You’re welcome to send your Live Wire news tips or suggestions to [email protected].

Today’s Live Wire: Quick Links

- Rick Scott, Radical Rising

- Washington Dithers, Poverty Rises

- Obama’s Leadership, Indicted

- Death Penalty Barbarity

- Graphic Inequality

- Home Forecast: Pain Through 2015

- Secret License to Kill

- Michele Bachmann’s HPV Retardation

- Earth Fly-Over

- Mom and Pop Myths

- Sarah Palin’s Welfare State

- Flight of the Griffin

- A Few Good Links

![]()

![]()

Rick Scott’s Radical Legislative Agenda

From the Sentinel: “Gov. Rick Scott has yet to formally roll out his 2012 legislative agenda, but documents from his office show that the first-term governor is looking at bills to abolish personal injury protection insurance, reform immigration laws, spend a dedicated amount of money in the classroom — and maybe give raises to state employees. […] Scott has been working all summer on issues that he wants to see turned into law. Some are campaign promises; others he sought last session. Nearly all are controversial. […] In a document obtained by the Sun Sentinel, Scott’s legislative staff laid out preliminary priorities in August, with PIP topping the list. It was followed by a statewide energy plan focusing on renewable energy, a bill allowing the sale of health insurance across state lines, Texas-style reforms to higher education that would eliminate tenure for university professors and an immigration bill. […] Education also makes Scott’s top tier of proposals. But his advocacy of Texas-style higher education reforms that eliminate tenure for professors has already drawn criticism from university presidents and the state Board of Governors. Haridopolos said, “We’ll give it the full venue it deserves.” […] One of his secondary priorities is an “education savings account,” as proposed by former Gov. Jeb Bush’s Foundation for Florida’s Future, that would allow parents to use state dollars to send their children to private school or pay for expenses such as textbooks or tutoring. Scott’s spreadsheet says that the foundation will “take lead” on it.” The full story.

From the Sentinel: “Gov. Rick Scott has yet to formally roll out his 2012 legislative agenda, but documents from his office show that the first-term governor is looking at bills to abolish personal injury protection insurance, reform immigration laws, spend a dedicated amount of money in the classroom — and maybe give raises to state employees. […] Scott has been working all summer on issues that he wants to see turned into law. Some are campaign promises; others he sought last session. Nearly all are controversial. […] In a document obtained by the Sun Sentinel, Scott’s legislative staff laid out preliminary priorities in August, with PIP topping the list. It was followed by a statewide energy plan focusing on renewable energy, a bill allowing the sale of health insurance across state lines, Texas-style reforms to higher education that would eliminate tenure for university professors and an immigration bill. […] Education also makes Scott’s top tier of proposals. But his advocacy of Texas-style higher education reforms that eliminate tenure for professors has already drawn criticism from university presidents and the state Board of Governors. Haridopolos said, “We’ll give it the full venue it deserves.” […] One of his secondary priorities is an “education savings account,” as proposed by former Gov. Jeb Bush’s Foundation for Florida’s Future, that would allow parents to use state dollars to send their children to private school or pay for expenses such as textbooks or tutoring. Scott’s spreadsheet says that the foundation will “take lead” on it.” The full story.

Click On:

Washington Dithers, Poverty Rises

From a St. Petersburg Times editorial: “While partisan, insular Washington dithers over the federal debt, the true depth of the nation’s economic struggles and the impact of unemployment has come into sharp relief outside the Beltway. The U.S. Census Bureau reports one in six, or 15.1 percent of all Americans, is living at or below the poverty line. The middle class, long the bedrock of the nation’s economic vitality, is also at risk of losing its claim to the American dream. It’s urgent that bipartisan political compromise and business leadership get this country back to work. […] The census figures indicate the pain hasn’t fallen proportionately. Median income for the bottom tenth of the economic ladder dropped 12 percent since 1999, while those in the upper tier of income saw a decline of just 1.5 percent. The census also found 49.9 million Americans don’t have health insurance. Yet, in Washington, Republican leaders have no fresh ideas for how to insure them, only a relentless drive to undermine the Affordable Health Care Act. […] Meanwhile American corporations, run by leaders who frequently enjoy significant tax loopholes, sit on an estimated $1.5 trillion in liquid assets. They need to step up and start demonstrating some faith and confidence in the value of American workers by investing in the nation’s economic future. More Americans may be poor than at any time in the past half-century. But this country never has had a shortage of citizens willing to roll up their sleeves.” The full editorial.

