Back in 1981 David Stockman was the wonderkid of the Reagan administration–the director of the Office of Management and Budget who’d craft in actual budgets the trickle-down miracle Reagan had promised on the campaign trail: lower budgets, lower spending, higher tax revenue. But trickle-down economics was a wish, not a reality. It’s never worked. Lower taxes don’t generate more revenue. They generate deficits.

Reagan knew it. So did Stockman. So did their guru, Friederich von Hayek. The deficits were intentional all along. They were edsigned to “starve the beast,” meaning intentionally cut revenue as a way of pressuring Congress to cut the New Deal programs Reagan wanted to demolish. “The plan,” Stockman told Sen. Daniel Patrick Moynihan at the time, ” was to have a strategic deficit that would give you an argument for cutting back the programs that weren’t desired. It got out of hand.”

Reagan knew it. So did Stockman. So did their guru, Friederich von Hayek. The deficits were intentional all along. They were edsigned to “starve the beast,” meaning intentionally cut revenue as a way of pressuring Congress to cut the New Deal programs Reagan wanted to demolish. “The plan,” Stockman told Sen. Daniel Patrick Moynihan at the time, ” was to have a strategic deficit that would give you an argument for cutting back the programs that weren’t desired. It got out of hand.”

A 1985 interview with von Hayek in the March 25, 1985 issue of Profil 13, the Austrian journal, was just as revealing. Von Hayek sat for the interview while wearing a set of cuff links Reagan had presented him as a gift. “I really believe Reagan is fundamentally a decent and honest man,” von Hayek told his interviewer. “His politics? When the government of the United States borrows a large part of the savings of the world, the consequence is that capital must become scarce and expensive in the whole world. That’s a problem.” And in reference to Stockman, von Hayek said: “You see, one of Reagan’s advisers told me why the president has permitted that to happen, which makes the matter partly excusable: Reagan thinks it is impossible to persuade Congress that expenditures must be reduced unless one creates deficits so large that absolutely everyone becomes convinced that no more money can be spent.” Thus, he went on, it was up to Reagan to “persuade Congress of the necessity of spending reductions by means of an immense deficit. Unfortunately, he has not succeeded!!!” Those three exclamation points, unusually effusive for an economist, are in the original.

Keep in mind: Hayek is speaking his disillusion with the GOP’s misapplication of his theories in 1985. To this day he remains a favored mask of budget-wreckers pretending to be fiscally conservative while pushing for more tax cuts. Those wreckers are at work in Congress today as they argue for an extension of the Bush tax cuts of 2001 and 2003, which were far larger than Reagan’s of 1981 and 1986 (in 1986, Reagan agreed to some tax increases, but mostly in the Social Security payroll tax, meaning on the middle and lower classes).

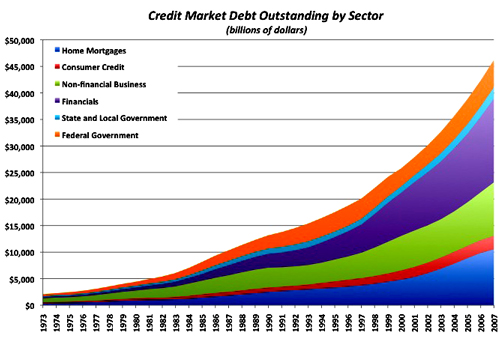

In a piece entitled “Four Deformations of the Apocalypse,” a clever play on the biblical image of the four horsemen of the apocalypse, Stockman outlines four major Republican breaks with discipline that set the stage, then compounded, American bankruptcy, beginning with Milton Friedman convincing Nixon to default “on American obligations under the 1944 Bretton Woods agreement to balance our accounts with the world. Now, since we have lived beyond our means as a nation for nearly 40 years, our cumulative current-account deficit — the combined shortfall on our trade in goods, services and income — has reached nearly $8 trillion. That’s borrowed prosperity on an epic scale.”

