By Matthew E. Kahn

The 1970s launched an environmental reckoning across the U.S. Spurred by rising public concern, corporations and national leaders pledged to protect resources, and created new laws and agencies to lead that effort.

Amid these discussions, a group of researchers at MIT tackled a far-reaching question: How long can humanity keep growing and consuming at its current rate?

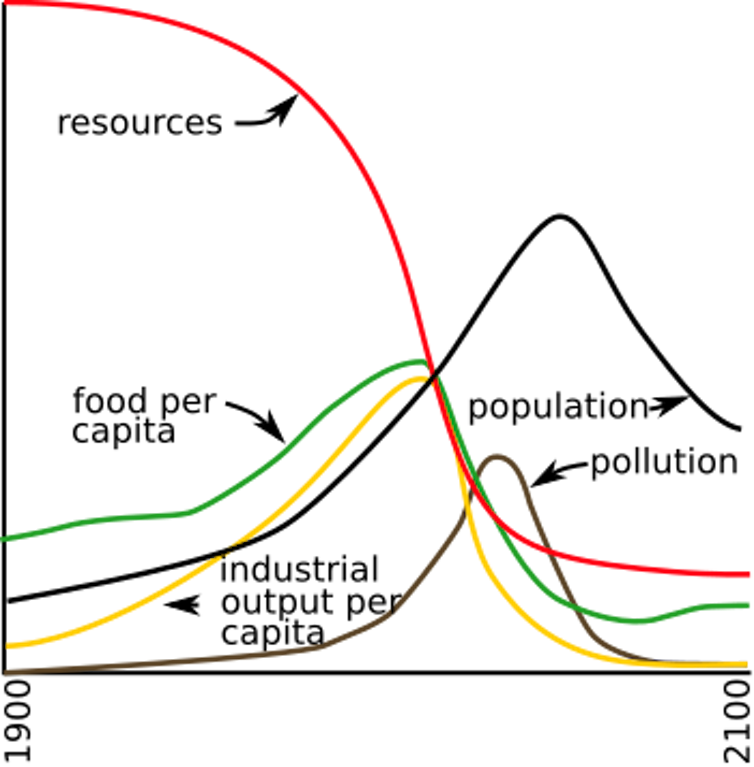

Using computer modeling, they came up with an ominous answer:

“If the present growth trends in world population, industrialization, pollution, food production, and resource depletion continue unchanged, the limits to growth on this planet will be reached sometime within the next one hundred years. The most probable result will be a rather sudden and uncontrollable decline in both population and industrial capacity.”

Their report, “The Limits to Growth,” generated widespread controversy when it was published in 1972. It was an intellectual extension of biologist Paul Ehrlich’s thesis in his 1968 bestseller “The Population Bomb,” which predicted that aggregate world demand for resources, driven by population growth, would lead to future starvation. Some predictions in “The Limits to Growth” were impressively accurate, while others proved to be way off.

As an environmental economist, I tend to be skeptical that any one model can explain how the global economy operates at a single point in time, let alone predict global conditions in 2100.

Nonetheless, I believe “The Limits to Growth” got a larger point right: Humans must limit and soon reduce their aggregate production of greenhouse gas emissions. The authors anticipated the potential for the world’s economy to shift to cleaner sources of energy, noting that “If man’s energy needs are someday supplied by nuclear power instead of fossil fuels, this increase in atmospheric carbon dioxide will eventually cease, one hopes before it has had any measurable ecological or climatological effect.”

YaguraStation/Wikipedia, CC BY-SA

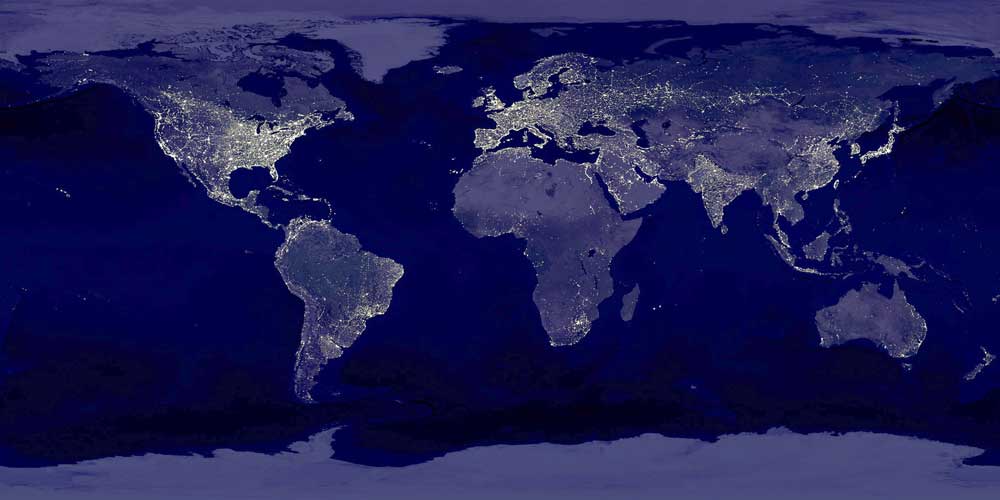

Extrapolating resource use

The MIT research team that produced “The Limits to Growth” focused on five basic factors that they claimed determined, and therefore ultimately limited, growth on Earth: population, agricultural production, natural resources, industrial production and pollution.

They hypothesized that a growing economy eventually devours its finite supplies of natural resources. If aggregate demand for resources such as wood, oil, rubber, copper and zinc increases as the world’s population grows and per capita income rises, they forecast that the world will eventually run out of these precious resources.

