To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Sunny. Highs in the mid 80s. South winds around 5 mph, becoming east in the afternoon. Thursday Night: Mostly clear. Lows in the lower 60s. See the daily weather briefing from the National Weather Service in Jacksonville here.

Today at a Glance:

Drug Court convenes before Circuit Judge Terence Perkins at 10 a.m. in Courtroom 401 at the Flagler County courthouse, Kim C. Hammond Justice Center 1769 E Moody Blvd, Bldg 1, Bunnell. Drug Court is open to the public. See the Drug Court handbook here and the participation agreement here.

The Palm Coast Beautification and Environmental Advisory Committee meets at 5 p.m. at City Hall, 160 Lake Avenue, Palm Coast.

The Flagler Beach City Commission meets at 5:30 p.m. at City Hall, 105 South 2nd Street in Flagler Beach. Watch the meeting at the city’s YouTube channel here. Access meeting agenda and materials here. See a list of commission members and their email addresses here.

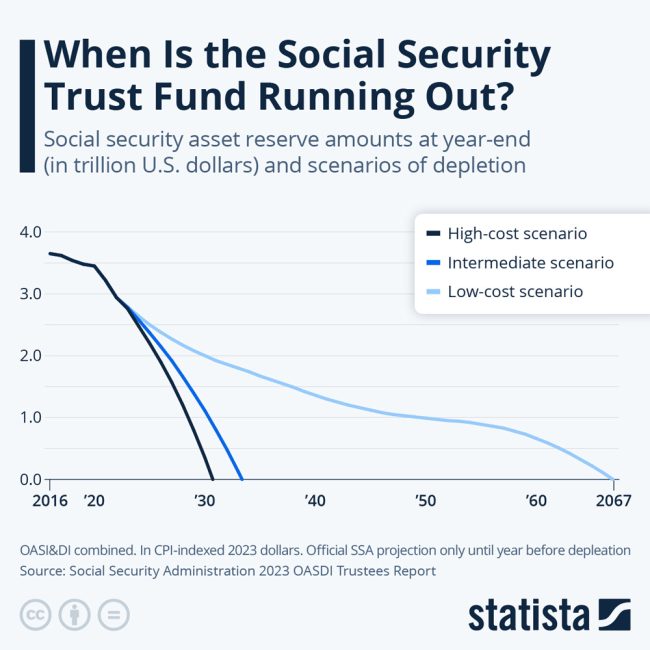

Notably: In 2005 the New York Times reported about Social Security: “Under the current structure, payroll taxes will begin falling short of what will be needed to pay benefits in 2018, according to the latest estimates by the Social Security Administration. By 2042, in this analysis, the trust fund will be exhausted, and the only money left to pay Social Security benefits will be what is paid each year in Social Security taxes, enough to pay only about 75 percent of scheduled benefits.” That never happened. Dire projections of the sort typically don’t, though that doesn’t mean that they won’t. The fraud underlying the Social Security debate though, whenever it recurs,. is that somehow the nation is strapped and unable to meet its obligations, even though,, just as George W. Bush was fabricating the latest scenarios about an insolvent trust fund, he was in the midst of four wars–terror, Afghanistan, Iraq, drugs–that would cost the nation upwards of $2 trillion and counting. No one ever paused to say that the money wasn’t there. It’s been in good part borrowed money, and in good part borrowed from the Social Security Trust Fund, what with three significant tax cuts during the Bush years and an enormous one the moment Trump got into office. So read the following with a grain of salt: From Statistia: “The annual OASDI trustees report by the Social Security Administration, covering old-age, survivors and disability insurance, shows that under the present circumstances, the asset reserve dedicated to the benefit program could be depleted sooner rather than later. Under the report’s intermediate scenario, asset funds would run out sometime in 2034, while this could happen as soon as 2031 if the administration was to shoulder a high volume of costs in the upcoming years. Under the low-cost scenario, the fund could remain solvent until 2066. The intermediate date was moved forward in the course of the COVID-19 pandemic, which seriously diminished Social Security’s income in payroll taxes. The system’s expenditures have been above its income for some time – with the difference being taken out of the asset fund and the interest it creates – but the gap has been widening over the years. As Baby Boomers retire and Americans are having fewer children, the balance between those who are working and funding social security and those who are receiving old age, survivor or disability benefits continues to tip. 2021 marked the first year when interest earned on the fund could no longer bridge social security’s spending gap, sending the asset reserve into a downward spiral. Because Social Security services are funded by the payroll tax on a pay-as-you-go basis, the income-cost gap equals the amount the administration would no longer be able to pay out if the fund would in fact be depleted. In order to stop funds from running low, Congress would have to act to provide additional revenue to Social Security, for example by raising the dedicated payroll tax, to lower its cost by cutting benefits or attempt a combination of both.

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Flagler Beach Farmers Market

Coffee With Flagler Beach Commission Chair Scott Spradley

Grace Community Food Pantry on Education Way

Gamble Jam at Gamble Rogers Memorial State Recreation Area

Stetson University Concert Choir in Concert with Orlando Philharmonic

ESL Bible Studies for Intermediate and Advanced Students

Grace Community Food Pantry on Education Way

Palm Coast Farmers’ Market at European Village

Stetson University Concert Choir in Concert with Orlando Philharmonic

Al-Anon Family Groups

Temple Beth Shalom Blessing of the Pets

Nar-Anon Family Group

Palm Coast Charter Review Committee Meeting

Bunnell City Commission Meeting

For the full calendar, go here.

So here is a little-understood fact of American tax policy: the people earning $76,200 and $944,000 pay exactly the same Social Security tax. Indeed, the person earning $76,200 and multibillionaire Bill Gates pay the same Social Security tax. Is that fair? That is the question – but not one being asked in the current debate in the presidential campaign. In fact, some analysts say the question is unfair. After all, while Gates may pay a minuscule portion of his income in Social Security taxes compared with most Americans, he also receives no extra benefits. If the Social Security tax cap was lifted, and if Gates paid the full 12.4 percent tax on his billions, then the Social Security administration might have to send him monthly retirement checks of $1 million or more. Still, some members of Congress such as Representative Jerrold Nadler, a New York Democrat, have decried what they call the regressive nature of the Social Security tax system. They believe that wealthier Americans can afford to pay to help shore up the system, just as they pay more to help provide other social programs for lower-income people.

–From “Social Security’s hidden dilemma,” by Michael Kranish, Boston Globe, May 14, 2000.

Pogo says

@Something to think about…

…while waiting for the world to beat a path to local experts on urban war:

https://www.google.com/search?q=urban+war

We’re All Living Under Gravity’s Rainbow

Looming apocalypse. Paranoid conspiracies. Rocket-obsessed oligarchs. As Thomas Pynchon’s novel turns 50, its world feels unnervingly present.

By John Semley Backchannel Feb 16, 2023 7:00 AM

https://www.wired.com/story/living-under-gravitys-rainbow-thomas-pynchon/