To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Areas of dense fog in the morning. Partly cloudy. Highs around 80. Southwest winds around 5 mph. Thursday Night: Partly cloudy in the evening, then becoming mostly cloudy. Patchy fog after midnight. Lows in the lower 60s. Southwest winds 5 to 10 mph.

Today at the Editor’s Glance:

In Court: Justin Rushing of Bunnell will seek to end his probation early, after his conviction in 2013.

Uncouth, an open mic night: Join a unique community of creative artists and performers on Thursday nights from 9:30 to 10:30 p.m. in Lee’s Garage, Carlton Union Building, Room 261A, 131 E Minnesota Avenue, DeLand, for an event featuring the student community of Stetson University. Uncouth is an “open-mic night” where students can perform their poetry, prose, music, and any other ‘artistic’ talents. This is a safe space for students to gather with their peers and enjoy the company of other creative minds.

Navy Bombing in the Ocala National Forest: Navy training schedules indicate that inert and live bombing will take place at the Pinecastle Range Complex located in the Ocala National Forest this week. Bombings at times can be heard in Flagler-Palm Coast. The bombings are scheduled as follows:

Thursday – 3:00 p.m. – 5:00 p.m. (Live/Inert)

During bombing periods wildlife may be temporarily displaced. Use extra caution when driving through the Ocala National forest and surrounding areas. Secure any items around your residence that could attract wildlife. Always be mindful of larger animals including black bears and practice bearwise measures. The telephone number for noise complaints is 1-800-874-5059, Fleet Area Control and Surveillance Facility, Jacksonville, Fla. For additional information, call (904) 542-5588.

In Coming Days:

Palm Coast hosts the 2nd Annual Tunnel to Towers 5K Run/Walk Palm Coast on Saturday, February 4, at 8 a.m. at Central Park in Town Center. All proceeds from this event will benefit the Tunnel Towers Foundation, which supports severely wounded veterans and first responders, gold star families, combating veteran homelessness and other timely causes. Most recently, the organization has been working to provide relief efforts for areas of southwest Florida that were most devastated in the aftermath of Hurricane Ian. Registration for the Tunnel to Towers 5K Palm Coast opens on Tuesday, November 1 at 10 a.m. via the event registration page. Participants will be able to sign up and get 50% any registration cost by using the promo code FIRSTRESPONDER at checkout through 10am on November 3. Those interested in volunteering may also sign up via the volunteer registration page. All participants and volunteers will receive a Tunnel to Towers t-shirt, and customized medals for the event. For all inquiries or sponsorship opportunities, email [email protected]

Love is Love Pridefest 2023 in DeLand: Saturday, starting at 2 p.m. on Artisan Alley, near the intersection of New York Avenue and South Woodland Boulevard. Pride Marketplace, Live Entertainment, Youth Activities, and more.

The 2023 Flagler Home and Lifestyle Show is scheduled for Feb. 4 and 5, from 9 a.m. to 4 p.m. Saturday and 10 a.m. to 4 p.m. Sundat, at Flagler Palm Coast High School, 5500 State Road 100, Palm Coast. Free parking and admission, food trucks, arts and crafts, service fair and more. The lifestyle show is a fund-raiser for Flagler County Schools’ Flagler Technical College.

Notably: The front page of the Wall Street Journal Wednesday had this lead story: “Pay Gains Shrink in a New Sign of Easing Inflation.” Below the fold, this story: “Exxon Hits Record Profit By Doubling Down on Oil.” Exxon’s profit–just profit–in 2022: $55.7 billion, the equivalent of $159 for every child, woman and man in the United States. That’s just Exxon. Chevron’s profit came in at $36.5 billion. BP announces its profits next Tuesday. Shell, which made over $30 billion in the first nine months of the year, is also still ahead. There’s also Marathon, Valero, and a few smaller ones. Combine it all and the share of profits that went to the principal oil companies equates to between $400 and $500 per American. The figure is actually much higher since children don’t drive and a good number of elderly no longer do. (Obviously, the companies don’t sell only in the States, but nor does this figure include the profits of even bigger graspers like Saudi Aramco, the world’s biggest oil company, and China Petroleum and PetroChina, the Number 2 and 3 companies. Exxon is 4th). What rankles is the Journal’s cheeriness about falling wages, a joy to Wall Street, where inflation matters more than workers’ paychecks, and obscene profits are divorced from the very inflation they decry. I recall a 1998 headline in the Journal: “Capitalism Is Giddy with Triumph; Is It Possible to Overdo It?” That was about privatization. But it might as well be about this week’s giddiness, which puts one in mind of Orwell’s corrective: “Fascism and capitalism are at bottom the same thing.”

