Weather: Partly sunny with a chance of thunderstorms. A chance of showers in the morning, then showers likely in the afternoon. Highs in the upper 80s. East winds 15 to 20 mph with gusts up to 30 mph. Chance of rain 70 percent. Tuesday Night: Mostly cloudy with showers likely with a chance of thunderstorms in the evening, then partly cloudy with a slight chance of showers and thunderstorms after midnight. Lows in the lower 70s. Chance of rain 70 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Flagler Beach here.

- tropical cyclone activity here, and even more details here.

Today at a Glance:

The Palm Coast City Council meets at 9 a.m. at City Hall. For agendas, minutes, and audio access to the meetings, go here. For meeting agendas, audio and video, go here.

The Flagler County School Board meets at 1 p.m. for a workshop at the Government Services Building’s third floor conference room, and at 6 p.m. for a business meeting, 1769 East Moody Boulevard, Bunnell.

Food Truck Tuesdays is presented by the City of Palm Coast on the third Tuesday of every month from March to October. Held at Central Park in Town Center, visitors can enjoy gourmet food served out of trucks from 5 to 8 p.m.–mobile kitchens, canteens and catering trucks that offer up appetizers, main dishes, side dishes and desserts. Foods to be featured change monthly but have included lobster rolls, Portuguese cuisine, fish and chips, regional American, Latin food, ice cream, barbecue and much more. Many menus are kid-friendly. Proceeds from each Food Truck Tuesday event benefits a local charity.

The Flagler Beach Library Writers’ Club meets at 5 p.m. at the library, 315 South Seventh Street, Flagler Beach.

Random Acts of Insanity Standup Comedy, 8 p.m. at Cinematique Theater, 242 South Beach Street, Daytona Beach. General admission is $8.50. Every Tuesday and on the first Saturday of every month the Random Acts of Insanity Comedy Improv Troupe specializes in performing fast-paced improvised comedy.

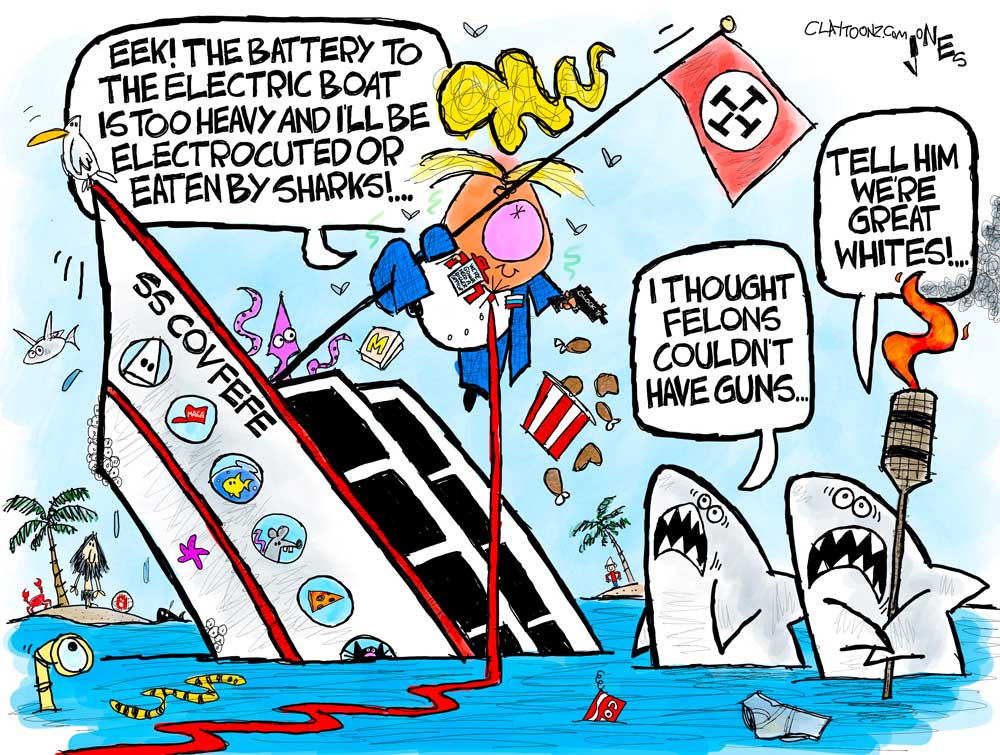

Notably: This might have a better place down below, but I couldn’t wait. It’s from Rushdie’s Knife: “There were probably exceptions to this principle, but very few of the people who ought to regret their lives—Donald Trump, Boris Johnson, Adolf Eichmann, Harvey Weinstein—ever do so.” What I like about the line is the company. Rushdie here has created a Dantesque Circle of Hell of his own. Note that he doesn’t include the Stalins, the Maos, the Pol-Pots and the Hitlers of the 20th century, but does include the more recent vernacular vulgarians of horror, throwing in Eichmann in there as if to certify the validity of the group: putrid, murderous, horrible, but not just quite yet down in that hell of hells that the other ones inhabit. No one can really claim that, other than Eichmann–the guy drew the blueprint of the Holocaust, for heaven’s sake–the other three horrors come close to having their hands on the blade. But still. A lovely line in an otherwise often disappointing book too rich in cliches (the surprising thing about Rushdie, that master of language who so easily slouches and lazes into sentences he knows should not make it into his books). Rushdie was featured here yesterday, He’s featured again. And why not. Below you’ll see him talk about The Moor’s Last Sigh, my favorite of all the books of his I’ve read, including The Satanic Verses, which I found to be a greatly, hilariously enjoyable romp, but which, alas, I don’t think I understood ninety percent of the time. The Moor’s Last Sigh was different.

