The Flagler County School Board on Tuesday adopted its budget and tentative tax rate for the coming year. But for one exception, the hearing drew little curiosity or questions from board members despite alarming changes and challenges in a shrinking budget. The budget reflects a lower tax rate, limited transparency about the dollars, stagnant enrollment and deception in how the district is now counting that enrollment to hide the number of students it is losing to private and home schooling.

A chart Patty Wormeck, the district’s finance chief, included in the budget presentation shows enrollment surging since the 2022-23 school year, crossing the 13,000-student threshold to reach almost 15,000 students this coming year. But those numbers include students attending school virtually. It includes almost 1,000 students attending a charter school, which is not run by the district. And it includes the sharply increasing number of students attending private school on public subsidies.

The chart denotes that last category as including those so-called “Family Empowerment Scholarship Students.” The district is essentially counting students who go to, say, the Baptist Christian Academy or the Catholic school as the district’s own, which is incorrect. The district ended the last school year with enrollment at its nine schools at 12,659, near the enrollment number of the 2008-09 school year

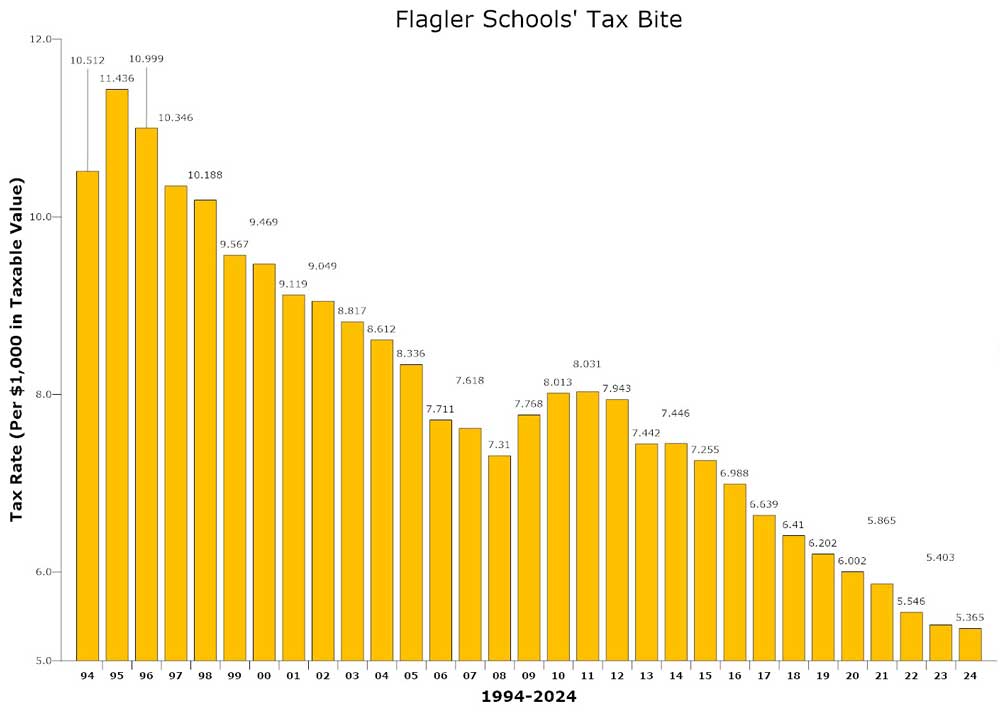

Three take-aways largely explain how the state is gradually emaciating traditional public education’s budget by lowering the tax rate, as it has almost every year since 1995, by diverting millions of dollars to subsidize families’ private, religious and homeschool education bills, and by causing an inevitable exodus of students from public school to privately subsidized education, but at public expense.

The local school board does not set the school tax rate. State lawmakers do. For the 10th straight year, as in most years since 1995, lawmakers lowered the school tax rate 7 percent, to $5.365 per $1,000 in taxable value. A $250,000 house with a $50,000 homestead exemption will pay $1,073 in school taxes next year, down from $1,080 this year. State, federal and local revenue will combine for a general fund total revenue of $155.3 million.

But the district will never see $10.8 million of that. That’s the amount the state will distribute this year to families to pay for the private or home school education of 1,250 students, a 56 percent increase over the 798 students privately enrolled at public expense last year, when the district lost $7.5 million to the program.