See Also:

- Florida’s poverty rate rises

- Super-Rich, Super-Disingenuous on Taxes

- Wages Down, Hours Up

From Michiko Kakutani’s review of Ron Suskind’s Confidence Men: Wall Street, Washington, and the Education of a President: “The portrait of the Obama White House that the veteran journalist Ron Suskind draws in his searing new book, “Confidence Men,” is that of a young, inexperienced president lacking the leadership and managerial skills to deal effectively with the cascading economic problems he inherited; a brainy but detached executive with a tendency to frame policy matters intellectually “like a journalist, or narrator, or skilled observer”; an oddly passive C.E.O. whose directive on restructuring the banks in the wake of the 2008 financial crisis was, the author says, ignored or slow-walked by his own economic team. […] [H]ow is the reader to evaluate the accuracy of the accounts here? Why have so many people in the Obama administration vented to Mr. Suskind in the first place, when the president was only partway through his first term? Like many of Bob Woodward’s sources a lot of them are motivated by spin, score settling and second-guessing. Given the stalled economy and the president’s sliding poll numbers, some former staff members are playing the blame game early, while others seem to be hoping to goad the president into a reboot and a more aggressive stance before the 2012 election. […] Mr. Obama emerges in this volume as an oddly passive chief executive whose modus operandi was to sketch out overarching principles, “wait until others had painted in those outlines with hard proposals” and then “step down from his above-the-fray perch to close the deal.” […] Mr. Suskind also questions the president’s “growing inclination to seek consensus” in contentious policy debates among his advisers (much like his inclination to seek consensus with hostile Republicans in Congress). “The administration’s domestic policy was fast becoming a debate society run by Larry Summers,” Ms. Suskind writes. “Obama would sit on high, trying to judge if there was any shared ground between the competing debate teams that might coalesce into a policy.” […] The former chief of staff Rahm Emanuel once observed, “You never want a serious crisis to go to waste.” In Mr. Suskind’s opinion Mr. Obama failed to use the sense of urgency that surrounded the economy when he took office in early 2009 (not to mention his leverage as a popular new president) to extract concessions from bankers and health care providers, thereby squandering two huge opportunities: substantially to drive down the ever-ballooning costs of health care and to grapple with the systemic problems that afflicted Wall Street and fueled the fiscal meltdown, including too much leverage, “too big to fail” institutions, sky-high executive compensation, and dangerous and poorly understood derivatives.” The full review.

From Michiko Kakutani’s review of Ron Suskind’s Confidence Men: Wall Street, Washington, and the Education of a President: “The portrait of the Obama White House that the veteran journalist Ron Suskind draws in his searing new book, “Confidence Men,” is that of a young, inexperienced president lacking the leadership and managerial skills to deal effectively with the cascading economic problems he inherited; a brainy but detached executive with a tendency to frame policy matters intellectually “like a journalist, or narrator, or skilled observer”; an oddly passive C.E.O. whose directive on restructuring the banks in the wake of the 2008 financial crisis was, the author says, ignored or slow-walked by his own economic team. […] [H]ow is the reader to evaluate the accuracy of the accounts here? Why have so many people in the Obama administration vented to Mr. Suskind in the first place, when the president was only partway through his first term? Like many of Bob Woodward’s sources a lot of them are motivated by spin, score settling and second-guessing. Given the stalled economy and the president’s sliding poll numbers, some former staff members are playing the blame game early, while others seem to be hoping to goad the president into a reboot and a more aggressive stance before the 2012 election. […] Mr. Obama emerges in this volume as an oddly passive chief executive whose modus operandi was to sketch out overarching principles, “wait until others had painted in those outlines with hard proposals” and then “step down from his above-the-fray perch to close the deal.” […] Mr. Suskind also questions the president’s “growing inclination to seek consensus” in contentious policy debates among his advisers (much like his inclination to seek consensus with hostile Republicans in Congress). “The administration’s domestic policy was fast becoming a debate society run by Larry Summers,” Ms. Suskind writes. “Obama would sit on high, trying to judge if there was any shared ground between the competing debate teams that might coalesce into a policy.” […] The former chief of staff Rahm Emanuel once observed, “You never want a serious crisis to go to waste.” In Mr. Suskind’s opinion Mr. Obama failed to use the sense of urgency that surrounded the economy when he took office in early 2009 (not to mention his leverage as a popular new president) to extract concessions from bankers and health care providers, thereby squandering two huge opportunities: substantially to drive down the ever-ballooning costs of health care and to grapple with the systemic problems that afflicted Wall Street and fueled the fiscal meltdown, including too much leverage, “too big to fail” institutions, sky-high executive compensation, and dangerous and poorly understood derivatives.” The full review.

