Palm Coast residents: chances are you’ll be looking at a new tax or two come fall. Look for them on your electric bill. They’ll be wrapped in a bit of lingo: “Utility franchise tax,” or “public service tax,” or both. They’ll likely average $6 to $8 per home per month, and quite a bit more for more power-hungry businesses. The property tax rate might go up some as well. In exchange, the city will eliminate the $8-a-month stormwater fee (or tax, as most residents see it) currently on water bills. And the city promises to spend $7.5 million a year on its stormwater system regardless—just as it promised 10 years ago to spend all the revenue it generated from its share of the half-cent sales surtax on resurfacing roads.

The Palm Coast City Council agreed to go down the route of new taxes in a meeting Tuesday because it has little choice: Like its infrastructure, Palm Coast’s method of paying for the upkeep of its infrastructure—its swales, its culverts, its bridges—is crumbling. Its “stormwater fee” is no longer tenable. After imposing it for years, the city now concedes it to be unfair, helped in good measure by its auditors, who point out that the revenue the fee is generating is not enough to cover costs. For the past three years, the city has been maintaining that infrastructure in large part on borrowed money, literally. It cannot borrow its way to repairs anymore.

The half-cent sales tax that’s paid for road improvements for 10 years, and is increasingly used to pay for stormwater system improvements, expires this year. Its renewal is in jeopardy, or may not generate the amounts it once did, now that the county is looking to reformulate the way the money from that sales tax is split. Palm Coast’s share would be reduced. But the city’s infrastructure continues to crumble.

“Now we’re stuck with, if you’re going to maintain the system, it’s going to cost money. How are you going to get the money: that’s what we’re here to talk about—options,” Palm Coast Mayor Jon Netts said at the beginning of the council’s discussion.

The council has spent the last several months learning about the mess of its infrastructure, and the mess of its stormwater fee structure. A lot of commercial properties saw their bills go down, residential properties saw their bills go up, exemptions kept numerous property owners from paying (government properties, for example, including schools, agricultural properties and properties in bankruptcy are exempt). The inequities exposed the city to potentially costly lawsuits. “If you were to implement the final product, you would have some people paying a small amount of money, other people paying obscenely large amounts of money, some people paying nothing, some people who’d never paid anything, now paying,” Netts said.

The ledger isn’t a bright spot, either. Two years ago, the city took in $6.5 million in stormwater fees. Last year it took in $5.8 million. This year’s projection is $4.9 million—nowhere near the needs of the stormwater system. To compensate for the shortages, the city took out $9.2 million in loans between 2010 and 2011. This year, the city is also using $2.6 million in revenue from its share of the half-cent sales tax and revenue from the property tax toward stormwater improvements. Those improvements are costing roughly $7.5 million a year. Put simply, the city doesn’t have enough money to keep those improvements going.

“Let’s call it what it is, and that is, in order to maintain the system you’re going to have to charge a tax to maintain the system,” Landon said. And the city is looking for an annual $4.9 million through that new tax.

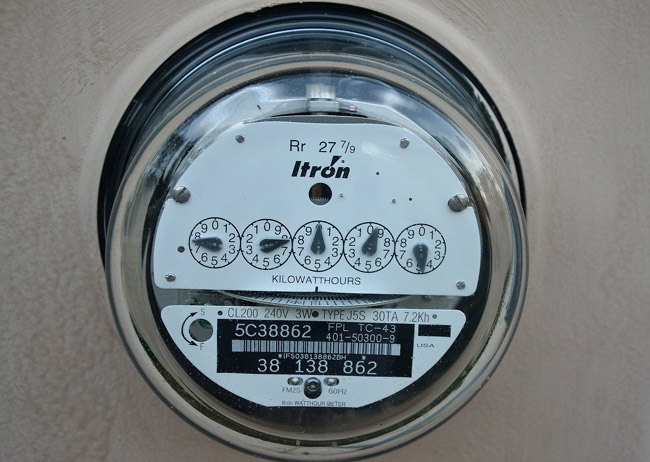

Landon is proposing a 6 percent electric franchise fee and a 2 percent public service tax, both of which would appear on electric bills. The combination would cost the average residential electricity customer between $6 and $8 a month, and yield $4.7 million in revenue for the city. More specifically: the average bill for a home in Palm Coast, according to FP&L, is $106. The 6 percent would apply to that $106. The usage part of the bill is $66, so the 2 percent charge would apply to that $66, for a total of $7.68 in additional taxes—as opposed to the $8 stormwater fee on the water bill, resulting in a modest annual decline of about $4. “So you’re basically shifting the bill from your water bill to your electric bill,” Landon said.