In her first budget presentation to the School Board last week, Wormeck had not included the number of students the district is losing to the program, nor the amount of money the state is including in the Flagler district’s budget to subsidize those students–only to withdraw the money later in the year. It took the repeated interventions of School Board member Colleen Conklin to ensure that those figures be clearly published. On Tuesday, Conklin again stressed at least four times the importance of transparency with those numbers, so the public understands what support the district is getting–and what it’s losing.

“I almost wish the state should just keep the darn money so that they are then accountable for it and transparency is on their shoulders,” Conklin said.

“We don’t have control over any of these funds. It is simply included in the revenue for the state in our first and second [budget calculation] and it is then removed,” Wormeck said. “We have no control over they handle all of the payments to the scholarship families.” The Flagler district is not responsible for distributing that money. The distribution is done by the state on a quarterly basis.

Nevertheless, the $10.8 million reflects the amount of money the state is siphoning out of what would have been in the district’s budget had it not adopted a voucher system, and vastly expanded it last year to make any student anywhere–regardless of income, abilities or disabilities–eligible for up to $8,000 to spend on private schooling. Rep. Paul Renner, the Palm Coast Republican, championed that change.

“This is what they’re estimating that this is going to cost for us,” Superintendent LaShakia Moore said. “If they don’t hit that, then we would see that some of those dollars would come to us. But this is what they’ve kind of put to the side as what it will cost for our scholarships.”

Families receiving the public money for private schooling may spend it on tuition and fees at eligible private and religious schools, which the state conveniently lists on its website for easy access and enrollment, transportation to an out-of-zone public school, instructional material, tutoring costs, and so on.

Here’s another startling revelation: when Conklin asked if the district had any means of staying in contact with families whose children have left the district, either to keep them informed about what may entice them back or to learn why they left, Moore told her there is no such system in place.

“As we see this population continue to grow, because it probably will continue to grow,” Conklin said, “that we figure out some way to continue to try to do outreach or communication with those families and get creative about how we can reintroduce them to our schools, or at least at a minimum, keep them abreast of some of the things that are happening within the school district.”

Obviously, not all 1,250 students slated to receive scholarships this coming year had once attended Flagler schools and now opted to go private. Rather, some of them would have been attending private school to start with, but with the expansion of the voucher program, are just now enrolling to grab their share of public dollars. Neither te district’s nor the state’s numbers are calibrated to make a distinction between the two categories. But the surge in the number of students shifting to public subsidies in private schooling underscores the challenge the district faces in coming years as the exodus is bound to continue.

In 2021, just 136 students were in that category, costing the district $880,000. In 2022, the number had jumped to 515, costing the district $4.1 million in lost funding, then 685 students in 2023, and 798 last year, when the district lost $7.5 million.

Moore said the district is developing a system to figure out how to draw back some private-schooled students in some courses or some programs in traditional public schools, and cash in on those portions.

The stagnant numbers have big implications for future budgets and school construction, especially in light of the board’s plea two years ago for more impact fee dollars on the assumption that enrollment would be booming, and that the district would need to build a middle school and a high school by decade’s end. None of those assumptions are so far proving true. (Impact fees are the one-time levy builders pay for new construction to defray the cost of development on roads, parks, schools and the like.)

Another challenge: in inflation-adjusted dollars, the school district is receiving several million dollars less this coming year than it did 10 years ago for its instructional programs. In 2014, the district budgeted $66.5 million for instruction. In current dollars, that would be $89.3 million. This year’s budget for instruction: $81.9 million. Board members seemed unaware, or uninterested, and Wormeck did not point out the fact that the district’s budget is literally shrinking before board members’ eyes.

For the entirety of the budget haring on Tuesday, and with a couple of exceptions from Board member Cheryl Massaro, the only board member to ask questions or probe for additional information was Conklin, who has been on the board since 2000 and has seen the state’s gradual undermining of public education in the name of “choice,” first through charters, then through the dismantling of zoning restrictions, and finally through vouchers.

Conklin is stepping down at the end of her term in November, as is Massaro. School Board member Sally Hunt, who no longer attends most meetings in person, when she attends them at all, said she is also resigning before November, just two years into her term. That seat will be filled by gubernatorial appointment. The board’s two senior members by then will be Will Furry and Christy Chong, who have each been serving just two years, and who have shown no interest in being inquisitive or questioning. It will be the least experienced school board in memory, with the least institutional history.