Now this:

Flagler Beach Webcam:

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

July 2025

Free For All Fridays With Host David Ayres on WNZF

Friday Blue Forum

Flagler Beach Farmers Market

Coffee With Flagler Beach Commission Chair Scott Spradley

Grace Community Food Pantry on Education Way

Second Saturday Plant Sale at Washington Oaks Gardens State Park

American Association of University Women (AAUW) Meeting

Peps Art Walk Near Beachfront Grille

ESL Bible Studies for Intermediate and Advanced Students

Grace Community Food Pantry on Education Way

Palm Coast Farmers’ Market at European Village

Gamble Jam at Gamble Rogers Memorial State Recreation Area

Al-Anon Family Groups

For the full calendar, go here.

Labor is prior to and independent of capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration. Capital has its rights, which are as worthy of protection as any other rights. Nor is it denied that there is, and probably always will be, a relation between labor and capital producing mutual benefits. The error is in assuming that the whole labor of community exists within that relation. A few men own capital, and that few avoid labor themselves, and with their capital hire or buy another few to labor for them. A large majority belong to neither class–neither work for others nor have others working for them. In most of the Southern States a majority of the whole people of all colors are neither slaves nor masters, while in the Northern a large majority are neither hirers nor hired. Men, with their families–wives, sons, and daughters–work for themselves on their farms, in their houses, and in their shops, taking the whole product to themselves, and asking no favors of capital on the one hand nor of hired laborers or slaves on the other. It is not forgotten that a considerable number of persons mingle their own labor with capital; that is, they labor with their own hands and also buy or hire others to labor for them; but this is only a mixed and not a distinct class. No principle stated is disturbed by the existence of this mixed class.” […] “No men living are more worthy to be trusted than those who toil up from poverty; none less inclined to take or touch aught which they have not honestly earned. Let them beware of surrendering a political power which they already possess, and which if surrendered will surely be used to close the door of advancement against such as they and to fix new disabilities and burdens upon them till all of liberty shall be lost.”

–From Abraham Lincoln’s 1861 State of the Union Address.

Robert says

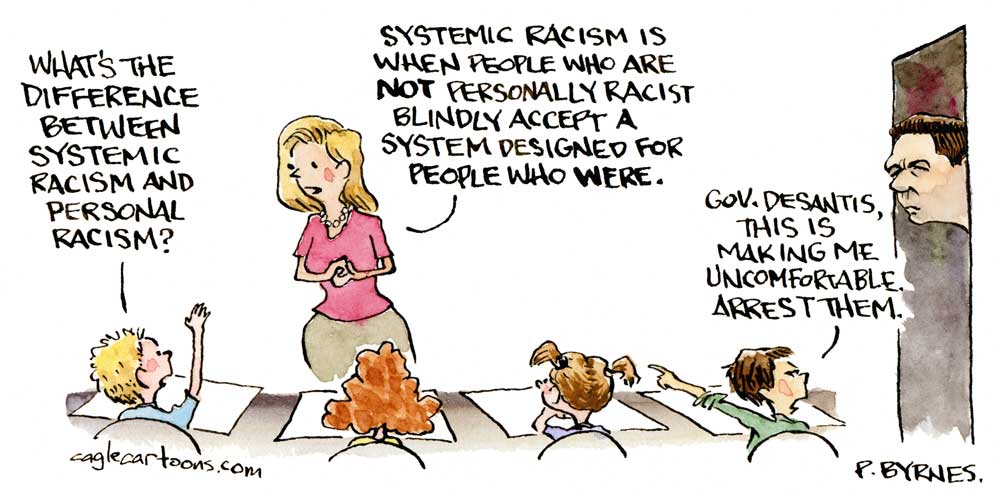

DeSantis is making truth a crime. What’s next???

Pogo says

@FlaglerLive

Today’s quote ought to appear every single time some elected, or otherwise, Republican bathes in Lincoln’s blood or otherwise dishonors his memory (such as it is — see the link, pun not intended).

Google ranks — what’s in a name?

https://www.google.com/search?q=Lincoln

Ray W. says

What an intriguing introduction into what might be one aspect of mid-19th century thought about the form of capitalism evolving in that era that Lincoln was willing to share to the nation.