—P.T.

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Free For All Fridays With Host David Ayres on WNZF

Scenic A1A Pride Meeting

Friday Blue Forum

Acoustic Jam Circle At The Community Center In The Hammock

Flagler Beach Farmers Market

Coffee With Flagler Beach Commission Chair Scott Spradley

Grace Community Food Pantry on Education Way

Gamble Jam at Gamble Rogers Memorial State Recreation Area

Stetson University Concert Choir in Concert with Orlando Philharmonic

For the full calendar, go here.

we look up and we hope the stars look down, we pray that there may be stars for us to follow, stars moving across the heavens and leading us to our destiny, but it’s only our vanity. We look at the galaxy and fall in love, but the universe cares less about us than we do about it, and the stars stay in their courses however much we may wish upon them to do otherwise. It’s true that if you watch the sky-wheel turn for a while you’ll see a meteor fall, flame and die. That’s not a star worth following; it’s just an unlucky rock. Our fates are here on earth. There are no guiding stars.

–From Salman Rushdie’s The Moor’s Last Sigh (1995).

.

Ray W. says

Just another comment about the ten recessions I have lived through.

The second of the 10 recessions is occasionally referred to as the recession that cost Nixon the 1960 presidential election, but a policy paper prepared in 1962 by a team of economists for one of the regional federal reserve banks called it the “rolling adjustment recession.” To place this in context, a reminder that the Federal Reserve Bank system was created 45 years earlier with two mandates seems appropriate. The legislation creating the banking system (a central Fed and 10 regional Feds) in 1917 intended that the system was to implement policies designed to maximize job growth while at the same time manage the overall U.S. economy. Over the 45 years leading to 1962, the Fed had tried to learn from each new recession and from the Great Depression. It had always acted independently of any political influences, as it tries to do to this day.

Prior to the strictly defined short period of recession from April 1960 to February 1961, the inflation rate slowly began to rise. The Fed hiked the lending rate from 1.98% to 4.03%. Concurrently, the unemployment rate had slightly ticked up and the trade deficit rose, but GDP growth continued despite these three headwinds. The economists concluded that the rise in the lending rates is what drove the economy into actual recession, hence the term “rolling” recession. GDP dropped by 1.6% during the actual recession, a relatively small drop. The DOW fell 14.1%. Unemployment ratcheted up to a peak of 7.1%. Industrial output shrank by 9.1%. Retail spending dropped by 4.4%.

In response, the Fed pumped an additional $1.4 billion into its “effective reserves”, which enabled commercial banks to invest or lend an additional $15.9 billion into the economy, what at that time was a record for a “credit expansion.” The Fed also lowered the lending rate from the high of 4.03% to 2.29%. During the same timeframe, the executive branch, i.e., Eisenhower and Kennedy administrations, initiated construction on what became the St. Lawrence Seaway and many of the projects associated with the fledgling interstate highway system were pushed into construction, which was an accepted form of stimulus spending at that time.

Compared to the Trump Recession, brought on by the massive impact of the pandemic, the rolling recession of 1960-61 acted in an opposite manner. Inflation occurred prior to the recession, instead of after the recession. Jobless rates ticked up prior to the recession, but really rose during it. In the Trump era, joblessness was extremely low prior to the pandemic and skyrocketed to over 14%, in only a few months, yet inflation remained low, primarily due to the huge influx of unfunded stimulus money that was artificially injected, i.e., forced, into the economy. The total workforce percentage was freefalling when inflation triggered by the huge spending spree began to rise. Some economists argue that the Fed waited too long after onset of the pandemic before hiking the lending rate. Had the Fed acted earlier, they claim, the inflation rate would have already been brought under control and lending rates would already be dropping. Who knows?

My thought is that economic conditions slowly worsened in 1959 and 1960. The Fed raised lending rates to counter a trend involving slight inflation. The raising of the lending rates appears to be what drove the economy into recession, causing a loss of jobs, a cut in consumer spending, even more unemployment, a drop in industrial production and a reversal of what had been normal GDP growth. We learned from the experiment.

Today, the Fed appears to have been much more hesitant a few years ago against prematurely raising lending rates, just as it seems reluctant today to prematurely cut lending rates, out of concern that raising or cutting rates prematurely will make things worse instead of better. But today, just as back then, economists knew that raised lending rates corresponds with a cooling of the economy. Today, our economy is the strongest in the world, though all the world’s economies were weakened by the pandemic; we just recovered better and faster. The Fed is still trying to cool our strong economy without driving it into recession. We keep adding huge numbers of jobs, yet our economy has not overheated. We keep plowing unfunded stimulus money into the economy, yet our economy has not overheated. The unemployment rate remains at 4.0%, a historically low percentage, which usually places pressures on inflation, yet our economy hasn’t overheated.

The 12-month rolling average rate of inflation peaked at 9.1% over two years ago and it is now down to under 3.5%. It leveled off for a few months early this year, but it has resumed its fall toward 2%, yet the economy keeps growing despite the higher lending rates. Something is happening today that has never happened before. Economist after economist keeps saying that we might achieve the mythical “soft landing”, without our economy cooling into recession. No one yet seems to have a complete explanation for why this is happening, but many are leaning toward the explanation that the massive infusion of unfunded stimulus spending has been properly managed by the independent Fed.

FlaglerLive readers might consider the following idea. Can political explanations for the steadily improving overall economy be correct if the actions taken by an independent Fed are primarily responsible for the current consistently improving state of our economy? Yes, political explanations might be secondarily responsible for today’s strong U.S. economy, but can they be primarily responsible?