Bailey’s Mom says

This is unacceptable! How do we stop Public Funds going to Private & Religious schools?

Public Funds should only go to support our Public Education System. You want to homeschool or send your child to a private or religious school than you should pay for it.

Bob J says

Talk to your governor.

Joy cook says

Lmao! As if he would listen.

Nephew Of Uncle Sam says

Start Voting Blue, Project 2025 would make it even worse.

STOP electing Republicans says

People need to STOP electing damn Republicans! They have had complete control and many years have held the super majority control of the Florida House, Senate and Governor’s office. This is the biggest scam of tax dollars we’ve seen in history!

Jack B says

So allowing special needs kids to get specialized schooling where they thrive… Is a scam to you?

I have an autistic daughter who was bullied, ridiculed, sent to detention for “not focusing” when her very condition was the reason, and special instruction remedies.

But the public school system thought that was too much effort. Better to collect the dollars and send her to the dark room.

Im terribly sorry special needs kids’ getting educations that will help them become productive members of society is so egregious a concept to you. What tolerance we see from you champions of the $200,000 superintendent salaries!

Or maybe the scam is your uneducated position. My daughter never would have gone to college at her public school.. Now she just might get into Duke. The $5/hr per student that this equates to seems a pittance…. And makes your position all the more selfish.

Brandon Blanks says

This is absolutely not true! When a child no longer attends a district the money leaves with them no matter what! The scholarship that kids apply for and receive has nothing to do with the district losing money! Parents have the right to make the choice of where they want to educate their kids! The district only gets paid for students attending their school! Period! If they want better enrollment, they need to be better! I almost enrolled my child in his zoned high school this year, but when the administration mocked homeschooling in front of me and told us that his credits will not count toward a diploma I declined respectfully! My child is already a dual enrolled college high school student and has passed entrance exams to enroll at the college! For the district to treat us like shit and like he is stupid and illiterate because he has been homeschooled single handedly lost our district money for my student!

Jim says

I think what you fail to acknowledge is that if the state wasn’t giving $10M of tax dollars to private schools, that money would be distributed for the existing students in public schools which nets more dollars per student. Sorry your kid got out of the system but that is your right. What is not right is for tax dollars to go to private schools that are not regulated.

Brandon Blanks says

Do any of you actually understand how money is allocated to the school district? It is by enrollment! The moment a child is no longer enrolled the county school losses that money! Period! In order for the public school to keep money they need to do better! I pulled my kids out of public school when the school refused to do anything about my child being stabbed in the back with pencils and beat up on the playground daily. He was being told snitches get stitches and end up in ditches! The public school did absolutely nothing to stop this situation. My so. Was coming home with stab marks all over him! If they would have handled it, my kid would still be enrolled! The district willingly let go of money the day we filed an intent to homeschool!

Noow says

You do realize it’s our tax money so those are our tax dollars and we should have the right to choose how our children should be educated. Maybe public school should do a better job.

Model Citizen says

Amen. The article says “public money” as if those who opt out of government-sponsored education are robbing those who stay in government-sponsored schools, but those who opt out are merely taking their own tax payments with them. Why should they be forced to pay for the government schools if they don’t use them?

Jack B says

We do. When kids are unenrolled, we still pay taxes, but we’ve been paying for YOUR kids in addition to our own.

What’s unacceptable is entitled pricks thinking I need to pay for your kids when I get no relief for my own autistic child who got D’s and detention every day in public schools, because the school treated her like an irredeemable cash cow instead of an obligation to find out how to teach to.

Objective testing now shows her scores up markedly all because we got to take some of the tax dollars we spend to help a special needs kid thrive.

Mayve educate yourself before punching down on those with learning disabilities next time, ‘kay?

Ben Hogarth says

Let’s call a spade a spade. Republicans have been trying to avoid being taxed for decades now. The wealthiest in communities like Flagler have spent years (decades) pointing out that they have the heaviest tax “burden” because they pay more in Ad Valorem than the average citizen. Forgetting of course that taxation in the state isn’t even based on income, but property value – so they are free to live in a cheap home and low property value if this is so upsetting. But nay. That isn’t the response. Instead, they spend years lining pockets of Republican campaigns and propping up Republican candidates to take super majority control of the state’s legislature to do what?