The franchise fee can be raised up to 10 percent. So can the public service tax.

The franchise fee is the cost to the utility to use the city’s public right of ways. Most cities levy that fee, or tax, otherwise the utility is using those rights of way for free. Then again, every penny of the franchise tax is passed on to the consumer. It’s a fairer alternative than the property tax, Landon argued, if the revenue is used to pay for stormwater improvements.

“Mr. Landon, it won’t be near as unpopular as a utility franchise fee,” council member Bill McGuire warned. “When we tell the voters that we’re going to put a surtax on your FPL bill, there will be rioting in the streets.”

“Well, there hasn’t been in any of the thousands of other communities that do it,” Netts said.

“I don’t know of any city that doesn’t have a franchise agreement with a utility company,” Landon said.

“Bill,” Netts told McGuire, “you’re absolutely right, this is totally unpopular with everybody, and this is not a popularity contest. We’re charged with maintaining the safety and integrity of the city. We all agree we’ve got to maintain the system. What’s the best, fairest—not the most popular—what’s the best, fairest, most equitable way of doing it in terms of long-term sustainability.”

“I agree with you, your honor,” McGuire said, “it’s not a popularity contest, but we do represent the will of the people,” McGuire said, “and the will of the people as it speaks to me says, the electric franchise fee would not be popular. Does that mean we can’t make it happen?”

McGuire and council members Jason DeLorenzo and Frank Meeker were in agreement with the new franchise fee, but not the additional 2 percent tax. They favored raising the property tax to make up the difference. Landon warned the property tax increase would be “significant.” Netts and Landon kept pressing for the additional public service tax, at least in a nominal amount—even if it were to be a quarter percent initially. “What this is doing is giving you a whole lot of flexibility come budget time,” Landon said.

That’s what the council will be voting on later this month: a pair of ordinances that establish both utility and franchise taxes, leaving it to another day to decide what the tax rates on either will be, and what the property tax rate will have to be as a consequence.

“The variables are,” Netts said, “we don’t know what’s going to happen with the half-cent sales tax, we don’t know where the property values are going to be set by the property appraiser. I would prefer that we keep as much flexibility as possible.”

PJ says

Here we go the double zinger!

I called it last month, don’t vote for the sales tax and you will open the door for Lazy Landon and Netts to hit us up with more taxes.

I said it we were going the way of South florida. High taxes poor services.

I thought when we got this six figure city Manager we were getting a top notch player. We got ourselves a guy who leads the board bu the nose and takes the safe lazy way out most everytime.

The best part he (Landon) gets us for more money everytime he ask for it in the form of a raise.

Netts follows him around bent over. This pathetic and sad. were taxed and taxed.

The garbage service will soon cost us more now than the end of the last contract. Now a “franchise fee” system. This is the way you can charge anything you want. He got a taste of it with the garbge contact to the tune of 600k and Landon realizes how easy it is to sucker punch us here in Plam Coast just to keep on paying through franchise fees.

Please speak up we need to let them know it it not right………….

PalmCoast says

“Tricky” council members and Mayor!! They propose to take the money from the taxpayers pocket one way or another! Their gonna get the money any way they can!! Tax…..Tax….Tax…how much more can they tax us?

Clint says

Well there goes my weekly food money. And if the property taxes goes up, then no more heart medicine either. Maybe I should just short sale my home and move into a trailer park that has only adults over 55.

Robert says

One does not need to be an economist or finance professional to see that this city cannot support itself on real estate tax revenue or business tax revenue. It is just not going to happen in the short or long term. Face it. Those who voted to incorporate were only told about the upside and they dutifully followed like sheep.

So the only way that this city is going to survive is to continue to raise taxes, plain and simple. It can be called whatever the politicians want to name it, it is still a tax. The city will be giving itself a tax increase each time FPL gets a rate increase and FPL is positioned to get another one and then one after that.

Smarten up people and dissolve this city and form one unified government. That is unless you like being taxed twice, once by the county and once by the city. Make that three times because the School Board also has taxing authority.