Friedman, a Nobel laureate also worshiped like von Hayek by free-marketeers, , had promised Nixon that markets would do what governments couldn’t–help deficits self-correct. They never did. “In fact,” Stockman writes, “since chronic current-account deficits result from a nation spending more than it earns, stringent domestic belt-tightening is the only cure. When the dollar was tied to fixed exchange rates, politicians were willing to administer the needed castor oil, because the alternative was to make up for the trade shortfall by paying out reserves, and this would cause immediate economic pain — from high interest rates, for example. But now there is no discipline, only global monetary chaos as foreign central banks run their own printing presses at ever faster speeds to sop up the tidal wave of dollars coming from the Federal Reserve.”

By 2009, the tax-cutting ideology had reduced federal revenues to 15 percent of the size of the economy, the lowest level since the 1940s. “Then, after rarely vetoing a budget bill and engaging in two unfinanced foreign military adventures, George W. Bush surrendered on domestic spending cuts, too — signing into law $420 billion in non-defense appropriations, a 65 percent gain from the $260 billion he had inherited eight years earlier. Republicans thus joined the Democrats in a shameless embrace of a free-lunch fiscal policy.”

That’s before accounting for the third major change–the deregulation of financial markets and government’s complete abandonment of oversight for the largest ponzi-scheming institutions in the nation’s (and the world’s) history–on taxpayers’ backs. “As a result,” Stockman writes, “the combined assets of conventional banks and the so-called shadow banking system (including investment banks and finance companies) grew from a mere $500 billion in 1970 to $30 trillion by September 2008. But the trillion-dollar conglomerates that inhabit this new financial world are not free enterprises. They are rather wards of the state, extracting billions from the economy with a lot of pointless speculation in stocks, bonds, commodities and derivatives. They could never have survived, much less thrived, if their deposits had not been government-guaranteed and if they hadn’t been able to obtain virtually free money from the Fed’s discount window to cover their bad bets.”

Fourth destructive change, and the one most familiar to those who lengthen unemployment lines these days: the off-shoring of high-value jobs in trades, transportation, technology and professions, a sector that’s shrunk from 77 million jobs to 68 million jobs. “The only reason we have not experienced a severe reduction in nonfarm payrolls since 2000,” Stockman writes, “is that there has been a gain in low-paying, often part-time positions in places like bars, hotels and nursing homes.” That’s the Floridanization of the American economy.

“It is not surprising, then,” Stockman concludes, “that during the last bubble (from 2002 to 2006) the top 1 percent of Americans — paid mainly from the Wall Street casino — received two-thirds of the gain in national income, while the bottom 90 percent — mainly dependent on Main Street’s shrinking economy — got only 12 percent. This growing wealth gap is not the market’s fault. It’s the decaying fruit of bad economic policy.”

And still, Republicans in Congress and across the country are staking their fortunes on more tax cuts, including–and especially–for the richest. That’s sacrifice. That’s fiscal responsibility. They know they have a winning platform because their voters want the free money, too. That’s the American economy of the past 40 years, an economy living so far beyond its means that it wouldn’t recognize a day of reckoning if it was baking it brighter and hotter than Florida’s noonday sun.

![]()

Pierre Tristam is FlaglerLive’s editor. Reach him by email here.

Mary says

Now THAT was a piece I could get behind

NortonSmitty says

And we can believe him because if you remember, he was the only one of Reagans inner staff to get publicly fired. For telling the truth. “The tax cuts are just a Trojan Horse for the rich” comment, to the Atlantic magazine if I recall.

Kevin says

The photo of Ronald Reagan is excellent. I’m not saying anything else about the article because it has the potential to get ugly:o)

A parent says

Once again FlaglerLive hits it out of the park!

BottomLine says

Once again FlaglerLive spins reality. What did Carter do for the economy? Obama is having a great time. Clinton.. I actually liked him when he went to the middle to get things done.

Mark Warren says

ok…

Carter inherited a very volatile economy that had spent billions of dollars and tens of thousands of American lives in an illegal war in ‘southeast Asia’. At the same time, the mid-east was starting to realize that America had cheated them out of THEIR land and THEIR oil. And they demanded more for their efforts. It wasnt a Carter policy that caused the oil crisis.

And then we had Iran. Iran was very angry with America because we had forced their people to accept a dictator known as ‘The Shah’. He got filthy rich as did American oil company CEO’s and the country did without. Kind of like how diamonds cost blood now. And Iran decided that they were taking their country back, away from the Shah and we were in the way.