Destroy public education so that the people who benefit are those who can AFFORD to send their kids to private school. Now, these people have at least some of their tax dollars return to them to send their kids to schools where they won’t have to mingle with “poors” and dare I say it – minority children. And the best part is they get to siphon the public dollars back for their own private benefit.

This isn’t a conspiracy. It’s a concerted, conscious, decades-old effort by Republicans to delegitimize public institutions while siphoning back their tax dollars for their own private benefit. A benefit that no poor and middle class tax payers ever get to enjoy – especially the middle class which makes up the vast majority of Americans. But to make matters worse, the public dollars now siphoned to these private charters who are owned by – you guessed it – Republicans and like-minded grifters. It should come as no surprise to anyone that more than 40% of charter schools in Florida lose accreditation, which in Florida, is a low bar already.

So Republicans don’t have to share their tax dollars anymore, Republicans destroy public schools for you and me, Republicans send their kids to private school on our dime, Republicans then receive kickbacks from Charter school leaders, and then Republicans scam other families applying to failing charter schools out of their cash.

The GOP may as well be called the Grifters Only Plan.

Bethechange says

Spot on, Ben. Effort documented since George HW era. May be why the Department of Ed is next in their crosshairs, as current legislative language includes equal access for all.

Always Teaching and Learning says

Are these children that are going to private schools attending schools in Flagler County? Are they attending schools in other counties? Are they attending schools in other states?

Another question to ask is how are children who are not living with their parent or parents being educated? Are they being home schooled? Are they being sent to a private school?

Finally, if the parents are divorced and the children are subject to a custody arrangement where they spend some amount of time residing outside of Flagler County; are those parents being compensated for their private or home schooling?

My hope would be that Flagler Schools has some visibility into these different conditions. If not; maybe the district, or the state should launch a bounty program to catch voucher cheats.

Nancy N. says

Flagler Schools has no control over or relevance to the scholarship program other than for some stupid reason that state is washing the funds through the local districts’ budgets. There are complicated rules for the scholarship programs that establish a child’s residency, whether it is with parents or another legal guardian, or governed by a custody agreement. Scholarships are awarded by the state, not by the county, so a child having parents in two different counties doesn’t matter. The county of residence is only determined for establishing the exact dollar amount of the child’s scholarship since it is tied to the per pupil rate in each county. It doesn’t restrict where the child goes to school within the state. Students can cross county lines to attend a private school in another county if it better meets their needs. (Many of the special needs parents do this for specialized schools.) As for catching cheats, this is not a free for all…there are extensive documentation checks at every step of the process, including residency verification each year (and with certain reimbursements) and statewide database checks 4 times a year to ensure a child is not enrolled in public school while receiving the scholarship.

FLRepublican says

They’re not losing $10.8 million…. that money is going towards the child’s education at the place that the child’s parents feel they will get the best education. If I’m pay tax towards schooling, I’d like to choose where and how my child gets their education. The school gets X amount of dollars for every child enrolled, why should it have to be in public school when there are other better options???

Laurel says

FL Republican: First of all, why am I not surprised at your party choice? As a NPA, I am highly offended that my tax dollars are going to religious and *home

schooling,* and taken away from public schools, though the tax dollars have been created for public schools.

Separation of Church and state!

Do you have conclusive proof that religious schools or home schooling is a better choice, especially for those who cannot afford it? Will you vote for Project 2025, and rid the country of the Department of Education? That’s where all this is headed.

Give breaks to the rich, and break the middle class and poor.

We need to get back to an inclusive, undivided America.

FL Republican says

Do you have children in the Flagler County public school system? I did. I took my child out of private Christian school where she was above average on every standardized test she took and enrolled in public school to see how things went. After the first year in public school, my child scored below average on almost every test. That’s enough evidence for me. I’m a tax payer and I believe I should have the right to say that my tax dollars will go towards the education I choose for my child! This has nothing to do with the separation of church and state and everything to do with government control.

You should do some more research as to how public schools are funded. “Total public school expenditures nationwide for fiscal year 2015 exceeded $650 billion, according to the most recent data available from the National Center for Education Statistics. That’s $12,500 per student. No state spends less than $6,800 per student. Some spend up to $20,700 per student.” The state gives about $7800/student. Looks like its saving the state money.

https://www.edchoice.org/school-choice/faqs/

Marc says

I agrée that you should have every right to choose where your kids go to school. Something tells me though that you don’t want to give ME money so that I can pay for my kid to go to a private school. As the article mentions, a typical PC home with a homestead exemption only pays just over $1,000 a year in school taxes. If I collect $8,000 a year to send my kid to a private school, then a little over $1,000 of that came directly from “FL Republicans”wallet. Keep your tax congribution(if you have school age kids) but no more.

