Flagler County’s unemployment rate edged back below 4 percent for the first time in six months, at 3.8 percent, as a couple hundred people gained jobs and the number of unemployed residents fell by 300. But Flagler County’s labor force again shrank, as it has most months for more than a year, to 50,849.

The labor force is at its lowest level since February 2023, when it was 50,773 and rising. It peaked at 52,293 in September 2023, according to the Florida Department of Commerce, and has declined since. The labor force is an important economic indicator to schools and the public school district, who depend on working-age families with children to sustain or increase their enrollment.

Enrollment in Flagler County schools has been stagnant for a decade and a half despite a substantial increase in the population, including working-age residents, as students have been enrolled in private and home school in increasingly large numbers, and more so in the last two years as families take advantage of an $8,000-per-student per-year state subsidy to pay for private, religious or home school. A continued reduction in the county’s labor force does not help the district’s enrollment trends.

Labor force figures have not affected the local housing market, which for the past decade has been powered by older adults and retirees: people 65 and over make up nearly 32 percent of the county’s population. The local housing market had cooled over the last few months, but it rebounded a little in December (compared with the previous three months), with 234 closings on single-family homes, matching the year’s average for monthly home sales. Last month, the number of home sales had fallen to the lowest level in almost seven years.

The Flagler County Association of Realtors reported today that new home sales were driven by a spike in cash sales, usually a reflection of retirees selling homes elsewhere and moving to Flagler County. The median sale price, flat since mid-2022, edged slightly up to $387,495, which means that half the homes that sold did so at more than that price, and half sold for less. The median figure is more reflective of the mid-point in any calculation since it is not disproportionately skewed by the highest or lowest figures in the total.

The median time for a house to sell, at 114 days, remains high, and higher than it’s been in almost a year even as new listings have declined to just over 200 in the county, and the overall inventory of single-family houses, which had been rising steadily for almost two years, posted a slight decline, to 1,262 houses. Closed sales in the condo market continue at a steady 537 for the year, compared to 562 last year, and a median price of $305,000, slightly down from last year’s $316,000. It’s a similar story with town houses, with 537 closed sales this year, and a median price of $278,000.

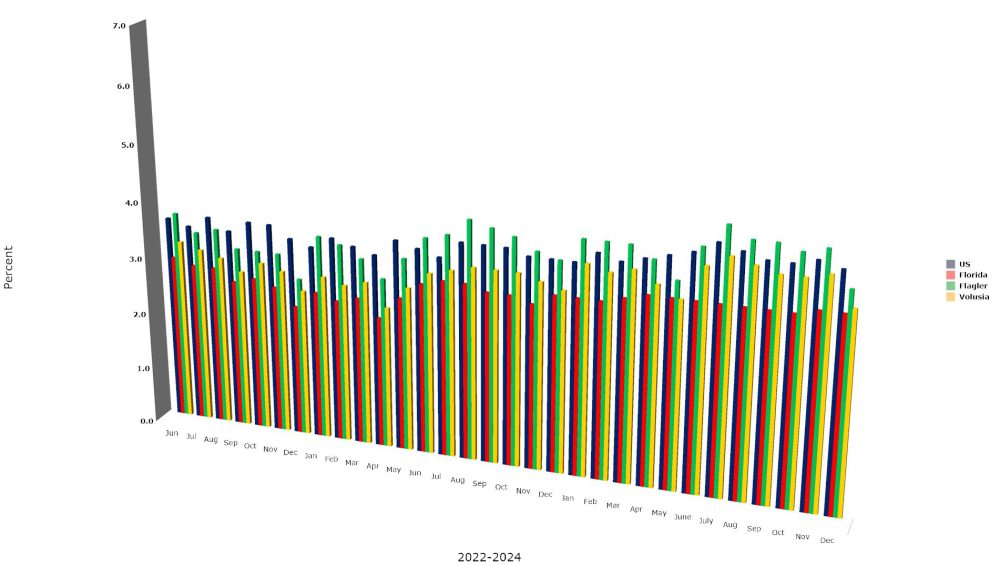

Florida’s unemployment rate in December was 3.4 percent, the same as in November, with 377,000 Floridians officially out of work, though the number is deceiving: the state records only those Floridians who qualify for the 12 weeks of unemployment checks, and who fulfill all requirements to qualify, including showing proof that they have looked for and applied for several jobs in the previous weeks. Once the unemployed run out of benefits, they are no longer counted among the unemployed. At 12 weeks, Florida has the stingiest benefit period for the unemployed, whose checks, maxing out at $275 a week, are also among the lowest in the nation.