Paul Krugram’s reaction: “OK, obviously I do have to read his account of what went wrong. But I was tearing my hair out, very much in public, over the missed opportunities early in the Obama administration in real time, as they happened; I don’t see much point in dwelling on them again, at least for now — maybe I’ll want to do postmortems after Rick Perry is sworn into office.

See Also:

- Truth squad: Obama misstates facts about debt plan

- Obama sparks middle-of-road rage

- Obama Veers Right

- Obama Surrenders

See Also:

- The Killing of Troy Davis

- Death Penalty Activism

- Florida’s Death Penalty Ruled Unconstitutional

- Florida Death Row Fact Sheet

- Capital Punishment As a Crime More Dreadful Than Murder: Dostoyevsky on the Guillotine

- Ring v. Arizona 536 US 584 (2002): Capital Punishment and Sixth Amendment Law

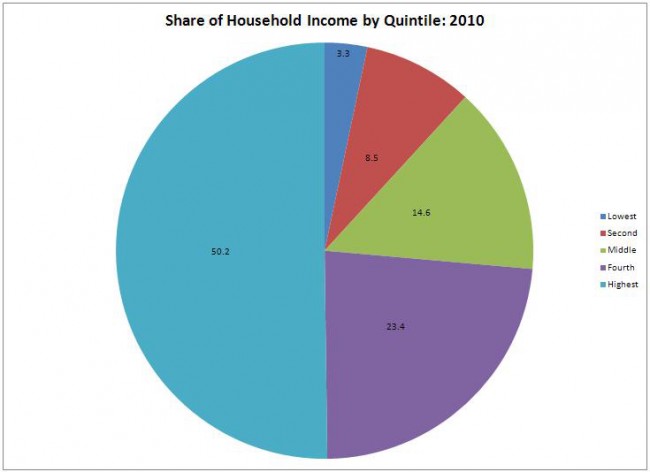

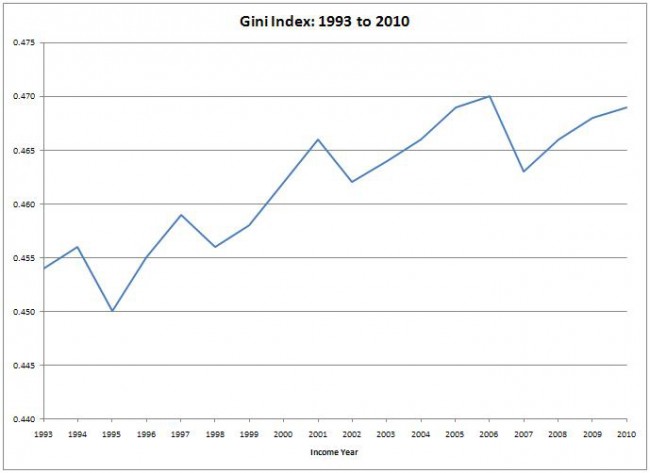

From the Census Bureau: “Economists study closely the issue of income inequality in our nation; that is, the income gap between the wealthiest and least wealthy Americans. The Census Bureau publishes several measures of income inequality every year. The two principal measures used are the share of aggregate household income received by quintiles (Quintiles mean the wealthiest 20 percent, the next wealthiest 20 percent, and so forth), and the Gini Index. We found that, based on the quintile measure, income inequality increased between 2009 and 2010. In 2010, the bottom 20 percent of households received 3.3 percent of total income, down from 3.4 percent in 2009. These households had incomes of $20,000 or less in 2010. There was also a decrease in the second lowest quintile from 8.6 percent to 8.5 percent. Toward the other end of the continuum, those in the next-to-top 20 percent (fourth quintile) received 23.4 percent of income in 2010, up from 23.2 percent in 2009. These households had incomes between $61,736 and $100,065. Those in the very top 20 percent, meanwhile, controlled about half the nation’s income, not statistically different from 2009. These households had incomes of $100,066 or more. About 23.7 million households fall into each quintile. The other measure is the Gini index, which stood at 0.469 in 2010. The Gini indicates higher inequality as the index approaches one. In other words, if the index was one, it would mean a single household in the U.S. had all the country’s income. Conversely, an index of zero would signal perfect equality, in which all the nation’s households had the exact same amount of income. Between 2009 and 2010, the change in the Gini index was not statistically significant. Since 1993, however, the earliest year for which comparable measures of income inequality are available, the Gini index is up 3.3 percent, which means inequality has increased somewhat over the long term.”

See Also:

- 2010: Incomes at Their Worst Since 1996, Poverty At a 52-Year High, Inequality Deepening