If you don’t have school age children, then there is a cost to living in an educated and organized society. Republicans like to say nothing is free. So remember, you get what you pay for.

Laurel says

FLP: “edchoice.org” huh? No bias there.

No, I do not have any biological children in school, but I have paid taxes to PUBLIC schools all my adult life, as I believe that it does take a village to raise a child. I went to public schools, and graduated from a public college (that I paid into) with a 4.0 average.

You stated your child got good grades in private school, and below average grades in public school. That’s a bad argument for private schools, if you stop and think about it. Maybe that was not all you needed to know. My grandchild (step) went to public school in Broward County and graduated in the top percentile in the country. She also had an off the charts high SAT score. She was sent to China twice through the public school system. How’s that working with religious schools and home schooling? Her mom’s support had a great deal to do with her success.

So instead of doing what you can to support your local public schools, to change them for the better, you would much rather pull your child out, pull the local school’s money out, and leave the kids out who cannot afford to attend your private school, or their parents cannot afford to stay home and home school the kids, right? This is a better choice for the community? Is this a better choice for the village…or the child?

feddy says

I agree with your comment that “We need to get back to an inclusive, undivided America” but it goes for all political affiliations not just the one you always throw your hate to.

Also I myself is highly offended that my tax dollars go to things i can’t control like supporting all the illegal’s entering this country.

FlaPharmTech says

Laurel, spot on and thank you!

Bethechange says

FLR, everyone’s an expert; if we follow your reasoning, then as a tax payer, I should be entitled to compensation for any service I provide for myself because I “feel” its best for me. Screw the fiscal efficiency of participating in a system designed to provide the most effective outcomes for all; no it’s all about ME, MY FREEDOMS, MINE.

Total Joke says

Agent orange face along with DeVos started this ball rolling many years ago; defund public education, rolling tax payer funding right into religious and private.. it’s sick and unconstitutional, but that, along with the courts, can be purchased now as well. And you can’t read about it in books; those have been banned.

Dennis C Rathsam says

If you provided a good education, like you claim…. why are parents taking thier kids out of your forum? Obviously theres something ROTTEN in your way of thought! In reality, the parents with deep pockets, want to give thier kids the best! Can you blame them? Who loses…. the kids whoes parents are struggling to keep a roof over thier kids heads, & a meal in thier belly! With folks like Will & his band of merry followeres… The citezens of P/C, who ellected these incompitant fools are to blame! ya,ll voted for this! Now pay up for youre stupitity.

Jim says

Dennis,

If you are going to call people stupid and criticize the public education system, I’d like to point out that (1) you need to learn how to spell (it makes YOU look dumb – did you get a public or private education?) and (2) please provide some facts that we can all see that prove that the private schools are actually providing a better education than the public schools. I’d love to see that information!

Ed P says

Are public school ( actually government schools) are serving the children as well as everyone hopes, there is room for improvement.

I’m convinced that schools are really run by the teachers unions and not the administrators including the boards.

I do understand that drawing off funding for alternate education will not help the current conundrum.

I also believe that if parents spent additional time educating their children instead of expecting it to be done solely by the public school system, results and test scores would soar.

I ask any parent, what could be more important than your own children?

Here’s a quote from my father:” I can’t choose your life’s calling, but I will make sure your experiences and education will allow you to be a peak performer”.

Me thinkith I done good in public skools.

Nancy N. says

I am the daughter and granddaughter of public school teachers. I never in a million years thought I would be an advocate for voucher programs. I still have reservations about them, but the state’s special needs voucher saved my daughter from the utter incompetence and endangerment of Flagler Schools when they forced an ill-conceived and poorly executed inclusion program on their autistic students. The funds have allowed us to homeschool our daughter. She has thrived in a way she never did in public school, learning things in a personalized home education program she never would have had access to in public schools due to her disability.

Kelly S says

You are not the only one who feels that exact same way. I would be happy to have the board contact me to ask why I have pulled my two students. I have proof of the poorly executed inclusion program.