You really should study history and not just listen to the foxbot. With Obama taking office in the heat of the biggest downfall in history, if you include the rest of the world and the largest recession in America since the last republican depression in 1929. And you want to blame liberals just like the barons did in the 20’s, while floating on their tax free yachts.

And I am sure you ‘actually liked Clinton’… when he was threatened with impeachment and forced to deal with ‘the contract on Americans’ written by Nueter Blinggrinch.

Rick Shannon says

And remember that Reagan used the CIA via George Bush to make deals with Iran over the hostages, to keep them until after the elections then release them. Part of the network of lies that included the Iran/Contra affair. That ugly business not only traded arms with Iran to fund the Contras, with evidence it established the Caribbean cartels and developed the American cocaine markets, producing another black market revenue stream. The people of the US were at this point shaken in their belief in their government by not only the war, but the crimes of Nixon and his disgrace, resignation and pardoning. The growing far-right agenda crowd organized against Carter like they have against Obama, destroying him with lies and political chaos. They tried the same thing with Clinton, but he was just too wily, savvy, and connected. He was also not that far politically from moderate and liberal Republicans.

Anonymous says

You never answered the question. What did Carter do? Okay he inherited a bad hand. Did he show leadership and make it better or flounder and make it worse?

Anonymous says

Carter brought in Volcker, who undid nixon’s runway inflation. In fact, he did such a good job at the Fed that Reagan reappointed him. Once inflation had been brought under control Volcker released the controls fueling an economic boom that helped Reagan win 84 in a landslide.

Anonymous says

The article wasn’t about Carter, Clinton, or Obama.

Hence … your confusion about the author’s failure to mention them.

If you wanted info about Carter, Clinton, and Obama … then reading an article entitled “How Nixon, Reagan, Bush and their GOP demolished the economy.” … is probably the worst place to look for that info. You would get better results if you read an article that was specifically about those 3 presidents, rather than one about 3 different presidents..

I can’t believe that you actually need this to be explained to you! Maybe you should just go over to fox “news” and get your anti american, communist conspiracy fetish stroked.

Taxman says

I would say that they shouldn’t be any room to dispute the facts. On the other hand there’s always one in every crowd.

Greg Ransom says

Were did you get a copy of Profil 13 — and who published it?

I’d like a copy of this Hayek interview.

NortonSmitty says

Kevin your probably right. But then again, pretty was never my strong suit.

What ya’ got? So far I’m disappointed.

NortonSmitty says

I guess it;s up to me to get this party started.

BottomLine, what facts do you think were twisted specifically? Don’t forget this is coming from David Friggin’ Stockman, Reagans Budget Director who was one of the initial planners of the greatest transfer of wealth within any society in the history of man. The shifting of the tax burden from Capital to Labor, from the Investment Class to the Working Class.

But tha’ts too long an argument to document here, and forever will be to most working-class Republicans.

But Stockman was the Golden Boy back then. An economic genius who was so good, he was put in charge of The Plan. Tax cuts that would increase the taxes collected. Capital Gains cuts that would allow the rich to plow their money back into American factories and not penalize them with taxes. Deregulation! Good times!

Even though Stockman didn’t believe a word of it. Knew it was bullshit as an acknowledged economic prodigy even though he planned it. Then he helped sell it to a shellshocked American public reeling from 20% inflation, skyrocketing energy costs. Stagflation and Japan kicking our ass. Thanks Jimmy! (I’ll sorta’ give you that one)

But he couldn’t help but try to convince his peers that he really didn’t believe anything that silly. So one night out after a few drinks, he told his buddies the famous line that cost him his job eventually. That the tax cuts were a Trojan Horse for the rich, and was quoted in a magazine. He committed the one eternal and unpardonable sin in Washington, he told the truth. And even worse, he let it get out to the Rubes!

I remember the outrage. It was in all the papers for weeks. OUTRAGE!! No, not that the policies we were spoon-fed and would ruin the economy to this day, but outrage that this young punk would betra our beloved Ronnies trust ! So Ron, being the kind, forgiving soul we all love, took the boy “To the Woodshed” to straighten him out. It was all over every paper. I remember because THERE WASN;T ONE STORY ABOUT WHETHER THE GUY WHO FORMULATED THE SCAM WAS TELLING THE TRUTH!

