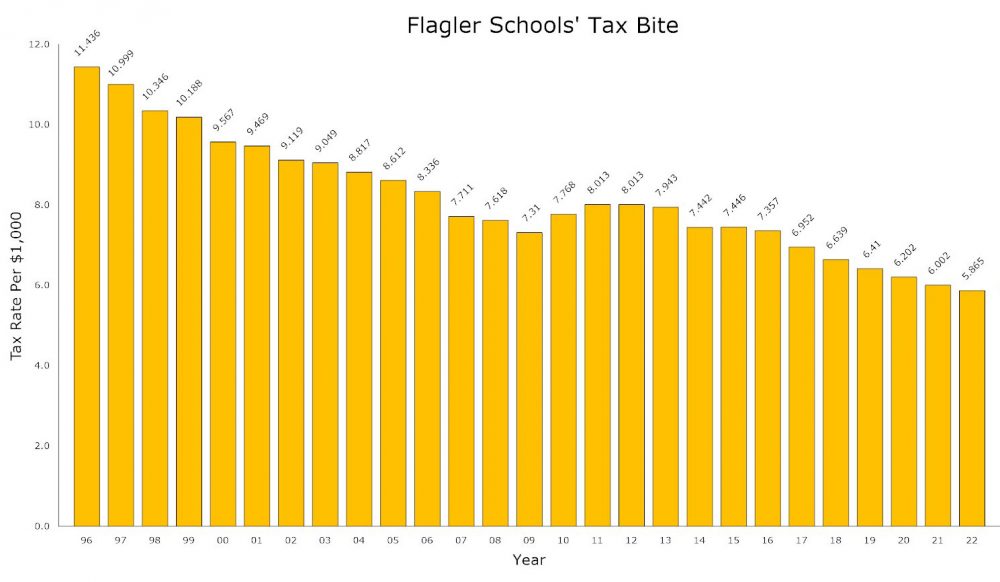

The Flagler County School Board on Sept. 7 adopted its property tax rate and $212 million budget for 2021-22. The tax rate, set by lawmakers in Tallahassee, continues a two-and-a-half decade downward trend, to $5.865 per $1,000 in taxable value, down from $6 last year.

While a decline, the rate still amounts to a 3.26 percent tax increase, because the revenue generated next year will exceed this year’s revenue by that much. Under Florida law, any tax rate that generates a net increase in revenue, year-over-year, is considered a tax increase. Still, the adopted tax rate is the lowest in a quarter century, and likely much further than that. The district will realize a revenue increase of $2,145,064, according to Patty Wormeck, the district’s finance director.

But net funding increases overall are dependent on the state school funding formula, which redistributes money to districts by combining revenue from property taxes with sales tax revenue, among other sources. The district’s funding is also reduced to subsidize the state’s private school voucher program. This year, for example, the Flagler school district lost $750,000 in public dollars that instead paid parents’ private school bills. The state redirected $325 million to private-school vouchers this year.

Palm Coast and county governments are adopting tax rates that are slight declines over the previous years, but nevertheless represent slight tax increases. Flagler Beach and Bunnell are adopting ore substantial tax increases. The school portion of property owners’ bills remains the largest share.

The median sale price of a house in Flagler County as of July, according to the Flagler County Association of Realtors, was $340,000. The median value of a house, according to the latest Census figures, was $217,000. Taking the latter figure, a homesteaded house at that value would have a school-taxable value of $192,000, and a tax bill of $1,126 next year, compared to a tax bill of $1,152 last year, a decline of $26. The comparison does not take into account the increase in value of the house, year-over-year.

If that house saw the average 8 to 9 percent increase in value, then its tax bill would be slightly higher: assuming the house had gained 9 percent in value, it would be at $236,000 next year, with a taxable value of 211,530, and a tax bill of $1,240, or $88 higher than the previous year. Tax increases for non-homesteaded properties would be higher.

The school district’s property tax rate is split into three pots: the so-called “required local effort,” which accounts for the bulk of the tax revenue ($41.7 million, which goes to the state and gets redistributed with other funding), a discretionary portion that raises $8.6 million and that stays in Flagler, and an additional portion that will raise $17.3 million, and that is earmarked for capital improvements. Capital revenue will increase by $1.5 million.

Unlike other local governments, the school board has little to no say in setting the property tax. But it is required to go through the same public-hearing formalities as do other local governments, giving the public a chance to speak on the budget and the tax rate. Typically, only a few people show up at those hearings, fewer still speak to the board. None did when the board went through the motions on Tuesday. The board voted to adopt the budget and the tax rate unanimously.

Merrill S Shapiro says

It is important to emphasize that “The district’s funding is also reduced to subsidize the state’s private school voucher program. This year, for example, the Flagler school district lost $750,000 in public dollars that instead paid parents’ private school bills. The state redirected $325 million to private-school vouchers this year.” More than 75% of that $750,000 goes to religious schools that teach, for example, Scientology.

Mike Cocchiola says

DieSantis’ war on public education continues unabated. If you can’t privatize public schools, starve them to death.

Public schools helped build America. They are the backbone of our democracy and our society. We cannot let Florida’s anti-knowledge Republican administration continue this outrage. Let’s fix it in 2022. Get DieSantis the hell out of Tallahassee.

A.j says

Mike I agree with you. Vote him out of office. We can get him out of office,will we?