Joe D says

This entire program is ridiculous!

“Voucher” programs exist in other states. But they are limited in number ( slots assigned by a lottery system) or they are limited to families making no more than $40k-$50k. They can only be awarded to formally licensed school programs (private, charter, religious), not home schools. Some jurisdictions only allow students to participate in voucher programs, if their PUBLIC school is considered a “failing” school ( based on annual standardized testing scores). Even unpaid home school students have to show that they maintain grade level standards through annual testing, or they can no longer participate in home schooling, and must return to the local public school.

This program is a DELIBERATE attempt to reduce the power of the teacher’s Unions, by defunding local schools.

Wake up TAXPAYERS! We are the ones voting these legislators into office!

Jim says

As disturbed as I am to see that public tax dollars are going to private schools that do not have to meet any educational requirements……

If Flagler County is losing $10M, how much is being spent by the Florida government statewide? I remember when the legislature voted to expand this program, the question was asked “how much will this cost?”. I never saw any estimates or response to that. But if this one county is losing $10M, throughout the state it must easily rise over $100M or more! I just can not believe our tax dollars are being used this way.

Let’s all be thankful to Renner for helping the Flagler County schools with this program and let’s be thankful that the Republicans are pushing this kind of use of taxpayer monies. If you think the Republicans are interested in keeping government out of your life, you are just not paying attention.

BMW says

My son went to private school for 15 years and 100% of his education was paid for out of pocket while continuing to contribute to public schools via property taxes. With nearly 75% of the children in his assigned elementary school speaking Creole and using English as a second language, when would the teachers have had time to stimulate and educate my son? Obviously my choice was not based on racist notions as I chose to own in a City that was nearly 40% Haitian, simply had to make the best decision for my individual child’s education. It is sad that the majority of the comments beat the same old political drum, blame this person, blame that party, name call like someone I would never have wanted my child near and speaking like you are trained child psychologists. Therein lies the problem, political hacks putting their visceral views ahead of parents wanting to match the needs of their individual families. And, please stop acting like all parents who send their kids to private schools are wealthy, my husband and I worked our asses off to nurture our son and to make sure he was in a structured environment conducive to learning. The data and trends are there, the County needs to adjust to the changing environment. Kudos to the parents getting the financial support we never received.

Celia Pugliese says

Is the sad demise of public education eroded by state officials!! Are within the 10,8 millions the fair cost per child or over paid?

JimSw says

If they want to do this, then also change it so those without children in a school system, public or private, being home schooled etc. don’t have to pay school taxes period. Would seem fair then too.

Nancy N. says

Not exactly sure how you think that would be more fair. I’m still paying taxes to for education. The scholarship program just allows my child to actually benefit from the state education system that she’s legally entitled to an education from. Also, if you think you aren’t benefiting from the school system because you don’t have a child in it, think again. The local school system affects everything from local property values to the quality of the local labor market to the ability of the community to attract business investment. Paying school taxes is an investment that we all make in growing the economy and providing the future workers. I’m going to assume since you don’t have school aged kids that you are probably a retiree…would you like doctors and nurses to take care of you in your old age? A car to drive? An accountant or tax preparer to help with your finances? A lawyer to help with your estate? Well, how do you think those professionals are created? They need to be educated…and that starts with schools.

Protonbeam says

This is excellent news! Stanford university just completed an exhaustive national research project which validated what others have – charter and private school students vastly out perform their peers on average – a charter schools in NY serving almost exclusively poor minorities saw them beat their public school counterparts math scores by 93%- this only debate should be hockey we can find the exodus

Bethechange says

And UF conducted one that concluded the single, best determinant of academic success is zip code.

My Two Cents says

When me, my brother and my sister were in school my father worked 3 jobs to pay rent, bills and feed us, my mom was sickly and could not work. We went public schools and guess what all three of us did very well for ourselves. I don’t know if it was a “back in the day” thing but our high school diplomas got us very good paying jobs. No, not a doctor, nurse, lawyer or CEO, CFO etc…… just a job in a department in a fortune 500 company. So if you can afford to send your child to a private school more power to you. I never had children and I pay for schooling through my taxes like everyone else however, I do not want to pay anymore than what I am expected to pay.

Nancy N. says

Today having only a high school diploma won’t earn you enough to keep from being homeless. The days of a high school diploma bringing financial security are LONG gone.