Not one. The more things change, huh?

So now he has come out to confirm what we have had proven to us about the supply-side, trickled-on economic theories for the last thirty years. They don’t work, no matter how extreme you take the theory.

Economic theories are at least consistent. Unfortunately, so are Republicans.

PS. The things Clinton went to the middle on were NAFTA and repaling the Glass-Steagle act that kept banks from getting too big to fail, How;s that middle workin’ for ya?

BW says

What you left out was that President Obama was the reason that President Reagan’s plans did not work. You can pretty much pin every failure on Obama these days and it’s real easy to do. Just watch Beck’s afternoon wacky fiction extravaganza and you’ll see how creative you can get with it too. It’s fun. Give it a try.

dlf says

When are we going to live up to fact that obama is the man in charge, has been for 18 months. What have we got, jobless rate between 9-18 per- cent, people still losing their homes, is there still a prison in Cuba, are we still fightong two wars, ts our tax rates going up? Yes, Bush may have been part of the problem but what the hell has the current man in charge done fo us, how is hope and change working out for you?,

Kathy Kelley says

Obama would have done more if the Republicans hadn’t dug in their collective heals to fight EVERYTHING he’s tried to do. They became the party of NO the minute Obama was elected and their plan was to block him at every turn in order to make him unsuccessful and thus look ineffective to the American public. Fortunately, many of us realize this selfish strategy. The Republicans care more about regaining the top office for the sake of power and wealth. They care nothing about the demise of this country or else they would have realized the country comes first and they must work cooperatively with their Democratic partners in government instead of blocking every bipartisan attempt Obama has made. Republican greed has killed this country!!! David Stockman was there at the beginning of this mess. He see’s what the rest of you refuse to see. It’s pathetic!!

Anonymous says

President Obama is the perfect candidate for the GOP. They had one goal – make him a one term president. They filibustered everything he tried to do, and now blame him for the failure resulting from their own policies. Pretty nice gig if you can get it.

Mike says

Another thought provoking article. What a great web site. “Trickle down” economics has been assaulted by several economists, it just doesn’t work.

As far as blaming Resident Obama for out troubles, we should be thankful he was in charge to lead us out of the worse recession since the depression of the 20’s. Thanks to President Obama we now have a health care bill, control over financial markets, complete coverage of money requested by the VA, a stimulus bill and 200 other pieces of legislation that has helped American families.

dlf says

Mike: wait till you get the bill for all these wonderful, free, social programs you think you are entitled to.. None of these shams have produced one single job.

Brandon says

Apparently, you did not read the article. Shill.

Lin says

Where are the flattering portraits of Bill Clinton, Barney Frank & Chris Dodd for their contribution to the mortgage, real estate debacle part of our demolished economy?

Anonymous says

Probably because the bill you are referring to wasn’t Clinton, Frank, Dodd. It was Graham, Leach, Bliley. All Republicans might I add. Its also instructive to note that Republicans had enough votes on their own to pass the bill, and as a member of the minority party Dodd and Frank didn’t have a lot of say in how the bill was crafted.

Bob K says

Hey, why don’t the likes of Franklin Raines, Barney Frank, Chris Dodd, Maxine Waters, and Kendrick Meeks get any credit for the financial collapse???? Well, let me think; I wonder what they all have in common.

Strling09 says

Well whats really scary is Rumor has it Jeb Bush is up against Obama in 2012. So where will the Taliban attack then and do more damage than 01. We do not need another Bush in the white house. We cannot afford the people that live in this country to be another target for the Taliban like they were with the old man and the last one. NO BUSH NO WAR we might live in some peace instead of trying to get even for daddy and GW.

Anita N. says

“Yes, Bush may have been part of the problem but what the hell has the current man in charge done fo us, how is hope and change working out for you?”

11/11/08: U.S. unemployment rates under President Bush have reached a 14-year high. According to the Bureau of Labor Statistics, unemployment climbed to 6.5 percent in October, as the country shed 240,000 jobs.The job losses were far-reaching: manufacturing lost 90,000 jobs, construction shed 49,000, professional and business services saw a decline of 51,000, and retail trade employment lost 38,000. Health care, however, added 26,000 jobs.

