When the Commerce Department revised its growth figures for the first three months of the year last week, it sent winter shivers down the nation’s economic spine: the economy had shrunk by a full percentage point, at an annualized rate. In late April, the Commerce Department thought the economy had grown, albeit negligibly. It was the first negative-growth quarter since the first quarter of 2011, but it contrasted sharply with President Obama’s “built to last” pledge about the economy–a sour note Republicans were quick to seize on in an election year when Democrats are already the underdog and bad news about or at least around the Obama administration seems to pile on daily. Most of that bad news is politically motivated rather than reality-based, but the net effect is the same: the administration is reeling, and poor economic news doesn’t help.

The blame for the slowdown was placed on bad weather and businesses adding far less to their inventories than they had the previous quarter. Wall Street analysts quickly predicted more robust growth for the current quarter–something along the lines of a 3 to 4 percent annualized growth rate. Today’s unemployment number appear to vindicate the prediction.

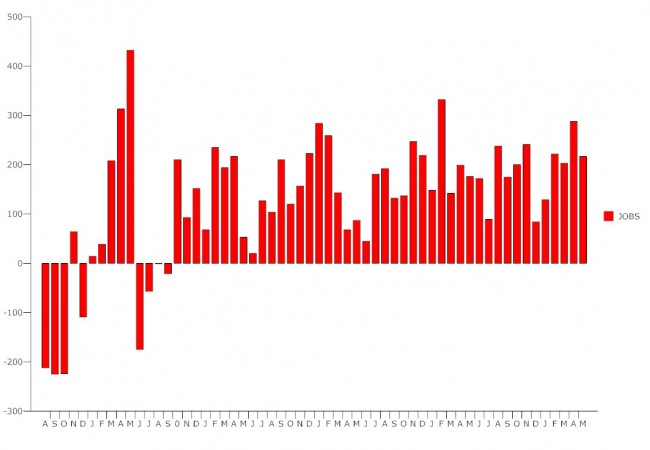

The Labor Department announced this morning that 217,000 jobs were added to the economy in May, continuing into a fourth month a streak of 200,000 or more jobs. So far this year–in the last five months–the economy has added 1.05 million jobs, though the unemployment rate, drawn from a separate survey, held steady at 6.3 percent. Florida’s unemployment rate is 6.2 percent, and Flagler County’s is 8.3 percent.

“We continue to move in the right direction with steady job growth, but we must take steps to help those individuals who are still feeling the lasting effects of the recession,” Secretary of Labor Thomas Perez said in a statement after the numbers were released this morning. “There are 3.4 million people experiencing long-term unemployment. It’s been five months since Congress allowed emergency unemployment benefits to expire, leaving so many families without a critical lifeline. These are our friends and neighbors, and they’re suffering — Congress must act so they can continue to pay their bills and put food on the table while they look for work.”

The number of unemployed people was unchanged in May at 9.8 million. Over the year, the unemployment rate and the number of unemployed declined by 1.2 percentage points and 1.9 million, respectively. But The number of long-term unemployed (those jobless for 27 weeks or more, and those hit hardest by Congress’ cut-off in aid) was unchanged at 3.4 million in May. These individuals accounted for 34.6 percent of the unemployed. Over the past 12 months, the number of long-term unemployed has declined by only 979,000.

Among the unemployed, the number of job losers and people who completed temporary jobs declined by 218,000 in May, a good sign. The number of unemployed re-entrants increased by 237,000 over the month, also a good sign. Re-entrants previously worked but were not in the labor force prior to beginning their current job search, so their re-entry tends to push up the unemployment rate, as they are again counted in the labor force.

“And despite the warm weather,” the labor secretary said, “Congress continues to leave low-wage workers out in the cold by refusing to pass an increase in the minimum wage. States and local jurisdictions have taken it upon themselves to ensure their residents get the long overdue raise that they deserve, and I encourage them to continue to act as long as Congress refuses to do so. No person who works a full-time job should have to live in poverty.”

The official unemployment rate does not include those who have quit looking for work altogether and the 7.3 million people who work part-time because they could not find full-time work, either because their hours have been cut back against their will or they could not find full-time work. When those numbers are included, the unemployment and under-employment rate is actually 12.2 percent, according to the Labor Department’s so-called U-6 “Alternative measures of labor underutilization.” Florida’s rate, where job growth has been driven by low-end, low-salary, low-benefits and part-time jobs, is above 14 percent.