Nephew Of Uncle Sam says

Nancy do you live in an alternative world? There are many jobs that don’t need a degree to earn the big bucks. Saying you’ll be homeless if you don’t get a degree is non-sense. I’ve known and worked with many a Bachelor and Masters holding individuals and some couldn’t find their way out of a paper bag on a wet day.

My Two Cents says

@Nephew Of Uncle Sam: Thank you for that comment. As I mentioned in my post, I worked for a fortune 500 company which was my last place of employment which lasted 36 years, during that 36 years I started out as an accounting clerk in the accounts payable department, was promoted to the cash management department processing wire transfers, was then promoted to admin to the Assistant Director of Accounting, then promoted to admin to the Director of Accounting. I’m sure you know things change fast in the Corporate world so from there I was promoted again, since our travel center fell under the accounting roof I was in charge of running the American Express program for all of our 2500 travelers/sales people. And then one dark day it was all taken away when our company (and I speak for all my direct co-workers and non direct co-workers when I say OUR COMPANY) was taken over by another fortune 500 company in a HOSTILE take over. Then a few years later within accounting one department at a time the work was moved to South America. I’m going to a very very sad time in my life so I will stop here (I lost my mom and my job in the same week), but the point I want to make is I only went to public schools and graduated from high school. The other point I want to make is while I worked in the accounting department as clerical and we did have accountants as well however, some of the new hires out of college started with less than I was making.

I Just Love Flagler Beach says

Then there’s the new Florida policy allowing tiny private “microschools” to open in libraries, movie theaters, churches and other spaces where they can fit in classrooms. The new rules for these “microschools” went into effect in July. They essentially allow a private school to pop up in these existing spaces without having to go through local governments for approval. There just seems to be a rush to open up the state to “school choice” without enough accountability. For example, from WLRN South Florida: “The original bill restricted voucher purchases to the expenses directly related to core curriculum areas of reading, mathematics, science, and social studies. However, in the eleventh hour, after the bill passed with these restrictions in all of its House committees and in two Senate committees, the bill was amended and the restriction was removed.”

Nancy N. says

That doesn’t mean there aren’t restrictions on what parents can purchase. It just means that it is governed by rules written by DOE and the SFO’s (scholarship funding organizations) instead of being detailed in the state law. There are extensive purchasing guides published by the SFO’s for each of the scholarships that lay out what is and is not allowed. The restriction you described was removed from the bill to allow coverage for additional subjects like languages, art, music, vocational education, and other subjects beneficial to kids (that are offered in public schools as well).

Samuel L. Bronkowitz says

I mean look, the status of education in general is messed up. Public schools are mired in political garbage, charter schools are lowest common denominator, and homeschooling has no quality control. The entirety of k-12 needs to be rethought.

Careful What You Wish For says

Public schools aren’t “losing” funds, and the vouchers aren’t “costing” anything. If not for the scholarships, exactly where would you put the thousands of students? You going to build a 10 million dollar school somewhere nowadays? Hire hundreds of teachers and admin staff, not to mention buses, resource officers, athletics, on and on for 10 million a year? No, let’s all thank our lucky stars that this program exists, l’est all of our tax obligations double.

FlaglerLive says

The commenter is misinformed. Assuming the taxpayer funds devoted to subsidizing private education were instead spent on a new school, the district would have accumulated $29 million between 2021 and this year in funds that have been diverted–lost, is the correct term–to private subsidies, close to what’s needed for a new school. If, as well, the state had not committed that other diversion at public expense–the diversion of Public Education Capital Outlay, or PECO, funds–exclusively to charter schools then the district would have had more than enough dollars to build a new school without even tapping its impact fee revenue. As for the operational expenses, the addition, or return, of 1,250 students would generate all the dollars necessary, just as the state provides a set amount of dollars for every student enrolled.

Joy Cook says

If parents want to take their children to private schools it should be out of pocket. Not handing out vouchers. No money should be taking from public schools. We will be in the need for new schools with this over development. Both my children went to public educations and so does my grand daughter. Where is this money coming from. Taxpayers or the lottery. Just curious.

John says

America has fallen from one of the best educational systems in the world to being one of the worst. Our students are falling behind other countries because of what we don’t teach anymore.

We’re to worried about politics and pronouns instead of teach our children.