Venezuela was working with TdA as justification for invoking the 1798 Alien Enemies Act to render migrants from Venezuela to El Salvador.

A spokesperson for the Office of the Director of National Intelligence said: “The Director is working alongside President Trump to end the weaponization and politicization of the Intelligence Community.”

Department of Justice leaders are also consolidating power under the claim of ending weaponization. In a dramatic reversal of Department of Justice policies, Trump loyalist Ed Martin said yesterday that when the department finds it does not have the grounds to charge political opponents with a crime, it will “name” and “shame” them, attempting to convict them in the court of public opinion rather than a court of law. Trump initially nominated Martin to be the U.S. attorney for the District of Columbia, but Martin’s extremism convinced Senate Republican Thom Tillis to vote with Democrats on the Judiciary Committee to stop his nomination.

So Trump put him at the head of the Justice Department’s “Weaponization Working Group,” allegedly designed to ferret out the weaponization of former president Joe Biden’s Department of Justice, but clearly intended to use the Justice Department to advance Trump’s interests.

A federal grand jury in Wisconsin yesterday indicted Milwaukee County Judge Hannah Dugan, charging that she tried to help a man evade agents from Immigration and Customs Enforcement (ICE). Dugan permitted an undocumented immigrant to leave her courtroom and enter the public hallway by the jury door rather than the public door. A week later, federal officials arrested her at the courthouse, photographed her in handcuffs, and spread the news of her arrest on social media, and Attorney General Pam Bondi told reporters that Dugan’s arrest was a warning to others. A bipartisan group of 150 former federal and state judges wrote to Bondi to protest both Dugan’s arrest and the administration’s threats against the judiciary.

Today, U.S. Circuit Judge Amy St. Eve and Judge Robert Conrad, both of whom were appointed by Republican presidents, asked the House Appropriations Subcommittee on Financial Services and General Government to increase funding for judges’ security. David Gilbert of Wired reported today that calls for impeachment and violent threats against U.S. judges on social media have gone up by 327% since last year.

In a piece in The Atlantic today, respected conservative judge J. Michael Luttig noted that for all of Trump’s insistence that he is the victim of the “weaponization” of the federal government against him, “[i]t is Trump who is actually weaponizing the federal government against both his political enemies and countless other American citizens today.”

Luttig warned that Trump is trying to end the rule of law in the United States, recreating the sort of monarchy against which the nation’s founders rebelled. He lists Trump’s pardoning of the convicted January 6 rioters (which he did with the collusion of Ed Martin), the arrest of Judge Dugan, which Luttig calls “appalling,” the deportation of a U.S. citizen with the child’s mother, and the “investigation” of private citizen Christopher Krebs.

“For not one of his signature initiatives during his first 100 days in office does Trump have the authority under the Constitution and laws of the United States that he claims,” Judge Luttig writes. Not for tariffs, not for unlawful deportations, not for attacks on colleges and law firms, not for his attacks on birthright citizenship, not for handing power to billionaire Elon Musk and the “Department of Government Efficiency,” not for trying to end due process, not for his attempts to starve government agencies by impounding their funding, not for his vow to regulate federal elections, not for his attacks on the media.

The courts are holding, Judge Luttig writes, and will continue to hold, but Trump “will continue his assault on America, its democracy, and rule of law until the American people finally rise up and say, “No more.”

And rising up they are.

The chaotic cuts of the Department of Government Efficiency soured people on billionaire Elon Musk and on government cuts. Yesterday, Representative Jared Moskowitz (D-FL) told Ben Johansen of Politico that while Republicans claim the House DOGE caucus, created to work with Musk to audit the government, is “just getting started,” Moskowitz says it is “dead…defunct…. We only had two total meetings in five months.”

Currently, Newark Liberty International Airport is serving as an illustration of the effects of DOGE’s cuts. On Monday the airport was supposed to be staffed with 14 air traffic controllers but was down to just three, causing delays of up to seven hours. As Ed Pilkington of The Guardian reported, Secretary of Transportation Sean Duffy assured the public on Sunday that it was safe to fly out of the Newark airport, but on Monday told a podcaster that his wife was supposed to fly out of Newark but he had switched the flight to one out of New York’s La Guardia.