President Obama put on the brakes. That’s what he did FOR us. Unfortunately the runaway plunge toward a recession, like a runaway train, doesn’t stop on a dime.

Bob K says

I wonder if strling09 realizes that the African embassy bombings and the USS Cole bombing happened during Clinton’s tenure. The Iranian hostage crisis happened under Carter. Oh, and that Major Hassan guy that shot 13 soldiers at Fort Hood; that happened when, Obama was in office. So, it may come to a surprise to you that regardless of who is in office, we’re a target.

NortonSmitty says

Bob K., lin & dlf,,

Time to spit out the Kool-Aid and think for yourselves. You can’t possibly still believe the propaganda you

were and continue to be fed in the face of the results we’ve had over the last ten years, and I hope you notice I included the last two. There isn’t a dimes worth of difference between the policies of GWB and BHO. Same policies.

Bob K agrees but doesn’t know it. As he said above, same results no matter who’s in office. Because we have the same foreign policy, the same monetary policy, the same Imperial ambitions and as you said, we get the same results (consequences) of these unchanging policies who’s goal is not to achieve gains for the American people. Hell if that was our aim we would have had $1.00/gal gas after we liberated Iraq and brought their oil here for our troubles. Did that happen? Of course not.

Instead,we spent a Trillion dollars we could have used to boost our own country, spilled the blood of five thousand young American soldiers, destroyed what little infrastructure they had there, killed hundreds of thousands of collaterals, and who came out ahead in the end? Take a wild guess.

What we really liberated was the Iraqi oil fields, and then handed them over to BP, Shell and the other Multi-Nationals. And they were so thankful, they kindly sold it back to us at $4.00 a gallon, remember? It wasn’t just because we had the two oil men in the White House. We would have got around to it eventually no matter who we voted for. Barack would be doing it now instead of making Afghanistan safe for Natural Gas pipelines, because It’s what we do. Or rather what our government does in our name, with our money. And our boy’s blood. We make the world safe for Big Business.

And that pisses me off to no end. And it should you too. Instead you waste your energy on whining about the minor deviations on the route we’re taking but ignoring the downhill path and destination. You are wasting precious anger on distractions like Republican ir Democrat that have as much real impact as arguing Bud or Miller, Brittany or Lindsey, Earnhardt or Gordon.

In the same way, you’ve been sold a brand, a product called Conservative (TM) that you all seem so proud of the same way people used to brag “I’m a Cadillac man” and about for the same reasons. It’s trendy, it brings me status and like-minded friends. You know, like being a Liberal in the Sixties.

And even though you watch nothing but Fox news and listen to talk radio all day, and absorb all of your info from a right wing propaganda operation that Josef Goebbels could have only dreamed of, you swear you’re unaffected, even Fair and Balanced.

In 1939 there were millions of Germans that also said they couldn’t be swayed by mere propaganda. In 1946, not so many.

I don’t want to see America become Germany 1946 and I know you don’t either. But if we don’t start paying attention to the real problems in this country and stop being led around by the nose parroting the talking points of the day, it will happen. We have to pay attention to the real threats to our freedom and way of life, not the sideshows.

So please guys, turn off the TV, get your noses out of Rush Limbaughs ass cheeks and into a good book or magazine, think for yourself and stop the dittohead bullshit. Your country need you.,

dlf says

Norton: very well said and to the point. Let me ask you where you get your information from ? I do not listen to Rush or Beck and yes I do watch FOX, CNN and CBS, but as you know they all have an ax to grind. all of them. Now you have guided the ill informed what are your suggestions to correct the problems that I think you would agree are present under obama as they were under Bush. It is easy to point out their short falls without a solution, the old walk in my shoes story.

Lin says

NS: my point was that there is enough responsibility to go around for the mess we are in. The koolaid you drank doesn’t let YOU see that it isn’t a Rush problem, a Fox problem, a Republican problem. You need to stop the blaming, realize it is 2010 and Obama has been President for 18 months. He has made MANY decisions that are going to make things worse for the county. Change is not necessarily good change. The anger is that only one side of the story is presented and/or listened to.