The federal Bureau of Labor Statistics tabulates the Alternative Measure of Labor Utilization, the so-called U-6 rate, which includes, in addition to the official unemployment rate, the rate for discouraged workers, workers barely attached to the labor force, and workers employed part-time because they could not find full-time work. By that calculation, Florida’s unemployment and under-employment rate is 6.3 percent. The national average is 7.4 percent.

Florida recorded 10 million people with jobs last month, and a net gain of 18,000 jobs, for a net gain of 149,000 this year. Industries gaining the most jobs over the year included education and health services (30,900 jobs), leisure and hospitality (29,500), construction (28,900), and government (25,100).

Consumer confidence among Floridians soared in December to 86.4, its highest level in more than four years, according to the University of Florida’s Bureau of Economic and Business Research. That was a jump of 5 points from a revised figure of 81.4 in November. National consumer confidence rose 2.2 points

“As the year ends, Florida’s consumer sentiment has seen a notable positive shift, rising nine points in the last couple of months,” says Hector Sandoval, director of the Economic Analysis Program at UF’s Bureau. “Notably, all three forward-looking components of the index are at their highest levels in nearly five years. The previous highs for each component were recorded in February 2020, just before the pandemic began. At that time, Florida’s unemployment rate was nearing historically low levels, and consumer sentiment was at its highest point in nearly two decades.” Donald Trump inherited an economy that had posted 48 straight months of job growth.

![]()

Susan. says

When is Trump going to lower the price of food like he promised? When is he not going to tax tips received or social security?

We are all waiting what he promised to happen. Lets see how he keeps his promises. When is he going to come out with a reasonable medical insurance he promised in he previous election and now this one?

Tom Hutson says

Hold your breath

King Trump is all talk

Likes to make promises he can not keep King will say anything that sounds good (1456) for more of King’s B.S

Atwp says

Keep waiting Susan, keep waiting. You will be waiting for a very time.

Not my President (two can play that childish game). says

How about the $800,000 plus to fly 86 immigrants. That taxpayer money. For what? 86 people that were taken from their jobs. Everything is getting more expensive because of anticipated tariffs. Now he wants to remove all Palestinians and put them in Egypt and/or Jordan. He’s putting unqualified people up for positions. Now he’s talking about getting rid of the military commissaries and having former service members “pass” a series of checks for VA care. All the non-voters own this. The Trump people were always voting for him. The 3rd party and non-voters did this. I blame them with my full chest.

Endless dark money says

Price of eggs is up, but the oligarchs are having a feeding frenzy ! They made billions more in just a week. At least this time the billionaires and Nazis are the same people.

Next non Nazi leader should commit to full pardon anyone who commits offenses on republicons! Maybe we can send them to the camps they are building with room for their whole family.

Practice your sieg heil ! The birth of the fascist oligarchy is here!

Like they carved in the walls in Auschwitz “if there is a god, he’s gonna have to ask me for forgiveness “. Time to make Germany great again!

Anti maga says

Unemployed didn’t fall they just don’t count them after 11 weeks and only count them to begin with if they claim the nations worst ue benefits. I assume they think they died from starvation or joined the homeless population to be locked up and sent to work for the profit prison . Work will set them free as they said in poland in the 1930s!

Ed P says

I’ve always wondered, how would any government agency know if someone was or was not unemployed once they stopped receiving unemployment compensation and the communications go dark.

Exactly, how would that work?

Maybe they should use the same tracking system the Mayorkas administration used tracking unaccompanied migrant children.

Atwp says

Things look a little grim for Flagler County. Hope things will get worse. Republicans in control, things will probably get worse. Just love it.

Ed P says

Atwp,

If nothing else, you are consistent, persistent, and predictable.

I will not speak for anyone else, but I do wish you would throw a curve ball once in awhile.

JimboXYZ says

Trump-Vance has to navigate this surgically. There’s that fine line between restoring relative affordability without going full on recession, creating 15+% unemployment like Fauci’s shutdown did in 2020. What good does it do if the working class poor become unemployed in Biden-Harris Bidenomics. Arresting the inflation of 4 years would have to become stagflation first, before that becomes deflation & recession. Recall those days of Carter => Reagan, Bush-Obama/Biden. The bottom dropping out becomes & is a bailout economy. We all know who came out just fine for both recessions 1980’s & 2010’s, the wealthiest & DC Swamp types. The one’s that have been instrumental for inflation aren’t giving that up easily, they were the big winners of Biden-Harris Bidenomics. Notice who got the Medals of Freedom ? The least deserving and it was the usual names. What has HRC done in the last 4 years to earn a Medal of Freedom that was visibly serving as a Government official ?

FlaPharmTech says

Trump Vance combined have the intellect of a turd. Granted, it’s a superb turd, well formed and solid, but alas still a turd.