Recent polling shows that Trump is underwater in polling—meaning that more people disapprove than approve of his actions—even on his core issues of immigration and the economy. Many Trump voters apparently believed he would deport only violent criminals and are now shocked to see masked officers breaking car windows to arrest mothers with children. The rendition of Kilmar Abrego Garcia to the notorious CECOT terrorist prison in El Salvador without due process and through what the administration initially called “administrative error” has caused such an uproar that, as Adrian Carrasquillo of The Bulwark noted today, the White House is working aggressively to try to recover control of the narrative by smearing the Maryland father as a member of the MS-13 gang, a human trafficker, and a terrorist with no evidence.

The administration has also lost credibility on the economy. Jeff Stein, Natalie Allison, and David J. Lynch of the Washington Post reported today that since he took office, Trump has changed his tariff policies at least 50 times. Some didn’t last a day. After insisting that his high tariffs would bring manufacturing to the United States, Trump’s administration on Monday announced it would reduce Trump’s 145% tariff on goods from China to 30%. China said it would correspondingly lower the tariff it had put on U.S. goods in retaliation for Trump’s tariff.

“It’s been completely insane,” economist Michael Strain, from the right-leaning American Enterprise Institute think tank, told the Washington Post reporters. “When I step back from the euphoria over easing tariffs with China, what I see is the tariff rate is five times as high as when Trump took office. And we seem to have gotten nothing out of it at all.”

Evidently concerned that Trump’s economic agenda is so unpopular it will fail in Congress, Trump’s political operators have spent in the “high seven figures,” Alex Isenstadt of Axios says, to run ads in more than 20 targeted congressional districts to push lawmakers to get behind it. “Tell Congress this is a good deal for America,” the ad says. “Support President Trump’s agenda to get our economy back on track.”

As the American people have turned on Trump, Democrats have been standing against him and members of his administration. Yesterday’s discussion of the “One Big Beautiful Bill” the Republicans are trying to get through Congress sparked dramatic pushback. The measure cuts taxes for the wealthy and corporations and helps to offset those financial benefits at the top of society with cuts to Medicaid and the Supplemental Nutrition Assistance Program (SNAP), which used to be known as food stamps, as well as a bevy of other programs that help ordinary Americans.

When the House Committee on Energy and Commerce began to debate their piece of the bill yesterday, there were protests within the hearing room and in the hallway outside. After ten hours, the committee still had not gotten to the Medicaid cuts, which Democrats suggested was intentional. Representative Troy A. Carter Sr. (D-LA) recorded a video at 1:00 this morning noting that “Republicans want to do this in the dead of night…and not let the American people see.” He continued: “Shame on you…. The people deserve to see the actions that you’re doing to them by cutting Medicaid in favor of the richest rich for tax breaks. Hashtag, WeWontLetYou.”

The fireworks in two other hearings today rivaled the fights in the hearing over cuts to Medicaid. Homeland Security Secretary Kristi Noem testified today before the House Homeland Security Committee. But she refused to answer Democrats’ questions about the deportation of U.S. citizens, the reality that the “MS13” on a photograph of Abrego Garcia’s hand was photoshopped, or that the Supreme Court has unanimously ordered the administration to return Kilmar Abrego Garcia to the United States. Instead, she simply kept talking over the members of Congress, reiterating administration talking points.

“Your department has been sloppy,” Representative Seth Magaziner (D-RI) said. “And instead of focusing on real criminals, you have allowed innocent children to be deported while you fly around the country playing dress-up for the cameras. Instead of enforcing the laws, you have repeatedly broken them. You need to change course immediately before more innocent people are hurt on your watch.”