- 2011: 2009: Record 43.6 Million in Poverty; Record 50.7 Million Uninsured; Only Elderly Thrive

- Still Spreading the Wealth

- A Riddle that Brings Joy to Mega Rich Hearts

Home Forecast Calls for Pain Through 2015

See Also:

From the New York Review of Books: “On [Sept. 15], a front-page New York Times story reported that a rift has emerged within the Obama Administration over whether it has authority to kill “rank-and-file” Islamist militants in foreign countries in which there is not an internationally recognized “armed conflict.” The implications of this debate are not trivial: Imagine that Russia started killing individuals living in the United States with remote-controlled drone missiles, and argued that it was justified in doing so because it had determined, in secret, that they posed a threat to Russia’s security, and that the United States was unwilling to turn them over. Would we calmly pronounce such actions compliant with the rule of law? Not too likely. And yet that is precisely the argument that the Obama Administration is now using in regard to American’s own actions in places like Yemen and Somalia—and by extension anywhere else it deems militant anti-US groups may be taking refuge. On the same day the Times article appeared, John Brennan, President Obama’s senior advisor on homeland security and counterterrorism, gave a speech at Harvard Law School in which he defended the United States’ use of drones to kill terrorists who are far from any “hot battlefield.” Brennan argued that the United States is justified in killing members of violent Islamist groups far from Afghanistan if they pose a threat to the United States, even if the threat is not “imminent” as that term has traditionally been understood. (As if to underscore the point, The Washington Post reports that the US has “significantly increased” its drone attacks in Yemen in recent months, out of fears that the government may collapse.) In international law, where reciprocity governs, what is lawful for the goose is lawful for the gander. And when the goose is the United States, it sets a precedent that other countries may well feel warranted in following. Indeed, exploiting the international mandate to fight terrorism that has emerged since the September 11 attacks, Russia has already expanded its definition of terrorists to include those who promote “terrorist ideas”—for example, by distributing information that might encourage terrorist activity— and to authorize the Russian government to target “international terrorists” in other countries. It may seem fanciful that Russia would have the nerve to use such an authority within the United States—though in the case of Alexsander Litvinenko it appears to have had few qualms about taking extreme measures to kill an individual who had taken refuge in the United Kingdom. But it is not at all fanciful that once the US proclaims such tactics legitimate, other nations might seek to use them against their less powerful neighbors.” The full post.