Jim says

Trump found time in his first week to free 1500 J6 criminals but zero time to do anything to address high prices. (And, by the way, JimboXYZ, still waiting on you to defend Trump’s pardons – come on – I know you’ve got it in you!). I would like to hear some MAGAtes explain this for all of us. Next time I see Trump standing up talking about law and order with a bunch of cops standing behind him, it’s going to be hard not to get physically sick. (And, by the way, to all you cops out there, why would you stand behind this felon after he has so blatantly stabbed you and your brothers in the back?)

Trump found time to fire 11-17 Inspector Generals on Friday night (thought no one would notice, I guess) but nothing on the economy. (Come on, Jimbo XYZ, speak up and defend the orange god). Why do you fire Inspector Generals? What do they do that keeps America from being great again?(Come on, Jimbo XYZ, give us your insight…). The only reason that makes sense is that you know your actions are not in compliance with the law and you want as few people as possible to see it as it happens.

There’s absolutely no plan in Trumpland to reduce prices or make life more affordable. If there was, Trump would be spouting it for all to hear. He’s not known for keeping his thoughts private when they cater to his base. However, since he’s clueless on how to reduce egg prices, he says nothing. But, maybe taking Greenland by force will keep MAGA from noticing.

And, where do you get your information that “the working class poor become unemployed in Biden-Harris Bidenomics”? That’s new information that I’ve not seen anywhere to please share your source.

I don’t think you can see the forest for the trees. Stand back and stand by as Trump leads this country into a disaster while the Musks, Bezos and Zuckerberg’s of the American oligarchy become richer while the working class poor just get deeper in the hole.

And, by the way, try to make a comprehendible sentence every once and a while. Drug addicts can communicate more clearly.

Ray W, says

According to the National Association of Realtors, the national median home sales price was just over $407k. With the average 30-year fixed mortgage interest rate hovering at or just over 6.5%, one economist recently argued that the total monthly cost of owning a median-priced home (principle, interest, taxes and insurance) is nearly twice the median rental rate. If this is so, there are significant comparative financial headwinds facing those who today seek to move out of a rental and purchase a home when rental rates are so much less.

Yes, a substantially large percentage of homeowners own their homes outright. In their cases, renting is not a financially beneficial alternative. Many in the home marketplace are still paying cash to purchase homes, having sold their homes in other states to remotely work or to retire to less expensive locals. For those who choose to move to Flagler County, there are still financial headwinds, what with Florida’s insurance premium situation likely significantly more expensive than that of most other states.

For the many memory-impaired FlaglerLive readers among us, the average 30-year fixed interest mortgage rate over the forty years between 1983 (the year stagflation died) and 2023 or so (when I last checked) was just over 7.7%. Some homeowners of the end of the era of stagflation had 18% 30-year fixed mortgage rates. My first home had a 13% mortgage rate. My loan officer commented to me that he didn’t think we would ever see single-digit mortgage interest rates again. It had been that long for him and it appeared that he just didn’t believe it would ever get good again.

To me, today’s 6.5% average mortgage rate is really not anything to get angry about. As the increasingly strong American economy matures, mortgages interest rates just might ease into a 4 or 5% range. Mortgage rates just before Bush’s Great Recession hovered in the 7% range for years.

The emotional problem angrily expressed by so many memory-impaired FlaglerLive commenters on the subject of today’s mortgage rates is that they never knew or had forgotten that in response to the pandemic, the Fed intentionally and artificially lowered the lending rate to financial institutions to 0% and made available to those institutions an additional $3 trillion extra in credit, which triggered the sudden widespread availability of artificially low fixed rate mortgages, some as low as 2.7%.

Lacking subject-matter clarity, the memory-impaired among us think that the sub-3% mortgage rates were normal and that 6.5% mortgage rates are an aberration. The Fed was trying to keep the economy from sliding further into recession; it took drastic steps to keep the economy going. The recent spate of low mortgage interest rates was the aberration, because the pandemic was an aberration. Over the past forty years, the only time of such low mortgage rates was a brief period between 2021 and 2022. How can that brief period ever be called normal?

Millions of American homeowners rushed to take advantage of the artificially low fixed rate mortgages and either sold their homes and bought new ones or refinanced their existing homes. Millions more jumped into new homeownership. With such aberrantly low rates, who could blame them? Median home prices skyrocketed.

So here we are with a Flagler County median home sales price of nearly $390k. Insurance premiums have skyrocketed. Taxes based on the higher valuation eat more and more out of a hopeful new homeowner’s pocketbook.