Democrats also challenged Secretary of Health and Human Services Robert F. Kennedy Jr. when he testified for the first time today before both the House Appropriations Committee and the Senate Health, Education, Labor, and Pensions Committee to promote Trump’s budget. Kennedy seemed angry at being questioned and, like Noem, repeated debunked lies. He angrily claimed he had “not fired any working scientists” and was “not withholding money for lifesaving research,” although during his tenure, 20,000 people—one quarter of the health workforce—have lost their jobs and the administration has cut $2.7 billion in research funding for the National Institutes of Health.

Memorably, Kennedy told Representative Mark Pocan (D-WI): “I don’t think people should be taking medical advice from me.”

Judge Hannah Dugan herself pushed back against the administration today when she moved for an order to dismiss her indictment. Her motion called the government’s prosecution “virtually unprecedented and entirely unconstitutional.” The government cannot prosecute her, she argued, because she “is entitled to judicial immunity for her official acts.” As precedent she cited Trump v. United States, the July 2024 Supreme Court decision protecting Trump from prosecution for crimes committed as part of his official acts.

Voters in Omaha, Nebraska, last night dramatically rejected Trumpism when they elected Democrat John Ewing as their new mayor over Republican incumbent Jean Stothert. Ewing served in the Omaha Police Department for almost 25 years before becoming Douglas County treasurer for 17 years. He will be Omaha’s first Black mayor.

Ray W, says

Barron’s have its own take on several possible future Fed-adopted economic frameworks.

Here are a few bullet points from the article:

– At last week’s Stanford University conference on monetary policy put on at its Hoover Institution, the theme was “finishing the job”, meaning continuing the Fed’s struggle to get inflation down to 2%, all the while working on easing interest rates.

– According to the reporter, “the job, as it turns out, may be unfinishable.” Furthermore, as Fed Chair Powell’s second term will end in 2026, the Fed itself may soon be reshaped by whomever is approved by the Senate to replace Powell.

– The conference’s conclusion on one point was clear, in that the “Greenspan-to-Powell era, a 30-year arc of central bank activism, could be nearing its end. What comes next is a narrower, more restrained version of the Fed that could break with recent precedent on everything from balance sheet strategy to its very purpose.”

– Originally, “Powell came into his role as a pragmatic centrist, but history thrust him into the role of economic firefighter. He slashed interest rates to zero during the Covid crisis and oversaw an enormous expansion of the Fed’s balance sheet to calm markets. After underestimating early inflation signals, he pivoted — sharply raising rates at the fastest clip in decades.”

– Inflation is falling, offering proof that the Fed’s steps under Powell have made progress. But “Powell is guiding markets, still trying to land the so-called plane.” Given that Powell is leaving early next year, the Fed “may not reach the runway before the crew is replaced.”

– One possible Powell replacement, Kevin Warsh, has argued that the Fed should offer less oversight, less mission creep, and a smaller balance sheet, with a more singular focus on keeping inflation in check. The “Warsh view” is that the Fed, having become a “data heavy” institution capable of intervening in crises and in steering economies, needs to be subjected to intellectual challenge via political and economic shifts.

– The dean of the Daniels School of Business at Purdue, James Bullard, also a former President of the St. Louis Fed, claims that “the traditional model of managing inflation in a world of ‘sticky’ prices no longer reflects reality. Prices now adjust quickly, … while contracts remain rigid. The Fed’s mission, then, should go beyond stabilizing inflation and to ensuring money is predictable enough to support those contracts.”

Harvard University professor Jason Furman looks at the issue differently, saying that the Fed, according to the reporter, “relies on an ever-shifting mix of indicators, leaving markets and the public guessing. He advocates for a clearer framework, while others argue that the central bank should lean more heavily on rule-based approaches like the Taylor rule, rather than reacting to data in real time.”

– “Cleveland Fed President Beth Hammick has urged a re-examination of how the Fed uses its balance sheet, including the long-term implications of quantitative easing and tightening.”

– Former Cleveland Fed President Loretta Master “believes policy decision memos have become too terse, pushing investors to read too much into Chairman Jerome Powell’s every word.”

– One possible replacement for vice-chair of supervision, Michelle Bowman, is expected to utilize a lighter regulatory approach than did her predecessor, Michael Barr.