From the New York Review of Books: “On [Sept. 15], a front-page New York Times story reported that a rift has emerged within the Obama Administration over whether it has authority to kill “rank-and-file” Islamist militants in foreign countries in which there is not an internationally recognized “armed conflict.” The implications of this debate are not trivial: Imagine that Russia started killing individuals living in the United States with remote-controlled drone missiles, and argued that it was justified in doing so because it had determined, in secret, that they posed a threat to Russia’s security, and that the United States was unwilling to turn them over. Would we calmly pronounce such actions compliant with the rule of law? Not too likely. And yet that is precisely the argument that the Obama Administration is now using in regard to American’s own actions in places like Yemen and Somalia—and by extension anywhere else it deems militant anti-US groups may be taking refuge. On the same day the Times article appeared, John Brennan, President Obama’s senior advisor on homeland security and counterterrorism, gave a speech at Harvard Law School in which he defended the United States’ use of drones to kill terrorists who are far from any “hot battlefield.” Brennan argued that the United States is justified in killing members of violent Islamist groups far from Afghanistan if they pose a threat to the United States, even if the threat is not “imminent” as that term has traditionally been understood. (As if to underscore the point, The Washington Post reports that the US has “significantly increased” its drone attacks in Yemen in recent months, out of fears that the government may collapse.) In international law, where reciprocity governs, what is lawful for the goose is lawful for the gander. And when the goose is the United States, it sets a precedent that other countries may well feel warranted in following. Indeed, exploiting the international mandate to fight terrorism that has emerged since the September 11 attacks, Russia has already expanded its definition of terrorists to include those who promote “terrorist ideas”—for example, by distributing information that might encourage terrorist activity— and to authorize the Russian government to target “international terrorists” in other countries. It may seem fanciful that Russia would have the nerve to use such an authority within the United States—though in the case of Alexsander Litvinenko it appears to have had few qualms about taking extreme measures to kill an individual who had taken refuge in the United Kingdom. But it is not at all fanciful that once the US proclaims such tactics legitimate, other nations might seek to use them against their less powerful neighbors.” The full post.

See Also:

Michele Bachmann’s HPV Retardation

From PolitiFacts: “After criticizing Texas Gov. Rick Perry for mandating a vaccine for school girls, Rep. Michele Bachmann added some scary charges: She claimed to have just met a woman whose daughter suffered mental retardation from the vaccine, that it has “very dangerous consequences” and that it puts “little children’s lives at risk.” In the CNN/Tea Party Express debate in Tampa on Sept. 12, 2011, Bachmann blasted Perry for mandating a vaccine for school girls to guard against human papilloma virus, or HPV, which can cause cervical cancer. The vaccine can prevent the virus, but the virus is sexually transmitted, which makes the idea of requiring the inoculation of young girls controversial among some parents. […] Bachmann received applause for her attacks. But in subsequent interviews, Bachmann became more specific that the vaccine harmed children’s health. Here’s what she said in an interview on Fox News: “There’s a woman who came up crying to me tonight after the debate. She said her daughter was given that vaccine. She told me her daughter suffered mental retardation as a result of that vaccine. There are very dangerous consequences. It’s not good enough to take, quote, ‘a mulligan’ where you want a do-over, not when you have little children’s lives at risk.” […] In several national television appearances, Bachmann said a woman reported her child had experienced mental retardation after receiving an HPV vaccination. We can’t judge the specifics of that case — neither the woman nor the daughter have been identified as far as we could find and skeptics have offered a reward if the victim can be found. But even if Bachmann’s portrayal of what happened is accurate, it falls well short of the scientific standard for demonstrating causality between an inoculation and an adverse health event. Ongoing studies of tens of thousands of reported adverse events following tens of millions of inoculations have revealed only a small number of serious ailments, only one of which — anaphylaxis — had strong enough evidence to suggest a causal link from the vaccine itself. Since Bachmann made her claim, medical organizations and individual experts have come out strongly against her implication that the HPV vaccine can cause mental retardation. We rate her statement False.” The full fact-check.

