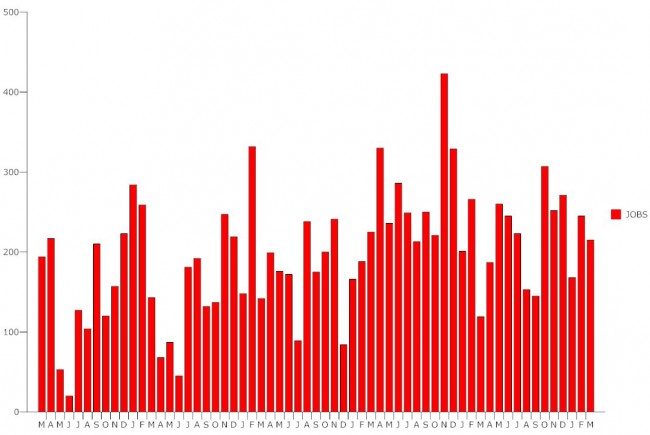

The national economy added 215,000 jobs in March, continuing a trend of strong job growth that dates back to the beginning of 2014. But the unemployment rate ticked back up to 5 percent, pushed up, paradoxically, by the large-scale return of workers to the job market after dropping out of it since the Great Recession: almost 400,000 workers joined the labor force last month, and nearly 2 million have done so in the past four months. Despite that flood, the unemployment rate has either fallen or remained flat.

In March, the employment-to-population ratio rose to 59.9 percent. It’s still relatively low by the standards of the last three decades, when it was closer to 62 percent (and peaked at 64 percent during the late Clinton years). But it’s the highest rate since March 2009. The labor force participation rate also rose to a two-year high of 63 percent, though it has a way to go to reach its pre-recession peak of over 66 percent. The recession alone is not to blame for the lower ratios. Baby boomers are retiring in large numbers, inevitably depressing the number of people in the labor force.

Wages have been the other questionable variable in the recovery since 2009, either barely keeping up with inflation or falling behind. In March, hourly wages rose a bit more strongly, by 7 cents, to $25.43, bringing the year’s overall wage increase to a tepid 2.3 percent: workers are barely keeping pace with cost of living increases, which means their standard of living is not improving.

“The long-range trend of flat wages, pre-dating the Great Recession by several decades, remains our greatest barrier to shared prosperity,” Labor Secretary Thomas Perez said in a statement this morning. “That’s why the recent decision by two of the nation’s largest states to adopt the nation’s highest minimum wage, $15 per hour phased in over time, is such good news. This historic step will give millions of New Yorkers and Californians a raise.” New York State leaders reached a budget deal today to raise the minimum wage to $15 an hour. Lawmakers in Florida are largely opposed to such an increase.

Nationally, the number of people employed part time for economic reasons–that is, either because they could not find full-time work or because their hours were cut back–stood unchanged at 6.1 million, a figure that hasn’t budged since November. Another 1.7 million people were marginally attached to the labor force, down by 335,000 from a year earlier. Those are workers who are not counted in the official unemployment figures because they haven;t looked for work in the past four weeks. That artificially lowers the unemployment rate.

The more accurate unemployment rate, which includes involuntary part-time workers–the under-employed–and discouraged workers, the so-called U-6, alternative measure of unemployment, stands at 9.8 percent, an increase of a decimal point since February, but a significant decrease from March 2015, when it was at 11 percent. In Florida, the rate remains relatively high, at 11.5 percent, belying Gov. Rick Scott’s claim that the state has been a job-producing juggernaut: jobs have been produced, but have been disproportionately low paying and part-time.

Officially in March, 8 million people were unemployed, but again, those were people actively looking for work and receiving unemployment checks. The long-term unemployed (those jobless for 27 weeks or more) was 2.2 million, or 27.6 percent of the unemployed.

Vincent neri says

The Atlanta Fed sees the 1st Quarter GDP Growth at under 1 percent. In 2016 a person can be fully employed yet still living in poverty. The government claims we have low unemployment and that millions of jobs have been created. However, this unempoyment rate is obviously not a good measure of the health of the economy if GDP is so low. GDP is low because a large percentage of the so called “jobs” are low paying. The GDP is low after the Fed provided round after round of quanitaive easing and interest rates remain very accomodative. If interest rates were allowed to normalize we would then see the real condition of this economy. The current condition is poor and if not for the Federal Reserve providing quanitative easing and low interest rates we would be looking at an all out depression. Now the Fed wants higher inflation so they are putting off raising interest rates and the stock market has been moving higher. Let me explain to everyone who pays for the higher stock market. We are all going to pay for it in higher prices because that is where increased profits come from. Profits are the mothers milk of stocks. Wages are the highest cost of running a business. Who thinks Wall Street wants higher wages? Wall Street wants profits to go higher and higher and will attempt to extract every dollar they can from the low wage workers that provide those profits. Most people have no idea of the inner workings of our economy and that Wall Street is really another branch of our government that controls our entire economy.

Knightwatch says

O.k., Republicans. Let’s see you dispute this article. Oh, yeah, the rules are you must use factual data. I know, I know, too many rules. But try.

Knightwatch says

O.k., Obama. Let’s see you dispute this article. Oh, yeah, the rules are you must use factual data. I know, I know, too many rules. But try.

Just me says

The more accurate unemployment rate, which includes involuntary part-time workers–the under-employed–and discouraged workers, the so-called U-6, alternative measure of unemployment, stands at 9.8 percent,

This says it all. we have NOT had a meaningful recovery. From the demacrat made economic meltdown.