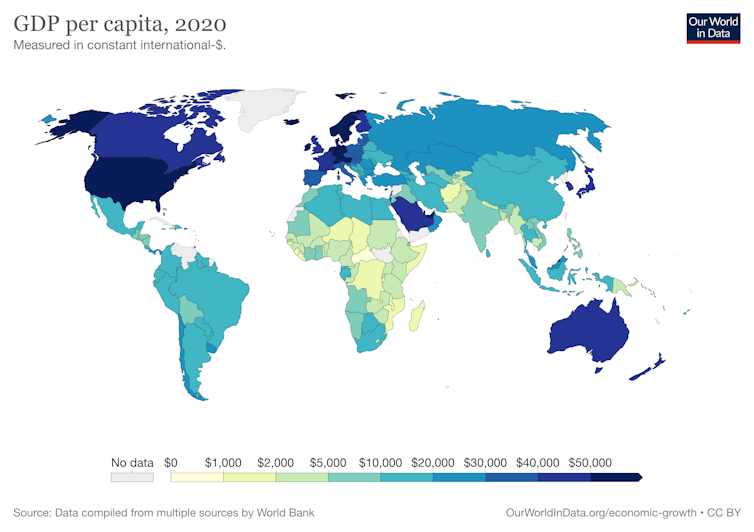

At its heart, this is an extrapolation exercise. If developing nations such as India catch up by the year 2035 to the U.S level of average income in the year 2000, the argument goes, then the average person in India in 2035 will consume the same quantity of natural resources as the average American did in 2000. This approach assumes that we can foresee a developing nation’s future consumption patterns by looking at consumption patterns in a rich country today.

Our World in Data, CC BY-ND

Economists respond

Economists have tended to be more optimistic that ongoing economic growth can slow population growth, accelerate technological progress and bring about new goods that offer consumers the services they desire without the negative environmental consequences associated with past consumption.

The Limits to Growth mindset implicitly assumes that our menu of consumption choices does not really change over time. Consider the vehicle market: In the year 2000, one could not buy a Tesla or Chevy Volt to get around without consuming fossil fuel.

A typical economist would argue that Elon Musk invested in Tesla because he anticipated rising demand for high-quality electric vehicles. In this sense, the belief that we could run out of oil helps us to adapt to expected scarcity by accelerating innovation.

Why? If the Limits to Growth hypothesis is correct, then future gas prices will soar as aggregate demand devours our finite supply of resources. And as gas prices rise, so will future demand for electric vehicles.

This point applies to more than cars. In a 1992 reassessment of “The Limits to Growth,” Nobel laureate William Nordhaus argued that rising aggregate demand for natural resources traded in markets, such as oil, wood and copper, will lead to rising prices. This scarcity signal will encourage buyers to substitute other products for increasingly expensive resources.

Economists tend to be optimistic that we can always find substitutes for resources that are becoming increasingly scarce. “The Limits to Growth” implicitly assumed that such possibilities were limited.

For-profit firms constantly design new products to attract consumers. Some goods, such as smartphones, may deplete natural resources. But others have smaller environmental footprints than the products they replace, and those eco-benefits can help attract customers.

For example, affluent people today are choosing to eat less red meat to improve their health. Innovative firms are designing “fake meat” to cater to those consumers. If more consumers substitute fake meat for meat, then the perverse environmental impacts of global caloric intake decline.

“The Limits to Growth” emphasized population and income growth as key determinants of resource collapse. But worldwide, as people move to cities and their earnings rise, they tend to marry later and have fewer children. Nobel laureate Gary Becker argues that choosing to have fewer children represents prioritizing quality over quantity of children. Such household choices help to reduce aggregate population growth and defuse the “population bomb.”

The limits that matter today

Today, scientists and policymakers widely agree that climate change is an overriding challenge worldwide. But the risk isn’t running out of resources. Rather, it is warming Earth drastically enough to produce heat waves, wildfires, floods and other impacts on catastrophic scales.

The standard economic policy prescription for cutting greenhouse gas emissions that drive climate change is adopting a carbon tax. This gives consumers an incentive to use less fossil fuel and businesses an incentive to produce better low-carbon technologies, such as electric vehicles and green power.

If every nation enacted a carbon tax that rises over time, then economists would be confident that we could avoid the most severe negative effects of global economic growth. Why? A great race would unfold, with carbon emissions per dollar of global gross domestic product declining faster than economic growth would rise and global emissions declining.

The vast majority of economists believe that economic growth is essential for improving the lives of billions in the developing world. As people invest in their education and urbanize, economic logic predicts that population growth will slow. And energy efficiency will increase if energy prices are rising over time, due to induced innovation.

Gordwin Odhiambo/AFP via Getty Images

Climate scientists are analyzing how much nations must reduce their aggregate emissions to avoid climate change on a catastrophic scale. Ideally, climate mitigation policies can be fine-tuned to balance ongoing global per capita income growth while staying within the aggregate emissions constraints prescribed by climate science research.

Since the full costs of runaway climate change aren’t known, many economists have embraced the idea of reducing carbon emissions as insurance against extreme climate risks. Call it a “limit to carbon growth.” Ongoing efforts to invest in climate change adaptation, and nascent efforts to explore the potential of geoengineering, provide humanity with additional strategies for coping with the consequences of our past carbon growth.

![]()

Matthew E. Kahn is Provost Professor of Economics and Spatial Sciences at USC Dornsife College of Letters, Arts and Sciences.

Pogo says

@Don’t worry, be happy

https://www.youtube.com/watch?v=xLy2SaSQAtA

Let’s get to work:

https://ronbegone.com/