– “The Fed is preparing to unveil an updated policy framework this summer, a product of months of internal review”, but the policy framework may be short-lived.

– The trend of Fed oversight may become more constrained, what with current economic tools possibly being pared away by new Fed leadership. The question, for now, is what if the lightened (pared away) Fed toolbox proves less effective should a next financial crisis erupt?

– Furthermore, according to the reporter, “President Donald Trump’s tariff and policy shocks threaten to reverse that trend.”

– According to Capital Economics’ Stephen Brown, “[c]ore CPI could rise to 3.5% by the end of 2025.

– “Apollo Chief Economist Torsten Slok predicted a stagflation-live environment with rising prices, slowing growth, and limited Fed control.”

Make of this what you will.

Me?

Economists remain living in far different worlds. Each named economist finds different faults with Fed policy, but the fact remains that Jerome Powell, for seven years, has provided a measure of stability, though perhaps not quite a measure of constancy, to the Fed’s role in steering the now-$30 trillion American economy produced by some 340 million persons.

To me, the sheer size of the economy begs credulity and FlaglerLive readers should remember that the pandemic shock produced an economic disruption unlike anything experienced since the Great Depression, yet here we are with an economy that is the “envy of the world.”

Trump’s responses to the crisis helped.

Biden’s responses to the crisis helped.

Powell’s responses to the crisis helped.

The jobs market remains strong. Unemployment numbers are in a healthy range. GDP growth stumbled in the first quarter, but much of the stumble is attributed to people sending money overseas prior to April 2nd to beat the cost increases thought likely from Trump’s tariff policies. Layoffs remain low. Job quits remain low. Applications for unemployment insurance remain low.

The only recent economic report that might prove worrisome is that American employee productivity growth flatlined in the first quarter for the first time in a long time.

Two productivity factors comprise overall employee productivity growth: More people receiving paychecks and then spending what they earn. Each person producing more due to technological and efficiency gains.

Employee productivity growth in many European countries and in Japan and in Korea has flatlined for some time now, due to long-dropping birth rates in those countries, plus low immigration levels. Without additional employees from immigration to offset declining numbers of native-born workers, Japan and Korea and Germany and France and other nations have long struggled to grow employee productivity.

America, blessed with large numbers of immigrants, has since the recovery from the pandemic shock enjoyed greater employee productivity growth compared to the nations that limit immigration. At least it has until now.

Sherry says

This from Politico on MORE TRUMP ADMINISTRATION CORRUPTION:

The Trump administration official overseeing the Treasury Department’s massive financial operations reported owning stock in many of the large banks and companies that do business with the department, according to disclosures obtained by POLITICO.

Tom Krause, who is also the lead official for Treasury’s DOGE team, reported hundreds of thousands of dollars’ worth of shares in a wide range of financial companies, including those that provide services to the unit Krause oversees.

He and two other Treasury DOGE team members — Todd Newnam and Linda Whitridge— also reported owning shares of Intuit, the parent company of TurboTax, which has lobbied heavily against IRS Direct File, a program targeted for elimination by Elon Musk and DOGE.

Krause, who is also the CEO of Cloud Software Group, has been leading Treasury’s DOGE team since January. In February, he also took on the duties of Treasury’s fiscal assistant secretary after David Lebryk, a longtime career official, resigned amid a clash over DOGE’s access to the payments systems.

As the top official overseeing Treasury’s Bureau of the Fiscal Service, Krause is at the helm of agency operations that include running the federal payments system and managing the cash and debt that finances the government.

Among his financial holdings were hundreds of thousands of dollars’ worth of shares of JPMorgan Chase, Bank of America, PNC and U.S. Bank. They are among the companies that provide financial services to the Bureau of the Fiscal Service as it disburses trillions of dollars of payments each year and seeks to collect debt owed to the government.

He disclosed investments in other banks, such as Wells Fargo, Deutsche Bank, Morgan Stanley and Santander, which are among the financial institutions that purchase U.S. debt securities through Treasury auctions managed by the Fiscal Service.