Don’t expect it to be put on a referendum by the town council either, and the apathetic voters need more signatures on a referendum than they can get signed.

The conclusion is, folks, you are stuck between two places and neither one is better than the other. The politicians, specifically the mayor, who you elected, are forcing another tax and the citizens are too lazy to respond with petitions (referendums) to make change.

And don’t let me forget that the town council is still trying to ram a new town hall down the citizen’s gullets and then they are pushing increased taxes up the other end.

palmcoaster says

@Robert. You seem to forget that the county rammed first his palatial structures on the back of Palm Coast tax payers. Who built their county palace first and basin their referendum on lying total cost., that of course was muuuch higher by the millions, than the people approved! Are you a fan of the commissioners that we in Palm Coast vote to office and then turn around and stab us in the back, always asking Palm Coast for more money when they are already receiving too much, about double of what the city share is of our home taxes? City meanwhile sustaining 839 residents per sq mile while, county has only 197 per sq. mile and county gets double the taxes than Palm Coast receives from my home? Yes you are right what we need is a referendum approving that the county shifts 1/3 of our home taxes to the City of Palm Coast. In my house would be like $300 and I would be just content that 250 of thouse change hands to PC. What we also need is to dissolve the gouging to Palm Coasters by the BOCC or dissolve the current seating positions and replace them with new elected ones. Just look at some of the approved waste of our taxes in frivolous spending in this pathetic economy for projects that could wait but were awarded, like 1.5 million to Princess Place road and its bridge improvements..hundreds of thousands to the airport and many more and so many awarded “do not show the cost”:

http://www.demandstar.com/supplier/bids/agency_inc/bid_list.asp?f=search&mi=713424

Stop frivolous capital projects that only benefit a selected few, stop contracting high paid consultants for zero results, keep all our county workers that labor the services our taxes pay for and stop asking the cities for more $$.

Palm Coast instead repairs heavily used public roads and drainage, among other public infrastructure that can be afforded. Thank God we bought the water utility for additional revenue.

@Gia comment before. The interchange could wait a bit for our economy to improve because the additional access (as you mentioned) “to improve business and bring hotels”….we have enough vacant hotels all over now, have you paid attention at their empty ample parking lots? The small businesses are not being attracted, only the large corporations for big pockets and those are not coming now either. Then the interchange can wait. Same way the PC city hall shall wait, so far 2 more years, hope much longer as is only “an ego investiture item” just like the Cty Taj Mahal’s in Rte 100.

Why is that our elected one’s get detached from the reality, once in office? Its very simple, when you and I don’t make enough money what do we do? we cut buying the non essential correct? Then our elected ones need to do likewise and stop yesing their administrator.

tired says

Why do Netts & Landon refer to the outdated ordinance as if it is old? They just spent over $250,000 having it re-written to the liking’s of Mr. Landon even though staff informed him through the two year process that the Stormwater Department would not remain revenue neutral as was stipulated in the contract. Why do they talk as if this ordinance is from the ITT days when in fact it was nit-picked to death by Landon himself. Why do the tax-payers of Palm Coast continue to allow this man to run this city into the ground? He continuously over-rides the educated and trained experts in their field of expertise to make the choices that He wants. Yet building permits continue to get issued for buildings that do not meet code and landscaping continues to be done while we are told sidewalks in Seminole Woods cannot be afforded. The city strong-arms the county to get what is “rightfully” theirs yet blows money on pretty flowers and landscaping in the Cypress Knoll neighborhood so Mr. Landon and his family can enjoy it along their bike rides. Landon will pretend to play nice in the sandbox but don’t think for a minute that he doesn’t have a knife buried in the sand. He always does.

Jim J says

The City should be taken to task for even proposing new taxes.

Think first, act second says

I do not like the utility tax scheme, though it does not matter, the City Council is going to impose them like it or not. The main reason I don’t like them is this. They are for ever or until cancelled by a future City Council, fat chance that will happen. With the annual taxes, if they are increased the council members fear the wrath of the voter, but if they take the heat this year, an off election year for all of them, then when the elections come around again the temperament of the residents will have mellowed and there will not be as much grief given to the candidates as they would receive if they increased millage rates for the 2 or 3 years until the elections. It is all about getting the money without the stigma of a “tax increase”.

overit says

I’m Moving!