And, the Notably commentary about “obscene” American energy company profit figures being released in recent days raises its own intriguing questions. For example, if OPEC and other oil producing countries continue to manipulate the international production levels of crude oil, are we in the early stages of a long-term adjustment into permanent higher prices for crude oil distillates, such as gasoline, kerosene, diesel fuel, fuel oils, greases, etc.? For investors in American energy companies, this might be considered, on balance, a good thing, if only for shareholders. For the overall American economy, could this focus on energy corporation profits drive us, in no small part, into recession?

One possible perspective might be gained from the following analysis:

In 2020, a year dominated by the pandemic, American energy producers extracted, on average, 11.3 million barrels of crude oil per day, though production was higher at the beginning of the year and much lower at the end. The annual average price for crude oil that year was $39.68 per barrel. Simple math yields the sum of roughly $450 million dollars of American energy company income from crude oil extraction efforts per day. Not all of the income was profit, as it costs a significant amount of money to located and extract the oil.

In 2021, OPEC voted to manipulate the international crude oil market by cutting production by six million barrels per day, with Saudi Arabia committing to cutting another one million barrels of crude oil from the international marketplace. Yes, months later, OPEC voted to slowly increase production each new month by 400,000 barrels per day. That year, American energy providers extracted, on average, 11.25 million barrels per day, though production was lower at the beginning of the year and higher at the end. Pandemics can have that effect. Crude oil prices averaged $68.17 per barrel. Simple math yields the sum of roughly $775 million per day, an increase of about $325 million in income per day. Through actions external to their own goals, American energy companies achieved a massive windfall.

In 2022, Russia invaded the Ukraine, with significant impacts on the world’s energy markets. Prices for crude oil peaked at over $125 per barrel. When prices began to drop, not only did OPEC vote to stop the plan to slowly increasing their production figures, but it also voted to cut once again the amount of crude oil it produced. President Biden went so far as visiting Saudi Arabia to seek an increase in production, but his effort was rebuffed. Such invasion and further manipulations kept crude oil prices artificially high. On top of these actions, a number of energy companies informed their shareholders that their short-term plans did not include attempts to increase their own production figures, though many others did announce plans to dramatically increase drilling efforts in order to increase their own production figures. On average, American energy producers extracted 11.85 million barrels of crude oil per day (the EIA predicts that American energy producers will set a new record in 2023 of an average of 12.4 million barrels of crude oil per day, but who knows what will happen in the international marketplace)? The average price paid per barrel of crude oil in 2022 was $94.53. Simple math yields the sum of under $1.1 billion per day, an increase of nearly $650 million per day over 2020. Through activities mostly external to their own plans, American energy companies achieved a second massive windfall in a row. Admittedly, during the earliest days of the pandemic, oil prices fell so quickly that some companies were selling oil at below production costs, so 2020, at times, was not a good year for American energy producers.

I readily concede that my figures do not reflect all factors of the national energy marketplace, nor do they adequately explain every facet of corporate decision-making. The point is to explain several possible driving factors behind today’s gasoline and diesel prices at the pump. The national and international energy marketplace is extraordinarily complex, and multiple doctoral theses are awarded each year to students who intend to devote a lifetime to the study of that marketplace. I am only a curious onlooker, though my level of curiosity seems to be much higher than most of the FlaglerLive commenters who wish to ignore the universal power of the capitalist profit motive and focus on the false narrative of political partisanship.

Does anyone now wonder why some American energy companies are telling their investors that they do not plan to expand their exploration efforts in the near future? From a profit perspective, it makes sense to me. If OPEC intends to continue to manipulate the world’s energy markets and Russia intends to continue its war on the Ukraine, why shouldn’t some companies maintain the status quo in order to benefit from higher prices not of their own making? Or are the higher prices of their own indirect making? As I have repeatedly commented, at one point during the Obama crude oil bonanza, roughly 2000 drilling rigs were in operation. The rigs still exist. New one can be built if the demand is there. At the beginning of the pandemic, about 770 rigs were in operation. Recently, barely over 770 rigs were in operation. Why the relative few? There isn’t a shortage of existing oil leases on federal lands, and those leases last for a long time. Leases permitting exploration for new sources of crude oil on federal lands continue to be put up for bid, though a recent bidding effort on Arctic federal land yielded only one bidder. Permitting to drill is comparatively not that expensive. American energy companies can still pay private landholders for permission to drill on non-federal lands. Can an argument be made that American energy producers might be intentionally limiting their efforts to hire far fewer drilling rigs in order to keep energy prices artificially high? In the corporate mindset, does the private windfall gained through indirect foreign manipulation of international energy markets outweigh the public impact of higher fuel costs on the overall American economy?