Taxman says

Norton Smitty,

Not so long ago thinking for your self would have resulted in the following;

Joe McCarthy would have branded you a communist.

Now jumping forward a few decades.

George Bush would have said you are either with us or against us.

The Patriot Act would have gotten your phone tapped; mail read and you put on a no fly list.

Michele Bachmann would have called you un- American.

And who knows what word Silly Sarah would say.

And no, most of these folks you refer to don’t have to listen to the Limbaughs, Becks, Palins, O’ Reillys etc of the world they just subscribe to similar views. The views are all one in the same.

I do have a couple of questions though.

Why are there no mass protests and condemnations for the authorization of another 30 something billion dollars to continue a war that has been raging for some 20 years. The Russians were there for about 10 years before they left with their tail between their legs. Don’t forget Donald Rumsfeld stated that this country could sustain two wars, with no problem.

I have been attempting to establish the root cause of all the discourse, discontent and often hateful rhetoric that only seemed to manifest itself after the election of the new president.

Did all of the perceived wrongs within the political establishment of our country begin after January 20, 2009? Why is it that many of these folks jump out of the wood work now? Where were they before January 20, 2009?

An apt analogy of both political parties is that they are two cheeks of the same behind.

some guy says

I like this place for local goings on BUT on politics. Their is NO reporting it is just a far left soap box for Flaglerlive. To the left the problem is always that someone did not pay enugh to goverment not that government speends way way to much!!

Bob Smythe says

Oliver North got fired in a very public way. Many Reagan staff were forced to resign. David Stockman resigned on his own after fighting many battles within.

Roger Priest says

It is essentially the same way that Rome was brought to its knees. Once government officials grow audacious enough to fleece the treasury, collapse is imminent.

Anonymous says

Holy Moly, I get it now Republicans, aka Conservatives, actually think they are God, or at least his son Jesus. They think they can feed the masses, (the American public), with a few loaves of bread and some fishes. The real miracle here is that Republicans still have a party and a following.

Jean Howard says

Now that the truth is finally coming out by insiders we’re to believe they want

the country to reform its economic base? I think not!! Its time for folks to wake the hell up

and really get the 99%ers in line to make changes!! No more messing around!! Pres.

Obama is just the one that’s left standing in a pile of SHIT!!!

Anonymous says

Ronnie raygun was the Turd that started this whole downward into the toilet mess and now Obama and the Nation have to wipe the ass and clean up.

Steve D says

Thanks, Dave, for confirming a theory I have long held. The point was to max out the credit cards. Except there is no such thing as maxing out this credit card because the Government can simply create money at will.

60srad says

The ultimate reason the “free market” is a scam is that it’s part of an even bigger scam known as “crapitalism,” a system that is so irrational it has boom-and-bust cycles like clockwork, sees a non-zero level of unemployment as “optimal,” is so insecure that it needs to stifle dissent through propaganda and witch hunts, and at extreme times need socialism to bail it out, instead of using it for the constructive purposes it was intended to serve..

David Wemby says

Isn’t that a sweet picture of Nixon? He must have been a great man because he really loved his dog.

VirtualDC says

Like all things, that Wednesday morning group gave rise to ideologues and less aware members who rise on their own intellectual incest and hot air. But they don’t know that they need to have a broader view to see more than what they know.

Anyone who can’t look into these men’s faces and see that they don’t believe in the social contracts of today, it appears as though it is their mission in life to tear down what has been built in order to create the world they want – anyone who can’t see this is in willful denial and lazy about creating the world of the future.

Bonnie Hilley says

Kathy, You make more sense than all the other stuff I have read from the yahoos who think they know everything. Thank you.

Bonnie Hilley says

Haven’t you been reading anything? Mitt was closing manufacturing plants in the USA and shipping the jobs overseas! He brags about creating jobs but they were in other countries. That’s how he made his millions which bty are in banks in other countries! That’s one of the big reasons he should be forced to turn over his tax returns. I and a lot of other people don’t think he has been paying any taxes in this country.

richard clack says

david stockman interview on phil Donahue after leaving White House about book on why reaganomic failed