In addition, Krause, who is one of the officials leading Treasury’s efforts to modernize its IT and financial infrastructure, disclosed owning shares of big government contractors like Accenture and large tech firms like Oracle, Google and Amazon.

It’s not clear whether he and the other DOGE team members have been required to divest from any of their financial holdings. After filing his initial financial paperwork in March, Krause disclosed in two additional filings a range of purchases and sales of assets, but none included any of his bank stock holdings.

“These Treasury and IRS employees are following all ethics laws and guidelines, including policies concerning recusals,” a Treasury spokesperson said in a statement. Krause did not immediately respond to a separate request for comment. Newnam and Whitridge also did not immediately respond to a request for comment.

Several former Treasury officials and government ethics experts said the disclosures raise ethics concerns.

📣 Want more POLITICO? Download our mobile app to save stories, get notifications and more. In iOS or Android.

“It’s a massive, glaring red flag of a conflict of interest here,” said Dylan Hedtler-Gaudette, the director of government at the Project on Government Oversight. “A person at this level of [the] Treasury Department should absolutely not have direct financial ties to the industries and the companies that he or she is in part responsible for overseeing.”

Don Hammond, who previously served as Treasury’s fiscal assistant secretary, said there’s a wide range of banks and financial companies that would be “extremely problematic” for someone in that role to be invested in because they’re service providers to Treasury. Other categories of potential conflicts include large IT contractors and the financial institutions that have an interest in how Treasury operates its sale of government debt, he said.

Several large banks provide Treasury with lockbox services, payment collection services, and electronic processing services for taxes. “JP Morgan Chase and Bank of America are huge, critical vendors to Treasury,” Hammond said. The fiscal assistant secretary “plays a predominant role in determining the sourcing of services, the manner in which payments are conducted, and how processing is done,” he said.

Julie Brinn Siegel, who was Treasury’s deputy chief of staff during the Biden administration, sharply criticized the DOGE team members’ investments in tax preparation software maker Intuit, which has been lobbying against the IRS Direct File program.

“The DOGE Team at Treasury killed free tax filing software, is outsourcing foundational technical infrastructure, and firing the cops who keep our financial system safe from catastrophe,” she said. “They also have large holdings in the exact tax prep, government contracting and financial services companies that will profit from their actions. Who are they working for?”

The Biden-era program, which the Trump administration kept for this year, allows taxpayers to pay their taxes for free directly to the IRS rather than use private sector tax preparation software. The Associated Press reported last month that the administration plans to end the Direct File initiative, months after Musk posted in February that his team had “deleted” the government group working on it.

The financial disclosures from Treasury’s DOGE team also come amid a political and legal battle over DOGE’s access to the Treasury payment system.

Democrats have blasted the administration for allowing DOGE to access sensitive payment databases, and federal employee unions have accused Treasury of violating federal privacy laws.

Treasury Secretary Scott Bessent has defended DOGE’s work as a much-needed effort to overhaul antiquated technology systems and payment processing, even as he has sparred with Musk over leadership at the IRS.

After several courts temporarily blocked DOGE’s access to the payment system, the administration has won several efforts to remove those restrictions.

A federal judge in New York is weighing a request by Treasury to dissolve the final remaining prohibition on DOGE employees getting access to the sensitive payment system.

Ray W, says

This the third comment derived from three different articles from three different sources about the Fed’s two-day gathering this week to review its “framework” economic strategy used since 2020 to inform its lending rate decisions.

The Wall Street Journal reports that Thursday morning, Fed Chair Powell admitted that deficiencies inhering in the Fed’s adoption of its 2020 “framework” policy, re: lending rates, caused a lack of resiliency by the Fed to adequately respond to “a broad range of economic outcomes, however unlikely they seemed at the time.”

According to the reporter “[f]ramework refers to how the Fed spells out its strategy for setting interest rates. Congress has assigned the Fed a mandate to maintain low and stable inflation while promoting healthy labor markets. How the Fed does that has largely been left up to the central bank, and since 2012, the Fed has laid out how it seeks to achieve those goals in a broader framework statement.”