As an aside, the EU ban on importing Russian diesel fuel starts very soon. EU nations will be purchasing their diesel fuel from other sources, including from American refinery owners. Will we soon see a spiral in diesel fuel prices? Will the zealous advocates among us understand the driving forces behind the rise in prices? Will the partisans, lacking any exercise of intellectual rigor, reflexively blame Biden administration policies in their never-ending efforts to displace blame from the proper targets?

Pogo says

@To no one in particular:

https://www.youtube.com/watch?v=gA-sEfXOaEQ

Should this be repealed?

https://www.google.com/search?q=The+Plain+Writing+Act+of+2010

Asking for a friend.

Ray W. says

In light of Lincoln’s explanation of labor’s role in the nation’s mid-19th century agrarian economy, separate from his understanding of capitalism, I think it appropriate to focus on today’s jobs report, which reveals a January gain of 517,000 newly created nonfarm jobs, including over 19,000 new manufacturing jobs.

At the beginning of the pandemic, there were 12.7 million manufacturing jobs, a number that plummeted to 11,414,000 one month into the pandemic. The January 2023 report reflects a total of 12,919,000 total manufacturing jobs, meaning that all lost jobs have been recovered and then some (1,505,000 total added manufacturing jobs since May 2020).

The 2022 jobs added report was updated to a total of 4.6 million new jobs added.

The 2021 jobs added report was updated to a total of 7.1 million new jobs added.

The unemployment rate was posted in January at 3.4%, lower than the unemployment rate during the Trump administration just before the pandemic hit, which was then posted as 3.5%. The 3.4% rate is the lowest since May 1969 (54 years).

Since the overall population of the United States grew by roughly 30 million people over the last 10 years, it is estimated that at least 120,000 new jobs must be created each month just to keep pace with the rising population (yes, I agree with the many FlaglerLive commenters who argue that population growth is the 800 lb. gorilla in the room of climate change).

The jobs available report saw an increase to 11 million unfilled job openings, over December’s 11.5 million job openings.

The latest weekly unemployment claims report reflects 183,000 former workers applying for unemployment insurance in the last week in January. The four-week rolling average for such claims also fell to 191,750. The weekly unemployment claims average from 1967 to 2023 is 368,250.

Given the rise in posted job openings nationwide and, given the drop in the four-week average number of applications for unemployment insurance, is it possible that the widely reported tech industry layoffs did not increase the number of people applying for unemployment insurance because those who were laid off quickly found new tech jobs? Is the current job market stronger than recent reporting suggests? Many economists insist that the main reason our heated economy has not yet slipped into recession despite inflation and interest rate issues is the consistently strong jobs added reports, the consistently high job opening reports, and the consistently low unemployment claims reports.

A quick check of stock market performance by president shows that after 25 months in office, the tally is as follows:

Obama 52.8% growth

Trump 30.5% growth

H.W. 23.0% growth

Clinton 21.2% growth

Reagan 17.5% growth

Biden 13.6% growth

W -27.5% contraction

After 48 months in office?

Clinton 105.8% growth

Obama 73.2% growth

Trump 50.9% growth

HW 41.3% growth

Reagan 35.8% growth

W -3.7% contraction

After 96 months?

Clinton 228.9% growth

Obama 148.3% growth

Reagan 147.3% growth

W. -26.5% contraction

I enjoy passing one the anecdotal story told to me by a friend. He visited his accountant late in the second term of the Obama administration. During the visit, the accountant began talking about how much better the economy would be if a Republican president were in office. My friend countered with the observation that the economy regularly did better during Democratic administrations. His accountant begged to differ. My friend challenged him to check closely for himself. Then next time he saw his accountant, the accountant admitted that he had checked for himself and that, overall, the economy had indeed done better during Democratic presidencies. Oy vey!

Ray W. says

On the solid-state battery front, an article was published today proclaiming that Stanford University researchers, along with SLAC National Accelerator Laboratory scientists, have isolated evidence of why “dendrites” form in the pressurized lithium metal storage medium during fast charging. Apparently, allowing dust or impurities to imprint into the metal medium during manufacture or creating nanofractures in the metal by any bending or other deformation of the medium allows lithium to intrude into the surrounding electrodes. If the dendrite growth follows the imprinted imperfection or the nanofracture and if it grows enough to penetrate through the solid medium into the positive and negative electrodes, it shorts out the battery.