From PolitiFacts: “After criticizing Texas Gov. Rick Perry for mandating a vaccine for school girls, Rep. Michele Bachmann added some scary charges: She claimed to have just met a woman whose daughter suffered mental retardation from the vaccine, that it has “very dangerous consequences” and that it puts “little children’s lives at risk.” In the CNN/Tea Party Express debate in Tampa on Sept. 12, 2011, Bachmann blasted Perry for mandating a vaccine for school girls to guard against human papilloma virus, or HPV, which can cause cervical cancer. The vaccine can prevent the virus, but the virus is sexually transmitted, which makes the idea of requiring the inoculation of young girls controversial among some parents. […] Bachmann received applause for her attacks. But in subsequent interviews, Bachmann became more specific that the vaccine harmed children’s health. Here’s what she said in an interview on Fox News: “There’s a woman who came up crying to me tonight after the debate. She said her daughter was given that vaccine. She told me her daughter suffered mental retardation as a result of that vaccine. There are very dangerous consequences. It’s not good enough to take, quote, ‘a mulligan’ where you want a do-over, not when you have little children’s lives at risk.” […] In several national television appearances, Bachmann said a woman reported her child had experienced mental retardation after receiving an HPV vaccination. We can’t judge the specifics of that case — neither the woman nor the daughter have been identified as far as we could find and skeptics have offered a reward if the victim can be found. But even if Bachmann’s portrayal of what happened is accurate, it falls well short of the scientific standard for demonstrating causality between an inoculation and an adverse health event. Ongoing studies of tens of thousands of reported adverse events following tens of millions of inoculations have revealed only a small number of serious ailments, only one of which — anaphylaxis — had strong enough evidence to suggest a causal link from the vaccine itself. Since Bachmann made her claim, medical organizations and individual experts have come out strongly against her implication that the HPV vaccine can cause mental retardation. We rate her statement False.” The full fact-check.

See Also:

Click On:

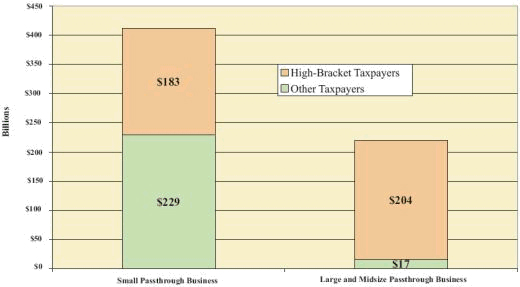

The Myth of Mom-and-Pop Businesses

Martin Sullivan at tax.com: “It is common practice for politicians and the press to use the term “small business” to describe passthrough businesses — sole proprietorships, partnerships, and subchapter S corporations. From the perspective of economics, this highly inaccurate label is of little significance because — despite all you may have been hearing — there is nothing particularly wonderful about small business that it deserves special treatment from the federal government. So if you want to provide tax relief to passthroughs, the effects on the overall economy will be pretty much the same if those passthroughs are all corner stores or a handful of mega-businesses. But politics has far more to do with emotion and perception than economic reality. Small companies are the darlings of the business world. They have semi-sacred status in the American political economy, like family farmers and homeowners. They are doers. They are entrepreneurs. Public sentiment for small business is far more favorable than for large business. When it’s David versus Goliath, human nature inevitably draws us to root for the little guy. It almost goes without saying that any public relations effort by business will place as much emphasis as possible on the smallness of it. And so the best defense of preventing the top two individual tax rates from returning to 36 and 39.6 percent is that it would be an assault on small business. It is true that the rate change would hurt small businesses. But a new study from Treasury economists using 2007 data makes clear that the magnitude of this effect is not nearly as large as the defenders of rate cuts would like the public to believe. […] What exactly is a small business? There is no one answer. The Small Business Administration has a long and convoluted definition that varies by industry and sometimes uses gross receipts and sometimes uses number of employees. For their study, Treasury economists had access to a treasure trove of tax return data, but even that did not include the number of employees. So they could use only gross receipts to determine business size. They chose $10 million of gross receipts as the threshold. This seems reasonable. According to Census Bureau data for 2007, employers with between $7.5 million and $10 million of gross receipts had an average of 52 employees. (See Table 3, Receipt Size of Employer Firms, 2007, http://www.census.gov/econ/smallbus.html.) Anybody who wants to challenge the Treasury study would be hard-pressed to find a more defensible alternative.” The full post.