The flip side to the recent aberration is that, now, many of these millions and millions of recent home buyers and refinancers are not about to upgrade into a much more expensive new home at today’s more normal mortgage rates. Neither are those who already own their homes outright. This means that the pool of potential home buyers has shrunk by a considerable amount.

So, what is the answer?

I don’t know. If we were to return to the brief era of aberrantly low mortgage rates, the median home price would likely again skyrocket. Insurance premiums would likely skyrocket. Taxes would likely skyrocket.

Maybe other FlaglerLive commenters have viable answers?

JimboXYZ, please don’t bother. In the four years I have been reading your comments, you have been so frequently wrong in your expressions of your beliefs that just about anything you type, when studied, turns out to be irrational. Your repeated expressions of these irrationalities bring into question the concept of just what exactly is the definition of knowledge? You claim that you know what you are talking about, but do you really possess knowledge?

Cambridge Dictionary defines knowledge as: understanding of or information about a subject that you get by experience or study, either by one person or by people generally.

The philosophical definition of knowledge is: justified true belief.

I don’t doubt that you, JimboXYZ, believe what you type, but belief alone is not enough to meet the definition of knowledge. A belief must be justified, and it must also be true. Most of what you submit is neither justified nor true.

Ray W, says

The November 2024 JOLTS report issued on January 7, 2025.

The December report drops on February 4.

The purpose of each monthly report is to statistically measure the monthly average number of unfilled posted job openings, the monthly average number of hires, and the combined monthly average number of separations.

Each initial monthly report is considered incomplete, as a more complete report issues each following month, followed later by a final report.

For example, October’s unfilled posted job opening’s figure was revised upwards in the November report by 95,000 jobs openings. Each JOLTS report contains the following language: “Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.”

This means that initial reports are “estimates” based on limited data. The agency is balancing the need for immediate data against the difficulty of rapidly collecting larger datasets from businesses and government agencies. If the Bureau of Labor Statistics were to wait too long to issue its estimates, the information can grow stale, so preliminary data goes out every month, but everyone knows that more complete data will be forthcoming in later monthly reports.

November’s preliminary estimate was 8.1 million unfilled posted job openings. 12 months earlier, the number of unfilled posted job openings was higher by 833,000 openings. October’s initial estimate was revised upwards from 7.7 million by 95,000 to 7.8 million unfilled posted job openings.

As I have repeatedly commented, prior to the pandemic, the unfilled posted job openings figure had never crossed above the 8 million threshold. Since the beginning of the pandemic recovery, almost every month saw an estimated figure above 8 million, with the peak figure occurring in 2022 at 12.2 million jobs that employers hoped to fill.

Economists consider the ideal ratio of unfilled posted job openings to the number of unemployed as 1 to 1. If there are six million unemployed, then the number of unfilled posted job openings should ideally be no more than six million. A high ratio of posted unfilled jobs to unemployed persons is expected to put upward pressure on wages and, potentially, on inflation.

The November estimate of new hires was 5.3 million. The October number of hires was revised upwards by 81,000 to 5.4 million. A year earlier, the estimate of hires was higher by 300,000 persons at 5.6 million.

The November estimate of separations, which combines both quits and layoffs and separations, was 5.1 million. The October number of separations was revised upwards by 45,000 to 5.3 million. A year earlier, the number of separations was higher by 287,000 plus or minus 5.4 million.

It should be remembered that two hurricanes made landfall on the Gulf coast in the early fall, which could have impacted the October statistics. I commented this past November that the ADP estimate of jobs added for October was quite different from the BLS jobs added figure (233,000 jobs added vs. 12,000 jobs added). But ADP measures the number of people on business payrolls, whether they get paid or not, and BLS measures the number of paychecks issued. Thus, if a Boeing worker was on strike during the BLS measuring week and didn’t get a paycheck, BLS would not count her as employed, whereas ADP would. Once the strike ends, the employee goes back to work and earns a paycheck. ADP would not consider that an added job. BLS would.

Make of this what you will.

Me?

The job market remains strong, despite efforts by the Fed to slow down job growth by manipulating the lending rate. Given the volatility of labor data in the short term, over the longer term of 12 months it appears that the number of employees sought, the number of employees hired, and the number of employees quitting or being laid off or transferred in a given months seems little changed.

American employers still want more laborers and other employees than are available to them.

From the perspective of a national economy, we need more workers to meet demand and have needed more workers for the past four years. Government efforts to allow younger and younger and older and older people to meet employer demand means that we are pulling from the least experienced student category and from the elderly retiree category to meet that demand and it is not enough. There is no secret that the prime working age is classified as those between the ages of 25 to 54.

Can it be argued that if a company cannot find the prime working age workers it needs to prosper may meet the definition of an economically less productive enterprise?