While primarily used as a term in the field of medicine, the scientists involved in this potential breakthrough seem to be adapting the term of nanofracture to the manufacturing process and that nanofractures would be a factor of 10 smaller than microfractures. I could be wrong (According to a Penn State article, there seems to be a dispute over the use of the prefix “nano” and “nanno”, and it is not yet settled whether the Latin term or the Greek term should prevail; neither is a metric term. The PSU article does describe the father of nanotechnology research as President Clinton). And, once again, it appears that government support of research in crucial areas of innovation (SLAC falls under the direction of the Department of Energy’s Office of Science and is part of but separate from Stanford University, and is not a part of private industry), is responsible for the breakthrough. Those gullible partisans who claim that government does not create jobs are, again and again, wandering through life fooling themselves.

It follows that once scientists isolate the possible cause or causes of dendrite growth, then steps can be taken to eliminate or reduce to probability of dendrite formation. Each good hypothesis that is tested, proved and disproved will be followed by a better hypothesis, and on and on. More to come in this emerging area of research.

Pogo says

@FlaglerLive

RE:

“…Notably: The front page of the Wall Street Journal Wednesday had this lead story: “Pay Gains Shrink in a New Sign of Easing Inflation.” Below the fold, this story: “Exxon Hits Record Profit By Doubling Down on Oil.” Exxon’s profit–just profit–in 2022: $55.7 billion, the equivalent of $159 for every child, woman and man in the United States. That’s just Exxon. Chevron’s profit came in at $36.5 billion. BP announces its profits next Tuesday. Shell, which made over $30 billion in the first nine months of the year, is also still ahead. There’s also Marathon, Valero, and a few smaller ones. Combine it all and the share of profits that went to the principal oil companies equates to between $400 and $500 per American. The figure is actually much higher since children don’t drive and a good number of elderly no longer do. (Obviously, the companies don’t sell only in the States, but nor does this figure include the profits of even bigger graspers like Saudi Aramco, the world’s biggest oil company, and China Petroleum and PetroChina, the Number 2 and 3 companies. Exxon is 4th). What rankles is the Journal’s cheeriness about falling wages, a joy to Wall Street, where inflation matters more than workers’ paychecks, and obscene profits are divorced from the very inflation they decry. I recall a 1998 headline in the Journal: “Capitalism Is Giddy with Triumph; Is It Possible to Overdo It?” That was about privatization. But it might as well be about this week’s giddiness, which puts one in mind of Orwell’s corrective: “Fascism and capitalism are at bottom the same thing.” ”

Orwell had it right — IMO too

https://www.google.com/search?q=obscenity+i+know+when+i+see+it

Laurel says

Ray W.: So the Republican Party of No Plans must continue to chase after Hunter Biden’s hard drive, which is hidden somewhere in a hermetically sealed, lead lined box. They must continue to do such political stunts as remove non-white, non-Christian, smart female Ilhan Omar from Congressional committees by a party line vote, while protecting Qrazy Marjory Taylor Green for worse accusations. They must continue to distract from Biden’s accomplishments by grabbing headlines with off the padded walls comments, and what do the Democrats do? Immediately dismiss Al Franken for a silly honk, honk picture.

The circus.

Laurel says

Pogo: I’ve always thought that capitalism must peak. Maybe now? Publix, which used to taut “Where shopping is a pleasure,” is now more of a “where shopping is a shock,” especially here in the Hammock where Publix takes advantage of the wealthier vacationers here for a short stay. The locals, who work there, cannot afford the groceries.

I’m not against people being wealthy, but what I cannot figure out is, if the ultra wealthy keeps getting tax cuts, and working at making the middle class into the poor class, who is going to shop at Target, Amazon and Walmart? If the wealthy wants to cut or keep healthcare away from the middle class, and allows gentrification, who will be the workers? If the wealthy corporations are good with pollution, where will their children and grandchildren live? Elon City on Mars?

To me, this seems like extreme short sighted greed. It doesn’t seem to make sense to me any other way, if it’s actually considered “sense.”

Pogo says

@Laurel

Well said. I suggest, professor Joe Hill, is about as good as any on your comment:

And so it goes

https://genius.com/Joe-hill-the-preacher-and-the-slave-lyrics