See Also:

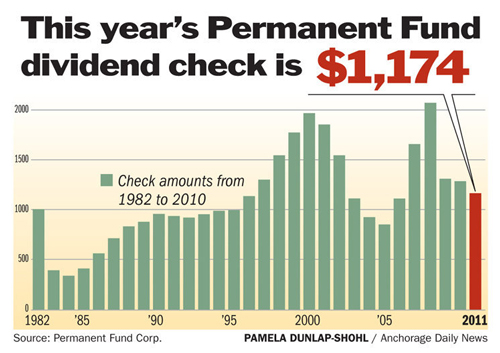

Sarah Palin’s Welfare State: Alaska’s Permanent Fund Check for 2011: $1,174

From the Anchorage Daily News: “Most Alaska residents will soon be getting a check for $1,174 simply for living here. Each person’s share of the state’s vast oil wealth was announced with much fanfare in Anchorage Tuesday, with Gov. Sean Parnell ripping open a gold-colored envelope to reveal the number. This day is so widely anticipated in Alaska that the announcement of the Permanent Fund dividend amount was carried live on television statewide, and dozens tuned in to watch a live webcast by the governor’s office. This year’s check is the smallest since 2006 and $107 less than last year’s amount, which was $1,281. Parnell warned the amount could diminish more in the future, given market volatilities and the fact that oil production in the state is declining. Nonetheless, he called this year’s amount “healthy.” […] Already, Alaskans are making plans for how they’ll use their dividends, from paying bills to putting the money toward a new car to buying sled dogs. Retailers are advertising “PFD” sales. So is Alaska Airlines, whose offer is popular in a state where few communities are connected to a road system and the cost of going to the nearest city to shop — or just get away — adds up fast. While the extra money is a great perk, it doesn’t always go far in a state where some rural residents pay $7 or more a gallon for gasoline and one study showed food costs for a week could run into the hundreds of dollars for a family of four. Today, state government relies heavily on oil revenues to run, and most Alaska residents receive a dividend check; people have to live in the state for a year to be eligible to apply. The amount of investment earnings allocated to dividends is based on a five-year rolling average of the permanent fund’s performance.” The full story.

From the Anchorage Daily News: “Most Alaska residents will soon be getting a check for $1,174 simply for living here. Each person’s share of the state’s vast oil wealth was announced with much fanfare in Anchorage Tuesday, with Gov. Sean Parnell ripping open a gold-colored envelope to reveal the number. This day is so widely anticipated in Alaska that the announcement of the Permanent Fund dividend amount was carried live on television statewide, and dozens tuned in to watch a live webcast by the governor’s office. This year’s check is the smallest since 2006 and $107 less than last year’s amount, which was $1,281. Parnell warned the amount could diminish more in the future, given market volatilities and the fact that oil production in the state is declining. Nonetheless, he called this year’s amount “healthy.” […] Already, Alaskans are making plans for how they’ll use their dividends, from paying bills to putting the money toward a new car to buying sled dogs. Retailers are advertising “PFD” sales. So is Alaska Airlines, whose offer is popular in a state where few communities are connected to a road system and the cost of going to the nearest city to shop — or just get away — adds up fast. While the extra money is a great perk, it doesn’t always go far in a state where some rural residents pay $7 or more a gallon for gasoline and one study showed food costs for a week could run into the hundreds of dollars for a family of four. Today, state government relies heavily on oil revenues to run, and most Alaska residents receive a dividend check; people have to live in the state for a year to be eligible to apply. The amount of investment earnings allocated to dividends is based on a five-year rolling average of the permanent fund’s performance.” The full story.

See Also:

- Alaska Lawmakers Approve Permanent Fund Checks for the Dead

- Sarah Palin’s Favorite Hike

See Also:

- Bill O’Reilly on the Civil War

- Marines Hit the Ground Running in Seeking Recruits at Gay Center

- Building the U.S. tax code, break by break

- Al-Jazeera chief’s surprise resignation raises fears for channel’s independence

- GOP leadership faces possible tea party revolt in 2012

- Honor Killings in the United States and Britain

Leave a Reply