Up until 2012, the Fed had never issued a “framework” position. In that year, the Fed’s “framework” statement adopted 2% as its target inflation rate. Prior to that time, there was no ideal targeted inflation rate. Ever since 2012, the Fed’s “framework” policy has included the 2% rate.

The Fed adopted its current “framework” policy in 2020, prior to the full impacts of the reopening of the country’s economy after the pandemic became apparent to economists. At the time of its adoption, the Fed agreed to review its 2020 “framework” policy after five years.

According to the story, the Fed has been working on a revised “framework” for some time; this week’s two-day conference is structured to permit gathered Fed officials to “hear from leading policy theorists over changes they should potentially make to their framework and communications tools.”

“Powell’s remarks Thursday indicated that the Fed would retract key changes it made five years ago.”

According to the story, the Fed generally reissues its “framework” policy every January, though not necessarily with any policy changes.

The 2012 formal “framework” policy adopting the 2% inflation target rate was not without perceptions of shortcomings. According to the reporter, “the very low global interest rate environment that followed the 2007-09 recession led officials to grow concerned that their new inflation target might have a flaw: With interest rates pinned more often near zero, the central bank might lack the ability to stimulate growth following downturns.

“As a result, the Fed faced a wider range of scenarios where it would be easier to slow down the economy by raising rates than to stimulate the economy by cutting rates. Six years ago, the Fed embarked on a yearlong effort — its first “framework review” — to consider changes that would account for this asymmetry.”

The 2020 framework policy made a “seemingly small but important change. Inflation had been running below the Fed’s 2% target even with historically low interest rates. So officials agreed to a “make-up” strategy: They would keep interest rates somewhat lower than widely used models might suggest, allowing inflation to run modestly above their 2% goal. …

“At their meeting last week, officials concluded they should revise this so-called average inflation targeting that they had adopted five years ago, Powell said Thursday.”

The problem with the “make-up” strategy was that “[t]he reopening from the pandemic in 2021 rendered the most notable changes of the 2020 framework inoperable by year’s end. Inflation hit 6% in November 2021. This ‘overshoot,’ driven by strong demand and discombobulated supply chains, hadn’t been contemplated by officials when they adopted the framework one year earlier.”

Most importantly, “Powell suggested that higher inflation-adjusted – or “real” — interest rates that followed the 2020 pandemic could moot elements of the bank’s current framework.

“Higher real interest rates might ‘reflect the possibility that inflation could be more volatile going forward than in the intercrisis period of the 2010s,’ he said. We may be entering into a period of more frequent, and potentially more persistent supply shocks — a difficult challenge for the economy and for central banks.”

Make of this what you will.

Me?

The Wall Street Journal is reporting that Fed Chair Powell has admitted that in the Fed’s blindness to the wide range of economic upheavals that could spring from the pandemic, the central bank adopted a revised “framework” policy that intentionally ignored known economic models. Instead, the Fed intentionally made up a policy that turned out within a year of the country’s reopening after the pandemic to be flawed. Fed officials are meeting this week to hear from experts to learn just how they might best unwind the bank’s flawed “framework” policy. The reason that the “framework” proved deficient was that it failed to anticipate the huge sums of stimulus money in their trillions of dollars that were injected into a failing economy. There simply was too much demand for goods based on the extra money injected into the economy at a time when supply chains were “discombobulated.”

Any FlaglerLive commenter who uses “Bidenflation” as a description of what happened to the American economy after the pandemic is laundering lies.

From the Wall Street Journal’s analysis, the Fed may very well be the party that is primarily responsible for the higher than targeted inflation rates that we all endured from late 2021 to today. The Fed admits that it misjudged the impact of the reopening of the country after the pandemic shutdowns that were ordered by each state’s governor because the Fed had adopted a year earlier a flawed “framework” from which it determined its responses. This seems to explain why so many economists argue that the Fed reacted too late in raising lending rates. Had it used known and accepted economic modeling in considering its lending rate options, the Fed, by raising lending rates earlier than it actually did, should have tamped down the inflationary wave before it grew out of control.