Some labor market highlights: Professional and business services added 55,000 jobs in May, the same as its average monthly job gain over the prior 12 months. Health care and social assistance, always a job creator, added 55,000 jobs. The health care industry added 34,000 jobs over the month, twice its average monthly gain for the prior 12 months. Within health care, employment rose in May by 23,000 in ambulatory health care services (which includes offices of physicians, outpatient care centers, and home health care services) and by 7,000 in hospitals. Employment rose by 21,000 in social assistance, compared with an average gain of 7,000 per month over the prior 12 months.

Within leisure and hospitality, employment in food services and drinking places continued to grow, increasing by 32,000 in May and by 311,000 over the past year. Transportation and warehousing employment rose by 16,000 in May. Over the prior 12 months, the industry had added an average of 9,000 jobs per month.

Manufacturing employment changed little over the month but has added 105,000 jobs over the past year. Within the industry, durable goods added 17,000 jobs in May and has accounted for the net job gain in manufacturing over the past 12 months.

Employment in other major industries, including mining and logging, construction, wholesale trade, retail trade, information, financial activities, and government,

showed little change over the month.

The average workweek for all employees on private payrolls was unchanged at 34.5 hours in May. The manufacturing workweek increased by 0.2 hour in May to 41.1 hours, and factory overtime was unchanged at 3.5 hours. In May, average hourly earnings for all employees on private payrolls rose by 5 cents to $24.38. Over the past 12 months, average hourly earnings have risen by 2.1 percent, still far below the sort of increase that would overcome inflation and the rising cost of health care premiums.

“The May figures do represent something of a landmark: Almost exactly five years into the recovery, total payrolls have finally surpassed where they were before the recession,” The New York Times reported. “While the addition of nearly nine million jobs since hiring bottomed out in February 2010 is certainly good news, the number is still far from what is necessary to accommodate new graduates and millions of others who have entered the work force since payrolls last peaked in January 2008 at 138,365,000 jobs.”

nomad says

“The blame for the slowdown was placed on bad weather and businesses adding far less to their inventories than they had the previous quarter. Wall Street analysts quickly predicted more robust growth for the current quarter–something along the lines of a 3 to 4 percent annualized growth rate. Today’s unemployment number appear to vindicate the prediction.”

Yes, when all else fails blame mother nature – the mother of all scapegoats. The economy flat out sucks. The increase in GDP was a result of millions of Americans being forced to buy Obamacare when they are flat out poor and broke, barely getting by of deadbeat slave wages. The housing recovery is still a gigantic disaster for ordinary homeowners but not for Wall Street winners who made out like bandits with the Obama “housing recovery aid” – so much so that luxury homes and construction is booming but not moving an inch for the non wealthy working class/middles class. And consumer spending is still at an all time low.

My goodness these “folks” must really think Americans are THAT stupid!

Another really good article: On Prostitutes, Drug Dealers & Economic Forecasters

( http://www.counterpunch.org/2014/06/05/on-prostitutes-drug-dealers-economic-forecasters/ )

[…] While weather might have been perhaps a minor factor in some east coast regions of the country, it was certainly not a factor nationwide. The bad weather metaphor approach to economic explanation also fails to explain why luxury retail sales, at Tiffany’s and other high end retailers, expanded at double digit rates throughout the bad weather months. Apparently the rich aren’t as deterred by weather from spending while middle Americas are. Buying milk at the grocery store is somehow postponed by bad weather, but buying diamonds and baubles at the jewelry store is not. Nor does ‘bad weather’ in January-February explain why a number of key economic indicators continued to decline in March and even April, when ‘bad weather’ was not a factor. Somehow bad weather deterred home sales more than usual this past winter, even though home sales were declining well before, and have continued to do so after March 2014. Or ‘bad weather’ advocates argue that industrial production slowed in the winter because of the weather, when one would suspect bad weather would boost energy utilities’ output and industrial production during such weather. So much for bad weather forecasting.[…]

Genie says

92,000,000 Americans still out of work. We’ve a long way to go.

Genie says

And Flagler County STILL has the highest unemployment in the state.